Billionaire Sam Zell, who built one of the largest real estate empires in the U.S. and made his hay by picking up distressed assets, died Thursday at 81 years old.

Sam Zell died Thursday.

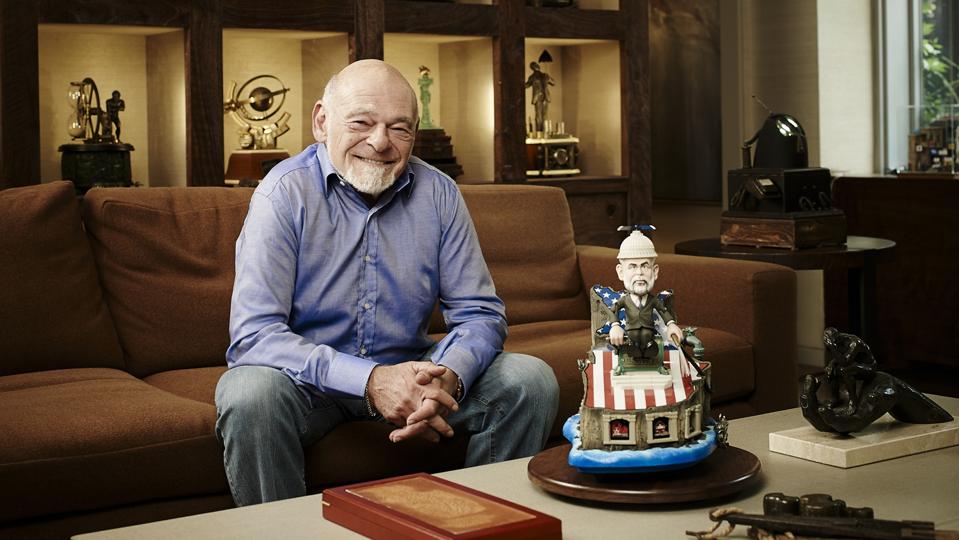

Photograph by Jeff Sciortino/The Forbes Collection;

Key Takeaways

- Equity Residential, the real estate giant founded by Zell, announced his passing without listing a cause of death.

- A pioneer in real estate investment trusts, Zell also famously orchestrated an $8.2 billion leveraged buyout of Chicago Tribune and Los Angeles Times parent Tribune in 2007.

- Nicknamed the “grave dancer” for his knack at scooping up undervalued real estate properties, Zell oversaw the $39 billion sale of his Equity Office Properties Trust to BlackStone in 2007, shortly before the real estate market’s collapse.

- In a statement, Equity Residential said it appointed David Neithercut, who served as the company’s CEO for 12 years, as board of trustees chair to replace Zell.

Forbes Valuation

Zell was worth $5.2 billion at the time of his death. Zell held 1.4% of Equity Residential’s common stock as of the company’s latest proxy statement, worth about $300 million Thursday. He also chaired and owned large stakes in several other real estate companies.

Key Background

Born in Chicago to Polish Holocaust survivor parents, Zell founded the predecessor to his real estate conglomerate while still a student at the University of Michigan, where he earned a law degree in 1966. The Tribune deal proved to be one of Zell’s few investing snafus, as the company filed for bankruptcy a year after Zell’s acquisition. In 2017, Forbes named Zell one of the 100 brightest living business minds. Much of Zell’s philanthropy focused on business education, establishing entrepreneurship and real estate initiatives at Michigan, Northwestern and the University of Pennsylvania.

Crucial Quote

“The key to my success is that my focus is never on how good it’s going to get. My focus is on the percentage that it doesn’t work,” Zell told Forbes in 2013.

Tangent

“I recognised a need common in all 13-year-old boys, saw a restriction on supply and I took advantage of it… Fifty-odd years later I’m still doing the same thing,” Zell once told Forbes about the impact his boyhood enterprise of selling Playboy magazines to friends had on his multibillion-dollar real estate empire.

This story was first published on forbes.com and all figures are in USD.

Forbes Australia issue no.4 is out now. Tap here to secure your copy or become a member here.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here.