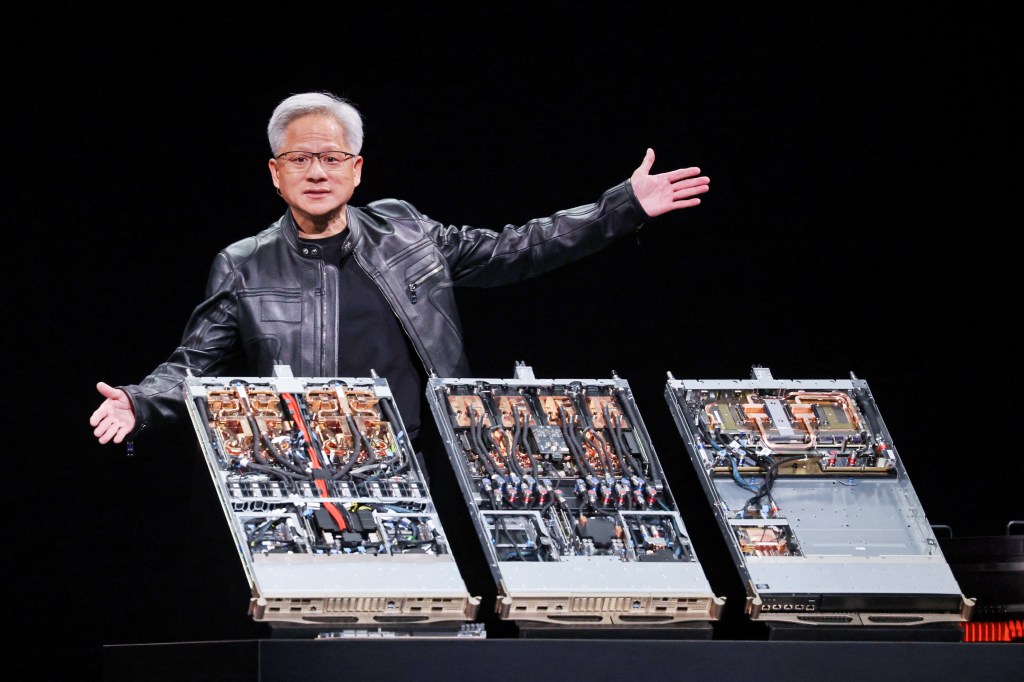

Nvidia CEO Jensen Huang moved ahead of LVMH’s Bernard Arnault to become the world’s sixth-richest person as shares of the chipmaker rallied to an all-time high Tuesday, after the company said sales of its H20 AI chips would resume “soon” in China, ending months of restrictions imposed by the Trump administration.

Key Takeaways

- Shares of Nvidia increased by more than 4% to just over $171 as of around 11:10 a.m. EDT, paring back earlier gains after reaching an all-time high of $172.40 and opening to a record $171.19.

- Huang met with President Donald Trump and Chinese leadership in Beijing earlier this month, Nvidia announced Monday, adding the U.S. government “assured” Nvidia it would grant the company licenses to sell its H20 chips in China, with deliveries expected to start “soon.”

- In April, the company forecast a $5.5 billion reduction in sales after the U.S. imposed restrictions on Nvidia’s chip sales to China, as Huang claimed a $50 billion market in China for AI chips was “effectively closed to U.S. industry.”

Forbes Valuation

Huang, who holds a roughly 3% stake in Nvidia, is the sixth-wealthiest person in the world with a fortune valued at $148.1 billion, according to Forbes’ estimates. The value of Huang’s stake increased by more than $5.3 billion as shares rose, ranking him just ahead of Arnault ($147.9 billion) and behind Google’s Larry Page ($150.6 billion).

Big Number

$145 billion. That’s how much was added to Nvidia’s market capitalization as shares surged Tuesday morning. Nvidia, with a valuation of nearly $4.15 trillion, ranks ahead of Microsoft ($3.7 trillion), Apple ($3.1 trillion) and Amazon ($2.3 trillion) as the world’s most-valuable firm.

Key Background

Analysts have been optimistic about Nvidia’s role in the AI market in recent months despite export controls under the Trump administration, as shares are up 24% on the year. Huang reportedly increased his lobbying efforts against export controls after the U.S. blocked deliveries of its H20 chips, arguing the regulations undermined tech leadership in the U.S. Ananda Baruah, an analyst for Loop Capital, said last month that Nvidia was at the “front-end” of the next “Golden Wave” for generative AI and more companies adopt the technology. Baruah raised his price target for Nvidia’s stock at the time to $250 from $175, surpassing a then-average $173 forecast among Wall Street analysts, and claimed the company’s valuation could peak near $6 trillion.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.