Fidelity Investments is preparing to offer bitcoin and ether trading to retail investors, according to the company’s website, which touts the upcoming service as commission-free, but there’s a catch: a 1% fee will be added to each transaction.

The company calls the fee a spread and defines it as “the difference between your execution price and the price at which Fidelity Digital Assets fills your order.” Although the 100 basis-point spread is a slim take for conventional retail investment transactions, it is pricey in the digital world, where the weighted average commission for a cryptocurrency trade is just 12 basis points.

“Free commissions is a gimmicky way to stand out in a crowded field and yet still make a bundle via spreads,” says Javier Paz, director of data and analytics for Forbes Digital Assets. “The free commission conveys a good feeling to traders to think they’re getting a deal, but only the savvy ones realize this is no free lunch.”

In response to Forbes’ request for comment, a company spokesperson pointed to an earlier statement: “Where our customers invest matters more than ever. A meaningful portion of Fidelity customers are already interested in and own crypto. We are providing them with tools to support their choice, so they can benefit from Fidelity’s education, research, and technology.”

The website did not identify a start date for the crypto offering. It stated that invitations to access the service will be sent based on factors such as the sign-up timing and state eligibility.

Last week, Fidelity Digital Assets, the company’s crypto arm, launched ether trading for institutional clients.

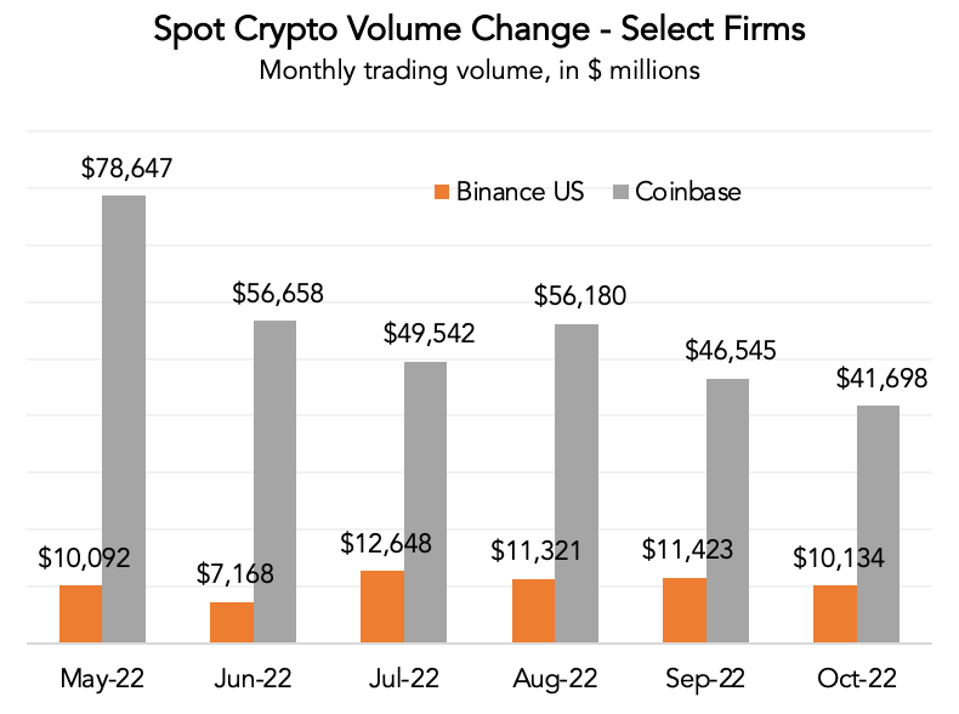

Cryptocurrency exchanges are engaged in a price war, ignited by Binance.US’s decision in August to eliminate fees on bitcoin trading. The commission-free model, popularized by stock and crypto trading app Robinhood at the onset of the coronavirus pandemic, had proven useful in winning customers from more established competitors.

However, it has not yet resulted in a significant boost for Binance. Meanwhile, Coinbase COO Emilie Choi said in September the country’s largest crypto exchange by volume doesn’t plan to bring its retail trading fees down to zero. “There’s a bunch of issues with zero fee,” Choi said. “Wash trading and so on. We are going to continue to play our own game.”

Forbes Digital Assets

In addition to cryptocurrency trading, Fidelity also provides an ether index fund, which tracks the performance of the coin in U.S dollars, as well as an exchange-traded fund (ETF) focused on metaverse investments and another one for crypto and digital payments. In April, Fidelity said it would allow employers to offer their employees access to bitcoin through an investment option in their core 401(k) retirement plans.