Razer, founded and run by Min-Liang Tan for two decades, is prepping to release cutting-edge AI tools to help game developers produce games faster and cheaper and to coach players to sharpen their skills.

Razer CEO Min-Liang Tan with Josephine Teo, Minister for Digital Development and Information at the opening of Razer’s AI Centre of Excellence.

Razer

This story is part of Forbes’ coverage of Singapore’s Richest 2025. See the full list here.

Across four floors of office and studio space at Razer’s $75 million regional headquarters in Singapore—a mirrored black building recognisable by a towering, fluorescent green neon logo of a triple-headed snake—the gaming hardware giant has been doubling down on its latest play: AI software tools.

One weekday morning in August, two members from Razer’s fledgling AI team huddle over their laptops in a live demo of new gaming software. The conference room setup is deceptively simple. On one laptop, synced with a large screen on the wall, a simulation game is being run. An avatar traverses an imaginary world when a brief pinprick of light appears on the monitor. It’s not part of the game, rather, a software glitch has just been detected; a running log of technical issues (such as “audio cutting out” and “enemy not reacting to player presence”) is simultaneously displayed on the bigger screen alongside other gameplay metrics, with more detailed reports a mouse click away. On the second laptop a video game is being played, and a Siri-like voice relays instructions on how to navigate a challenge.

These programs are still in iterative testing, and lack the sleek names of Razer’s blockbuster products, such as DeathAdder, its ergonomic mouse; BlackShark, an esports gaming headset; and the BlackWidow keyboard. Yet, the company promises the quality assurance and coaching software tools it’s developing—called QA Co-AI and Game Co-AI, respectively—will be game-changers for the business.

“We believe that AI gaming is going to completely disrupt all of the game industry,” says Min-Liang Tan, Razer’s 47-year-old chairman and CEO, casually attired in his trademark black T-shirt and jeans, at Razer’s base in One-North, an enclave of high-tech companies in the city-state, where its newly opened AI Centre of Excellence is also located. “And we want to be at the forefront of it.”

Razer’s QA Co-AI, set to hit the market later this year, is aimed at giving game developers muscular performance-related software so they can produce games faster and cheaper, the company says. Its other offering, Game Co-AI, currently being beta-tested globally, puts more power into the hands of players with real-time coaching to improve their skills.

Tan is betting these new software products will unlock a fresh revenue stream at a time of sluggish growth in the $42 billion market for gaming hardware and peripherals, which account for about 90% of Razer’s overall sales, according to the most recent data available. Hardware developers, relatively unscathed by previous economic downturns, today are feeling the pinch of higher costs, inflation-hit consumer spending and supply chain uncertainties, PitchBook’s senior research gaming analyst Eric Bellomo wrote in an April report.

In comparison, AI in game development, which includes AI-powered non-player characters, is on a growth trajectory, with the global market projected to expand to $28 billion by 2033 from $2.3 billion in 2023, according to New York-based research firm Market.US. Razer’s strategic pivot could help it evolve from a maker of gaming gear into a gameplay architect shaping how games are developed and experienced, notes Loo Wee Teck, a global insight manager at data analytics firm Euromonitor International.

“We believe that AI gaming is going to completely disrupt all of the game industry. And we want to be at the forefront of it.”

As for Razer’s investors, which include European buyout giant CVC Capital Partners—Tan and billionaire board member Lim Kaling own about two-thirds of privately held Razer—harnessing AI would be a means to boost both earnings and Razer’s valuation as they eye taking the company public again. Three years ago, when Razer’s Hong Kong-listed shares were languishing, investors voted to take the company private in a $3.2 billion deal pegged at HK$2.82 (36 cents) a share, which was at a 27% discount to its 2017 IPO price of HK$3.88.

Tan says it’s premature to set a revenue target for its AI push. “For us it’s still early days, so we’re still figuring out the monetization,” which could extend to subscriptions to use its tools and licensing agreements with game companies for its AI models, he says. “We do know that there’s a huge demand for these products and services.” This is an evolving business model, notes PitchBook’s Bellomo. “While some companies have shown the ability to scale AI-native revenue lines, others are still testing whether AI can sustain price power.”

If Razer is successful, says Nirgunan Tiruchelvam, the Singapore-based head of consumer and internet research at Aletheia Capital, “the AI tools could transform it from a hardware-heavy player into a high-margin software services platform.”

This isn’t the company’s first expansion beyond its core gaming business. Tan, who cofounded Razer in 2005, built the company on premium equipment for gaming pros and enthusiasts, including PCs, mice, keyboards and headsets. He was a first-mover in cloud gaming with Synapse, an app launched in 2006 that allowed players to store their settings online, which grew into a cloud-based ecosystem for Razer’s products. “Everyone knows Razer for the really good hardware, but actually, for the last 15 years, we’ve been building out our software platform,” notes Li Meng Lee, Razer’s chief strategy officer.

Game Engine

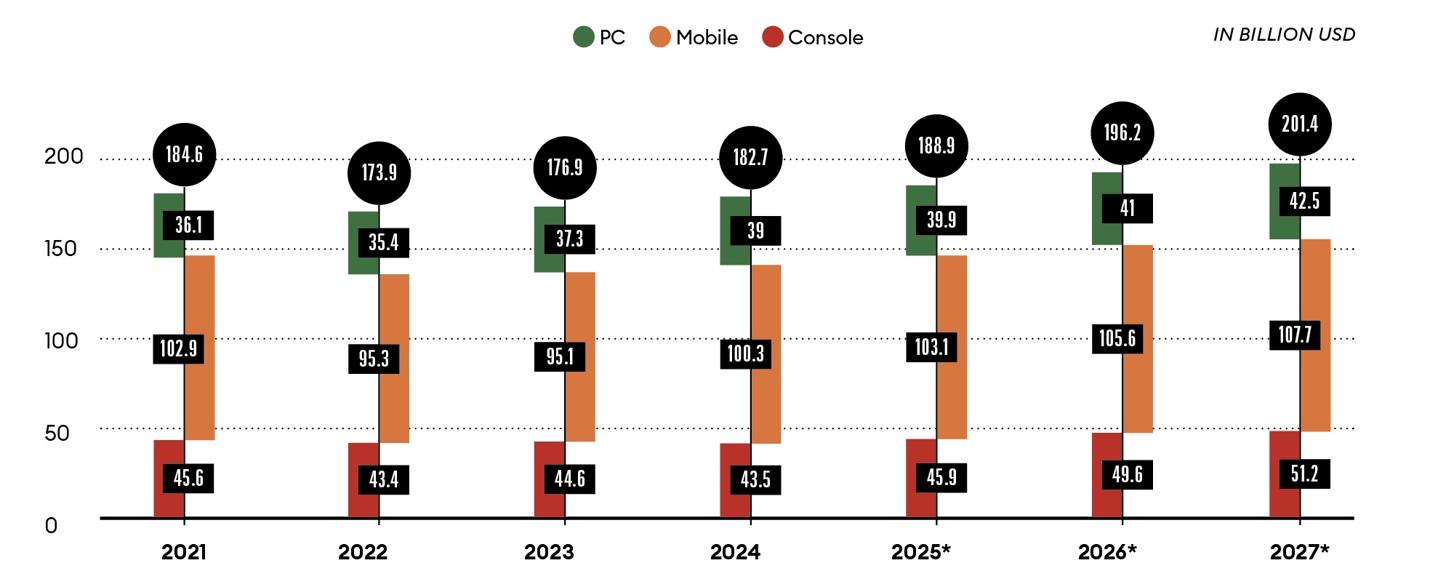

Mobile gaming leads growth in the global games market, which remains relatively flat.

With AI’s potential to reshape game development—and making money from it—Tan is relying on Razer’s deep ties to the gaming world. With relationships spanning 40,000 game developers, Tan says Razer is plugged into the pulse of the industry. “We can quickly identify gaming trends,” he says. “We put our resources on what we believe gamers are focused on, such as MOBAs [multiplayer online battle arenas] and TPS [third-person shooters]. So if a particular genre is rising and we see a huge number of gamers gravitating toward it, that’s where we start designing our tools.”

Razer needs to be proactive, says Aletheia’s Tiruchelvam. “They need to be nimble, given the fluidity of these AI developments.” AI software tools are an attractive proposition for game studios facing a saturated market and spending cutbacks as the cost of producing games rockets in line with rising expectations for realistic, immersive—and bug-free—gameplay, with no guarantee a title will be a hit.

But Razer has some catching up to do. San Francisco-based Unity Technologies and EQT-owned Keyword Studios in Ireland already dominate testing, says Euromonitor’s Loo, while GGWP and Mobalytics in the U.S. are coaching players with precision. “Razer is jumping into a battle royale in the AI gaming tools space, where competitors already have their sights locked and positions fortified,” says Loo. Closer to home, Chinese internet giant Tencent uses AI to auto-generate virtual worlds at a fraction of the time and manpower, while South Korean billionaire Chang Byung-gyu’s Krafton uses AI tools to power non-playable characters who can go off script and react to player behavior.

While Razer hasn’t revealed how much it’s investing in its AI strategy, Tan says being privately held gives the company the freedom to make bold decisions, noting that “a lot of this is investing off our balance sheet.” The company—with dual headquarters in Singapore and Irvine, California—says it’s among the leading global brands for gaming peripherals, generating $1 billion in annual sales, similar to the figure that was publicly disclosed in 2021, and that its software suite boasts over 200 million users. Since delisting, Razer doesn’t disclose worldwide earnings data, but according to regulatory filings in Singapore, Razer (Asia-Pacific)’s 2024 revenue held steady from the previous year at S$708 million ($551 million). Net profit, however, was down over 90% to S$3 million from S$35.4 million over the same period. The company declined to comment on the profit drop, adding the report doesn’t represent the full financial snapshot of its worldwide operations. Based on his sizeable stake in Razer, Tan is No. 33 on Singapore’s 50 richest leaderboard with a net worth of $1.7 billion.

Anavid gamer since childhood, Tan was a law student at the National University of Singapore when he had the idea for purpose-built accessories for intense gaming, such as mice sensitive to touch. After meeting Robert Krakoff, the former general manager at Kärna, a computer-peripherals maker in the U.S., in an online game, the pair teamed up to design the world’s first PC gaming mouse, and later launched Razer to make and sell high-performance gaming gear.

By 2011, Razer had become a global top-seller for gaming hardware, jostling with rivals such as Swiss firm Logitech and U.S.-based Corsair, at which point Tan turned his attention to Razer Synapse 2.0, which allows users to customize and sync settings across their Razer devices. “We were the first to have all our gaming peripherals connected to the cloud,” he says. That early move laid the foundation for building compatible gaming software for its hardware, like Chroma RGB, which helps players personalize their gaming setup with colors and lighting effects, and Cortex, used to optimize settings to boost game performance.

He then looked further afield to tap Razer’s massive customer base—with varying degrees of success. In 2014, Razer debuted Nabu, a smart fitness band, but quietly discontinued the line two years later, saying it wanted to concentrate on its core gaming products. Next he plunged into fintech, launching a payments service Razer Gold for in-game purchases, which last year processed, Tan says, over $10 billion in payments across 70,000 games, including titles from Tencent and U.S.-based game publisher Blizzard Entertainment.

An e-wallet released in Malaysia in 2018 followed by Singapore several months later, however, struggled to gain traction in a crowded market. Razer pulled the plug on the venture targeted at “youths and millennials” after three years, saying it would sharpen its focus on fintech solutions. And a push into digital-banking services failed to get off the ground after Singapore regulators rejected its application for a license for a so-called global youth bank in 2020—though the company continues to operate a payments gateway platform across Southeast Asia.

As Razer looks to accelerate its software ambitions, Tan is optimistic about the potential of its two new AI tools. “Within the next couple of years, I would expect that AI game revenues would be a significant part of our revenues,” he estimates.

“No one really talks about QA, but it’s such an important part of game development.”

QA Co-AI is aimed at streamlining one of the most time-consuming stages of game development, testing a game to make sure it runs as intended—critical for good reviews and commercial success. According to U.S. software testing firm Qestit, Razer’s tech can identify 25% more bugs than manual testing—speeding up testing time by 50% and reducing production costs by up to 40%. Currently in beta with around 50 developers, from big game studios to indie upstarts, QA Co-AI is set to launch globally via AWS Marketplace by the end of this year. “QA is often overlooked,” Tan notes. “Everyone talks about game design. No one really talks about QA, but it’s such an important part of game development.”

Its pre-built templates for bug detection can be used across various game genres. For example, if a significant number of gamers were to suddenly flock to 2D side-scrollers (games where a character moves from left to right along the screen, such as in Super Mario Bros.), Razer can swiftly build QA-AI models for a specific genre—ready to deploy when developers decide to jump in. “They would go like, ‘Great, I wanted to do a 2D side-scroller but didn’t have the resources to do it. But now I’ve got a tool that, boom, I’m able to do it,’” explains Tan.

Razer’s other AI tool is built for both serious gamers honing their skills and casual players looking for a shortcut. Razer Game Co-AI can coach players through a tough quest or puzzle to advance. “You’ll never get stuck again,” says Tan. “Today, gamers will alt-tab, jump out, look at YouTube tutorials and jump back in. The Game Co-AI will make [game playing] seamless.”

A beta tester, speaking anonymously because of a confidentiality agreement, says: “This is a big step up. Rather than watching [videos on demand], I can actually replay the exact moment I messed up and grind it until I get it right”—game speak for getting through tedious play to level up. “It learns how I play and pushes me to improve without needing a full team [of players] or running full matches.”

The software is partially trained on datasets of game footage from elite esports players, including League of Legends superstar Lee Sang-hyeok (aka Faker) and top-tier teams like OpTic and Sentinels, all partners of Team Razer, the company’s esports division. “We’re like the Nike of esports,” says Tan.

Under the hood, Razer’s AI tools run on a mix of models: a proprietary large language model built in-house, alongside popular systems from OpenAI and Anthropic. “We are model-agnostic,” Tan explains. “Sometimes we believe our own proprietary models are the best, but sometimes an open-source model might be better at, say, video generation or multi-planning. Or we may be working with a third-party AI company.”

Tan’s vision is to have a crack AI team spread around the globe. In Singapore, Razer plans to hire 150 AI specialists in total, up from 50 now (their numbers have tripled over the past eight months), spanning engineering, data science and game development—helped by a recruitment drive supported by the Singapore government. It will also roll out AI hubs in Europe and the U.S. “It’s not just recruitment, per se, but it’s pulling the entire ecosystem together and pushing the AI gaming interest to us,” says Razer’s Lee.

What else is at stake? “AI will increase productivity, so you’re going to be able to have a lot more work done in a very short amount of time,” Tan says. “There’s going to be a lot more free time. What are you going to do with it?” More time for gaming, perhaps.

With additional reporting by Jessica Tan.. This story was originally published on forbes.com and all figures are in USD.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.