What began as a tool to troubleshoot power grids has pushed Neara into unicorn territory, as booming data centre demand reshapes how electricity networks are planned and supplied.

Key Takeaways

- Australian-founded infrastructure software company Neara has raised $90 million in a Series D funding round led by US growth equity giant TCV.

- The raise comes just over a year after Neara’s $45 million Series C, taking total funding to around $180 million.

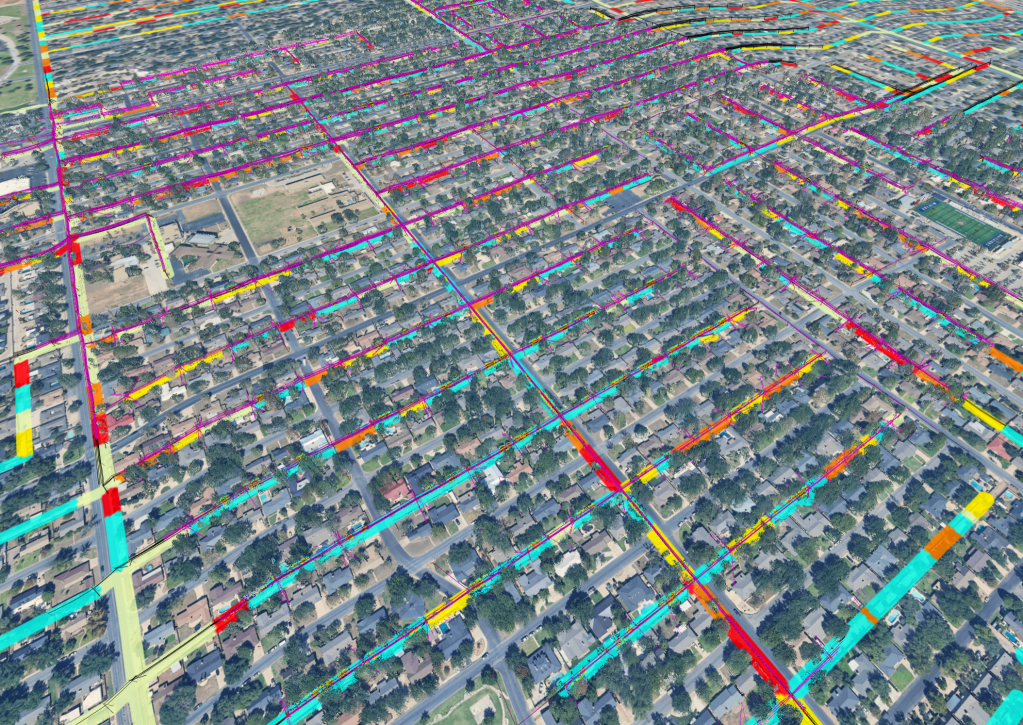

- Neara’s physics-enabled digital twin technology is used by utilities to identify underused grid capacity and accelerate new connections.

- The company now works with close to 90% of Australia’s electricity network utilities, alongside major customers in the US and Europe.

- The funding will be used to expand Neara’s global footprint and deepen its AI and machine-learning capabilities.

Big number

945 terawatt hours. That’s how much energy the world’s data centres are forecast to be chewing up by 2030, compared to about 415 terawatt hours in 2024. Data centres accounted for about 1.5 % of global electricity in 2024. That will be about 3% by 2030.

Key Background

Founded in Australia in 2019 by Daniel Danilatos, Karamvir Singh and Jack Curtis, Neara builds detailed, physics-based digital twins of critical infrastructure networks, including electricity grids, transport and communications systems.

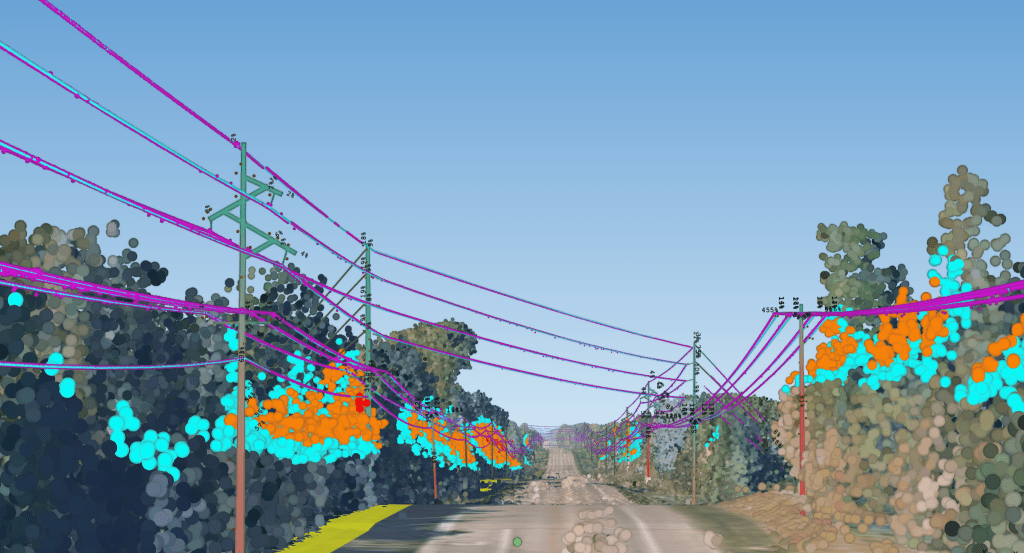

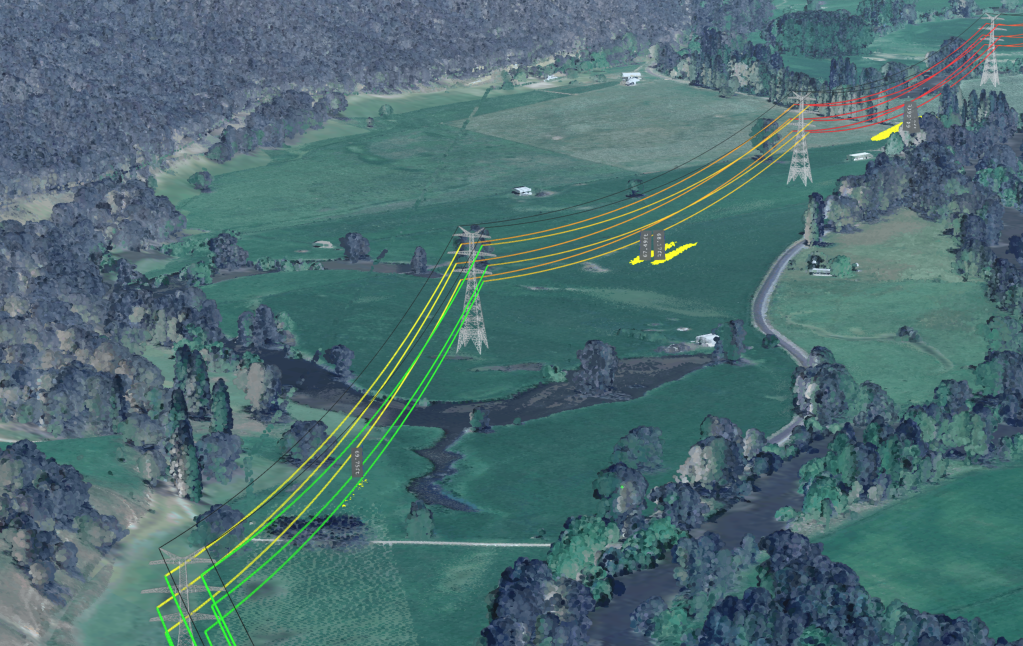

Unlike traditional planning tools that rely on heuristics and statistical assumptions, Neara grounds every simulation in real-world engineering physics, allowing utilities to test how assets behave under stress – from rising electricity demand to extreme weather events.

Its customers include major utilities such as Southern California Edison and CenterPoint Energy in the US, ESB Networks in Ireland, Scottish Power in the UK, and Hedno in Greece. In Australia, its clients include Ausgrid, Endeavour Energy, Essential Energy and SA Power Networks.

The company says it can model entire networks in hours or days, rather than the months or years typically required by manual surveys. Globally, Neara has now modelled more than 15 million assets across over 3 million kilometres of infrastructure, spanning four continents.

The round was led by TCV, a global equity firm that has a knack for picking winners, and which has previously invested in technology companies including Netflix, Revolut, Spotify, Toast, Clio, Employment Hero, Nubank, SiteMinder and Xero.

Returning investors include: Partners Group, EQT, Square Peg Capital, and Kim Jackson and Scott Farquhar’s Skip Capital

“This investment marks TCV’s third investment in an Australian-founded, category-defining technology,” TCV general partner Muz Ashraf said in a release. “We believe the infrastructure challenges facing the world, from climate resilience to energy access for AI compute require fundamentally new approaches.”

Tangent

Neara is by no means the only recent unicorn in the energy sector. Here are some notable members of the elite club.

Company | Sector / Focus | Valuation / Unicorn Status | Notes |

Octopus Energy | Renewable energy & energy tech | ~US$9 billion (unicorn) | UK‑based renewable energy supplier and software platform serving millions; also commercialises energy tech via Kraken. |

Fuse Energy | Renewable electricity provider | >US$1 billion (unicorn) | UK clean‑energy supply startup aiming for affordable, solar‑powered electricity for consumers. |

Envision Group | Energy internet & grid tech | US$21 billion+ (unicorn) | China’s energy internet services and AI‑powered grid tech leader. |

1KOMMA5° | Home energy & AI systems | ~US$2.4 billion (unicorn) | Germany’s AI‑driven solar + storage + EV charging energy platform. |

Zenobe Energy | Battery storage & fleet solutions | ~US$1.1 billion (unicorn) | UK battery‑energy‑storage and fleet electrification provider. |

Newcleo | Nuclear / SMR energy tech | ~US$1.7 billion (unicorn) | France‑based small modular reactor developer. |

Verkor | Battery manufacturing | ~$3.7–5.6 billion (unicorn) | European battery maker aiming to scale gigafactories. |

Stegra (ex‑H2 Green Steel) | Green industrial energy | ~$4.1 billion (unicorn) | Stockholm‑based hydrogen‑powered industrial transformation. |

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.