In the face of a downturn, the opportunity lies in new company creation and early-stage companies, write Silicon Valley Bank’s Andy Tsao and Sara Rona.

After the greatest venture funding year in history in 2021, we find ourselves in the midst of a significant technology correction – the first in 15 years post the Global Financial Crisis. Coming off of record fundraising and valuation highs, the economic environment has tightened and retracted.

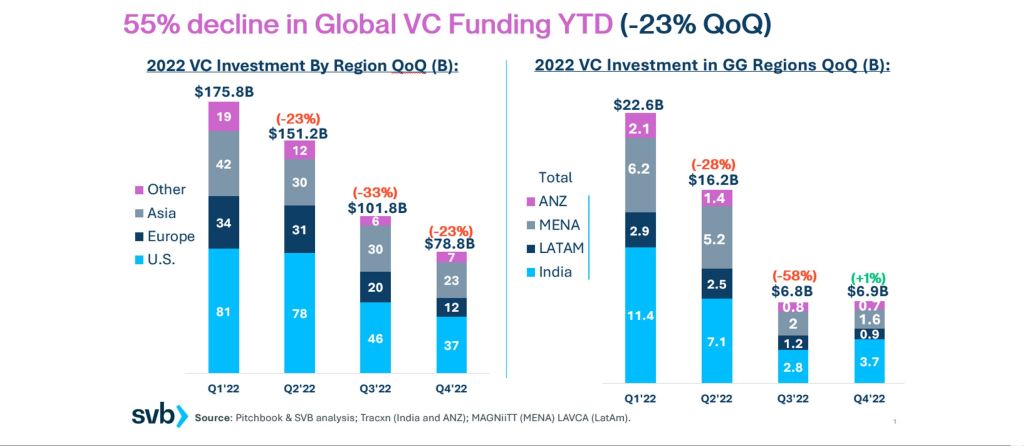

In the last year, macro-economic uncertainty triggered a 31% decline in the technology-heavy NASDAQ which in turn led to a 35% drop in global venture capital deployment according to Crunchbase.

Specific to Australia, data from Cut Through Venture and Folklore Ventures showed a 30% drop in venture funding into startups as seen in the latest State of Australian Startup Funding report released today.

But while there is no doubt pain for many startups and founders, at Silicon Valley Bank we remain optimistic about the opportunity for the Australian startup ecosystem in 2023 and beyond.

We have witnessed record fundraising activity in the global VC industry, with US$202 billion raised in 2022, resulting in a huge amount of dry powder (US$558 billion), according to Preqin. A majority of the top Australian VCs like Blackbird, Square Peg, OIF Ventures, Second Quarter Ventures (and others), have all raised their largest funds to date. In the US, in the last 5 years the amount of dry powder per company has increased by 119%, and today VCs hold a record US$300 billion waiting to be deployed, according to SVB’s H1 2023 State of the Markets report. Eventually, that capital needs to be put to work.

The resilience of the ecosystem

The recent growth of funding, startup creation and broader infrastructure in startup ecosystems has resulted in a maturing of the innovation economy, including in Australia, Latin America, India, and the Middle East. The downturn is no doubt having an impact but shows the resilience of the local ecosystem compared to its previous state 3–5 years ago, when a similar downturn may have had a larger impact. It is safe to say there is more critical mass today. The technology ecosystem has grown in size and matured over the last couple of years that it is now able to withstand such trying times.

As a well-known Latin VC said recently “American founders eat cereal for breakfast, Latin founders eat crisis for breakfast.” We agree and note that you can replace any new and emerging market in the place of Latin, and it will still be true. Despite being a well-developed economy, we do consider Australia an emerging ‘technology innovation’ hub. Silicon Valley Bank has been actively doing cross-border business development in Australia over the last 10 years and it’s safe to say that the growth of the ecosystem has been nothing short of remarkable.

We’ve been privy to the recycling of local talent within unicorns like Canva and Atlassian, and a dramatic increase in the amount of onshore capital available for founders. The ability of founders and early employees of these companies to invest back into the startup ecosystem, and the stated intention to continue investing in 2023, shows the opportunity to build the ecosystem for the better throughout the next year.

Founders in new and emerging markets have grown up in uncertainty with far less capital available, which makes them that much more creative and resilient. We would bet on these amazing founders and investors all day long.

Though a resilient ecosystem, an important point to make is that economic downturns like this disproportionately impact female founders — which fell to 10% of Australian startups in 2022 — as well founders from underrepresented and underfunded groups. It’s important that investors and the tech community alike have awareness and provide resources to support those founders.

Early-stage growth remains promising in the second half of 2023

In the face of a downturn, the opportunity lies in new company creation and early-stage companies. While some companies face a difficult decision to take a down round, explore venture debt or alternative financing options as opposed to equity financing and/or reset their valuations altogether, there remains significant dry powder in the VC segment for early-stage companies.

According to a recent report that our SVB team pulled together alongside AngelList, the median pre-money valuation for seed-stage companies grew 32% YoY (specific to Australia this rose by 13% per Cut Through Venture’s latest stats) while late-stage valuations declined 5% in 2022 and are likely to continue their decline. Only the strongest startups are getting funded in today’s market, which explains the increase in early-stage valuations from last year. Although the capital invested for early-stage deals in 2022 was considerably less than in 2021, the median deal value increased by 30% YoY, according to SVB’s H1 2023 State of the Markets report.

At that early stage, there is a huge opportunity for Australian companies to amplify their unique strengths in sectors like Enterprise SaaS and Climate Tech, where they really have the white space to prove their models and scale globally when that time is right.

Related content

The downturn, as those Silicon Valley has faced before it, is often the ‘make or break’ moment for startup ecosystems. The early signs show that Australia’s startup ecosystem is a lot more resilient than it has been previously and stands as a shining opportunity on the global stage as we see through the next 12 months.

Despite the macroeconomic headwinds, we are still very optimistic as it pertains to the medium to the long-term growth of the innovation economy. Adjusting for the top-of-the-market behaviour in 2021, we expect to see VC deployment return to a more linear growth curve from pre-pandemic levels.

While history may not repeat itself, it often rhymes, and the data suggest that this is the best time to launch a startup or deploy venture capital. Even with increasing tech layoffs, these are opportune times to hire top talent that may have been inaccessible in years past. It is important to note that some of the world’s best companies have formed during a down cycle and have learned to thrive in the face of adversity (Airbnb, Meta, and LinkedIn, as examples). Having been around since 1982, Silicon Valley Bank has weathered multiple downturns and global volatility and we’ve seen this many times. For context, in the three years during and directly after the Global Financial Crisis, 127 unicorns were founded — a 76% increase over the prior three years according to SVB’s H1 2023 State of the Markets report.

We are hopeful and believe that this is a time and opportunity for Australian founders to buckle down, master their businesses, learn to be lean and scale thoughtfully.

Andy Tsao is a Managing Director and leads SVB’s Global Gateway, which assists innovation companies in the emerging markets with their US and international market expansion.

Sara Rona is a director of Startup Banking for Silicon Valley Bank (SVB) and is the market lead for Australia and New Zealand (ANZ) and Global Channel Partnerships across ANZ, India, MENA, and LAtAm.