Howard Huang is laser focused on turning his Shenzhen-based Orbbec into the world’s top supplier of advanced 3D vision sensors for humanoids.

About 500 humanoid robots from 16 countries competed in what was billed as the first competition of its kind, the World Humanoid Robot Games, in Beijing in August, facing off in 26 events from athletics and soccer to dance and martial arts. Among the winners in the three-day tournament was Chinese state-backed research institute X-Humanoid, which scooped up 10 medals, two of them gold. Its 1.8-meter-tall bipedal bot, Tien Kung Ultra, won the 100-meter dash, while its wheel-based Tian Yi claimed first place in the materials-handling contest, which simulated factory tasks.

Behind the bots’ performances lay a critical piece of technology: their “eyes.” These advanced 3D vision sensors were developed by Orbbec, an under-the-radar company based in the manufacturing hub of Shenzhen in southern China. The technology enables robots to perceive depth as humans do, allowing them to navigate complex environments and interact with their surroundings. The company’s 46-year-old chairman and CEO, Howard Huang, is aiming for a lofty goal. “We want to give robots vision capabilities that surpass those of humans,” he says in a video interview.

X-Humanoid’s Tian Yi (top) claimed first place in the materials-handling contest at the World Humanoid Robot Games in Beijing in August 2025 while its Tien Kung Ultra (above) won the 100-meter dash.

X-Humanoid

Founded by Huang in 2013, Orbbec started out making vision sensors for use in 3D scanning and biometrics. Its specialty is cameras that capture both color and depth and are used for close-to-mid range tasks such as scanning faces and identifying objects. The company also makes lidar, or light detection and ranging, sensors, which are used for long-range tasks such as navigation. Both types of sensors are embedded individually or combined in a range of robotics, from industrial robots, autonomous mobile robots (AMRs) and robotic arms to self-driving cars, drones and, more recently, AI-powered humanoids.

Huang’s ambition “to build the best robotic ‘eyes’ in the world” aligns with searing growth in the global robotics market, which is estimated to expand at a 14% compound annual growth rate to $179 billion by 2033 from $53 billion in 2024, according to a June report from Research and Markets. The Dublin-based firm cites propelling factors such as rapid advances in AI and rising demand for industrial automation.

“We want robots to have vision capabilities that surpass those of humans.”

As the world’s largest market for robotics, China is driving global demand, helped by government support, according to a June report by Morgan Stanley. Crucially for Orbbec, the U.S. investment bank sees expansion in the country’s market for robotics components keeping pace, with the fastest growth coming from 3D vision and other sensors. Shanghai-listed Orbbec, which gets 90% of its revenue from the domestic market and the rest from countries including South Korea, Singapore, Japan and the U.S., is already reaping the benefits.

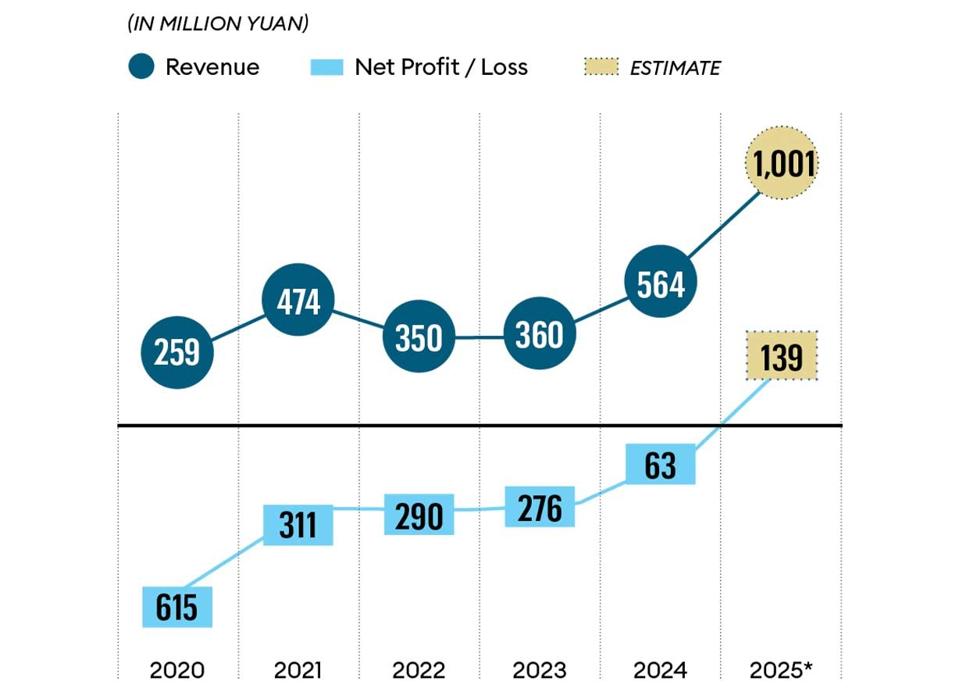

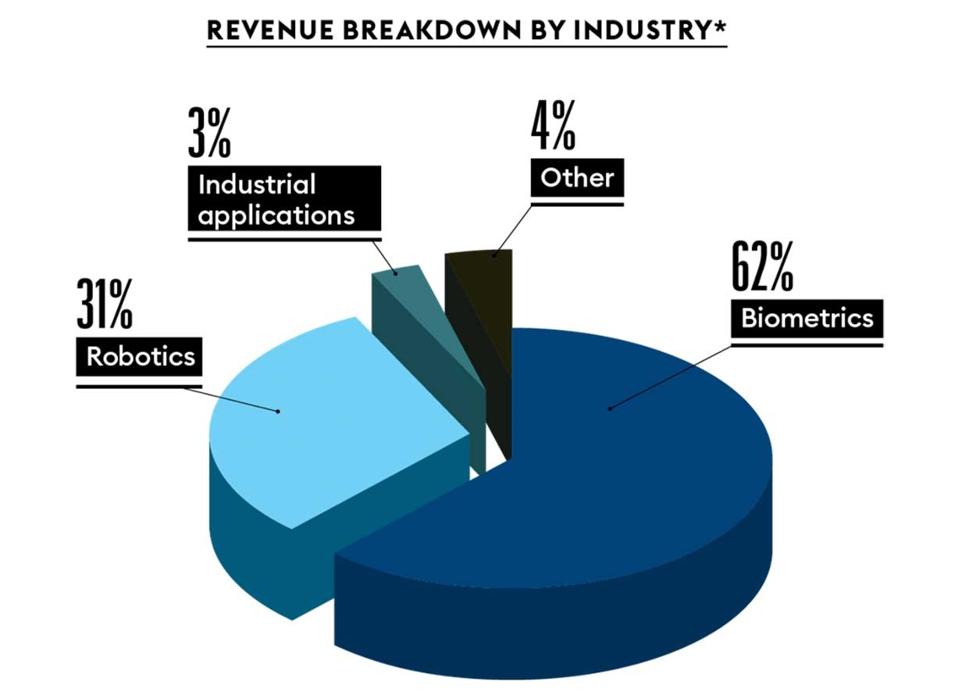

In the first nine months of 2025, Orbbec swung to a net profit of 69 million yuan ($9.8 million) from a year-earlier net loss of 102 million yuan with revenue more than doubling to 714 million yuan. While a breakdown of revenue wasn’t available for that period, for the first six months of 2025, almost two-thirds of sales came from sensors for biometrics, chiefly facial recognition, and scanners for consumer applications such as 3D printing and gaming VR; sensors for robotics accounted for a third.

The company, which claims a cumulative output exceeding 5 million sensors as of end-December, has seen its shares more than double over the past 12 months. That made Huang, with a 27% stake, a billionaire for the first time last year and gave him a net worth of $1.6 billion as of mid-January.

Robopop

Surging demand for robotics helped Orbbec turn profitable in 2025.

*Estimates by Tianfeng Securities

Source: Orbbec

Among Orbbec’s prominent customers is Chinese fintech giant Ant Group’s Alipay digital-payments platform, which uses its cameras for facial recognition in contactless payments. (Ant owns 9% of the company through its venture capital arm.) In robotics, the company supplies mostly service-bot makers, including China’s Pudu Robotics and Gausium, both of which specialize in cleaning bots, and South Korea’s Robocare, which makes human-care bots. Based on units sold, Orbbec claims 70% of the market for 3D vision sensors for mobile service robotics in both China and South Korea. It also sells sensors to companies that make AMRs for factories and warehouses, such as China’s Standard Robots and Korea’s Twinny.

But these days, Huang is laser-focused on humanoids, expected to emerge as the largest robot category long term. Morgan Stanley in January estimated the global market for the AI-powered anthropomorphic robots will hit $7.5 trillion by 2050. Demand is set to increase as manufacturers scale up and costs fall. Bank of America Global Research estimates the cost of building a typical humanoid could roughly halve in the next five to ten years, assuming most of its parts are made in China.

Orbbec’s client roster has a steadily increasing number of humanoid manufacturers. Besides X-Humanoid, it supplies AgiBot; Ant-backed Stardust Intelligence; and Ant’s own Robbyant unit, all based in China. Another notable customer is billionaire Zhou Jian’s UBTech Robotics, which in November said it would start mass-producing humanoids for industrial work.

While he doesn’t have exact data, Huang says Orbbec’s market share for 3D vision sensors for humanoids in China “is likely higher” than for service bots. “Almost all humanoid robot companies you can name in China have either already installed our vision sensors, or at the very least, have received samples for testing,” he elaborates. Huang expects sales of vision sensors for robotics to double annually over the next three to five years to become the company’s biggest revenue contributor, spurring a five- to tenfold jump in total revenue by 2030.

Eye-Catching

Looking ahead, 3D vision sensors for robotics could replace sensors for biometrics as Orbbec’s biggest revenue contributor in five years.

*H1 2025

Source: Orbbec

Orbbec is well-placed to benefit from China’s robotics boom because it’s the only domestic player specializing in RGBD (red, green, blue, depth) cameras for the complex machines, says Zhou Xinyu, an analyst with Wuhan-based Tianfeng Securities. The company’s local competitors, such as Shenzhen-based RoboSense Technology and Shanghai-based Hesai Technology, are focused mostly on lidar sensors for self-driving cars, he notes.

The main rival Huang must contend with is California-based RealSense, which separated from U.S. semiconductor giant Intel in July and, like Orbbec, claims more than 3,000 clients. RealSense says its customers include Unitree Robotics, among China’s best-known humanoid makers; Boston Dynamics, a Massachusetts-based subsidiary of South Korea’s Hyundai Motor; and Nvidia-backed Agility Robotics, based in Oregon. It says its depth cameras are embedded in 60% of the world’s AMRs and 80% of humanoids. Orbbec declined to comment on RealSense’s market share claims, but Zhong Len, general manager of the Chinese company’s robot product line, says Orbbec “has secured more than three-quarters of the world’s leading cleaning and delivery bot makers as customers.”

“If you’re prepared when Big Tech makes its move, that’s your moment.”

Huang says Orbbec’s flagship 3D camera, the Gemini 435Le, performs 30%-50% better than RealSense’s D555, one of its leading models, in terms of depth precision, depth-map completeness and edge sharpness—all of which help a robot to identify an object, figure out how close it is, and scoot around it—for the same $499 retail price. Mike Nielsen, vice president of marketing at RealSense, concedes that while the performance of the two rivals’ cameras “could be considered comparable,” the high deployment of its sensors in humanoids is a better indicator of which company has the edge.

Orbbec’s cameras rival RealSense’s in technical metrics because the Chinese company has been through more development cycles, according to Song Zhan, executive director of the laboratory for intelligent design and machine vision at the government-backed Shenzhen Institutes of Advanced Technology. Orbbec also produces a wider variety of 3D cameras for robots, he notes. “RealSense only has a few models. If they work, great—if not, there’s not a lot of other options.”

Huang in Orbbec’s 3D vision technology showroom at its Shenzhen headquarters.

Simon Zhao for Forbes Asia

Orbbec’s customers root for its products, saying they offer high quality at a reasonable price. Zhang Qiang, chair of the research committee at X-Humanoid, says humanoid makers prioritize image quality, operational stability and consistency in mass production. “Orbbec’s vision sensors are cost-effective with a high level of completeness, backed by strong after-sales support,” he says.

All of Orbbec’s sensors are made in-house, from designing specialized chips and building algorithms to final assembly. Its products are compatible with Nvidia’s Isaac software suite and Jetson Thor computing platform, both of which are used to program robots (RealSense products are similarly compatible). “I’ve been focusing on 3D optical measurement [a core technology behind 3D vision sensors] since 2002,” Huang says, adding that developing products that have very few bugs, offer a smooth user experience and high reliability is impossible without years of accumulated experience.

Hailing from a modest background, Huang didn’t grow up aspiring for tech riches. He says his childhood was “uneventful” with a father who worked at a state-owned institution and a mother who taught secondary-school math, politics and music. Excelling at physics, Huang notched up a bachelor’s degree from Peking University, a master’s from the National University of Singapore, and a Ph.D. from City University of Hong Kong, all in engineering. He became a research fellow focusing on 3D optical measurement at several institutes, including the Singapore-MIT Alliance for Research and Technology in Singapore and Hong Kong Polytechnic University.

Eventually, Huang hankered for more. “In academia, I was publishing research papers; I couldn’t see their real-world application,” he says. “What we’re doing now is writing research papers in the factory, writing them for the industry,” he adds. While in university, the sci-fi action movie I, Robot had captured his imagination. A box-office hit of 2004, it depicts the world in 2035 in which robots are commonplace. For the young student, it was a compelling vision of the future.

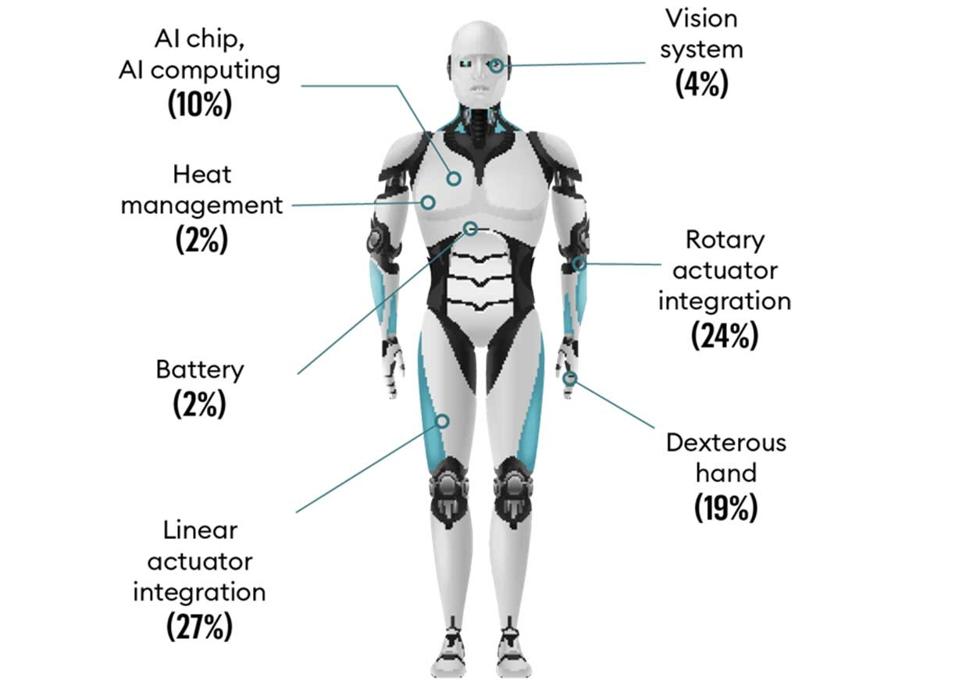

SUM OF PARTS

The average $35,000 build cost of a humanoid could more than halve by 2030-2035. Here’s how much each component costs in percentage terms today.

In 2013, he borrowed 10 million yuan from four high school friends and started building a production line for 3D vision sensors at a factory he rented in China’s Pearl River Delta. But the transition to entrepreneurship wasn’t seamless and he soon ran into cashflow problems. He went cap in hand to friends again. “Academia was simple, I worked on principles and algorithms, and used cameras I bought to build a demo and that’s it,” Huang says. “But as a company, we had to handle everything in-house, from making molds to product designs. It was a real challenge.”

The budding entrepreneur also realized that his dream of making robot eyes was premature as the market just wasn’t big enough at the time. His first device, launched in 2015, was for 3D scanning, followed two years later by sensors for use in biometrics. That helped him land Ant and Chinese smartphone maker Oppo as customers. Keen to replicate Apple’s success in face identification, Oppo chose Orbbec, Huang says, because it was the only company at the time offering advanced facial recognition sensors other than the U.S. smartphone giant, which doesn’t license its Face ID technology to others. “If you’re prepared when Big Tech makes its move, that’s your moment,” Huang says, “But if you wait until they’ve launched to start your R&D, you’re at the same starting line as everyone else.”

As Orbbec’s roster of high-profile customers grew, it attracted prominent investors such as MediaTek Ventures, the venture capital arm of Taiwan chip designer MediaTek, and Hong Kong-based investment firm SAIF Partners, as well as Ant. In mid-2022, the company’s listing on Shanghai’s tech-focused Star market raised 1.2 billion yuan, mainly to develop 3D vision sensors for smart homes and robotics. The timing was fortuitous as generative AI exploded onto the scene shortly thereafter, heralding the potential of combining AI capabilities with robotics hardware. With AI chips making automatons smarter and better able to respond to their environment, Orbbec’s team of 300-plus engineers doubled down and the company was able to introduce specialized vision sensors for robotics a year later.

Today, as he eyes a bigger chunk of the humanoid market, Huang has his work cut out on the technical front. Humanoids remain clunky partly because 3D cameras are not sophisticated enough, says X-Humanoid’s Zhang. They need better depth-perception capabilities and the ability to process different lighting conditions, he explains.

In response, Orbbec is raising 980 million yuan through a private share placement to be deployed largely to develop more-advanced vision sensors and algorithms. Around 12% of the proceeds will go toward expanding a 120,000-square-meter factory in Guangdong that began operations in 2024. Besides sensors, the plant has the capacity to assemble about 100,000 AMRs a year, a new business Huang entered in 2024, spurred, he says, by customer demand. A second factory is being built in Vietnam for customers targeting overseas markets, such as the U.S., taking advantage of lower U.S. tariffs there.

Sensing that his vision of the future is now within his grasp, Huang exudes enthusiasm. “I was always optimistic about robotics,” he says, but with the advent of AI, “The future in robotics is as vast as the stars and the sea.”

This story was originally published on forbes.com and all figures are in USD.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.