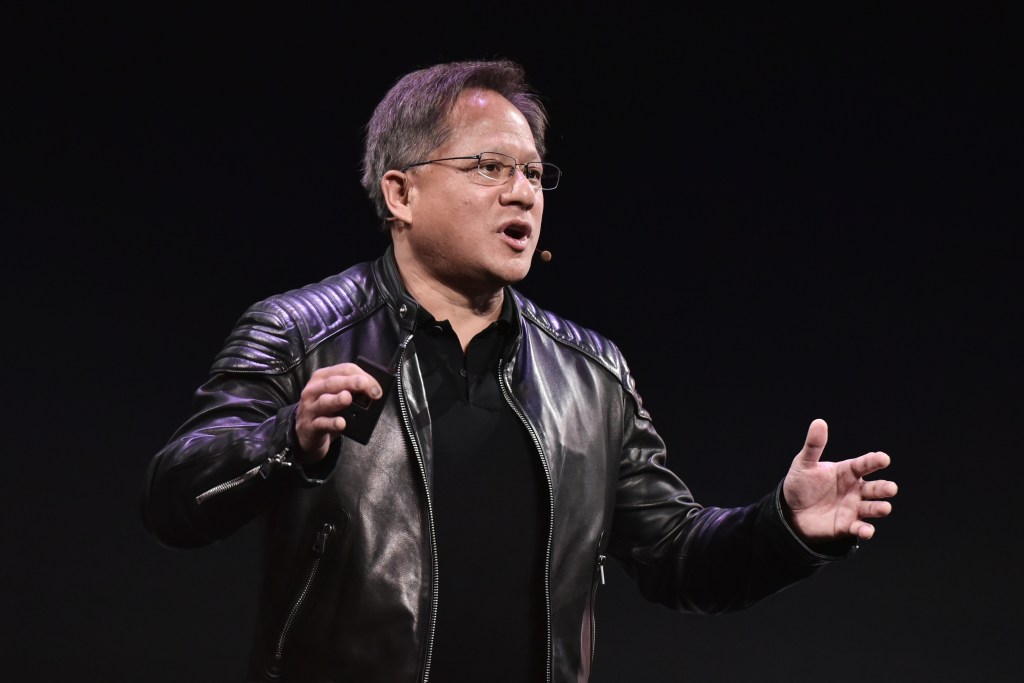

Founder and CEO Jensen Huang has more than doubled his multi-billion-dollar fortune this year thanks to artificial intelligence.

It was a stellar day for graphics chipmaker Nvidia, with shares surging 24% to a record high thanks to an analyst-clobbering quarterly earnings report and huge demand for chips that will power the AI revolution.

No one is benefitting more than Jensen Huang, Nvidia’s billionaire founder and CEO, who added $6.5 billion (AUS$10 billion) to his fortune on Thursday alone, according to Forbes’ estimates.

Huang, who owns about 3% of Nvidia’s shares, had a net worth of approximately $27.5 billion when the market closed Wednesday. Then Nvidia released its first quarter earnings report, estimating $11 billion in sales for the second quarter–50% more than analysts had forecast–and reporting earnings per share of $1.09, $0.17 higher than predicted. “The computer industry is going through two simultaneous transitions — accelerated computing and generative AI,” Huang said in a press release. Nvidia’s chips are well poised for both and Huang said the company is “significantly increasing” supply to meet “surging demand.”

That helped trigger a stock rally for shares of both Nvidia and other AI-adjacent businesses like Advanced Micro Devices and C3.ai. After a day of bullish trading, Huang’s fortune now stands at an estimated $34 billion–up more than 23% in 24 hours and enough to make him the world’s 37th richest person, per Forbes’ real-time rankings.

Related

“Nvidia’s results and guide leave us with our jaws dropped as the technological leadership in AI is being monetized and seems to be blasting through any lingering bear thesis concerns for now,” Cowen analysts led by Matthew Ramsay wrote Thursday.

It’s been a long road for Huang. Born in Taiwan, he moved to Thailand as a child before his parents sent him, at age 9, and his brother to the U.S. amid civil unrest in the Asian nation. He majored in computer science and chip design at Oregon State University and got an electrical engineering master’s degree from Stanford in 1992. After watching cartoonish PC games, he and cofounders Chris Malachowsky (currently Nvidia’s senior technology officer) and Curtis Priem (who retired in 2003) founded Nvidia in 1993, spying a market for improving the gaming graphics. Huang, who has been CEO from the start and who tattooed the Nvidia logo on his upper-left bicep, took the business public on Nasdaq in 1999.

“There was no market in 1993, but we saw a wave coming,” Malachowsky told Forbes in 2016. “There’s a California surfing competition that happens in a five-month window every year. When they see some type of wave phenomenon or storm in Japan, they tell all the surfers to show up in California, because there’s going to be a wave in two days. That’s what it was. We were at the beginning.”

Despite early struggles, Nvidia prevailed in the nascent market for graphics processor units, or GPUs, which enable machines to produce detailed and clean images at ultra-fast speeds. The technology ignited the PC gaming market into the gargantuan industry it has become. Today, GPUs help power gaming consoles, autonomous vehicles and robotics for more than 35,000 Nvidia customers that include Google, Mercedes-Benz, Amazon and Meta.

“The more content there is, the more visual interest there can be, the more processing horsepower people need,” Huang told Forbes in 2007.

Nvidia’s technology has become crucial in AI-driven companies; the chips that power generative AI are essential to new services like ChatGPT or Google’s Bard. These high-power chips have a higher processing power than most on the market, making them able to process larger and more complicated data intakes.

“We’re seeing incredible orders to retool the world’s data centers. And so I think you’re seeing the beginning of, call it, a 10-year transition to basically recycle or reclaim the world’s data centers and build it out as accelerated computing,” Huang said on Wednesday’s earnings call. “You’ll have a pretty dramatic shift in the spend of a data center from traditional computing and to accelerate computing with SmartNICs, smart switches, of course GPUs and the workload is going to be predominantly generative AI.”

That has helped drive Nvidia shares higher than ever before–helping Jensen, already a multi-billionaire, more than double his net worth this year, jumping from an estimated fortune of $13.8 billion at the start of 2023 to $34 billion as of Thursday. Nvidia, now boasting a market capitalization of $950 billion, is on the verge of becoming just the sixth company to hit the $1 trillion mark, an elite club of just Apple, Microsoft, Saudi Aramco, Google parent company Alphabet and Amazon.

This story was first published on forbes.com and all figures are in USD.

Forbes Australia issue no.4 is out now. Tap here to secure your copy or become a member here.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here.