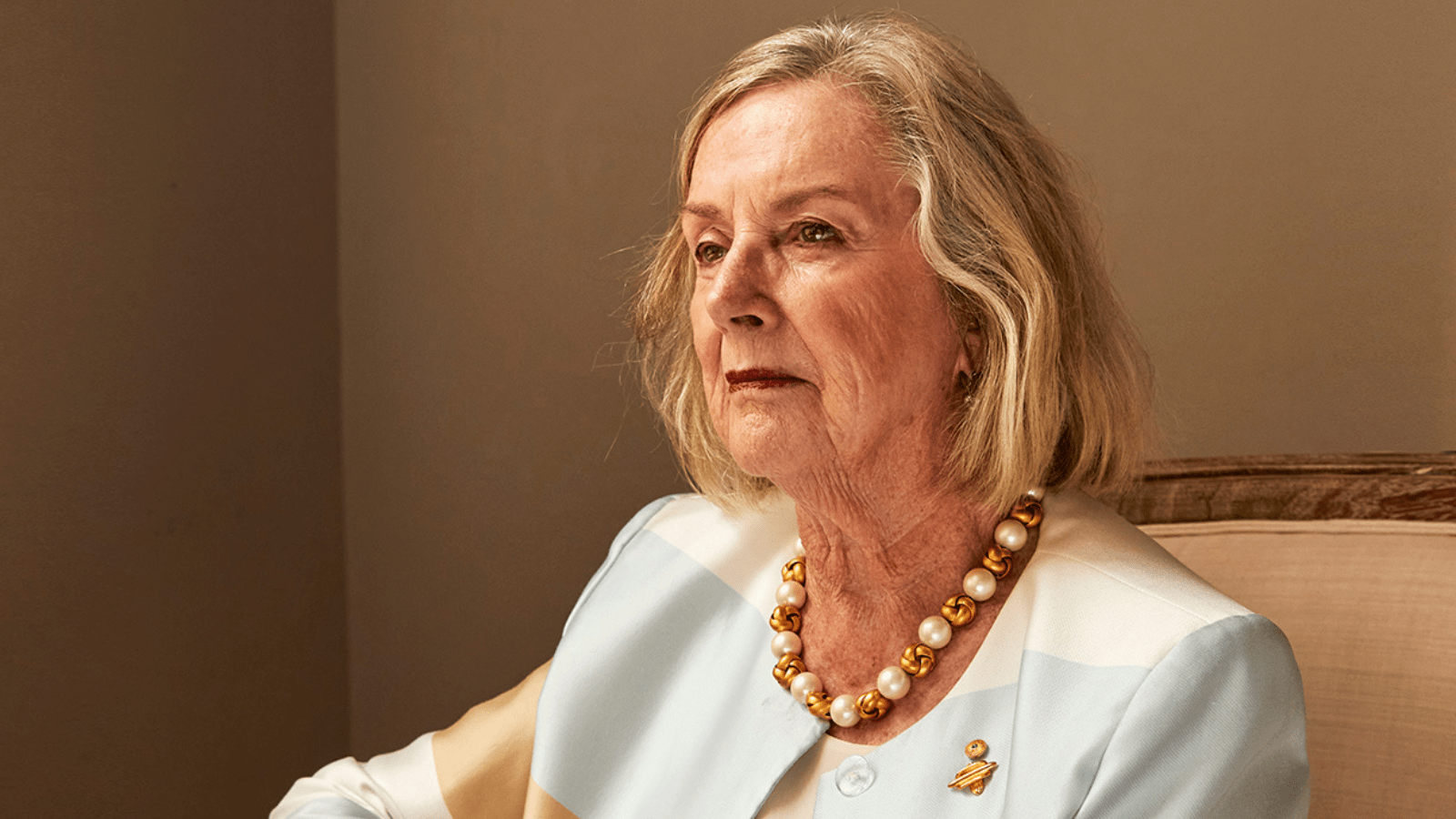

Let the data do the talking: JBWere CIO Sally Auld

BRANDVOICE – SPECIAL FEATURE

Pressure amidst uncertainty makes most people panic. That’s where JBWere CIO Sally Auld says she thrives. Her strategy? Do the background work and get “your fingers dirty in the data”.

From the medieval halls of Oxford University to the high-rise offices of JBWere, there’s a recurring theme in Sally Auld’s career.

“No matter what the challenge is, control the stuff you can control,” she says. “That is, how hard you work and how well you do your job.”

She recalls her daunting first year at Oxford as a green 24-year-old on a scholarship.

“I felt like I’d made a massive mistake and bitten off more than I could chew,” she says. “You’re surrounded by super smart people. It was quite intimidating, but you don’t grow unless you are challenged. My response has always been to knuckle down and get on with it.

“For any hard thing, throw yourself into it. If there’s stuff that you don’t understand or you’re not quite sure about, then do the work.”

JBWere CIO Sally Auld

That mentality has been a tailwind throughout Auld’s career, lifting her from a DPhil at Oxford to a graduate role at Credit Suisse First Boston, to leading fixed income and FX strategy at J.P. Morgan, where she was appointed Chief Economist in 2016.

“They expected a lot from you and high standards. But that’s okay. I love that. I thrive on that,” she says. That’s not to say there weren’t some white-knuckle moments.

“The bigger the role, the higher profile it is,” she says. “You have to forecast and hopefully get more right than wrong. Some of those forecasts can be pretty public.”

“It wasn’t long after I’d taken that role that we had some unusual data and we decided to make a big call on what the RBA would do next, which was at the time a very non-consensus call. They’re the ones that can either make or break your career, but my attitude is, there’s no point just calling what the consensus calls all the time. What value do you offer?”

“Thankfully it turned out to be the right call, but it is a bit nerve wracking when you’re sitting there, and in the row opposite, you have all the traders who are effectively backing your views. So, they’re risking the bank’s capital on you being right. I felt pretty sick at 2:29 before the RBA announcement came out, but ultimately, while it’s always interesting to hear what people think or might write about a topic, really, the only way to feel confident that you’ve got a view worth listening to is if you do the work yourself. Get your fingers dirty in the data and let the data do the talking for you.”

Related

Auld brings her do-the-work-yourself mindset to the role of Chief Investment Officer at JBWere, which focuses on preserving and enhancing wealth over the long-term.

JBWere’s diverse client pool, which includes high net worth individuals, family offices, charities, schools and universities, rely on Auld and her team to help understand an uncertain world.

“In this particular moment, geopolitical issues are front of mind, given Ukraine, the Middle East and the US election later this year,” says Auld. Productivity, housing, interest rates and AI are also top concerns.

“Clients are looking to us to help navigate all of that, and what it means for their portfolios and how they should think about those risks.”

“We’re in the early days of a new regime, where it feels like the environment is going to be less benign and more difficult to invest in. “

It means that you are probably going to have to be more nimble in your asset allocation and potentially, we’ll get more volatility in financial markets if we have some more volatile geopolitical backdrop and economic backdrop.”

“We just take it as we find it.”