The National Reconstruction Fund Corporation has made its first transport investment, backing Melbourne-based autonomous vehicle maker Applied Electric Vehicles with a $30.7 million equity injection as part of the company’s $58 million Series B raise.

The money from the federal government’s $15 billion sovereign investment fund will help send 100 Australian/Japanese made vehicles – with neither steering wheel nor driver’s seat – out into the world.

The NRFC has now made 20 investments totalling $1.19 billion. The $30 million equity stake in Applied EV will be used to launch the company’s fleet of Blanc Robot autonomous electric vehicles, Applied EV co-founder and CEO Julian Broadbent tells Forbes Australia.

The round also drew in Japan Post Capital, the venture arm of Japan’s postal service, with Japan Post emerging as an early customer — a move that could accelerate the rollout of Applied EV’s driverless delivery vehicles onto public roads.

Applied EV is preparing to deploy the 100 sixth-generation autonomous electric vehicles built on a Suzuki platform, a significant scale-up in an industry where most operators are still stuck in pilot mode, and many more are corporate wrecks left by the wayside.

The 20 vehicles Applied EV has out working in the world have been doing confined, mundane tasks like dust suppression for miners and inter-warehouse logistics for manufacturers.

“The real update, is we have 100 Suzuki vehicles in our building and we’re looking to deploy them, which would be a very significant result in the world of driverless vehicles,” Broadbent says, adding that the goal over the next three-to-five years was to get thousands of vehicles into use.

“We will have manufacturing elements here in Australia. A lot of the technology and development of that technology will be done here, which includes low-volume manufacturing.”

“It’s not our style to put it to work then ask for forgiveness later. You really want to have stakeholder buy-in so you’re not pushing a rope.”

The vehicle frames are built by Suzuki, but the boxes that control them are made in Melbourne,” says Broadbent. “But there’s new jobs as well coming in what I call Applied EV 2.0. We have to employ a lot of people to manage the fleets that are in operation remotely. We have to have a lot of data analytics and telemetry. We have to provide a lot of support. So we do see the company growing in Australia and around the world.”

Applied EV has been profitable for the last three years, Broadbent says, operating on a “lease/license model”.

The number of logistics companies reaching out has increased over the last year. “The world has started to believe that autonomous driving will happen,” says Broadbent. “If you’re a logistics company or an operator of fleets, you probably don’t see your whole fleet changing overnight, but if you don’t start thinking about how to have autonomous vehicles in your fleet and your competitors do, you know you’ll miss out.”

Applied EV is prioritising customers with the capacity to make large orders in the future.

Japan Post has a fleet of more than 80,000 vehicles, says Broadbent. “And we’ve got another global logistics company that everyone would know, who I can’t name, who is talking to us about doing logistics at airports, which is amazing because we see a good pathway to scale that.”

Broadbent told Forbes Australia in April last year that the company was in no rush to get its vehicles on public roads. But Japan Post’s involvement is now speeding that up.

“We’re looking at very low-speed urban sort of work with them. They have big challenges in a lot of cities in Japan due to reductions in populations. We’re using this to solve a problem where there aren’t any drivers in the town to be able to do all of the jobs that this company needs to do.

“It’s what I would call a megatrend-size challenge. But the first steps are quite small. It involves a lot of stakeholders.”

He imagines small vehicles delivering between small depots, rather than to retail customers. “It’s not on road like San Francisco. It’s on road in remote little towns that don’t have a lot of traffic.”

Despite the need, getting on road would be slow, he predicted.

“You’ve got to picture the number of people that need to give the nod for something like this to happen in the wider culture. It’s not our style to put it to work then ask for forgiveness later. You really want to have stakeholder buy-in so you’re not pushing a rope. The more that you can be pulled along by the stakeholders to solve a real problem, the better it is for business, for everyone.”

NRFC CEO David Gall said, Applied EV had created an Australian success story by focusing on industrial uses.

“Applied EV’s product pipeline, commercial contracts and partnerships with industry leaders will allow it to quickly scale its business,” Gall said. “We are proud to be investing in a company that commercialises Australian innovation, builds the country’s manufacturing capabilities, and creates highly skilled jobs.”

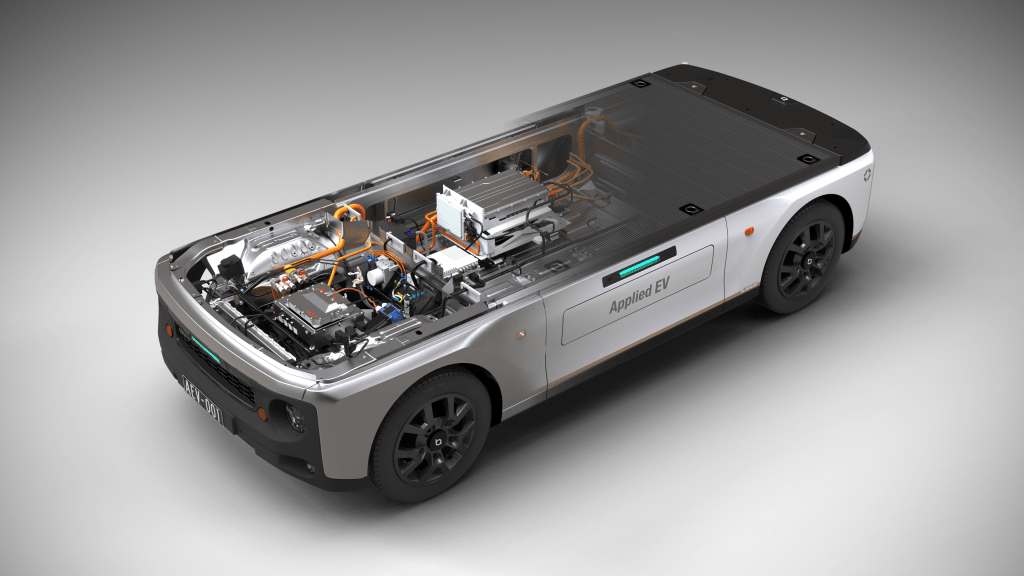

The company’s Generation 6 Blanc Robots claim to pioneer a new class of logistics vehicles, featuring a cab-less design and flat chassis that can be configured for multiple uses.

Broadbent said the NRFC’s investment validated “the vision that brought us here in the first place”.

“When traditional automotive manufacturing left Australia, we saw an opportunity, tapping into the wealth of local engineering talent and building something truly innovative from the ground up.”

Applied EV employs 113 people and NRFC’s investment will create up to 25 new jobs in Melbourne.

$13.81b to go: Where the NRFC’s $1.19b has gone

Company/fund | Investment ($AUD) | Description |

Arafura Rare Earths | $200 million | Boosting supply chain resilience for critical minerals in the net zero transition |

Brandon Capital | $150 million | Investment fund to help create and scale next-gen Australian medical breakthroughs |

ASDAM | $150 million | Building Australia’s sovereign defence capabilities through the manufacture of key defence equipment |

Intellihub | $100 million | Helping Australians make the most of their solar panels while contributing to the energy transition |

Resource Capital Funds | $100 million | Emerging technologies driving safer, cleaner and more efficient mining |

Gilmour Space Technologies | $75 million | Developing sovereign space capability to secure access to essential space services that underpin everyday life |

Synchron | $54 million | World-first brain-computer interface technology that allows paralysed people to control digital devices with their thoughts |

Liontown Resources | $50 million | Supporting the production and processing of lithium for battery production |

The Arnott’s Group | $45 million | Adding advanced manufacturing capability to support domestic and international growth ambitions |

Russell Mineral Equipment | $40 million* | Revolutionary mine safety equipment made in regional Australia |

Patties Food Group | $36 million | Modernise production facilities to ensure household names continue to have a strong future in Australia |

Morse Micro | $35 million | Award-winning Wi-Fi HaLow technology increasing the range of Wi-Fi for IoT applications |

Harrison.ai | $32 million | Pioneering technology for quickly and accurately diagnosing conditions like cancer |

Applied Electric Vehicles | $30.7 million | Manufacturing autonomous electric vehicles for industrial, logistics, and commercial purposes |

PolyActiva | $27 million | Groundbreaking eye implant technology to treat glaucoma |

Myriota | $25 million | World-leading satellite technology delivering real time tracking for Australian businesses |

Vault Cloud | $22.5 million | Keeping us safe by making sure defence and critical infrastructure information is stored at home |

Omniscient Technologies | $20 million | Using AI to convert MRI scans into personalised maps of patients’ brains |

QuintessenceLabs | $15 million | Protecting Australian governments and businesses from cyber security threats |

Quantum Brilliance | $13 million | A world first diamond foundry delivering leadership in quantum computing |

Hypersonix Launch Systems | $10 million | Next generation hypersonic aircraft that travel at Mach 5-7 without producing CO2 emissions |

* Russell Mineral Equipment received its $40 million through Resource Capital Funds out of its $100 million NRF investment and so has not been counted twice here.