The key to producing superior risk-adjusted returns is not to focus on the traditional valuation measures such as price-to-earnings or price-to-book ratios.

The sources of evaluating returns for investors in global equity markets has shifted, and it is a shift that Australian investors — who have traditionally focused on Australian equities with their tax paid dividends — cannot afford to ignore.

There are three three determinants of equity returns: how much money a company makes, how much it gives back to shareholders, and the price investors are willing to pay for those elements. The most common measures of these three determinants are earnings, dividends, and price-to-earnings ratios.

But the key to producing superior risk-adjusted returns is not to focus on the traditional valuation measures such as price-to-earnings or price-to-book ratios.

A better focus should be whether companies are generating free cash flow, and whether they have management teams committed to deploying that free cash flow for the benefit of shareholders. Free cash flow is defined as what is left over after all expenses, planned capital spending, and cash taxes.

Traditional accounting concepts such as earnings and book value are dependent on assumptions and accruals such as depreciation. In many instances, these are generated at ‘best guesses’ that can be a poor reflection of the reality of a company’s situation.

Free cash flow, by comparison, is a transparent measure of a company’s moneymaking ability – and free cash flow is what seeds future growth.

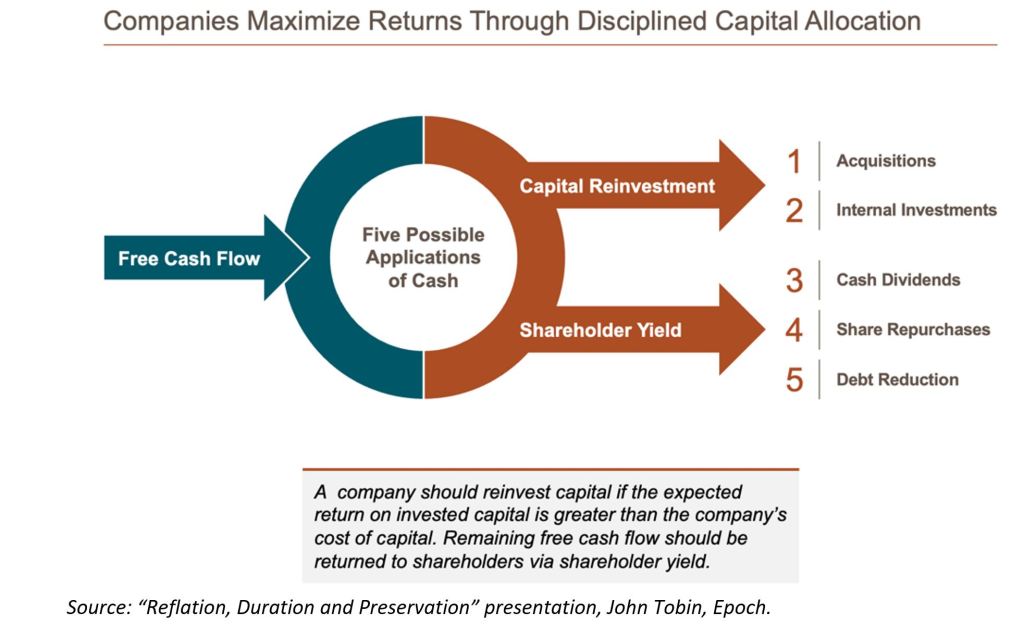

At Epoch Investment Partners, the focus is identifying companies based on their ability to generate free cash flow, grow free cash flow, and allocate free cash flow. This approach is what we refer to as the fives uses of cash model.

The idea behind the model is simple. Free cash flow can be broken down into capital reinvestment and shareholder yield, which then further break down into the five different applications for cash. These are:

- to make acquisitions

- to reinvest back into the business

- to pay out to shareholders in the form of dividends

- to buy back stock

- to reduce debt

The first two applications of free cash flow are ways a company can reinvest for growth. It is a preferred metric only when those actions generate returns above the cost of capital. If it does not, companies should instead return the excess cash to shareholders through dividends, share buybacks or debt repayment.

These final three points constitute shareholder yield. Many investors focus only on cash dividends, however repurchasing shares and paying down debt are also ways of returning capital, as both provide shareholders with a larger claim on a company’s free cash flow.

Companies that practice the fives uses of cash model are considered good capital allocators. It is the ability of a company to generate free cash flow makes the business worth something. How management allocates a firm’s free cash flow determines whether the value of the business rises or falls.

In today’s market, evaluating the discipline with which companies allocate cash will be key in successfully navigating the global investment landscape. Owning businesses that are shrewd capital allocators and utilise the five uses of cash model should prove a superior investment strategy.

John Tobin is a portfolio manager and senior research analyst at Epoch Investment Partners

The information included in this article is provided for informational purposes only and is not investment advice of any nature. The information contained in this article reflects, as of the date of publication, the current opinion of Epoch Investment Partners, Inc (Epoch) and is subject to change without notice. Any opinions expressed in this material reflect our judgment at this date, are subject to change and should not be relied upon as the basis of your investment decisions.