As the sandwich chain eyes a potential US$10 billion sale, a Forbes investigation reveals that late cofounders Peter Buck and Fred DeLuca and their families salted away billions for themselves and their foundations. Meanwhile, some franchisees say they are left with crumbs.

In the early 2000s, a footlong frenzy swept the United States. More than three decades after the first Subway opened in Bridgeport, Connecticut, the sandwich shop started appearing everywhere from strip malls to churches to Walmart Supercenters in all corners of the country. By 2011, Subway’s iconic yellow and green awnings were more ubiquitous than the golden arches of McDonald’s.

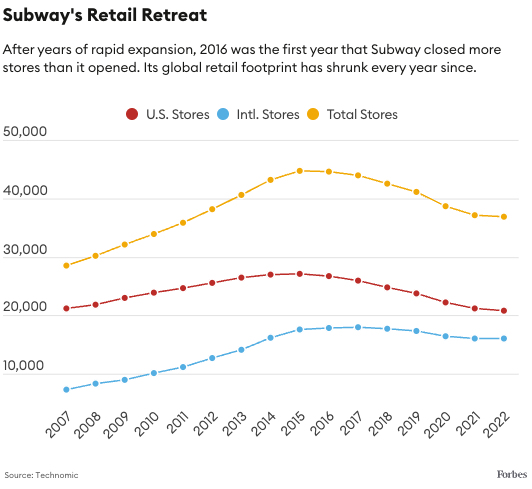

But almost as quickly as it arrived, the world’s seemingly insatiable desire for cheap subs began to wane. After the 2015 death of Subway cofounder and longtime CEO Fred DeLuca, which happened to coincide with a colossal public relations crisis for the company when its spokesperson Jared Fogle pleaded guilty to child sex and pornography charges, the restaurant chain saw its sales sputter. The years since have been an undoing of much of Subway’s rapid expansion. Nearly a quarter of the over 27,100 U.S. stores open at the time of DeLuca’s death are now closed.

So it wasn’t a huge surprise when in February, 15 months after its second cofounder, Peter Buck, passed away, the company officially said it’s for sale. According to reports, the price tag could be anywhere from $7 billion to over $10 billion.

New reporting by Forbes in light of that impending deal uncovers new details on just how much money Subway’s billionaire owners pocketed over the years, as well as the moves they’ve taken to both protect and minimize their wealth in the lead up to the sale. Through its ups and downs, one thing has remained constant: Subway has been paying out generously to its owners and their families for years.

This reporting–which is based on hundreds of pages of court documents, charitable filings, historical financial disclosures and interviews with experts and insiders–also pins down for the first time the fortune of DeLuca’s widow, Elisabeth DeLuca, 75, who debuted on the Forbes’ World’s Billionaires list in early April. DeLuca, who has one son, inherited her late husband’s 50% stake in the restaurant giant. With her family, she is estimated to be worth as much as $8 billion, after subtracting disclosed charitable gifts and calculating investment returns on the Subway royalties.

Subway’s other cofounder, Peter Buck, left instructions in his will, a partially redacted copy of which was obtained by Forbes, to leave his half of the company to his family foundation after his November 2021 death, a bequest that might possibly hit $5 billion pending final sale, and ranks as one of the biggest single charitable gifts to a foundation. (It will also help the family avoid a huge tax bill.) Separate from this, Forbes’ reporting reveals that the Buck family bought up forestland in Maine worth up to $1 billion, parts of which the late Subway cofounder passed onto his heirs using a tax-minimizing maneuver that at one point was challenged by the Internal Revenue Service.

Even before the historic donation by Buck, Subway’s owners were giving chunks of their fortune away. Both families have been lauded for their philanthropy. But complicating that legacy is a backlash by some franchisees who accuse the owners of enriching themselves while they struggled amid thousands of store closures. Representatives for the DeLuca and Buck families did not respond to multiple requests for comment for this article. Responses from Subway are included below.

Subway’s story started in 1965 in the small coastal town of Bridgeport, Connecticut, when a 17-year-old DeLuca approached a friend of his parents, Peter Buck, a successful nuclear physicist, for advice on paying for college. According to Subway’s website, it was Buck’s idea that the aspiring medical student open an Italian-style submarine sandwich shop to help pay his tuition. Buck gave DeLuca a $1,000 investment to get the business going. “I just wanted to get through college,” DeLuca, the son of a factory worker, reflected in his 2000 book Start Small, Finish Big. “I didn’t really plan to make a career out of the sandwich business.”

That eventually changed. DeLuca, who got a degree in psychology from the University of Bridgeport, spent more and more time on his sub shop business. Over the next decade, the pair opened another 15 stores, under the new name “Subway,” across Connecticut. Then in 1974, they switched to a franchise model, and business took off. It helped that it was significantly cheaper to open a Subway franchise than most other fast food companies. Today, the fee to open a Subway restaurant ranges from $10,000 to $15,000, and startup costs add on another $115,000 to $260,000 or more. In comparison, the fee to open a McDonald’s franchise is $45,000, while startup costs range from $1 million to $2.2 million.

By 1988, Subway had opened 2,000 sites across the country. In 2011, it overtook McDonald’s as the world’s largest restaurant chain with 33,749 locations around the world.

The franchise model wasn’t just highly scalable. It also made DeLuca and Buck very, very rich. The pair equally shared ownership of Subway’s parent company, Doctor’s Associates, incorporated in Connecticut in 1967, which charges franchisees an 8% royalty on gross sales, one of the highest rates in the industry, according to franchise expert John Gordon of Pacific Management Consulting Group, who said rates typically fall closer to 5% or 6%. Subway also takes an additional 4.5% cut of revenue for its advertising fee. McDonald’s charges franchisees a 4% royalty fee and a 4% advertising fee, Burger King takes 4.5% for its royalty fee and 4% for advertising.

Forbes first called the partners billionaires in 2004. At time they were estimated to be worth $1.5 billion apiece, based on our valuation of the parent company. What was harder to peg down was just how much Buck and DeLuca were getting in cash each year from royalties. In 2014, DeLuca’s personal banker of many years, Fran Saavedra, who claimed to be romantically involved with the married Subway cofounder, testified in a deposition that the Subway founders were getting the equivalent of $1 million a day in royalties in the form of a weekly check in the early 2000s.

“That was the boys’ money, their royalty split,” Saavedra said of DeLuca and Buck in the deposition. “They called it their bonus money.” (Saavedra was deposed after DeLuca was sued for fraud by his former business partner, Anthony Pugliese III. Pugliese lost the case and was ordered to pay DeLuca’s family $23.1 million in court judgments in 2018.) According to Saavedra’s deposition, DeLuca had hundreds of millions of dollars in his bank and trust accounts in the early 2000s.

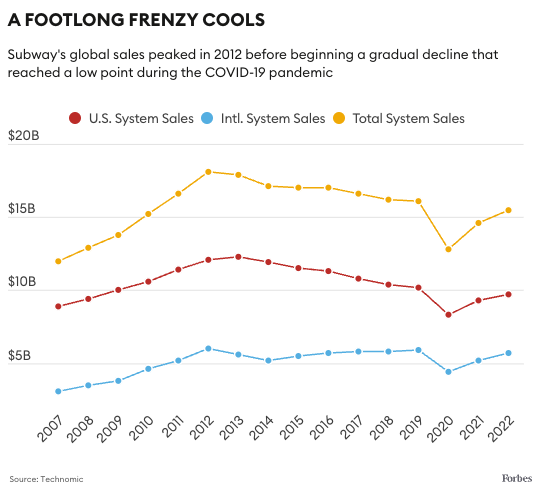

But this was before Subway had reached the heights of its growth. The restaurant chain recorded about $5 billion in global revenue in 2002. That number more than tripled over the next decade, peaking at $18.1 billion in 2012, according to data from the restaurant industry data tracker Technomic.

Four months after DeLuca’s death in September 2015, Subway underwent an internal restructuring that involved moving its global intellectual property to a newly formed Delaware corporation, the company’s franchise disclosure documents show. Delaware is a tax haven where there is no state tax on royalties.

Then, starting in 2017, Subway’s parent company began sending the equivalent of roughly half of Doctors Associates’ revenues to the new Delaware entity, which restructured again in 2018, converting to a Delaware limited liability corporation. The Delaware intellectual property company took in over $2 billion worth of royalties between 2017 and 2021. This money is basically “pure profit” for Subway’s owners, explains Morningstar analyst Sean Dunlop (though it’s still subject to federal and net investment income taxes).

Forbes estimates that Subway’s owners received almost $5 billion in royalties (after tax) from the sandwich chain during the 13 years from 2009 to 2022, or about $2.5 billion per family. That’s assuming the DeLuca and Buck families both paid the highest federal income tax rate each year and an additional net investment income tax. Subway’s royalty payments to its owners peaked between 2011 and 2013 when the owners were each getting more than $200 million in royalties per year, according to Forbes’ estimates. After declining during the COVID-19 pandemic, the estimated royalty payment rebounded to about $180 million in 2022.

It’s common for companies to restructure for a number of reasons, including minimizing their taxes, but there could be other motivations, according to Elizabeth Bawden, a partner at the law firm Withers, who said Subway moving its intellectual property to a Delaware-based entity could be motivated by estate planning. “Sometimes you’ll see companies restructuring because the family knows there will be significant charitable gifts and they’re trying to make sure the assets that are going into the foundation aren’t going to cause any adverse tax impacts,” she said.

Another reason a company would restructure this way is because it is preparing for sale, said Bawden. It can be useful if the owners want to “sell some aspects of the business but not all, or advisors they’re working with on the sale suggest it will be easier to sell if different assets are segregated from one another.” By hiving off their intellectual property, Subway’s owners could theoretically hold onto that part of the business in a sale and continue to collect a significant chunk of the royalties. However, a person close to the sale talks said this is not the case and the company is for sale in its entirety.

While the Peter and Carmen Lucia Buck Foundation described Buck’s gift of his Subway stake as “over a decade” in the making, the donation also comes just in the nick of time to erase what likely would have been a hefty tax bill for his estate if Subway is sold. David Slenn, a tax and estate law expert with the law firm Akerman, explained that if Buck had not given his Subway ownership to charity, his estate would have to pay a 40% estate tax on the “fair market value” of the asset. By donating his share of the restaurant company to the family’s charitable foundation, Buck’s heirs, likely his two sons Christopher and William, don’t have to pay any tax on the sale. Of course, they also will end up inheriting billions of dollars less than they would have otherwise. (Elisabeth DeLuca would not have been subject to this estate tax because it does not apply to assets passed on to spouses. Buck’s wife, Carmen Lucia Passagem, died in 2003.)

A copy of Buck’s will, obtained by Forbes, shows that he named his sons as executors of his estate. Both Christopher and William are on the foundation’s board.

Another big portion of Buck’s estate is tied up in land. The Subway cofounder started buying timberland in Maine’s North Woods, the largest remaining undeveloped forest in the eastern United States, back in 2007. That’s around the time that paper companies started a “cataclysmic” selloff of land that threw the future of the North Maine Woods into flux, explained Karin Tilberg, the president and CEO of the Forest Society of Maine.

The Buck family has since accumulated 1.3 million acres of the roughly 10 million acres that make up the North Maine Woods, making them one of the largest landowners in the state and prompting the executive director of the local Nature Conservancy to call them “great landowners.” They also own land in Vermont and Iowa.

A person with knowledge of the transactions said the Buck family bought about half of their North Maine Woods land in the past six years, with purchases as recent as last year. Buck and his relatives paid an average of $500 per acre for much of the land, often bidding above the market price, according to this person. “Most of the properties they’ve bought, they’ve been the top bidder on or they’ve approached people and paid a price they couldn’t resist for properties that weren’t for sale.”

Soon after initially buying the land, Buck began passing it onto his sons. In 2018, Buck sued the IRS for charging him additional gift taxes after he transferred property to his sons for what was a significant discount to the purchase price, using a mechanism called fractional interest discounts. According to documents filed as part of Buck’s lawsuit, the Subway billionaire purchased seven tracts of timberland in Maine and one in Vermont between 2009 and 2013 for a combined $82.9 million, and then from 2010 to 2013, transferred a 48% stake in the land to each of his sons, keeping 4% for himself. He then saved millions in gift taxes by valuing the same plot of land at $37 million, a 55% discount to the purchase price, based on the assumption that it would be less valuable to a hypothetical buyer when divided.

The government challenged the use of the discount since the ownership of the land previously wasn’t divided. In September 2021, the court issued a favorable ruling for Buck on summary judgement but Buck died before it could be concluded. David Slossberg, the lawyer representing Buck in the matter, said his estate ultimately settled the case with a magistrate judge. The estate negotiated a “number that was acceptable” for the refunded taxes, Slossberg told Forbes, though he couldn’t share the exact amount.

“When you’re this wealthy, it’s a process to keep reducing that estate. It’s not a one and done.”

David Slenn, tax and estate attorney at Akerman

In a 2018 affidavit published in the case, Buck explained how he wanted to assemble “an extensive tract of timberland in Maine primarily as a long-term investment in a new asset class.” He said he set up a revocable trust, known as The Tall Timber Trust, to facilitate the acquisition of the land, which was then transferred to LLCs owned by himself and his sons. “My sons and I do not require any cash flow from the timberland. Instead, we view the timberland as a multi-generational endeavor and, as a result, we have instructed the managers of the timberland to maximize the long-term health and productivity of the timberland,” Buck wrote in the affidavit, noting that his companies only harvested about one third of annual timber growth at the time.

As part of the lawsuit, the government requested Buck’s will and estate planning documents, which Buck’s lawyers vehemently declined to turn over, citing privacy concerns. However, a 2007 agreement for the “Tall Timber Trust” produced by Buck in the lawsuit outlined how upon his death, the trust property would be distributed as guided in Buck’s will (the unredacted portions of Buck’s will did not explain the fate of the Tall Timber Trust).

Jay Braunscheidel, the president and lead forester at the Maine-based Tall Pines Forest Management, said the Buck family’s land in the state could be worth between $325 million and nearly $1 billion today. Price per acre would vary greatly on how the land was divvied up at a sale, since smaller parcels historically sell for more than those the scale of Buck’s, according to Braunscheidel.

Buck’s lawyer Slossberg insisted that while there was “an investment aspect” to Buck’s focus on the Maine forest, it wasn’t his main motivation. “Really his goal in accumulating all of these hundreds of thousands of dollars of timberland was to create a primeval forest. [It] was really for conservation,” he said.

Slenn, of the law firm Akerman, who reviewed Buck’s lawsuit and the partly-redacted copy of the will, said Buck used tools “consistent with somebody who has got high wealth and is trying to reduce his estate.” This includes grantor retained annuity trusts (GRATs) and his private charitable foundation, though Slenn emphasizes that private foundations are still “subject to complex rules, such as those governing business holdings.” “When you’re this wealthy, it’s a process. It’s not a one and done,” explains Slenn. “It’s a process to keep reducing that estate.”

Buck was notably charitable throughout his life. Prior to the posthumous gift of his stake in the company, Buck had donated more than $560 million to the Peter and Carmen Lucia Buck Foundation over 24 years, according to Forbes’ calculations. Even now, the Buck family foundation gives tens of millions of dollars each year to an array of nonprofits spanning education, journalism, medicine and land conservation. He also gives to numerous nonprofits working to improve the quality of life in Danbury, Connecticut, where Buck lived until his death.

Isabel Almeida, the president of United Way of Western Connecticut, described Buck as transformative to Danbury (population: 87,000). “There are few organizations in Danbury that were not touched by his charitable contributions at one point or another,” said Almeida.

In the case of DeLuca, the donations really came after he died. Though it was set up in 1999, his family foundation received no donations until 2007. From then until his 2015 death, annual contributions to the foundation never exceeded $1 million. A person close to DeLuca, who spoke on the condition of anonymity, said during his lifetime the late Subway cofounder was unsure how to spend the cash piling up in his accounts. He purchased at least three homes in Florida in addition to his home in Connecticut, and a 100-foot yacht. He’d sometimes throw parties in his sparsely decorated Florida homebase, which he’d cater with Subway sandwiches.

His widow, Elisabeth DeLuca, who previously worked at Doctors Associates, mainly writing operations manuals before retiring in 2004, began donating money almost immediately after her husband died. In the first five years after his death, she donated nearly $450 million to the Frederick A. DeLuca Foundation, averaging around $90 million a year, according to a review of the foundation’s tax filings. This does not include any donations made in 2021 or 2022 since the information is not available yet. Elisabeth DeLuca is listed as the foundation’s president, director and secretary, while Kevin Byrne was named its CEO in March 2022. Byrne, who did not respond to requests for comment from Forbes, previously spent nearly two decades at the foundation started by the family of Dell Technologies CEO Michael Dell. DeLuca also quietly incorporated her own foundation, the Elisabeth DeLuca Foundation, headquartered in Pompano Beach, Florida, in December 2020.

The Frederick A. DeLuca Foundation—which gave away about $25 million in 2020—predominantly supports organizations in Connecticut and Florida, where Elisabeth lives and owns homes. The DeLuca Foundation is unique because “you can’t just reach out and apply,” said Debra Lee-Thomasset, the CEO and executive director of The Arc at the Glades, a nonprofit that serves adults with intellectual and developmental disabilities in the Palm Beach-adjacent Glades County.

“The charitable stuff is on the backs of franchisees. They’re out there getting credit for being the nice guy and that’s screwing franchisees.”

Anonymous Subway franchisee

Outside of her Subway stake, Forbes identified two modest homes belonging to Elisabeth DeLuca: a condo in Pompano Beach, and a 2,500 square foot house in Orange, Connecticut. Together, they’re worth about $2 million. Her son Jonathan, who is also a director at the family foundation and at Subway’s parent company, owns two splashier properties: a seven bedroom home in Pompano Beach worth an estimated $3 million and a $4 million Boca Raton pad.

ot everyone is impressed with the Subway founders’ charitable efforts. In April 2021, a group of more than 100 Subway franchisees published an open letter to Elisabeth DeLuca outlining a host of previously reported issues at the chain—including Subway denying their requests for higher quality ingredients and cannibalizing sales by opening up new restaurants next to existing ones. “We were prevented from reducing our hours [during the COVID-19 pandemic] to make ends meet so that the corporate office can generate more royalties,” said the franchisees, specifically highlighting DeLuca’s donations: “We see you presenting charities with large sums of money doing good work. If anything, this shows us that you want to do the right thing in life.”

In the letter, the group of franchisees requested a royalty rebate of 8% of the sale “as a sign of good faith for all the turmoil, and heartache that we have endured through Subway’s 40+ year history.”

“The charitable stuff is on the backs of franchisees,” one long-time franchisee said to Forbes, speaking on the condition of anonymity for fear of retribution. “They’re out there getting credit for being the nice guy and that’s screwing franchisees and getting the money on the backs of them because right now large swaths of franchisees aren’t that successful.”

While none of the Bucks nor the DeLucas commented for this article, a Subway spokesperson emphasized how the company has been overhauled since its current CEO John Chidsey joined in 2019. Chidsey, who previously served as Burger King’s CEO, is the first chief executive outside of Subway’s founding families and “took a fresh look at every aspect of our business, including refreshing our relationships with franchisees through improved operations and support,” the spokesperson said. Since taking over, Chidsey has slashed Subway’s corporate staff, initiated an overhaul of Subway’s menu and restructured its contact with franchisees, mainly through diminishing its reliance on controversial business development agents. So far, there’s been no permanent change in the royalties franchisees are required to pay.

In response to the specific concerns raised by franchisees, the Subway spokesperson highlighted that there are 10,000 franchisees in the Subway system with “many points of view.” The spokesperson pointed to the company’s sales, which jumped 6% in 2021 according to data tracker Technomic (Subway declined to comment on its financials), as an indicator that “these improvements are working.”

Subway also put Forbes in contact with two franchisees. Michael Rodriguez, a franchisee who runs 10 Subways in North Carolina, applauded Subway’s owners for their charitable giving. “I think that’s great that they’re giving money to charity, I think that makes sense,” said Rodriguez. “My company is my company, that’s where I earn my living. I’ll do with my money what I think is right and I think everyone else deserves the same leeway.”

Raghu Marwaha, a second generation Subway franchisee whose family owns over 100 restaurants in California, pointed out that the company cut franchisees’ royalty fees in half for a few weeks at the start of the COVID-19 pandemic, and then offered the option to pay royalties late for a few weeks. Ultimately, Marwaha said he’s personally not spending much time thinking about how much Subway’s owners will get from a sale. “I’m going to worry about my own business … What I’m mostly interested in is do I have a future with this brand?”

With additional reporting by Sue Radlauer.

This story was first published on forbes.com and all figures are in USD.

Forbes Australia issue no.4 is out now. Tap here to secure your copy or become a member here.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here.