Innovation isn’t always born in a laboratory – it can be bought off the shelf. Data journalist Juliette O’Brien shows how companies with deep pockets are skipping the long grind of research and development by acquiring ready-made ideas, teams and technologies.

This story appears in Issue 19 of Forbes Australia, out now. Tap here to secure your copy.

Atlassian is in a shopping mood. In September, it bought The Browser Company, developer of a cult web browser, and snapped up AI start-up DX. These are not deals aimed at market share or customer lists. They are bets on fresh products and new capabilities.

Australia is seeing more of this behaviour. Grant Thornton’s Dealtracker notes a rise in acquisitions aimed squarely at importing innovation, particularly in artificial intelligence, digital infrastructure and data-driven services.

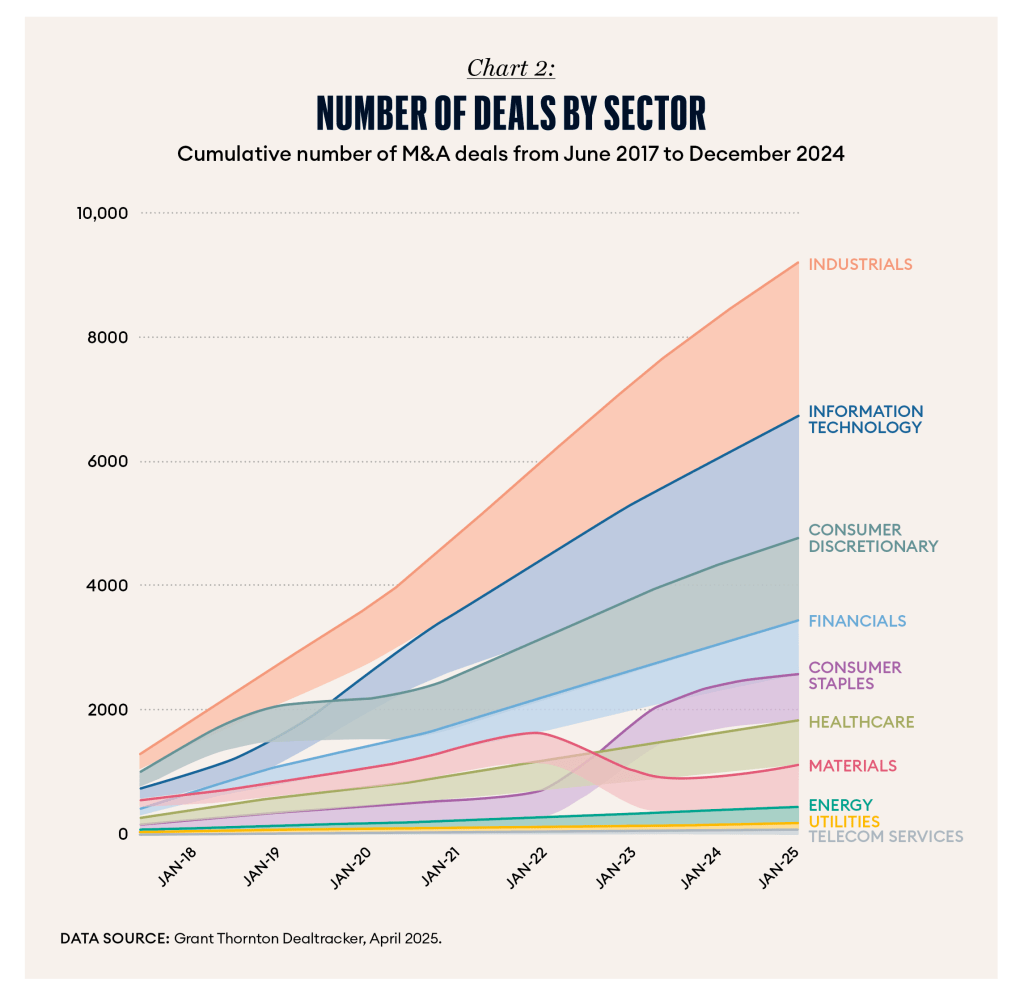

In its April 2025 report on mergers, acquisitions and IPOs, the consultancy found the IT sector accounted for 22% of all deals in the 18 months to December 2024, with AI and data at the centre of activity. (Chart 2).

Targeting Innovation

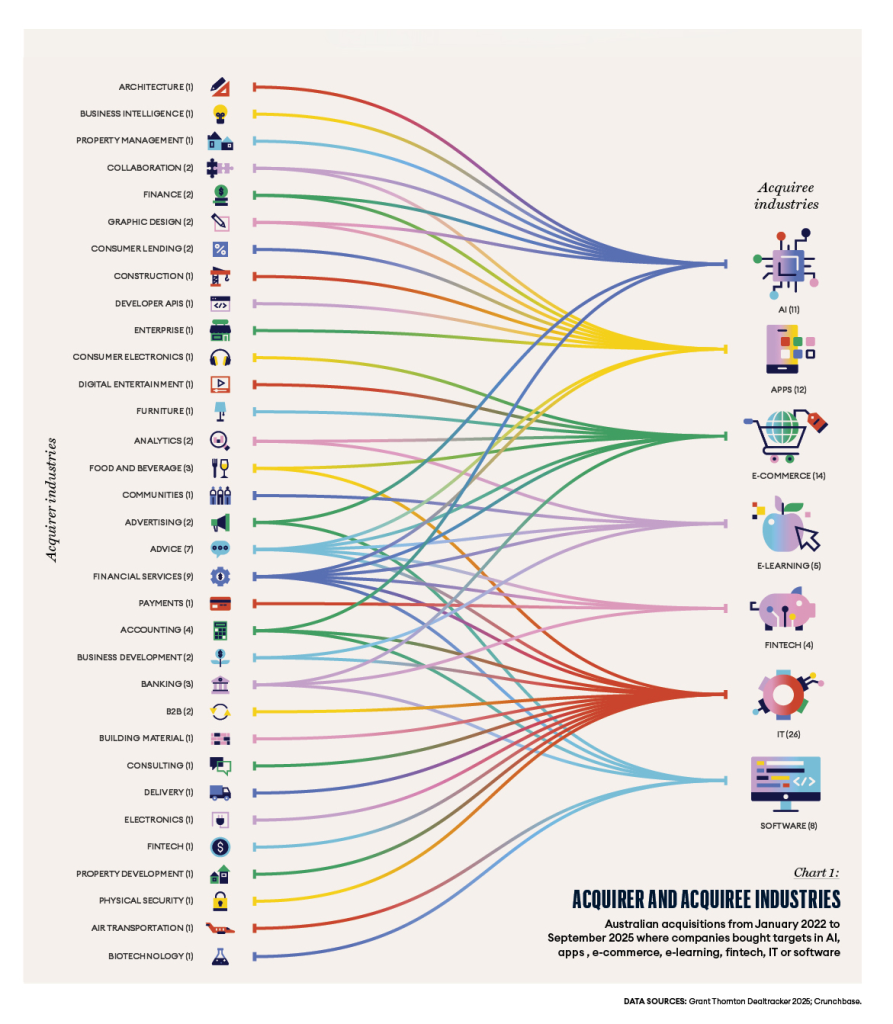

Crunchbase data helps map who is buying whom. It shows non-tech firms targeting tech businesses, using ‘drop-in’ innovation to leapfrog years of in-house development.

Between January 2022 and September 2025, there were 81 such cross-sector deals, according to a Forbes analysis of Crunchbase data (excluding same-industry takeovers and transactions led by private equity). The pattern is clear: established companies are buying their way into fields such as AI, apps, e-commerce, e-learning, fintech, IT and software. (Chart 1).

The deals span a wide range. Webjet Group bought Locomote, a corporate travel platform with an established booking system. Audinate, an audio-visual firm, bought Iris Studio, which builds cloud-based, AI-powered camera control. Admyt, a cashless and ticketless parking operator, took over SHôPING, an in-mall engagement app.

Each purchase delivered not just technology but also teams and products ready to slot directly into the acquirer’s business.

Valuing Innovation

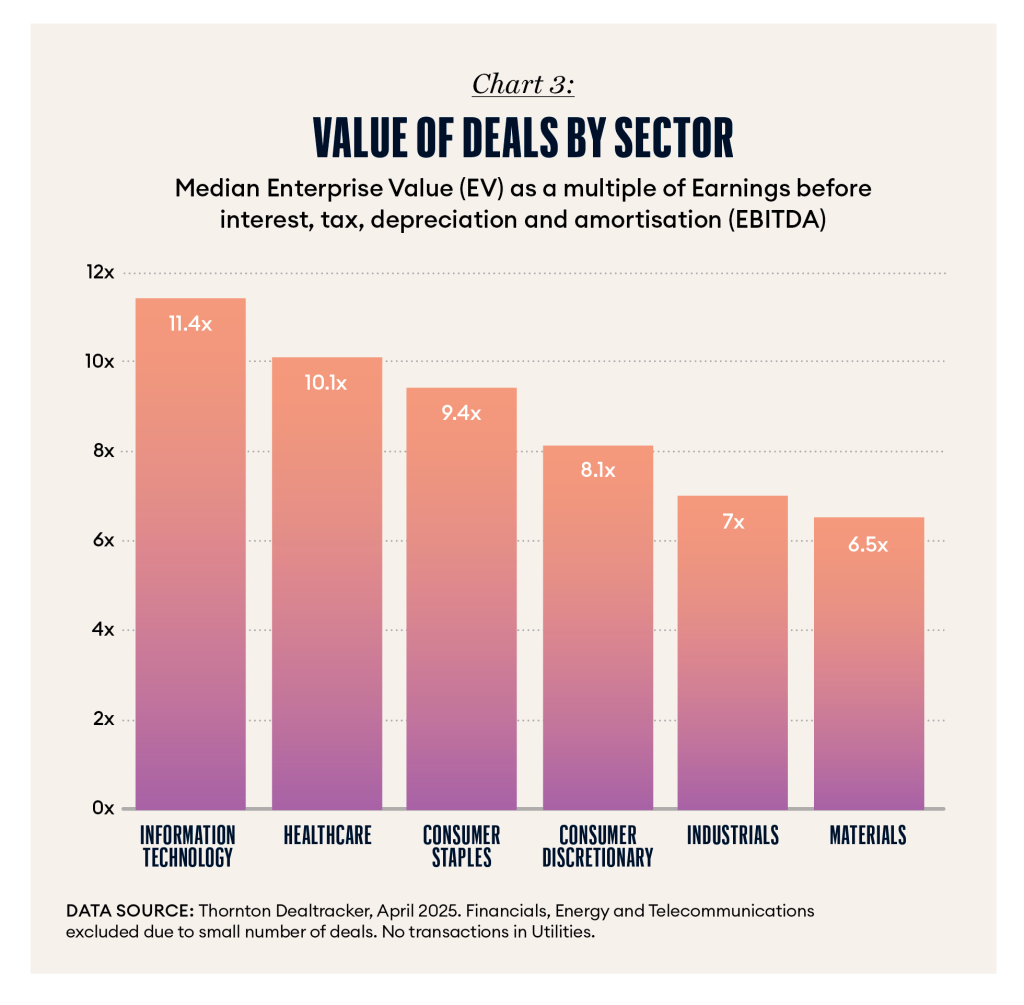

One measure of investor appetite is the multiple of enterprise value (EV) to Earnings before interest, tax, depreciation and amortisation (EBITDA). By that yardstick, technology continues to stand apart.

Grant Thornton’s tracker shows IT companies commanding higher valuations than any other sector. (Chart 3).

Take Damstra Holdings, an enterprise compliance software provider, was bought by Ideagen Limited for $69.6 million at 19.9 times EBITDA. More broadly, the IT sector has carried an average multiple of 16.3x, with peaks above 23x. Investors are willing to pay such premiums for scalable products, proven software, and the promise of growth.

Importing Innovation

Buying innovation is quicker and often less risky than building it. Acquirers gain ready-made products and skilled teams, while spreading their bets across emerging technologies.

The question is whether innovation can truly flourish when it is imported rather than home-grown.

For now, markets reward speed over patience. In sectors where technologies evolve in months, not years, acquisition has become more than a growth tactic. It is the innovation strategy.

Data sources: Grant Thornton Dealtracker 2025; Crunchbase.

This article represents the views only of the subject and should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance. You should seek independent financial and tax advice before making any decision based on this information, the views or information expressed in this article.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.