In just over six months, Australian tech firms have raised more funding than they did throughout all of 2024. Late-stage raises are driving the investment, while early and seed-stage have dropped sharply from last year. Here are the startups and scaleups benefiting the most.

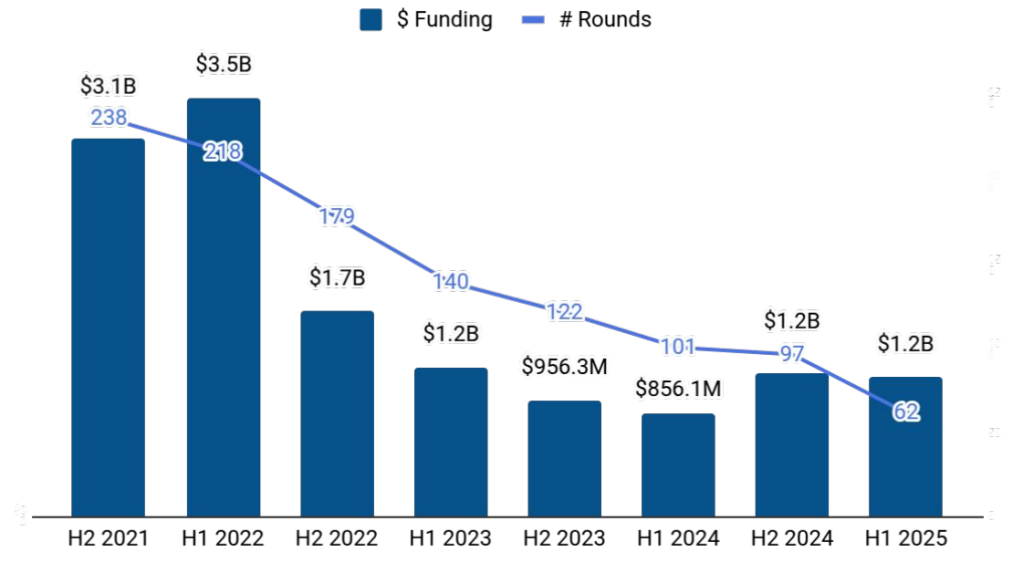

In the first half of 2022, Australian tech firms raised $5.4 billion. By July 2023, that number had declined to $1.8 billion, around a third of the previous year. 12 months later, just $1.3 billion had been injected into startups in the first half of the year.

Data just released by Tracxn shows that first-half-of-the-year funding has picked up in 2025. Tech companies raised $1.8 billion in Q1 and Q2, on par with the value of raises achieved in the first half of 2023.

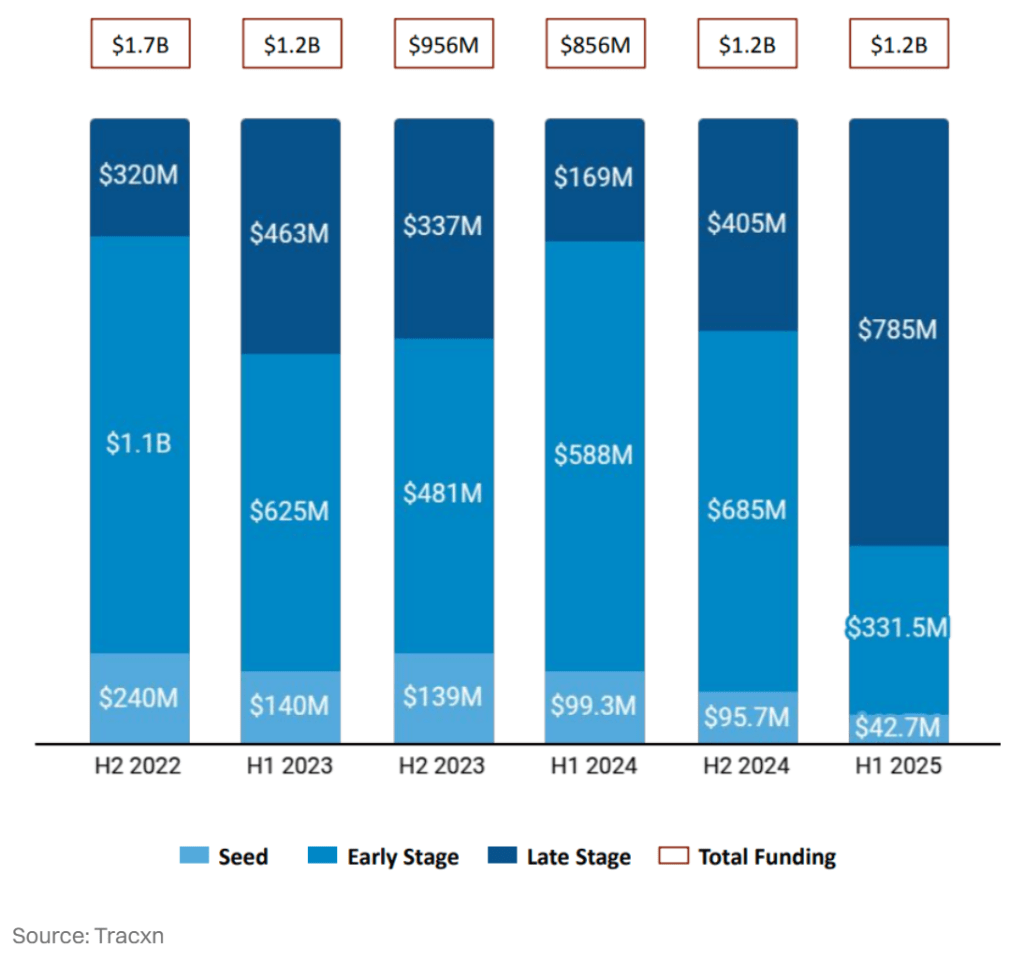

Analysis shows that a big chunk of that funding is flowing toward late-stage firms looking to scaleup. Established companies Protecht, AdvanCell, and Harrison AI, which are based in Sydney, and Melbourne’s Airwallex, Raygen, and Polyactiva, collectively raised $1.2 billion in late-stage funds between January and July.

Meanwhile, funding for seed and early-stage startups has dropped by around 50 per cent from levels seen in 2024, according to Tracxn data.

Just $65 million in funding has been raised by seed-stage companies this year. Early-stage raises dropped from $855 million in the first half of 2024, to $507 million during the same period this year.

Australian raises 2022 – 2025 (USD)

Stages invested in H1 2025 (USD)

Early-stage funding

New South Wales is home to the majority of companies that have received funding this year.

“Sydney-based tech firms accounted for 54% of all funding seen by tech companies across Australia. This was followed by Melbourne at a distant second,” the Tracxn report states.

The largest Series A raise this year has been Blinq, landing $38 million in May, led by San Francisco VC Touring Capital, which looks to make investments in AI-powered B2B companies. Boston’s Hubspot Ventures also participated in Blinq’s Series A, alongside existing investors Blackbird and Square Peg Capital.

Overall, Gandel, Insight Partners, Breakthrough Victoria, In-Q-Tel and InterValley Ventures were the strongest early-stage investors, according to the Tracxn data.

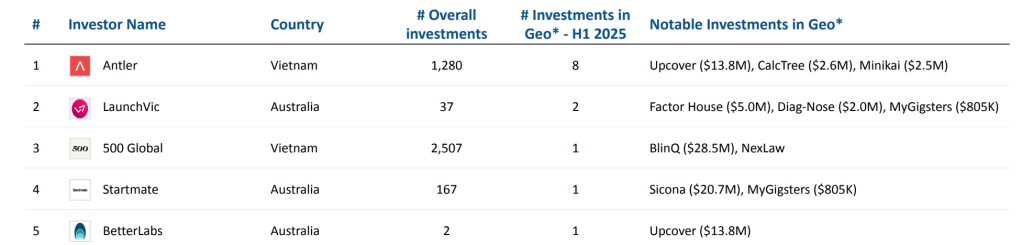

Most Active Investors: Accelerators & Incubators (USD)

Incubators and accelerators have also invested in Australian startups. Startmate, LaunchVic, and 500 Global were some of the most active acclerators alongside ‘day-zero’ investor Antler, according to the Tracxn data.

Upcover, CalcTree, Minikai, Factor House, Diag-nose, MyGigsters, BlinQ, NexLaw, Sicona, and Muval benefited from those investments.

Turning to seed raises, the data reveals that Main Sequence, Blackbird Ventures, Tidal, AirTree, and Macdoch Ventures were the most active.

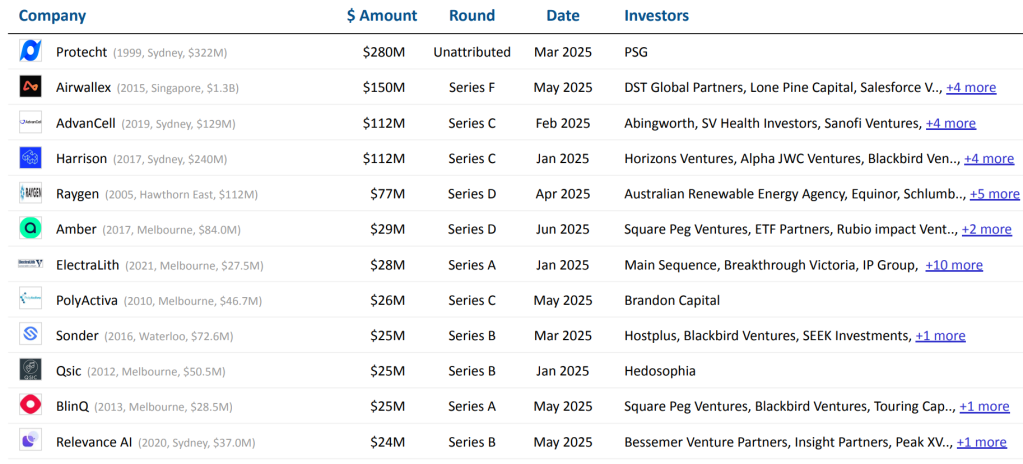

Largest raise: Protecht

The recipients of the 2025 funding so far range from biotech firms, to renewables companies, to fintech scaleups.

Governance, risk, and compliance firm Protecht has achieved the biggest raise, bringing in $428 million in March from US investor PSG, which sees great value in what Sydney-headquartered Protecht offers.

“The global risk management market is projected to reach nearly US $22 billion by 2029, underscoring the immense need for innovative, and scalable solutions,” Adam Marcus, the managing director of PSG notes.

Top Funding Rounds in H1 2025 (USD)

PSG is a growth investor and believes Protecht – which has offices in London, Los Angeles and Sydney – is well-positioned to capitalise on the expanding market.

“As regulatory scrutiny grows globally and operations become more complex, organisations are under greater pressure to adapt,” a Protecht statement reads.

“This strategic investment will empower Protecht to help deliver AI-driven risk management solutions, positioning Australian tech companies to be among those at the forefront of addressing global enterprises’ needs.”

Other big late-stage raises: Airwallex, Advancell, Harrison AI

The Protecht fundraise had the highest value, but deacorn fintech Airwallex and biotechs Advancell and Harrison AI, have also brought home big rounds in 2025.

Singapore-based, Melbourne-founded Airwallex closed out a series F round in May. Half of the $460 million series F was a secondary round, meaning only $230 million of it is considered a traditional fundraise, putting it behind Protecht in terms of the value of the raise.

Kell Reilly is a partner at Airtree Ventures which participated in Airwallex’ most recent round.

“We’ve spent time with hundreds of teams across the global fintech landscape, and we believe Airwallex is one of the best-positioned companies in one of the largest addressable markets in technology,” says Reilly.

The investor calls CEO Jack Zhang a ‘force of nature,’ and believes Airwallex is setting the pace for fintechs operating in regulatory-intensive environments.

“We believe all businesses will come to expect financial infrastructure to be embedded, borderless and programmable. Airwallex is already there, providing tools to help all shapes and sizes of customers with their financial requirements. We’re proud to be in their corner as they build the future of modern banking.”

AdvancCell and Harrison AI are tied as the third-highest rounds so far in 2025. Both Sydney-based biotech firms raised a series C in the first quarter.

Boston and Sydney-headquartered Harrison AI raised $178 million in a Series C round led by Aware Super. Wollemi Capital Group, Blackbird Ventures, and the Australian National Reconstruction Fund Corporation (NRFC) also participated in the raise.

Dr Aengus Tran is co-founder and CEO of Harrison.ai.

“[There is] growing demand for equitable and effective healthcare calls for advanced systems like AI to enhance human diagnostics and address disparities in access to care,” says Dr Tran.

The series C funds will be used to continue expanding the biotech internationally.

“Harrison.ai meets this need by developing clinical-grade AI models designed to improve capacity. We look forward to bringing our life-saving technology to healthcare systems in the U.S. and continuing our expansion across the globe.”

In January, Aussie biotech Advancell announced a $178 million raise to fund ongoing clinical trials for its prostate therapy.

“We’re now running a Phase 1-2 clinical trial treating men with metastatic prostate cancer at two public hospitals in Brisbane, Royal Brisbane and the Princess Alexandra Hospital,” Adamovich told Forbes Australia in May.

“We’ve treated 16 men so far. We’ll treat four men this week. We treated three last week. The results are looking unbelievably good. Really tolerable… and also looking like they’re very, very effective.”

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.