Ever wondered how much you need to earn to be in Australia’s top one per cent? Knight Frank just released the 2024 list of minimum net worth you need to earn to be in the exclusive club – and the threshold in Australia fell almost a million dollars from last year.

If you were sitting on $8.3 million last year you were in luck – you were a part of the very fortunate 1-per cent club. If you were just a million shy, the tide may have now turned in your favour.

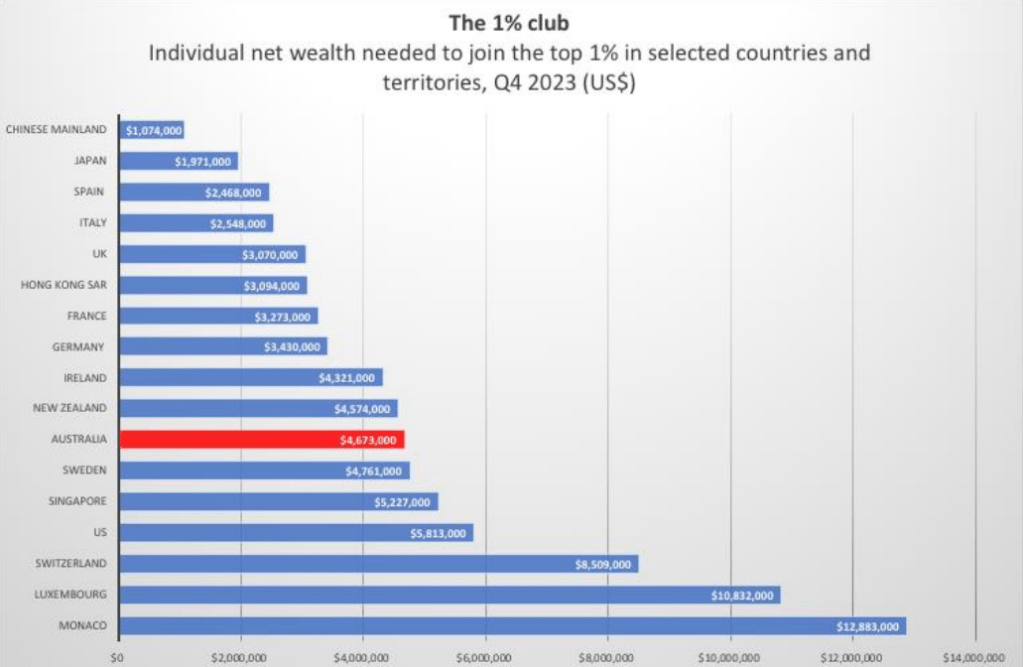

Knight Frank releases its annual Wealth Report this week, including figures on how much high net worth individuals need to be worth to be a part of the 1-per cent club in each country.

In Australia, your net worth now needs to surpass $7 million to be considered a 1 percenter. To become an ‘ultra high net worth individual’ or UHNWI as Knight Frank describes it, you need to be worth more than $46 million.

The UHNWI threshold is already reached by more than 15,000 Australians, and another 4000 or so are expected to meet that net worth benchmark within the next four years.

The number of UHNWIs living in other areas around the world is also growing. The report states that globally there are 4.2% more this year than when the 2023 report was released. The region with the highest growth in the number of UHNWIs is the U.S. Significant growth is also happening in the Middle East, Africa, and Australasia.

There are six countries where the net worth it takes to be considered a 1-per center is greater than Australia. At the top of the list is Monaco, which requires a net worth exceeding $18-million. Luxembourg, Switzerland, the U.S., and Singapore round out the Top 5. Then comes Sweden, and Australia.

Ben Burston is real estate firm Knight Frank’s chief economist.

“The improving interest rate outlook, the robust performance of the US economy and a sharp uptick in equity markets helped wealth creation globally over 2023,” says Burston.

The report states that enthusiasm over AI helped buoy equities in the first half of 2023.

“The S&P Global 100 delivered a 25.4% annual increase in 2023. While some sectors grappled with the lingering impact of elevated debt costs – particularly commercial real estate and private equity – residential property values surprised on the upside. Residential capital values grew by 3.1% across the world’s leading prime markets through 2023.”

What are high-net-worth individuals doing with their money?

Strong investment in real estate will continue globally, according to Knight Frank, though the firm says it expects a move away from office and retail real estate investment. Attitudes to investment in residential real estate in Australia is positive, according to its data.

“According to Knight Frank’s Attitudes Survey, Australia ranks 4th as a location to purchase a new home, with 5.6% saying the most likely location they would buy is in Australia if they were planning to purchase a new home. Australia sits behind the UK (17.7%), the US (9.8%) and France (7.2%),” the report states.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.