There are several ways to invest in property, and investors need to weigh up the advantages and disadvantages.

When it comes to property investment, many people immediately think residential property. This is a natural conclusion as it is a familiar asset class, given it incorporates the family home, with investors typically branching out into other residential property. The transaction size is also within reach for individual investors.

Commercial property such as major shopping centres, CBD office towers and large logistical assets are beyond the reach of most individual investors. However, smaller commercial property such as individual shops, small warehouses or strata offices may be possible.

Property has had favourable tailwinds with the declining interest rate regime of the last 30 years. However, the rise of inflation as a global phenomenon has led to the most abrupt increase in interest rates and has irrevocably changed the investing environment.

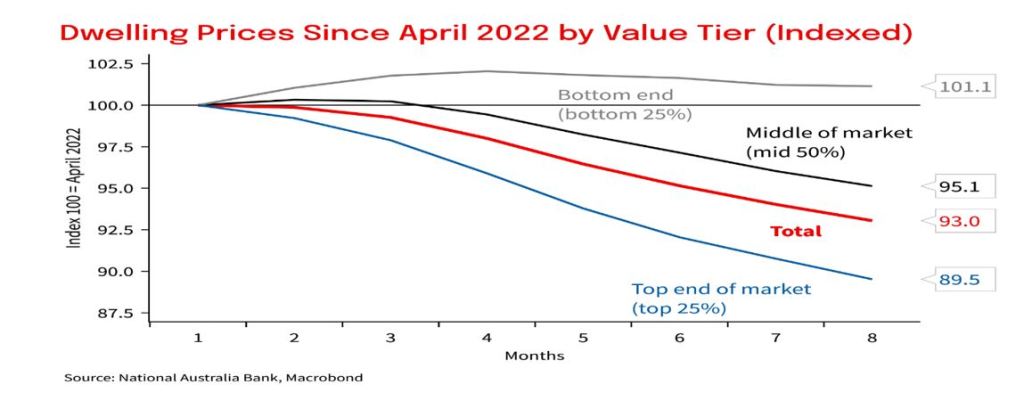

Australian residential property prices declined throughout the course of 2022, with many predicting this will continue for much of this calendar year.

The decline in the residential sector has been most evident in the Sydney and Melbourne metropolitan markets and the aspirational top end of the market. The bottom end of the market, including needs-based housing and regional markets, have proven more resilient.

Australian Real Estate Investment Trusts (AREITs) have also sold-off collectively over the course of 2022. While direct commercial property has far been more resilient, there’s an expectation of softening further into 2023.

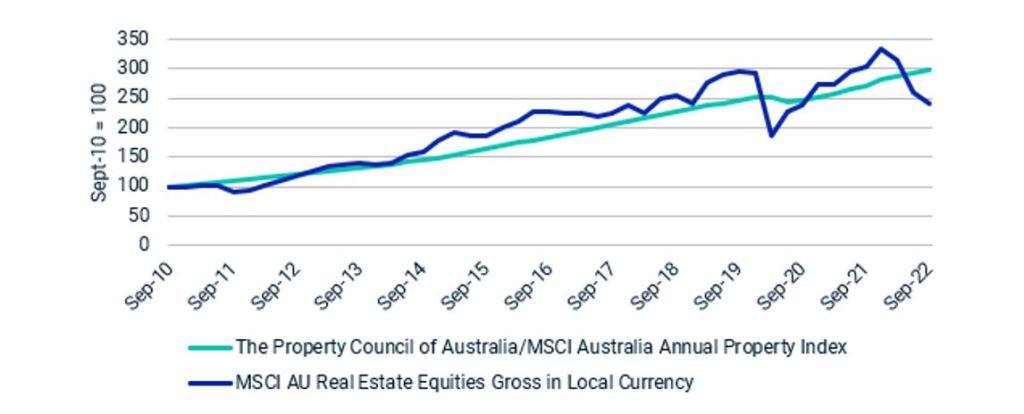

The chart below highlights that post GFC, the AREIT sector and direct property have rewarded investors, however, AREITs outperform and underperform direct property at times. Direct property follows a smoother trajectory being less reactive to short-term events and benefitting from the smoothing of a valuation-based methodology (i.e. not transaction based).

While the higher volatility of AREITs may be a deterrent for investors, it also creates opportunities for arbitrage, such as buying below direct property pricing or selling above direct property pricing. Interestingly, in the current cycle there are AREITs trading below direct property pricing.

There are advantages and disadvantages to different approaches in property investment. Investing directly into your own asset or portfolio comes with the certainty of knowing the asset, and not having other properties added or taken from the portfolio. It may also mean lower operating costs such as not paying a fund or asset manager.

The disadvantages could be higher transaction costs, a highly concentrated portfolio, and the burden of management oversight. Also, smaller transaction sizes may be limiting to highly competitive submarkets resulting in lower property income yields such as small-scale retail, strata office and warehouses.

Another approach may be to invest into a direct property fund or syndicate. This might have the advantage of being able to provide exposure to a direct asset or portfolio beyond the capacity of the individual investor, without the burden of management oversight (albeit at a cost). The disadvantage may be loss of individual control and potential liquidity issues, that is, the ability to exit the investment on request.

Another alternative is to invest in AREITs individually or via a fund, with the advantage of being able to invest or realise an investment at short notice. Daily pricing and settlement typically within two days of transacting is an attraction.

There is also the advantage of considerably lower transaction costs to direct property investment, most notably stamp duty. Similar to a direct property fund, there is management oversight, albeit also at a cost.

The disadvantage is the underlying AREIT manager may buy or sell assets or change the capital structure, such as gearing up at the wrong time or issuing more securities, ultimately diluting investors at potentially low prices. This risk is generally lower when there is a combination of the following:

- AREITs trading below Net Tangible Assets (NTA)

- Gearing is low

- Cost of debt is higher.

Given the rise in the cost of debt, the decline in security prices and the strength of balance sheets, several REITs find themselves in the position described.

All things considered, there is currently an opportunity to invest in AREITs below direct property values, with lower risk of value destruction through discounted equity raisings or gearing up to buy assets at peak prices.

Investors should takethe view that property moves in cycles. We use “through the cycle” capitalisation rates (yield hurdles) in our valuation framework, largely to reduce the risk of being over enthusiastic at peak pricing or overly pessimistic at bottom of the cycle.

It’s also important to recognise the close association of capitalisation rates to inflation-linked bonds. We were not prepared to use negative inflation-linked bonds in determining appropriate capitalisation rates, an occurrence at the end of 2021.

In the direct property market, capitalisation rates have drifted down to below five per cent. SGH uses capitalisation rates ~six per cent, however the implied pricing in the REIT sector has extended beyond this as reflected in higher implied capitalisation rates. This highlights the value opportunities on offer within the sector.

There are several ways to invest in property, and investors need to weigh up the advantages and disadvantages of:

- Control

- Management intensity, oversight and costs

- Liquidity

- Transaction costs

- Asset quality and type

- Sub-markets

- Diversification

- Capital structure

- And most importantly, pricing

Grant Berry is a director and portfolio manager of AREITs, SG Hiscock & Company

This article represents the views only of the author and should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance. You should seek independent financial and tax advice before making any decision based on this information, the views or information expressed in this article.