How volatility in the markets can sometimes work in your favour.

Jun Bei Liu is Lead Portfolio Manager of the Tribeca Alpha Plus Fund at Tribeca Investment Partners, with just under $1.1 billion funds under management. Liu explains the long-short investing strategy used, the rewards of volunteering, and what to watch for in the coming 12 months in the markets.

In three years you have grown the fund from $300m to more than $1 billion in value. When it comes to retail investing, what have you seen to be the most significant influence on people buying and selling shares?

Jun Bei Liu: We’ve noticed changes in retail investors. My clients include both large institutional investors like superannuation funds, and then there’s the mum and dad retail investors who directly invest with me to invest in the sharemarkets. I’ve been investing for over 20 years now across Australian shares and global shares as well. Over that time, I have really noticed a change in the behaviour of retail investors. These days, they react quickly to information. In olden days, it was generally accepted that the retail investor was always a little bit slower to react to information. They were the last to buy and the last to sell. In the past five years, especially since the pandemic, retail investors have really changed in terms of how quickly they get on top of information and what trends they want to invest with. They are really fast now at catching onto trends.

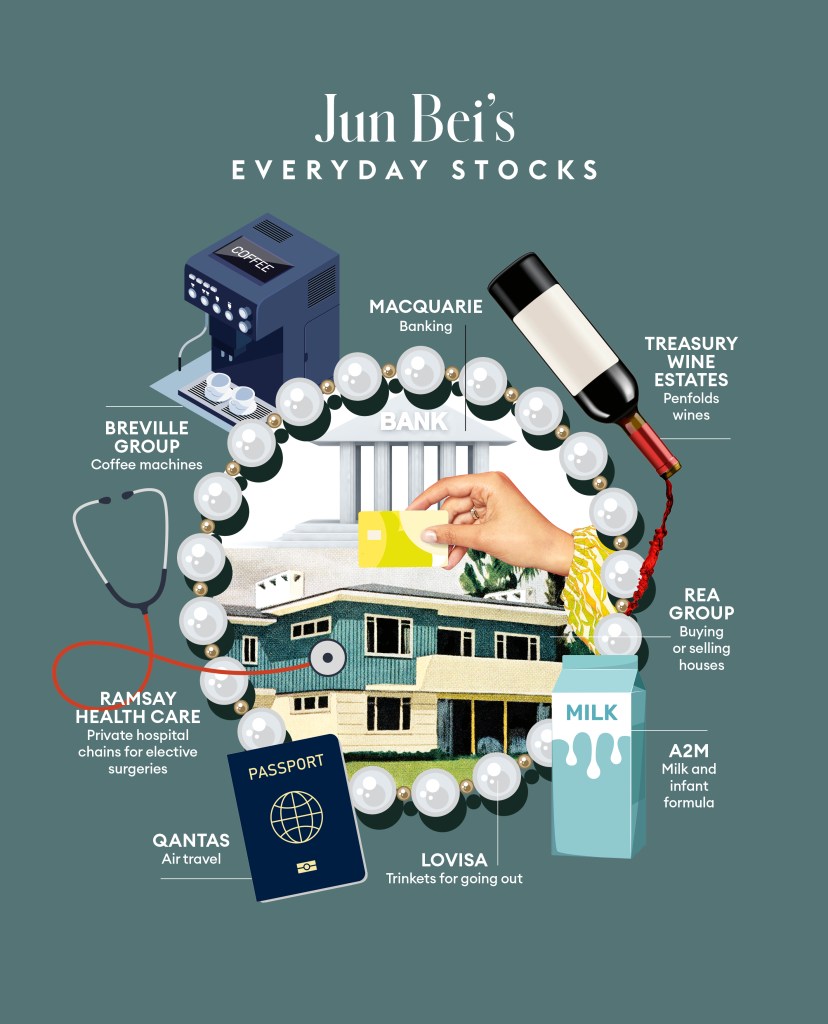

It’s been incredibly interesting to observe the changes in retail investor behaviour, but ultimately for the best return, they do their homework and get to know the company. They follow them, and know what the company does, and for best they experience the company’s products or services. These are some of the basic principles that always work throughout time for investing.

You run a long, short fund specialising in Australian equities. Can you explain the long, short investing strategy and how this strategy might best serve investors.

Jun Bei Liu: Long-short investing, our fund has been around for about 16 years, however long-short investing is still quite new in the Australian investing universe, particularly for retail investors, the access to long-short is difficult. We have the ability to buy companies if we think the share price is going higher and at the same time we also have the ability to short a company, which we borrow from someone else’s stock, and short it, thinking the share price will fall. For most of the fund manager investors, when you think the future return is going to be negative you either sell your existing stock but if you don’t hold it, you don’t do anything about it. Whereas we do. We can go out and take advantage of that information and generate return for investors. During a the rising and falling market, it gave us a great hedge for the sharemarket. When the sharemarket falls, stocks generally tend to move down with the sharemarket. Even a great company’s shares will be sold in a panic mode, which we saw during the GFC [Global Financial Crisis 2007-2009], during the pandemic. For most investors if you want to make money you have to sit back and wait for that panic to stabilise before you move back in. You sit back and sit on cash. But what we do as a long-short manager, whenever we see an opportunity like that, we just jump in and buy. Because I never run out of cash. I can always short the company that is less quality, or the company that has the earnings problems, and buy the high-quality business and take advantage of the once-in-a-decade buying opportunity and take advantage of the volatility.

Would you say you’ve benefitted from the volatility in the markets that we have seen recently?

Jun Bei Liu: Absolutely. Because the market has been sideways trending as well as, if you like, moving in and out of different flavours from month to month – resource companies this month and growth companies the next – you’ve seen incredible volatility between sectors. At the start of the year, people were selling healthcare and tech and buying into resources because it would be an inflationary hedge sector. Then a few months ago it went the other way. For most fund managers it is difficult to move that way. We don’t have the crystal ball to tell us when it is going to happen. You can take some profit and sit there on cash. A lot of the time you miss the opportunity of oversold sectors because you don’t want to get in there until you see some sort of stabilisation. Whereas us, we bought healthcare at the start of the year because it was way too cheap and you know, these bottom drawer stocks, you just leave them there and they will be so much higher in 12 months’ time. We don’t have running-out-of-cash issues or issues with the portfolio becoming too volatile, because we can short. It has been an incredible experience.

That sort of active management must take a lot of research. How do you prepare for a day at work?

Jun Bei Liu: Funds management is 24/7. We never stop. I was joking with my clients that we were sharemarket experts years ago, but then we had to become healthcare experts during the pandemic, then we become political experts when Russia went to war with Ukraine. As fund managers we have to know something about everything. But this is why we have a great team of 20 analysts working with me, watching whatever is coming through in the news flow. This is one advantage that a professional active investor does have over the individual retail investor. We are constantly connected (with the help of technology). I have two kids, eight and 11 years’ old. I can take them to the train station when they go to school, we have dinner together, we do lots of family things, but at the same time I can do my work, because I can stay connected and work flexibly. I wake up about 5.30am or 6am and read through my Bloomberg information. I get my kids ready for school and drop them off. I drive to work and do my morning calls. I talk to analysts, strategists about what is going on in the world. By the time I am at my desk around 7.30am or 8am I know all the information that came through overnight when I am sleeping and then I look at (ASX) company announcements as they start to come in. We process that information, so by the time the market opens at 10am we know approximately what we want to do for the day. We know information we need to react to, anything we need to reprocess or perhaps it’s a day not to transact. After the market opens, we meet with companies. It’s very dynamic and I love it. I talk to people from so many various backgrounds and process very different information every day. You pull the strings together and work out the bigger picture.

You are very active in volunteer work. Tell us what you do and what benefits you think it brings to the people that you connect with?

Jun Bei Liu: For career, or personal progression, to me it is many angles. You have to try things that are new. With work, push, see how far you can go, but be able to give back. I want to help the next generation to come through. Seven or eight years ago, I started at my kids school. Now, I mentor with some of the younger people in the finance industry, particularly women, because finance and business industries lack females, sometimes because of a lack of role models. Maybe not so many senior female role models are there. I volunteer at the Student Asset Management to help kids who are trying to manage their own portfolio. They’ve done an incredible job. It gives them real-life experience of running funds. I offer workshops for them to come through and work experience to come and work alongside me. I volunteer with the Raise Foundation to connect highschool kids with mentors. That’s very rewarding.

How do you like to relax when you are not working?

Jun Bei Liu: I love investing, I love what I do, I love my kids, I love volunteering. I get enjoyment out of what I do. I get excited to be challenged. I do Bikram yoga. Stretching is good to take out some stress. I catch up with friends. Travel will be good again. It’s incredibly essential, almost crucial in my job, to see the companies and to talk to competitors, see other people and once you have seen the world it gives you better perspective. You make better decisions and become more well rounded as an investor and as an individual.

Travel brings new ideas and helps you to see products and services and use them. It makes us think perhaps how we want to invest and what we can invest in.

Do you think this can make a difference to investing?

Jun Bei Liu: Definitely, especially for retail investors. This is the best way of investing in a company. They say do your homework, but what does that really mean? You can look at company accounts, but you don’t really connect. You don’t necessarily understand why the company exists, especially if it is a complex industry. If you invest with Apple and use their iPhone and compare that with the Google product, you get to know what you like and then you understand what’s important. You have a better understanding of the product. That’s what I mean about retail investors being more aware of new trends. You see this product that’s new and amazing and you do some more work on it and it might be an opportunity that no one has come across. Don’t assume that everything has been done before.

Diverse experience and different perspective is so important for investment decisions. When you invest the same way, your mind can become more narrow. You worry about certain things and you have behavioural bias. You can miss opportunities. If you have a fresh perspective combined with experience, I think that can be incredibly powerful.

What is your key strategy for investing and has it always worked?

Jun Bei Liu: There’s certainly lots of things that you would never do again. Over 20 years, I have found that buying quality companies during a selloff doesn’t happen often, maybe once every few years. The pandemic selloff was a once in a decade. Buy the quality. It has to be quality companies. They have a good track record, they’ve done this for many years, they have global reach, they’ve got growth, and they’ve got the product that everyone knows and uses. Make sure they have got enough cash. Make sure they have hard assets. During selloff, companies with hard assets are the first thing you would buy. Companies where you know the asset is worth so much more than what the share price indicates. Airports are an example. You know it will come back, and if it doesn’t, someone will take it private. Hard assets … it’s easier to assess value. Healthcare services are highly demanded. These are the defensive nature you look for and these businesses you should keep in your bottom drawer of your portfolio.

What are some of the sectors that might see growth in the next 12 months?

Jun Bei Liu: You can’t look short term. When 9/11 happened, people stopped going to the shops. They were fearful and Colgate shares dropped because people stopped buying toothpaste. These things happen short-term because consumers can be very scared for some time. This is why you have to look at the whole year, to really see where things land. Short-term blips sometimes provide buying opportunities. The sharemarket is currently worried about a lot of things. In the next 12 months to two years we’ll see more inflationary pressure coming through but then inflation will peak. That will determine the interest rate trajectory. Potentially, they will go a little bit higher than people expect because wages will be sticky. People don’t take a pay cut when inflation goes lower. Around the world it is the same story. Maybe the US will have a shallow recession, Australia, maybe not. China, is it going to come back next year and what will happen to the housing market? There is a lot of uncertainty. That is why the sharemarket is gyrating from one level to another. In this environment the best standout buy with be in sectors that don’t require those things as a precursor to have good earnings. Healthcare stands out in this environment, like CSL and Cochlear. They were only hit during Covid because some surgeries were curtailed and blood collection was tough. As things come back, whether there is recession or not, people are still going to go ahead with their child’s Cochlear implant.

Some of the tech might be good, but not the consumer exposed tech. Fintech might find it tough. Look at the leading tech companies that can do well in this environment, like WiseTech. Xero is global and dominate in NZ, Australia, then they went to UK and then US. These businesses will grow. Be mindful of the consumer discretionary sector. You need to be mindful on that basis, when the consumer does get crunched. Consumers are being very selective where they are spending that dollar, whether buying some of the services they haven’t experienced for a while or buying another TV.

There’s a lot to think about for investors. What is it that you think investors should really understand at this particular point in time?

Jun Bei Liu: The key for the investor is to remember that ultimately it is about finding the right company that will generate you more return than finding a sector. It works sometimes, but when the sector is hot you tend to overpay for some of those companies. If it’s gone up a lot you could be buying into some of the lower quality companies in that sector. As a long-short manager, I see that frequently. Within the sector we can do long-short pair trades. This is where we take advantage of finding the best company and shorting the lower quality company. This is where we see that it is finding the right company, not the theme. Then you can make a lot of return. Some of the high quality companies can be in your portfolio for years. Don’t sell your winner too early, especially those quality companies. For some of the losers, make sure you assess it rationally.

Does working with a fund manager take some of the emotion out of the investor’s decision making because they put their trust in you?

Jun Bei Liu: Yes. There can be bias. You get emotional. This is something that as a professional manager we are trained to do. Twenty years I have been doing this. We make mistakes. Learning from mistakes, one thing is how can we be more rational in decision making. Things go wrong all the time. When things go not as you expected, how do you respond to it is what really defines your return as a good investor or as a good manager. It is how you deal with these unknowns and uncertainties and how you work out a system, or investment process, that you rely on when new information presents.

When information changes, you need to move with it. With retail investors, often they move in the same way as everyone else, but often it’s the wrong way. Maybe you should be selling instead of buying.

The sharemarket has been thinning out over the past five years, mainly as a result of sharemarket participants changing. There’s a lot of passive money, ETF money, quant money that is driving the stock price in a way it shouldn’t. It provides a lot of opportunity for active investors, but for individuals that are not on top of things, they could be impacted by these passive swings. Professional investors might have access to information to process that. For individual investors it might be much harder to see.

This is an edited version of the conversation.

This article represents the views only of the interviewee and should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance. You should seek independent financial and tax advice before making any decision based on this information, the views or information expressed in this article.