A CSIRO report examining the geography of digital businesses has revealed 96 tech clusters spread across the country – in sometimes surprising places.

Key Takeaways

- Australia has 96 tech clusters.

- 36 of those are “regional niche clusters”.

- The four “superclusters” are: the “Sydney arc”, the “Melbourne diamond”, the “Brisbane corridor”, and the “Canberra triangle”.

- Clusters contributed to 62% of national digital-workforce growth over the 10 years to 2021 yet made up only 4% of the total area of Australia.

- Companies inside clusters produced 63% more intellectual property patents than similar firms outside the cluster in the same city.

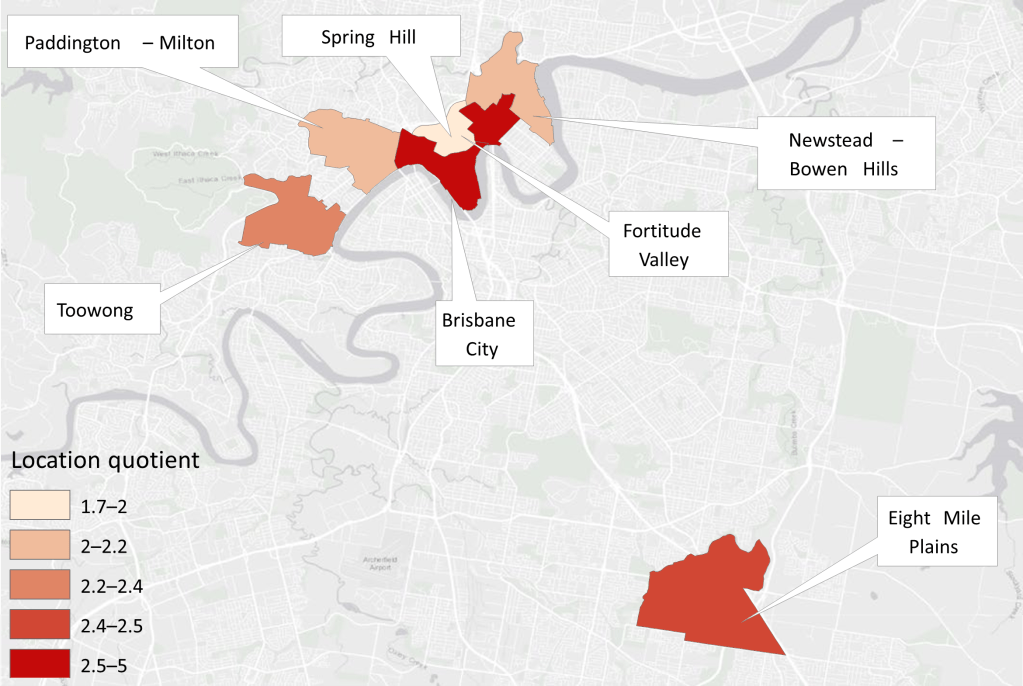

Eight Mile Plains in Brisbane’s south came up bright red when CSIRO principal research consultant Stefan Hajkowicz plugged in the numbers for the concentration of tech jobs in Australia, trying to identify tech hotspots. That surprised him.

As did Baulkham Hills–Bella Vista in Sydney’s northwest.

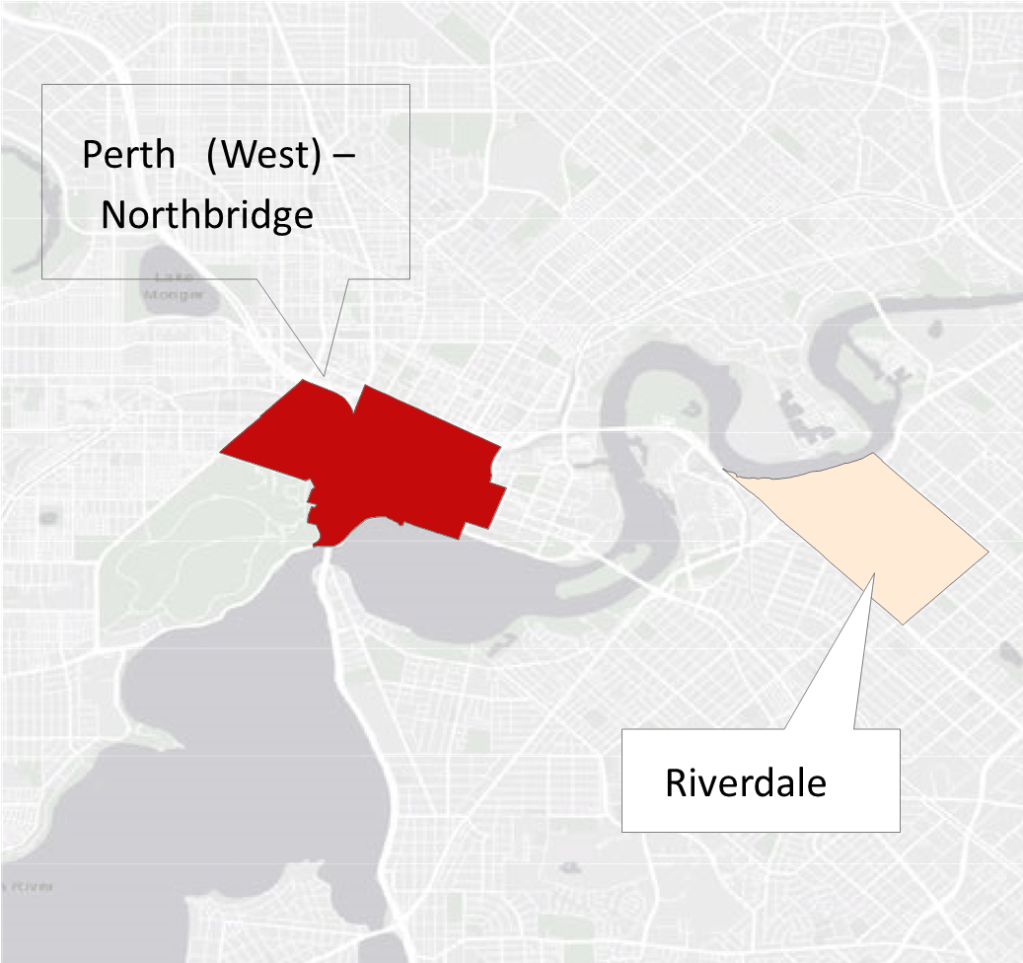

And what was the story with Ashburton in the Pilbara? The area centred on the mining town of Tom Price was employing an unusually large number of telecommunications trade workers and was the only such hotspot to appear in Western Australia outside Perth.

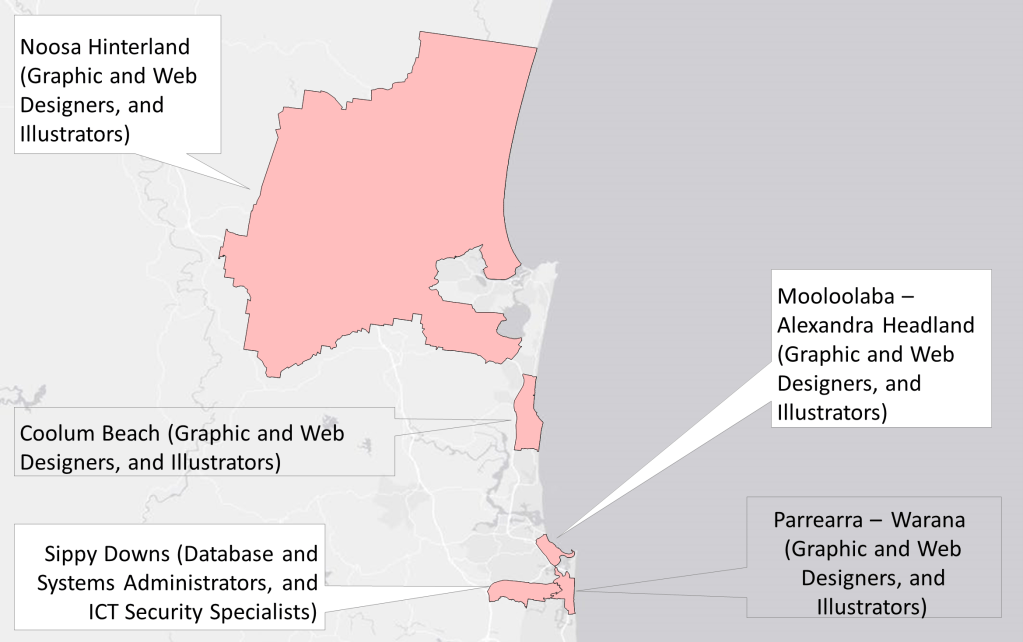

Sippy Downs near Maroochydore, Queensland, showed enough database and systems administrators to be included in the list of niche regional areas.

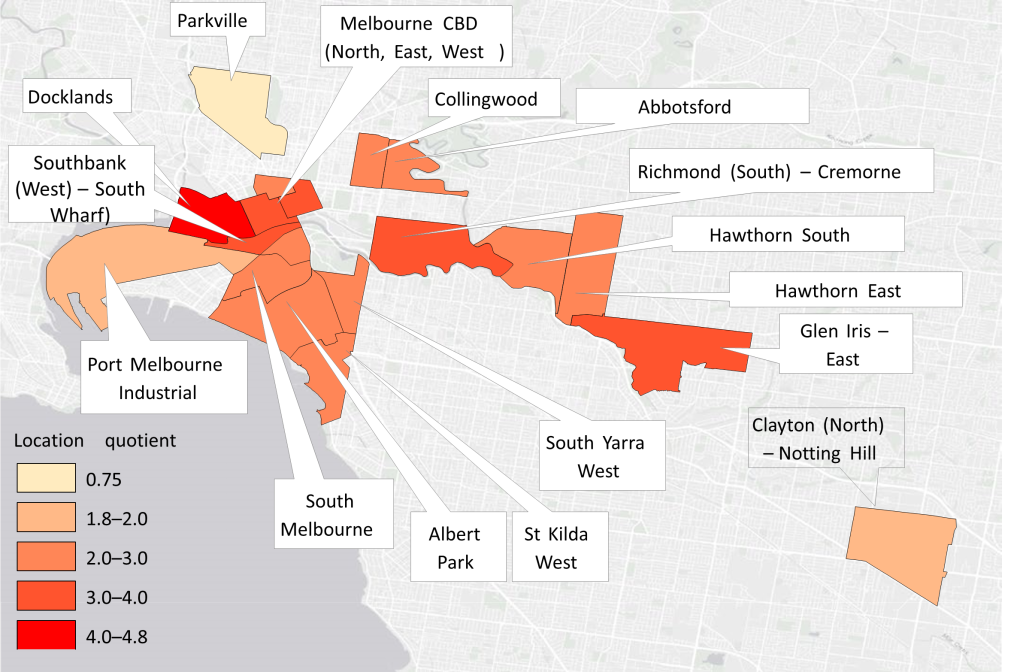

Melbourne had Clayton/Notting Hill showing up as an outer cluster and Canberra had the outer southern suburb of Greenway showing a bright scarlet.

While the city of Adelaide contained by far the most tech workers of any place in South Australia (12,425), Payneham-Felixstowe and Mawson Lakes- Globe Derby Park both had a much higher proportion of tech workers compared to other jobs.

And Rivervale, east of the Perth CBD, was Western Australia’s second major cluster.

Hajkowicz was compiling the CSIRO and Tech Council’s Geography of Australia’s Digital Industries report bringing together data from across the nation to map and describe the development of digital technology clusters.

But what surprised him most, he says, was the heavy concentration of graphic and web designers who had fled the cities. “Especially in coastal locations, the Noosa hinterland, the Gold Coast – especially Burleigh Heads – Byron Bay near the beach and in Torquay in Victoria,” Hajkowicz said. “They look like a profession that’s taken advantage of the sea-change phenomena in the pandemic.”

The second biggest surprise was the clustering of job types. “Lavender Bay (on the harbour side of North Sydney) has this really big population of ICT (Information and Communication Technology) professionals. For every one that the rest of Australia employs, Lavender Bay employs 15. We found evidence of really intense spatial clustering. There’s no way it’s a random distribution.”

He said companies in the same field tended to co-locate. “We found that companies inside a cluster tended to be more innovative. They produced 63% more IP patents than firms outside the cluster in the same city. That’s a similar experience to California.”

Clusters contributed to 62% of national digital workforce growth over the ten years to 2021 while making up only 4% of the total area of Australia, he said.

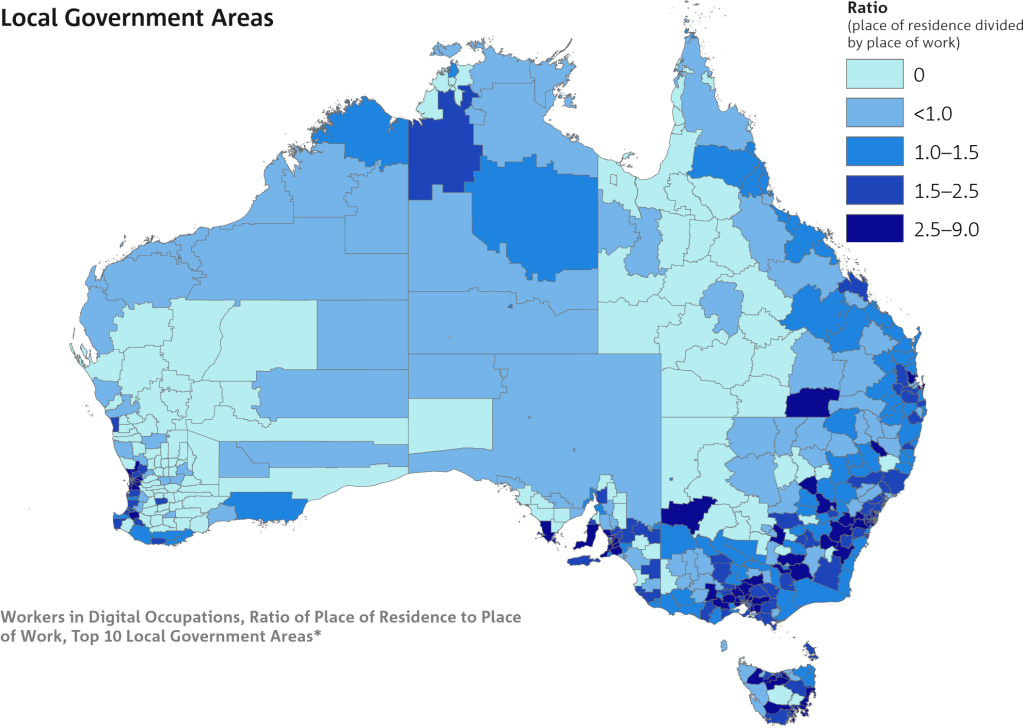

Most of the figures related to place of work, but when the place of work was compared to the place of residence, it was found that the Yass Valley, in NSW just outside the ACT, Sorell 25km east of Hobart in Tasmania and Campbelltown, South Australia, had the highest ratio of tech workers employed outside the area in which they lived.

For every tech worker who lived and worked in the Yass Valley, there were 8.18 who lived there but worked elsewhere. Sorell had 7% and Campbelltown had 6.7%.

Hajkowicz said the information had important implications for government.

“Most governments have an ambition to grow their tech sector,” he said. “If you are the Gold Coast trying to get your tech sector happening, have a look at the graphic design profession in Burleigh Heads. Host an annual conference there. Build a centre of excellence. Fund an R&D program with the local universities. Go with the flow. Go where we see growth organically and you’re much more likely to be successful.”

Explore the CSIRO’s tech-industry mapping tool

However, he pointed to the success of $3-billion start-up Go1 as proof that you don’t need to be in a cluster to thrive. “Greenfields can certainly work. You don’t have to be in a cluster to succeed. Your unique situation is unique. But most data suggests that firms in clusters tend to grow faster, tend to innovate more.

“But Go1, they’ve hit their [three] billion-dollar mark and they’re still there in Logan (an economically disadvantaged suburb in Brisbane’s south). But they’re a six-minute drive from Eight Mile Plains, one of our hotspots.”

The City of Logan has launched an incubator with Go1 to encourage more tech into the area.

“Eight Mile Plains was a 2008 initiative by the Queensland government Smart State Initiative. That amazed me how bright red it came up on our map. Shit, you build it and they do come.”

Stefan Hajkowicz

It was no accident that Microsoft, Amazon and Google had located headquarters close to each other in Sydney, Hajkowicz said, because such groupings attracted more companies, more workers and more investment.

Sydney had 81 ASX-listed digital companies valued at $52 billion and employing 119,636 workers, according to the report. Melbourne had fewer companies on the ASX, 62, but they were valued much higher at $203 billion, employing 95,112 workers.

Brisbane had 19 ASX listed digital companies valued at $13.29 billion. While Canberra had just two, worth $60.14 million.

CSIRO acting CEO Kirsten Rose said that understanding the geographical patterns was important. “The experience globally has shown that firms in clusters grow, employ and innovate at a faster rate,” she said. “We know comparatively little about this in Australia, but what this report tells us very clearly is that geography matters and understanding that geography can help us catalyse growth.”

Tech Council of Australia CEO Kate Pounder said the 36 regional specialist clusters proved that digital innovation could spring up anywhere. “Giving a range of communities access to this opportunity is vital as this report highlights the benefits for communities of being in a cluster.

“Given tech jobs are amongst the fastest-growing, best-paid and most flexible jobs in the country, it’s a great advantage for any community to have a cluster in their area,” she said.