While craft brewers struggle to survive a COVID-19 tax hangover, they’ve still managed to dominate Australia’s Hottest 100 of beers.

Key Takeaways

- Melbourne’s Hawkers Beer and Adelaide’s Big Shed Brewing Co. are the latest casualties – going into voluntary administration.

- The number of craft breweries in Australia has grown by more than 80% in the last eight years.

- About 20 craft breweries have disappeared in the past year.

- The Independent Brewers Association has made a federal budget submission calling for tax relief and treatment more like the wine industry to stop more going to the wall.

- Craft breweries contributed $1.93 billion to the local economy in 2021 according to a KPMG analysis.

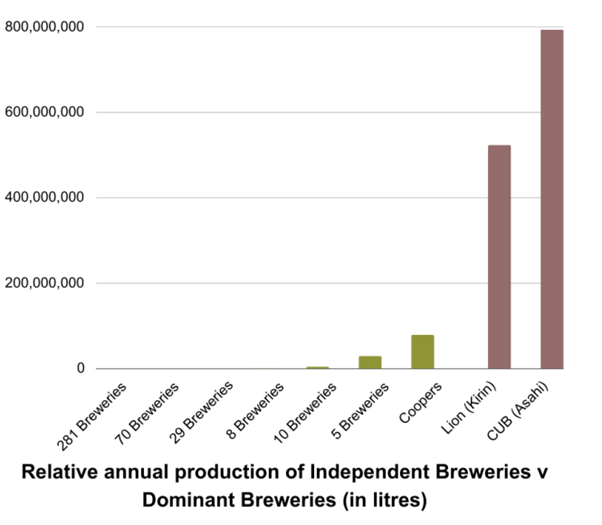

- Craft brewers employ 10,000 people directly – more than half of the entire brewing industry despite producing only 7% of all beer.

- The 2023 GABS Hottest 100 beers announced last week were dominated by independent brewers, including Mountain Culture at No. 1.

- The big brewers and retailers have further squeezed the independents by “craftwashing” – making their beers look like independents.

When Kylie Lethbridge first started at the Independent Brewers Association (IBA), Australia was getting more than one new craft brewery a week.

And while the numbers continue to grow, the last 12 months have seen “around 20” close their doors, go up for sale or go into voluntary administration, as the rising cost of inputs, tax debts left over from COVID relief, and rising input costs all continue to blow the froth off the top of the industry.

The number that have gone out of business is probably more than 20, says Lethbridge, CEO of the IBA. “Some will be doing it very quietly and we don’t hear about it. Others are gearing up for that next step: if we can’t sell, what happens?”

In 2016, there were 355 independent breweries in Australia. That rose sharply to 582 in 2020. And while there have been some spectacular exits – like Balter’s reported $150 million-to-$200 million sale to Japanese brewer Asahi (through CUB) in 2019, or the sale of Stone & Wood and Melbourne’s Two Bird Brewing for $500 million to Japanese giant Kirin (through Lion) in 2021 – the number of less glorious exits is mounting.

Meanwhile, the much-loved Hawkers Beer, located in Reservoir, Melbourne, declared on Monday that it has voluntarily entered administration. In a statement, founder Mazen Hajjar mentioned several difficulties impacting not only Hawkers but also the broader craft beer industry.

“Post-Covid has been a challenging period with bigger players increasingly restricting access to taps and shelf space,” he said. “That is combined with broader economic pressures, including increased input costs and taxes.

Adelaide’s 22-year-old Big Shed Brewing also went into voluntary administration this week, citing a large investment it made to expand just before COVID-19 lockdowns hit.

Sydney’s Wayward went into voluntary administration in January, owing a reported $2 million, $1.27 million of which was to the tax office. It has since come out of administration having cut a deal to pay back 10 cents in the dollar.

In October, Melbourne’s Bad Shepherd went the same way.

Western Australia’s Running With Thieves went into voluntary administration in August. Brisbane’s Parched Brewery did the same in March, a month before Sydney-based Tribe Brewing (Stockade, Wilde gluten-free and Mornington Peninsula Brewery) was saved from the same fate when it was bought out by Kathmandu founder Jan Cameron.

Queensland’s Ballistic Beer Co went into administration in January 2022 before fellow Queensland craft brewer Catchment Brewing swooped in to buy it, after having bought into fellow Queensland brewer Fortitude with their Noisy Minor beer in 2022.

And while independent brewers make only 7% of Australia’s beer- down from 8% a couple of years ago – they employ 51% of the entire brewing workforce, often in regional areas.

During COVID-19, the breweries were given a holiday from excise owed, but the money still needs to be paid. Lethbridge has called on the tax office to give brewers more time to pay it. “The ATO is losing out overall because instead of getting 100 cents in the dollar, they’re getting five cents (as with Tribe) and 10 cents (as with Wayward) whenever it goes into voluntary administration.”

The Independent Brewers Association has made a federal budget submission calling for a range of other concessions, including relaxed labelling laws owing to the more than 3,000 new brews a year that the industry comes out with – each requiring onerous labelling; and taxation more akin to the wine industry – beer drinkers pay twice the tax of wine bottle drinkers and eight times that of cask wine drinkers per standard drink.

Lethbridge recognises there was bound to be rationalisation after the growth spurt of the last eight years but is adamant there is room for more. “If the federal government doesn’t act now, Australian-owned independent brewers will continue to close and the cost of a pint will be out of reach for many.”

“The question for the federal government is, what beer industry does it want to see in the future?”

Kylie Lethbridge

Beer’s Hottest 100

But it’s not all doom and gloom. The GABS Hottest 100 beer competition was voted on by more than 60,000 Australians, and of the 1,877 beers on the ballot, the top ten was dominated by independent brewers, with first place taken out by independent Mountain Culture’s Status Quo Pale Ale for the second year running.

Mountain Culture was founded in the Blue Mountains west of Sydney by DJ and Harriet McCready in 2019, at the peak of the boom.

They picked a historic building in the middle of Katoomba, 100km west of Sydney. “We were trying to do an industrial process in the middle of a town centre in a World Heritage Area and produce alcohol,” recalls Harriet McCready. “Our town planner was like ‘you’ve literally picked the hardest DA to get across the line’.”

After two years of ploughing everything they had into it, they opened just in time for the catastrophic 2019 east coast bushfires, which forced them to pivot to canning, just in time for COVID-19 to lock them down. They sold 20 cases in the first week and presumed they were done for. But Harriet opened an E-commerce site on Shopify and they got onto the beer forums.

“I guess people didn’t really have much else to talk about at that point besides what they were drinking,” says DJ.

They started selling out. The staff they’d sent home got recalled.

Unlike most independent brewers who tend to be refugees from tech and finance jobs, DJ McCready, 37, is a trained brewer from the town of Asheville, North Carolina, which happens to be the craft brewing capital of the US with more than 50 breweries serving a population of just 94,000.

Since starting out with a 60,000-litre per annum capacity, Mountain Culture has only recently been able to keep up with demand. “Before lockdown had even ended, we put in another brewery capable of producing about 2 million litres per annum. And now again for the fourth birthday, we’ve expanded a third time to where our current brewery is able to produce about 10 to 12 million litres per annum … now we can actually produce 60,000 litres of beer in a day.”

The McCreadys say they’re growing 50% year on year and making a “20% net profit margin”.

Why have they succeeded where others are struggling?

“E-commerce has always been one of our strong suits,” says DJ. “Our site sells as much as both of our pubs combined to this day. And a lot of breweries will make the mistake of getting too in bed with Dan Murphy’s and BWS and that’s great for a while and then all of a sudden it’s a race to the bottom. Then they de-range you and you’re left with nothing.”

He says they’ve been focused on being easy to work with for the 1,000 independent retailers that stock them. “And we create fans, not customers, out there in consumer land.”

The Gabs Hottest 100 beers

- Mountain Culture Status Quo Pale (NSW, independent)

- Balter Brewing XPA (Qld, Asahi)

- BentSpoke Brewing Crankshaft IPA (ACT, independent)

- Your Mates Brewing Larry Pale Ale (Qld, independent)

- Bridge Road Brewers Beechworth Pale Ale (Vic, independent)

- Gage Roads Single Fin (WA, ASX -listed Atomic)

- Coopers Brewery Original Pale Ale (SA, independent)

- Stone & Wood Pacific Ale (NSW, Kirin)

- Young Henrys Newtowner (NSW, independent)

- Pirate Life South Coast Pale (SA, Asahi)

With the rising popularity of craft brewing, the big players and supermarkets have got into the act with their own craft labels. “We call it craftwashing,” says Lethbridge. “They’re very nice in the fridge. They look exactly the same as the independents. And because our government is not very strict on enforcing the labelling requirements of having to declare who the beer is made for, it’s very easy to be fooled.”

“They’ve all got multiple labels now,” says Lethbridge. “They fill their own shelves with their brands under the craft section, and it is craft beer by definition. But still, those profits aren’t staying here, so we’re calling on a little carve-out and hopefully our federal government will recognise we’re a bunch of small businesses like any other that are really part of our community and these other guys aren’t so maybe they could give us a little help on that basis.”

Who Really Makes Your Craft Beer?

Asahi (CUB)

- 4 Pines Brewing

- Balter

- Great Northern Brewing Co

- Yak Brewing

- Matilda Bay

- Pirate Life

- Mountain Goat Beer

- Green Beacon Brewing

Kirin (Lion)

- Stone & Wood

- Kosciuszko Pale Ale

- White Rabbit

- Little Creatures Brewing

- James Squire

- Fixation Brewing Company

- Eumundi Brewing

- Byron Bay Brewery

Endeavour Group (split from Woolworths in 2021. Owns BWS, Dan Murphys)

- Sail & Anchor

- Zytho Brewing

- John Boston

- X XPA

- Algorithm Brewing

- Culture House

- Crony

- Southern End Brewing Co.

- Golden Pipes Brewing

- Fresh Track Brewing Co.

- Loud & Proud

- New Dawn Brewing

- Big Things Brewing Co.

- Largo Brewing

Coles

- Tinnies

- Lorry Boys Brews

- Steamrail Brewing Company

Coca Cola

- Feral Brewing Co.

(Compiled from the Crafty Pint’s Who owns your beer?)