Not all offices are created equal: Inside the sector’s diverging future

BRANDVOICE – SPECIAL FEATURE

By Peter Studley

Green shoots and a market turnaround have dominated discussions in the office sector recently with premiumisation and flight-to-quality continuing to be strong thematics. But beyond tentative optimism, industry data confirms a tangible recovery is emerging in Australia’s office market, with demand stabilising, workers returning to the office, and tenants actively re-evaluating their space decisions.

We’ve seen office transaction volumes surge by 14% in the year to Q1 2025, as shared in our latest Australian Real Asset Review, with Q1 sales alone up 20% compared to 2024. This uptick signals improved liquidity and a renewed appetite for office assets. While a burst of global uncertainty may dent investor appetite for large transactions in the short-term, the momentum is moving in the right direction and declining interest rates will likely prove a tailwind for future deal flow and valuation performance. Recent data from MSCI revealed a 1.1% rise in Sydney CBD office values in Q1 2025 – the first increase in two years. While that figure feels seemingly marginal, it marks a clear inflection point and if annualised, implies capital gain of 4% this year. The reality of booking actual capital gains will be a powerful positive factor for investor sentiment in the year ahead.

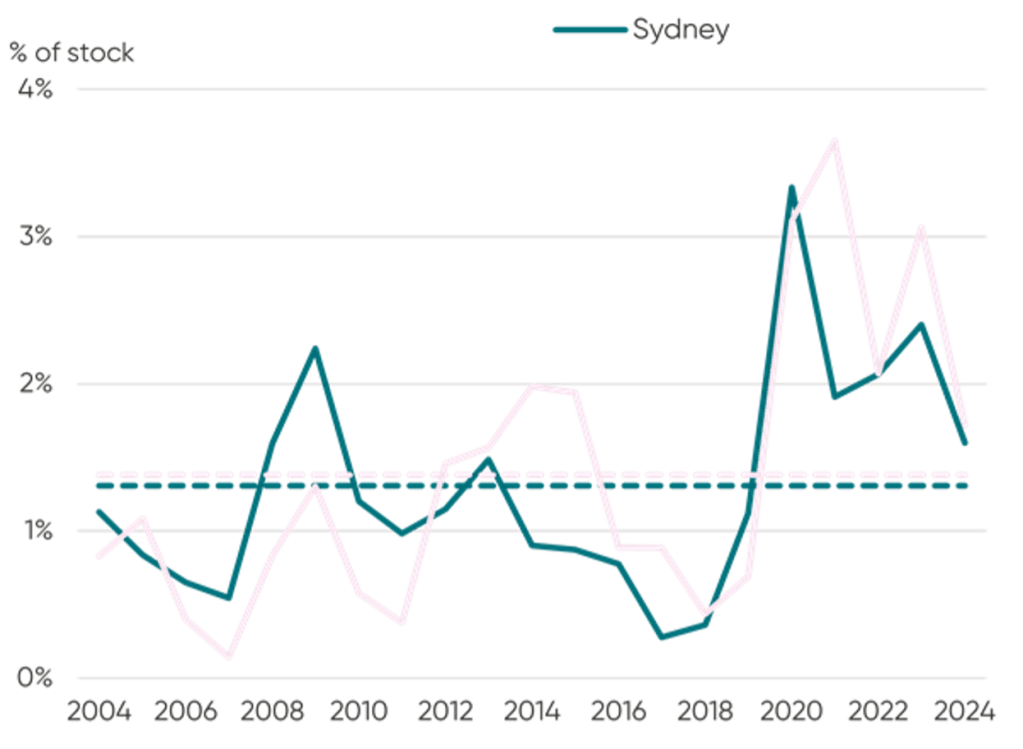

Turning to leasing, CBD vacancy rates fell in Melbourne to 18.6%, Sydney to 15.3%, and Perth to 15.7% over Q2, while Brisbane edged up to 10.2%. There are signs that the consolidation of office space which occurred following the pandemic has run its course. Sub-lease vacancy – a measure of companies shedding surplus office space – has fallen dramatically over the past four years. Supply of sub-lease space across the four main CBDs is down 45% from 2020 levels (399,000 to 218,000 sqm). In our own portfolio, we’ve seen some tenants expand their workspaces by as much as 260% – for example Pinsent and Masons at 33 Alfred Street, Sydney. With a steady return to office trend happening there are even examples of companies running short of desk space on the peak days of the week (Tuesday through Thursday).

Sub-lease space in Sydney and Melbourne has more than halved since 2020

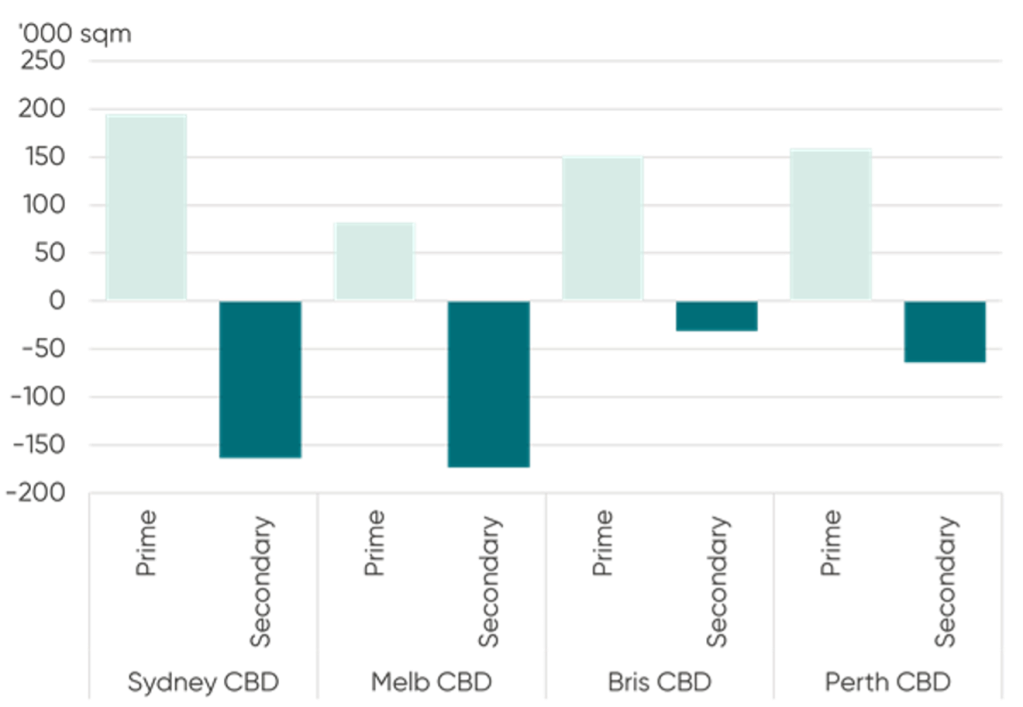

However, the office market is not just recovering—it’s evolving. A divide is emerging between outdated, lower-grade stock and the growing demand for high-quality, ESG-compliant assets in prime locations. This bifurcation is being reinforced by occupier preferences, with companies increasingly prioritising premium, amenity-rich workplaces. As a result, net absorption of top-tier office spaces remains strong, while older, lower-grade assets face challenges, particularly as lease expiries approach, making these assets ripe for value-added opportunities, as leveraged through our opportunity fund series.

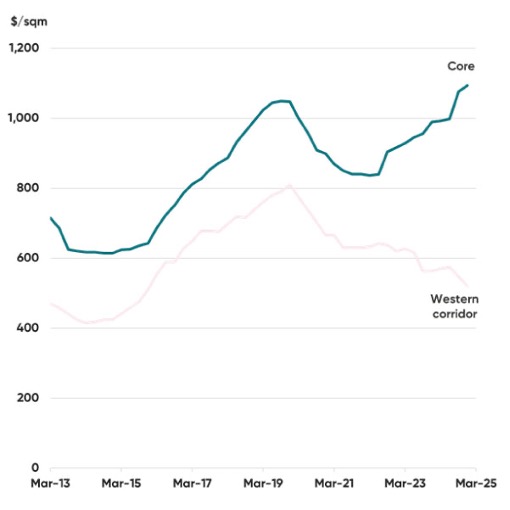

The investment case for premium properties is becoming more compelling. Across Australian CBDs there is an evident willingness to pay for premium grade space, as reflected in the relative rental growth. Premium rents have grown 4.1% more than A Grade rents, with this divergence accelerating post pandemic. Sydney CBD appears to be leading this bifurcation trend, with Brisbane and Melbourne following suit. Our research highlights in Sydney CBD, net effective rents increased by 5.8% over Q1 2025, while prime incentives decreased to 33%, the lowest since 2021 – and there is still some way to go. Vacancy in Sydney’s western precinct and south is leading to higher average incentives and weaker effective rent growth, while rents in the core are increasing.

While Brisbane CBD had negative net absorption over the quarter, net effective rents grew 3.6%. In Melbourne, the divergence of rents in CBD precincts is even more pronounced – with the Eastern Core far outperforming the Docklands precinct in terms of price per sqm ($647 per sqm and $200 per sqm respectively).

Sydney CBD premium rents

In terms of supply, our data shows the pipeline in Sydney and Melbourne has tightened significantly, with new developments falling well below historical levels. In Brisbane, Dexus’s Waterfront Place is one of few developments earmarked for new office supply in the Queensland capital. A constrained supply pipeline for FY25-27, which is down 32% from the five-year average, should further support rent growth. In addition, there’s a 20% gap between current market rents and the rent required to make it worth commencing a new building, which suggests a growth phase in market rents as a ‘catch-up’ occurs.

CBRE’s latest Mind the (Office) Gap report underscores the growing premiumisation shift, with occupiers willing to pay substantially more for high-rise floors with expansive views in premium towers. On average, CBRE’s data shows renting space in these upper floors costs around 60% more than securing lower-floor accommodation, with occupiers in Sydney’s Core Premium properties paying approximately $800 per sqm more for top-tier space.

CBD office net absorption over the past four years*

Australia’s office sector is showing clear signs of recovery, with a growing divide between premium assets and lower-grade stock. Businesses that can invest in high-quality office environments are driving demand, as employers prioritise the employee experience to attract and retain top talent. The vibrancy, amenities, and transport convenience of CBD locations make them a preferred choice, reinforcing the strength of top-tier assets. At the same time, as reflected in our recent office research, Sydney’s office market is offering attractive yields. The prospect of these tightening over the next few years could contribute to capital gain, marking a turning point for investors seeking higher returns.

As market conditions align, high-quality office properties stand to gain, cementing their status as the preferred choice for businesses and investors in a recovering market.

Peter Studley is Head of Research at Dexus