Whether seeking shelter or chasing opportunity, data journalist Juliette O’Brien explores how investors are navigating the so-called ‘untradeable’ market.

This story was featured in Issue 17 of Forbes Australia. Tap here to secure your copy.

Markets need movement. Without price shifts, there is no profit. Volatility is part of the game, and investors have learned to navigate it.

But 2025 has brought more than turbulence. Some parts of Wall Street labelled the market ‘untradeable’.

The VIX index – Wall Street’s so-called fear gauge – measures how much volatility investors expect in the S&P 500 over the next month, based on option prices. It recently hit its highest point since the COVID-19 crash.

At the same time, sharp swings in stocks and bonds have left investors reeling.

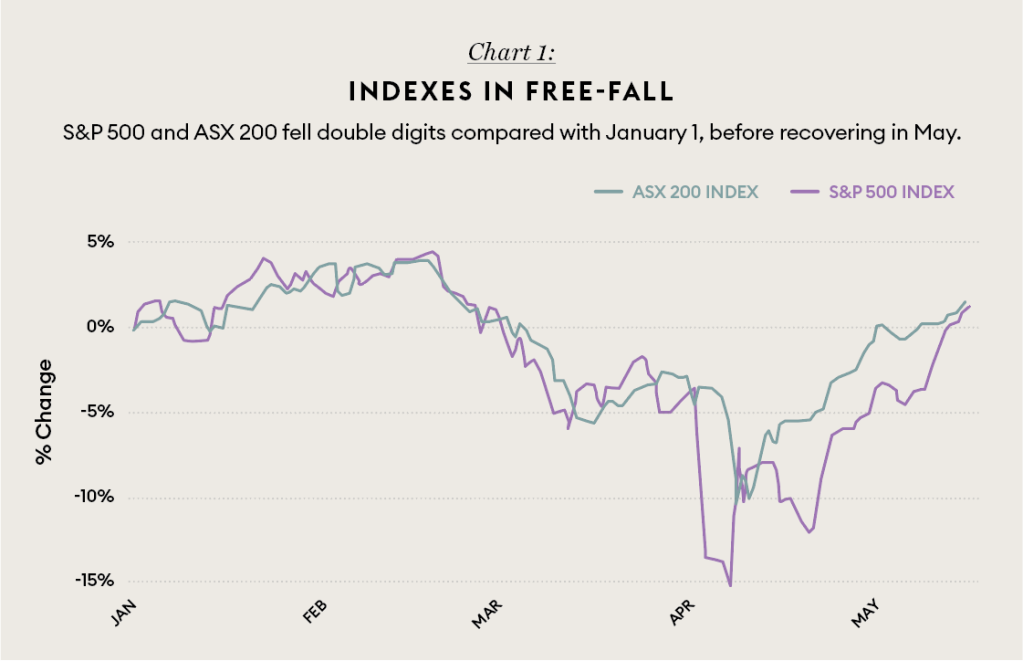

The S&P500 and ASX200 indexes fell double digits compared with January 1, before recovering in May. (Chart 1) Crypto currencies weren’t immune with bitcoin falling almost 20% from the start of the year only to whipsaw back to a year-to-date gain of more than 15%.

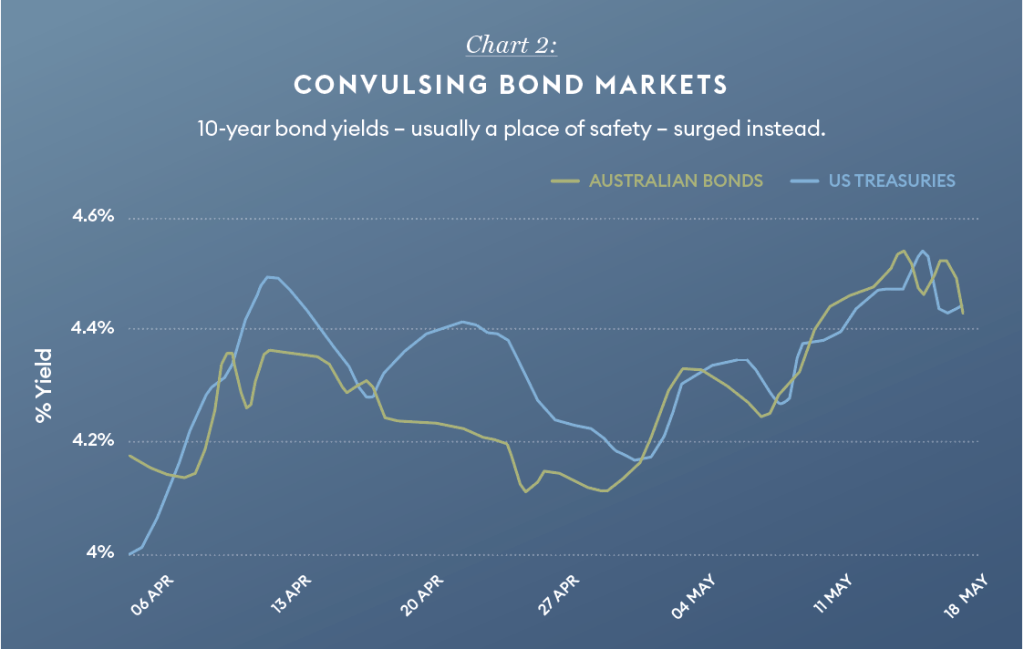

The bond market also convulsed. As stocks fell, 10-year bond yields in the US and Australia – usually a place of safety – surged instead. (Chart 2).

All this raises the question: where can investors find safe harbour – and opportunity?

BlackRock’s Chief Investment Officer of Global Fixed Income, Rick Rieder, offered a piece of advice: don’t miss the forest for the trees. “Keeping an eye on big picture developments and avoiding the daily barrage of dramatic headlines is key for investing in this environment,” he wrote.

Whether you’re seeking shelter or hunting for bargains, here are ways investors are navigating the so-called ‘untradeable’ market.

Stockpile Cash

This year, the safest asset of all – cash – saw its largest two-month build-up since April 2020 as fund managers lifted cash holdings to 4.8% in April, according to Bank of America. Cash offers safety in volatile markets. But with zero yield, it’s a short-term refuge, not a long-term home for capital.

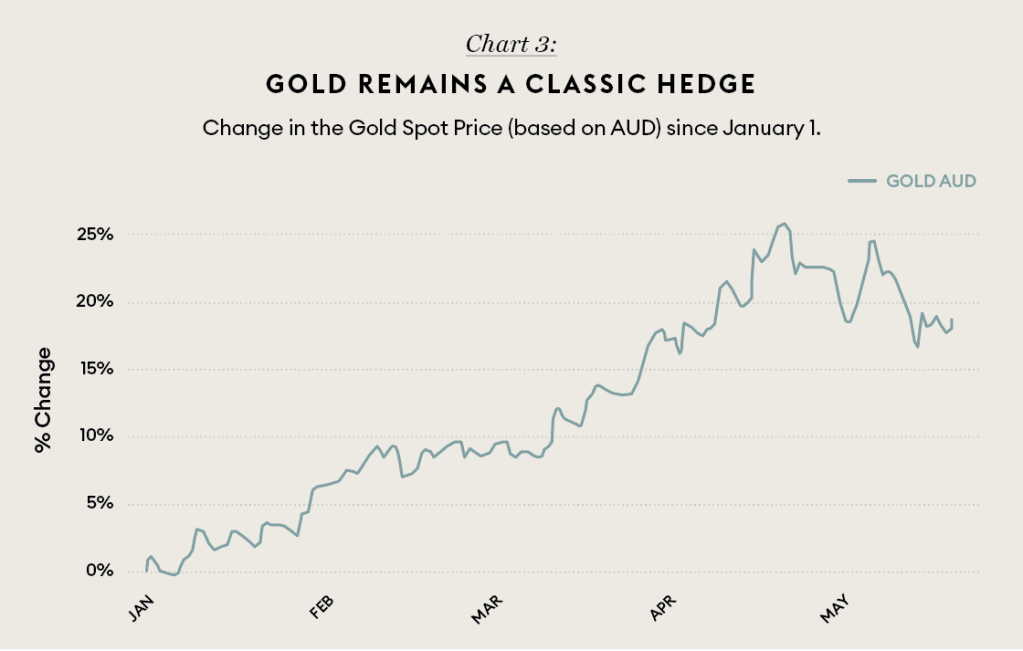

Go Gold

Gold remains a classic hedge. Investors have piled in, buying physical bullion or backing gold funds, futures, and stocks. The gold spot price hit $5,332.70 on April 21. (Chart 3).

Buy Francs and Yen

In currency markets, the Swiss franc and Japanese yen are considered havens. Capital has flowed in, pushing both currencies higher against the Australian and US dollars. On April 8 and 9, the AUD slid -10.8% (0.50 CHF ) and -10.3% (88.47 JPY) compared with January 1.

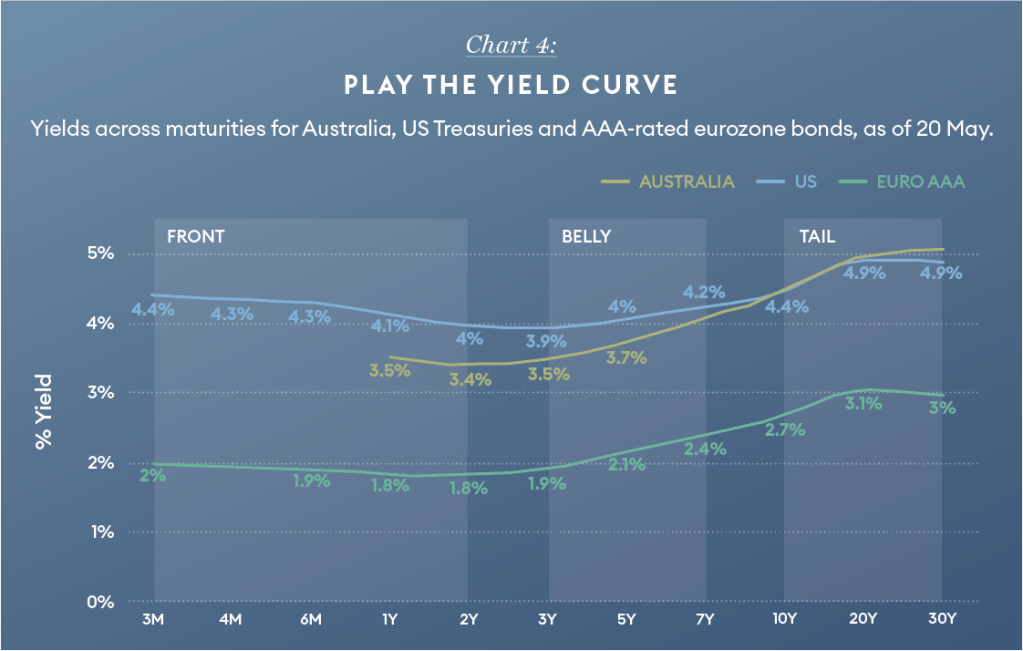

Play the Yield Curve

The yield curve shows how much investors earn by holding government bonds over different time frames. The front reflects short-term maturities, the back captures long-term bets, and the middle, known as the belly, reveals market expectations over the medium term (Chart 4).

Rieder sees rare value here, especially in European rates. “The potential to lock in high-quality yield in the front-to-belly of the curve with very little duration risk like this is a once-in-a-generation opportunity.”

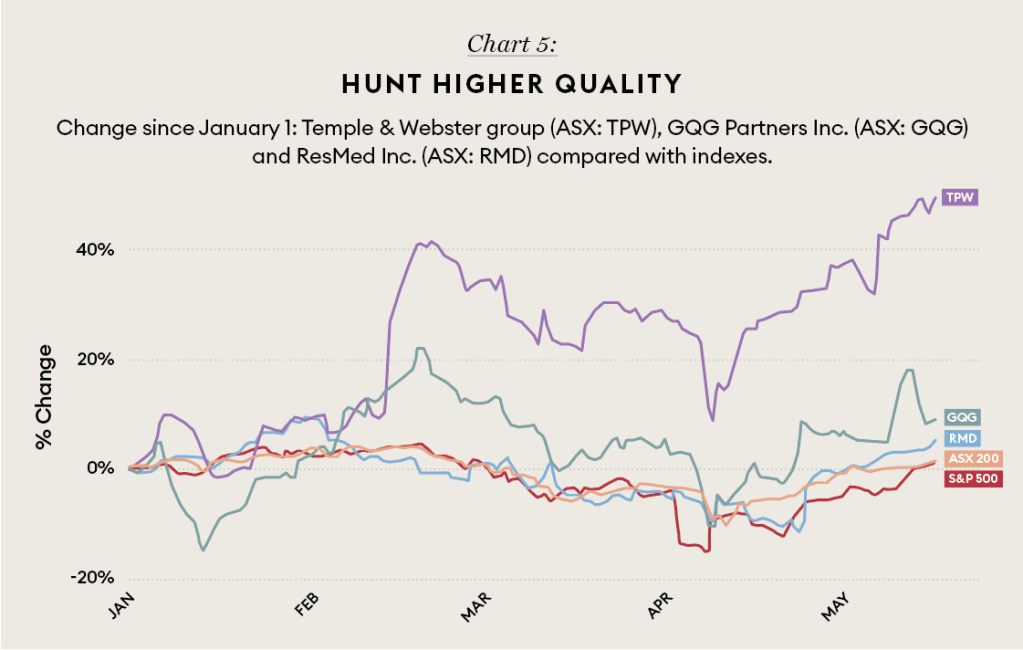

Hunt Higher Quality

In market chaos, even strong companies get punished. Volatility drags down quality stocks along with the rest. But for traders, that creates opportunity. The hunt is on for firms with solid fundamentals – strong cash flow, steady earnings, and low debt. Wild swings can push these stocks to bargain prices.

One way to find them is by tracking buy ratings from analysts. In April, Motley Fool reported that Citi was bullish on Temple & Webster Group (ASX: TPW), and Goldman Sachs recommended GQG Partners Inc. (ASX: GQG) and ResMed Inc. (ASX: RMD). By May 20, all three had outperformed the indexes since January 1, with Temple & Webster soaring. (Chart 5).

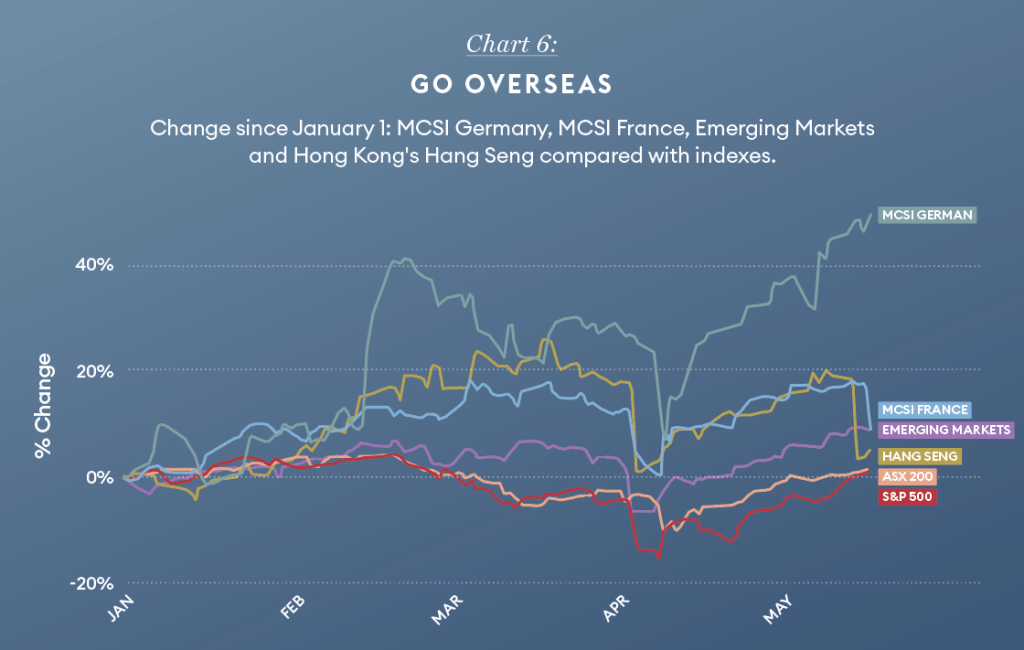

Go Overseas

While US and Australian markets slid, other parts of the world held steady – or surged. European stocks are outperforming, with the MSCI Germany index up 17.1%, and MSCI France gaining 18.4% as of the end of May. Hong Kong’s Hang Seng rose 18.9%, while emerging markets delivered 9.6% (Chart 6).

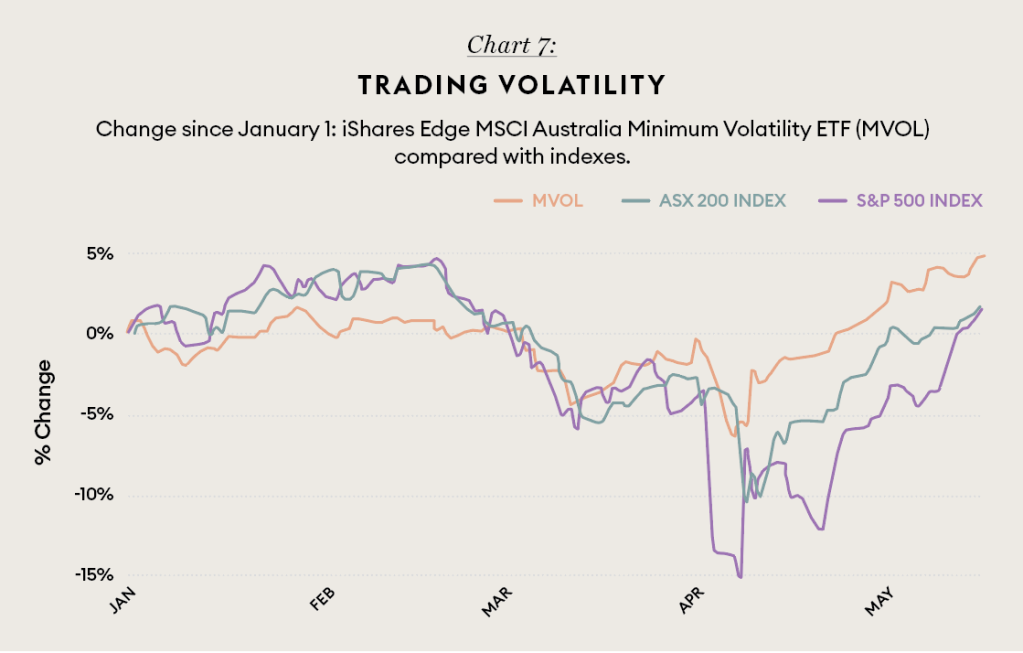

Trade the Volatility Itself

For those willing to bet on the chaos, volatility can be traded directly. ETFs like the iShares Edge MSCI Australia Minimum Volatility ETF offer exposure designed to smooth out the ride (Chart 7).

Of course, by jumping in and out of stocks, especially when liquidity is thin, you may fuel the very thing you’re trying to manage. Rieder puts it plainly: “A modern portfolio needs to be dynamic around a global economy undergoing significant change. Stapling together a generic 60-40 makes no sense when the world of debt and equity is nothing like they were before.”

This article represents the views only of the subject and should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance.You should seek independent financial and tax advice before making any decision based on this information, the views or information expressed in this article.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.