Risk Management Strategies Every Forex Trader Should Know

BRANDVOICE – PARTNER CONTENT

There is always risk involved in forex trading; in fact forex trading is built on risk. As a trader, you’re speculating on which way you think the market is going to move, and you’ll profit if the market moves the way you predict. If it moves the other way, you’ll lose, and therein lies the danger.

But this doesn’t leave you powerless, cast adrift on the stormy sea of the forex market. There are steps you can take to manage this risk.

Statistics vary as to the loss potential of forex trading, but reports suggest that somewhere between 60% and 85% of their retail accounts lose money. This statistic underlines how important good risk management is when it comes to developing a sound trading plan.

The following approaches can help you manage this risk – although risk can never be reduced to zero.

Practice Thoroughly with a Demo Account

Most brokers provide a demo account, where you can open positions and make trades in a simulated environment. The same market forces and dynamics are all in play, but there’s no actual money at stake.

For CompareForexBrokers founder Justin Grossbard, using a demo account is important for traders of all levels.

“Beginners certainly need to practice on a demo account before trading for real,” he said. “It’s the only way to get a feel for what actual trading is like.”

“But other traders can benefit too. In fact, whenever you want to explore a new strategy or trade a new market, a demo account is really helpful. You get to see how the strategy can work, without the risk.”

Trade Only with Regulated Brokers

In Australia, it is the Australian Securities and Investments Commission (ASIC) that regulates forex brokers. While the ASIC doesn’t guarantee successful trades every time, it does provide you with important risk management protections.

ASIC-regulated brokers have to keep client funds segregated from their own operational funds, which means traders are protected even if the broker gets into financial trouble or goes insolvent. On top of this, they require negative balance protection, so traders never end up owing money to the broker.

The regulator also gives traders recourse if there are any problems as ASIC requires brokers to have a formal independent dispute resolution process in place. The ASIC register features a search function, making it easy to check who carries a valid license to offer trading services.

Use the Tools the Broker and Platform Provide

The best forex brokers in Australia all provide tools to help traders manage risk, so it’s important to use them. For example, a stop-loss is a limit order that automatically closes a position once losses exceed a certain level. A take-profit is essentially the opposite – the trade closes once profits rise to a specified level.

All of this is useful for keeping trading sustainable, and within pre-defined strategic parameters. But these risk management tools can still be at risk of slippage. This occurs when volatile markets move so quickly that the stop-loss or take-profit is already exceeded before the limit order kicks in.

To counteract the risk of slippage, traders can look for guaranteed stop-loss orders (GSLOs). While not all brokers offer GSLOs, those that do are ensuring your stop-loss executes at the set level, and not a cent under.

Be Conservative on Position Sizes

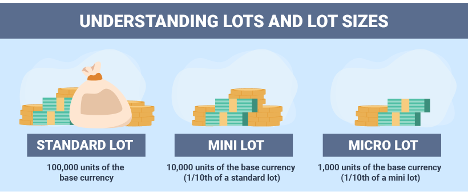

Forex trading is usually conducted using standard lots – i.e. 100,000 units of the base currency. While traders won’t need to put up all of this money upfront, it still represents a lot of capital. While such volumes mean greater potential wins, it also means greater potential losses, especially when you factor in leverage risks.

Trading with smaller position sizes can limit the risk. Some brokers may allow you to trade with mini lots, which are a tenth the size of the standard lot at 10,000 units. Below that, there are micro lots at just 1,000 units of the base currency, and nano lots at 100 units. In other words, some brokers allow traders to open positions 1,000th the size of a standard lot.

While this means potential profits will only be 1,000th of the size, it also limits losses by the same magnitude. For beginner traders in particular, this can be a less stressful entry point for the market.

Increase Leverage Gradually

In 2024, Robert Stammers published his top reasons for forex investment failures on Investopedia. One of the most significant risks he identified was traders becoming overleveraged and undercapitalised.

Essentially, this means traders are overreaching, using leverage to control positions way beyond what their capital reserves would permit. This means even a very small movement in the wrong direction is magnified enormously, and can quickly wipe out entire account balances.

Leverage is always a part of forex trading, so it’s not something that can be avoided. However, it is something that can be managed, and this is an important factor in mitigating risk. Increase your leverage slowly and gradually over time, and avoid letting greed and ambition dictate your trading decisions.

Risk Management: A Foundation for Forex Trading

If the forex market is built on risk, then risk management can be its more stable foundation. Risk never entirely goes away, but it can be controlled, reduced, and made more predictable.

For Justin Grossbard of CompareForexBrokers, effective forex trading and responsible risk management go hand-in-hand.

“You really can’t be an effective forex trader without good risk management, in my opinion,” Justin said.

“There are plenty of methods that can make forex trading a success, and the top traders are all successful in their own ways. But they all have one thing in common – they take risk seriously and manage it well.”

Investing involves risk and your investment may lose value. Past performance gives no indication of future results. These statements do not constitute and cannot replace investment or financial advice.