Mario Verrocchi, co-founder and CEO of the pharmacy unicorn is hoping for 400 more stores in Aus and 70+ duty-free outposts in China. Verrocchi will continue to run the Chemist Warehouse Group once the reverse merger with Sigma takes place. He may no longer have a CEO title in the new entity, but his vision for simultaneous global and local expansion stays the same.

Key Takeaways

- Chemist Warehouse Group (CWG) and Sigma Healthcare have agreed to merge, forming Australia’s largest pharmacy company after a long period of rumours and failed negotiations.

- The long-awaited CWG deal to go public consists of both cash and stock offers for the notoriously private founders.

- Current CEO Mario Verrocchi will own 22.3% (fully diluted) of the new ASX-traded entity that consists of CWG and Sigma Healthcare.

- Brothers Jack and Sam Gance will hold around 13% and 14% respectively.

- Collectively, the three Melbourne-based founders will hold 49% of the merged companies, pushing their net wealth well into multi-billionaire status. A cash offering of $700 million is also on the table.

“When I started a pharmacy 43 years ago, Boots the Chemist was the gold standard,” says Mario Verrocchi, the CEO and co-founder of the Chemist Warehouse Group.

“They had it all. They manufactured products, they owned products. They had distribution capabilities all over the UK and a store network that underpinned its success.”

Verrocchi took the Boots vision and ran with it. Today, he oversees more than 500 stores in the Australian Chemist Warehouse franchisee network. He sees the capacity for 400 more. And is looking abroad, to the region where the vision was born, to fuel additional growth.

“By the end of February, we will have 10 trading stores in Ireland,” says Verrocchi. “Ireland is finally showing the same promise as New Zealand. Ireland is the start of the European expansion.”

Verrocchi studied pharmacology at the University of South Australia. He joined pharmacist brothers Jack and Sam Gance as a trainee. He learned the pharmacy ropes, and in 1982, the three men opened their first pharmacy together in Melbourne’s Northland shopping center.

Within 15 years, they had 30 stores throughout Victoria and rebranded them from Amcal to MyChemist.

In 2000, Verrocchi and the Gances were ready to introduce their Victorian customers to the ‘Chemist Warehouse’ concept, a fusion of the economic model of a supermarket and the vision laid out by ‘Boots.’

It was a huge year for the partners, who were joined by Sam Gance’s son Damien Gance as the first Chemist Warehouse franchisee. Stores in Footscray and Dandenong opened that year, as well as Sydney and Adelaide.

The Boots’ roadmap became the playbook for success as CWG expanded. It worked well in the Australian market.

So well, that CWG did more than $3 billion in revenue in 2023. Statutory EBIT margin is 15%. The retail network achieved $7.9 billion in network sales this year. 5-year CAGR is 10%.

“Stripping out all repetitive costs, eliminating inefficiencies, and pooling resources to deliver affordable outcomes to more people in more locations,” says Verrocchi of the things he admired about Boots.

Verrocchi and the Gances added a twist. Unlike Boots, CWG would be a franchisor in Australia, and the stores would be run by franchisees.

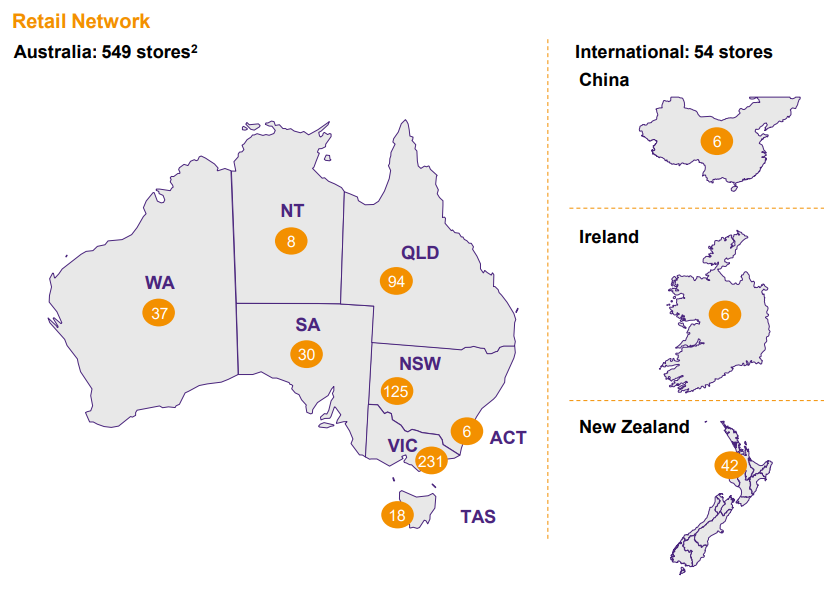

23 years later, CWG has 548 franchised stores in Australia. The majority are in the founders’ homestate of Victoria. And Verrocchi sees opportunity for around 400 more in other domestic states and territories.

He has his sights set on international markets too. The Chemist Warehouse abroad opened in New Zealand in 2017. 48 more Kiwi stores have followed since.

Verrocchi also spearheaded the growth into China, first, as an online store in partnership with Alibaba’s Tmall which was an enormous success.

“It became the biggest international health and beauty store on the platform, and consistently the biggest health and beauty store for the 11/11 sales – Singles Day. Which is the busiest online sales day in China.” says Verrocchi.

“Online is one thing, but if you are serious you need to get your boots on the ground,” he continues.

In 2019, the first ‘brick-and-mortar’ store opened in China, in the central Henan province. Zhengzhou City was chosen because of its pilot program that allowed Chinese customers to order from Chemist Warehouse, and pick up products in the bonded area of Henan province at a duty-free price.

The benefit to Chinese customers is two-fold — there is no need to wait for the delivery of items from Australia. And they do not have to pay customs fees because it is classified as ‘duty-free’ shopping.

It was also highly beneficial to Chinese customers because they have direct access to coveted Australian products.

“It was an immediate success, people waiting in queues for hours to come in, and the results, incredible,” says Verrocchi. There are now 8 stores in China and the possibility of many more under the innovative custom-free model.

“FYI, there are 16 duty-free provinces in China. There is opportunity and potential to open 70 odd stores,” says Verrocchi. “In truth, there is 100 years of work in China alone.”

A centenary of operation is a benchmark of success for Verrocchi.

“We have a theory. If you want to be a truly world-class, iconic retail brand, it will take 100 years to achieve. Just have a look at Walgreens, Walmart, CVS, and Boots. It took them 100 years of time and effort to get there,” says Verrocchi.

The founders see themselves as just half-way through that journey.

Sigma Healthcare disclosed this week that Verrocchi will continue to run CWG in the new entity post-reverse-merger. It is not known if he will retain the title of CWG CEO, but it is confirmed he will be Executive Director of the reverse-merger-entity that includes CWG.

Jack Gance will also be an Executive DIrector, as will Damien Gance – co-founder Sam Gance’s son. Sam himself will not be on the board of the new entity.

Verrocchi says the reverse-merger with Sigma was chosen as the path forward, because it allows him to continue to continue to lead the business.

“We want to be a part of the next stage of this journey,” says Verrocchi. “That’s why we agreed to stay on, that’s why we allowed our shares to be escrowed. Our pharmacy story has another 50 – 60 years to run.”

The Deal

- Sigma acquiring CWG (Chemist Warehouse Group) via a scheme of arrangement in exchange for Sigma shares and $700m cash consideration.

- CWG shareholders will hold 85.75% of the new entity upon completion of the Proposed Merger.

- CWG founders Mario Verrocchi, Jack Gance and Sam Gance will collectively hold 49% of MergeCo at the completion of the proposed merger. They have agreed to escrow arrangements with Sigma in relation to those shares.

- The remaining CWG shareholders will collectively hold 37% of MergeCo post-completion and will not be subject to escrow arrangements.

- Sigma shareholders to hold 14.25% of the new entity upon completion of the Proposed Merger.

- Proposed Merger has the potential to unlock significant efficiencies, with cost synergies initially estimated at $60m per annum, expected to be realised four years post-completion.

- There is a strong commercial logic [for the deal] with cost synergies expected to be realised across supply chain and corporate.

- Potential for additional synergies and flow-on benefits to franchisees.

- Integration is expected to be completed within four years post completion of the Proposed Merger, subject to the receipt of regulatory approvals – with full run-rate synergies expected to be achieved in year five.

Source: Sigma Healthcare merger documents

The current Chemist Warehouse Group board

Mario Verrocchi – Co-founder and CEO

Jack Gance – Co-founder and Chairman

Sam Gance – Co-founder

Damien Gance

Adrian Verrocchi

Marcello Verrocchi

Mario Tascone

Mark Finocchiaro

Sunil Narula

Source: Sigma Healthcare merger documents

The post-reverse-merger board

Michael Sammells – Chairman (current board member Sigma)

Vikesh Ramsunder – CEO & Managing Director (current CEO & Managing Director Sigma) Mario Verrocchi – Executive Director

Jack Gance – Executive Director

Damien Gance – Executive Director

Danielle DiPilla – Executive Director (current CWG Chief People Officer and cousin of Mario Verrocchi)

Annette Carey – Non-Executive Director (current board member Sigma)

Neville Mitchell – Non-Executive Director (current board member Sigma)

Chris Roberts – Non-Executive Director (current board member Sigma)

Source: Sigma Healthcare merger documents

Co-founders new ownership split – fully diluted

Mario Verrocchi 22.31%

Jack Gance 13.90%

Sam Gance 12.75%

Source: Sigma Healthcare merger documents

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.