The RBA’s position that it is unwise to actively try and destroy a 60-year policy goal of full employment is refreshing.

There is no doubt that costs of living are rising in Australia, but as global fixed income investors, Australia looks to be the lucky country, well-protected from the inflationary pressure felt in most other developed economies, according to Scott Solomon, Associate Portfolio Manager of the Global Dynamic Bond Strategy, and Aadish Kumar, International Economist at T. Rowe Price.

While many have been critical of the decisions of the Reserve Bank of Australia (RBA) and have challenged its forward outlooks, there is no question that Governor Philip Lowe has the best interest of the Australian people in mind when deciding the country’s monetary policy. The RBA considers the strength of the labour market as a “significant achievement” and has signalled a bias against overly aggressive tightening policy in order to preserve its strength. The RBA’s position that it is unwise to actively try and destroy a 60-year policy goal of full employment is refreshing. A comparison of the real policy rate (using the current policy rate and 1-year ahead CPI forecasts) compared to the Central Banks estimate of the neutral real rate shows policy remains in accommodative territory in Australia in contrast to the US where policy is restrictive.

A primary driver of higher policy rates in the US is due to the transmission of monetary policy through the residential mortgage market. In the US, mortgages are typically fixed for 30 years. Thus, you are only subjected to a payment increase if you move and have to get a new mortgage. In contrast, more than 50% of housing loans in Australia are variable-rate, which means households see an increase in their mortgage payments when the policy rate is increased. As a result, the transmission of RBA policy to the real economy is much faster.

“Where are the best places to invest for 2023? Global government bonds will likely remain challenged, but relatively we expect Australia to be a reasonable hide-out.”

– T. Rowe Price

Governor Lowe understands the strain rising mortgage payments puts on the population as a result of tighter monetary policy. Whether or not the decision to slow rate hikes ultimately proves correct remains to be seen, but it is clear that RBA’s policy stance, relative to other developed markets central banks, reduces the likelihood of an aggressive hard-landing and a sharp rise in the unemployment rate.

Domestic growth is clearly declining. But is it simply a reversal of a very strong demand environment or are there much tougher days ahead? We think there are some green shoots and confidence has picked up. This is partly due to the RBA and government officials preparing the population for the worst. It was widely accepted that a recession was imminent. But now we look around and its possible a recession is avoided altogether. An improvement in the Eurozone and a China re-opening should give a much-needed boost to global growth. (However, China to return to an 8% growth rate is not our base case.)

Labour market dynamics are of fundamental importance to the RBA. The Australian labour market is tight and wage growth has picked-up. However, there is no clear sign of a wage price spiral. Although the RBA’s relatively looser policy stance risks higher wage pressures in the coming year, the slowdown in growth indicates labour market pressures are also easing. Low level of migration, due to border restrictions, have also contributed to the tight labour market. But a rebound in migrant arrivals will help ease the pressure in the labour market and limits the need for significantly tighter policy.

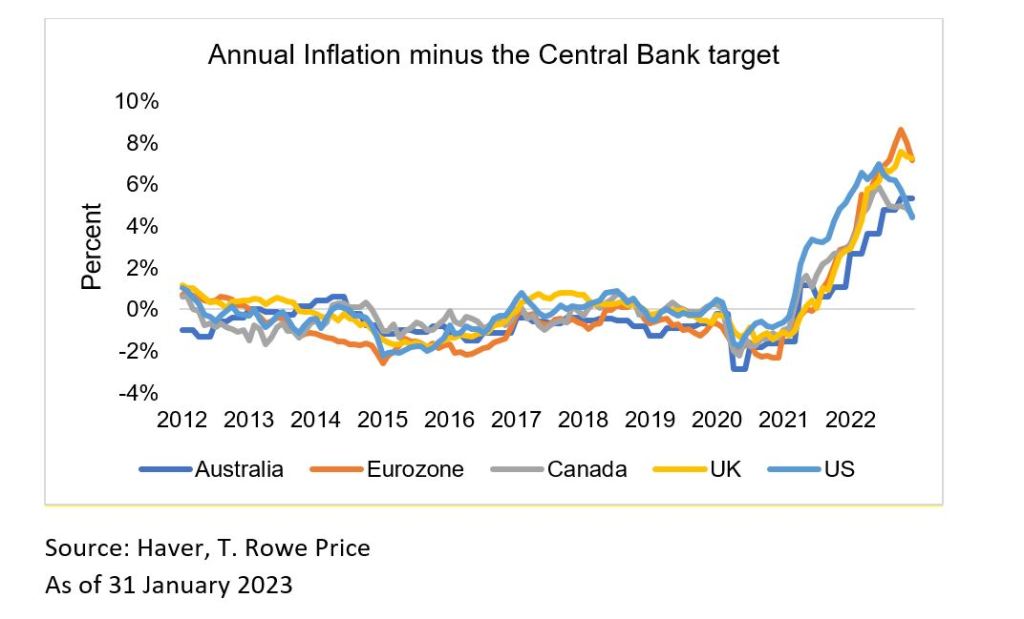

Although inflation in Australia is significantly above target and high relative to history, inflation is partly a global phenomenon and the comparison of headline inflation against the central bank target for the major developed markets shows the peak in headline inflation is likely to be lowest in Australia. Lower commodity prices, easing goods inflation and steady wage growth indicates falling inflation in the coming year. The fading of significant supply side distortions will also be supportive for the lower inflation outlook.

We believe that the RBA will be among the most dovish central banks in the world – a view that we have held since last year. Although Fixed Interest returns were generally negative in 2022, the Australian bond market outperformed the US by a couple of percentage points.

Where are the best places to invest for 2023? Global government bonds will likely remain challenged, but relatively we expect Australia to be a reasonable hide-out. As de-globalization themes persist, we expect central banks to disassociate from one another and the RBA can set their own course via lower rates, especially as recession risks fading and a recovery in China growth will be supportive for the Aussie Dollar. There are distinct opportunities within global high yield bonds from companies rated below BBB as they now possess a buffer from lower dollar prices and higher coupons. As inflation continues to recede there may also be opportunities from the local bonds of emerging markets. After all, dealing with inflation is not a foreign concept to those central banks.

Scott Solomon is Associate Portfolio Manager of the Global Dynamic Bond Strategy, and Aadish Kumar is International Economist at T. Rowe Price.

This article should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance. You should seek independent financial and tax advice before making any decision based on this information, the views or information expressed in this article.

Important Information

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. Investment involves risks. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of January 2023 and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

Australia – Issued by T. Rowe Price Australia Limited (ABN: 13 620 668 895 and AFSL: 503741), Level 28, Governor Phillip Tower, 1 Farrer Place, Sydney NSW 2000, Australia.