Economic conditions remain challenging for stocks as slower growth and tighter monetary conditions pressure valuations, according to Kera Van Valen and John Tobin at Epoch Investment Partners.

The key to understanding a company – and whether an investment in that company will provide a good return – requires a focus, not on accounting metrics such as earnings or book value, but rather on cash flow. How the business generates cash flow, and how management allocates that cash flow among various available alternatives will determine whether the business creates value for shareholders over time and therefore represents a good investment opportunity.

In our view, the best predictor of long-term shareholder return is a company’s growth of free cash flow, and the intelligent use of that cash flow. We look for strong company management with a commitment to financial transparency and a track record of delivering returns to shareholders through the application of sound capital allocation practices. In short, this means if there are no available investment opportunities expected to earn above the firm’s cost of capital, cash should be returned to shareholders in the form of paying down debt, share repurchases, or cash dividends. Directing capital to low-return opportunities or hoarding capital are value-destructive and should be seen as warning signs.

Free cash flow and capital allocation

Traditional accounting concepts, such as company earnings, are prone to distortion via various accounting rules and assumptions. Cash flow, however, provides a simpler and more transparent view of the flow of funds into and out of a company. Consistent and growing generation of free cash flow, the cash available for use after expenses and cash taxes, is difficult to misrepresent and is an indicator of business strength. Behind every stock there is a real company, and the focus should be on evaluating a company’s track record—and outlook—for generating and growing free cash flow.

Of equal importance to generation of free cash flow are capital allocation policies and evidence of good capital discipline by management. When we think of the various alternative uses for cash that management must evaluate, there are only five:

1. Invest for inorganic growth via acquisitions

2. Invest for organic growth via capital expenditures and R&D spending

3. Cash dividends

4. Share buybacks

5. Debt reduction

The last three on that list comprise the different ways management can return cash to shareholders. The first two should only be pursued if management has a reasonable expectation of generating a return that is above the company’s cost of capital.

This is where disciplined capital allocation policies matter. For a company that is generating strong levels of free cash flow, there will always be a finite number of profitable investment opportunities. Knowing this, shrewd capital allocators will have a policy in place to distribute excess cash to shareholders via debt paydown, share repurchases, or cash dividends. Dividends are generally the most consistent method of returning cash to shareholders, and well-covered dividends that are stable and growing are the mark of a strong business and an attractive equity investment.

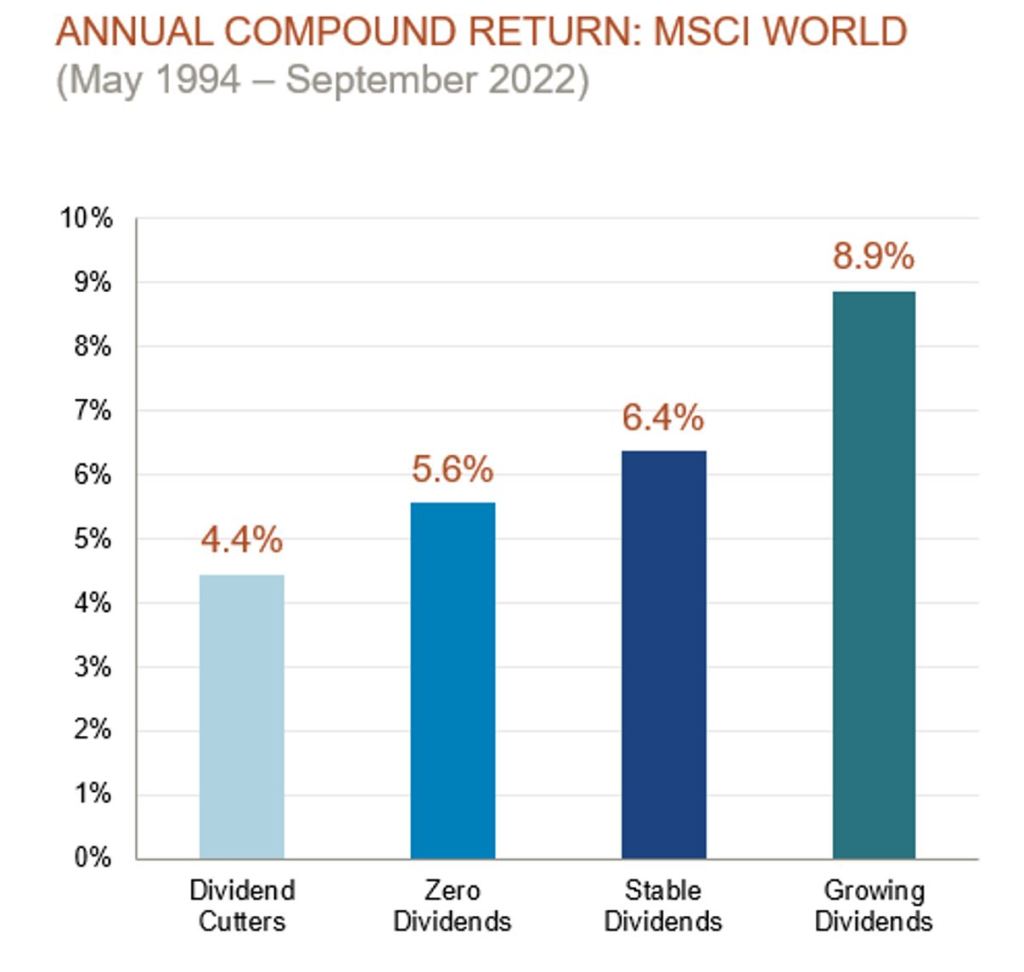

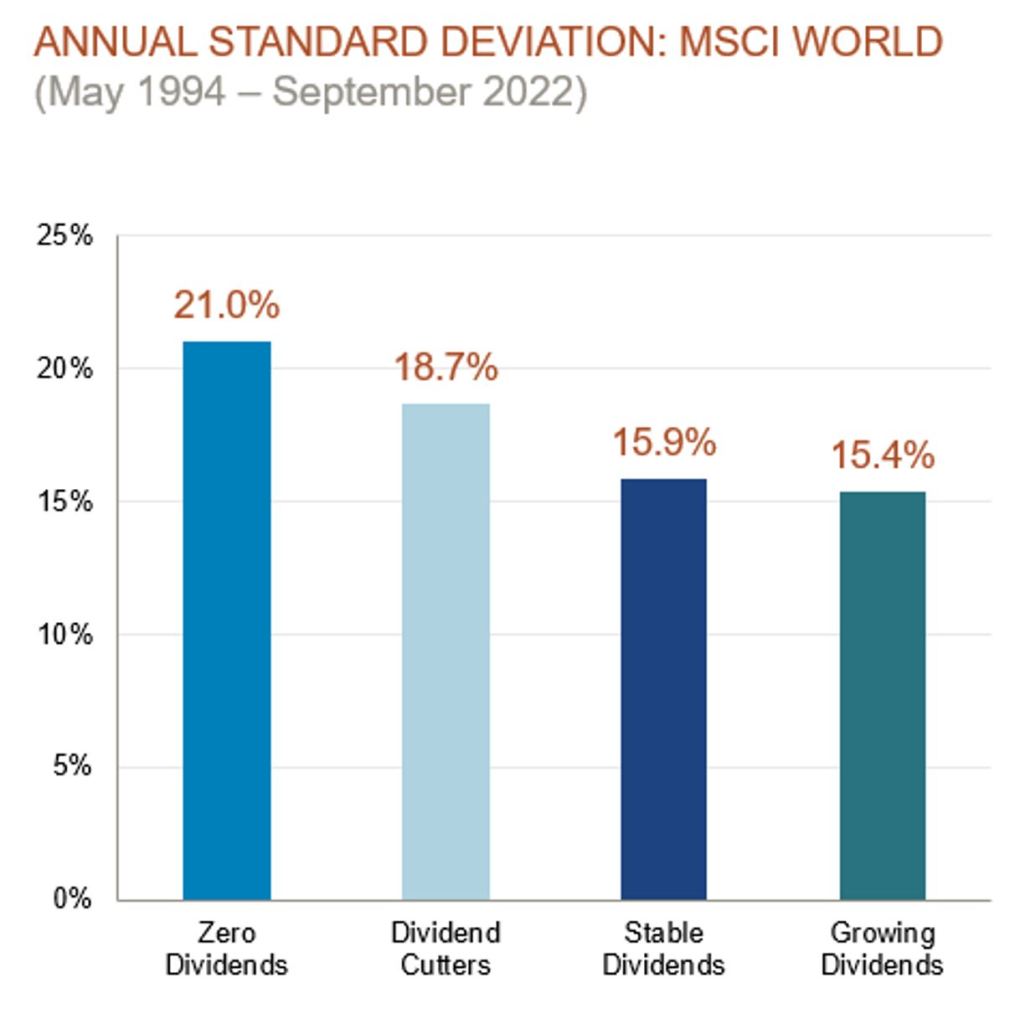

The research bears this out. Looking at data analysing returns over a 28-year period shows that the highest returns were generated from companies that had growing dividends.

Companies with growing dividends also presented the lowest standard deviation.

Achieving the best return, with the lowest volatility, is a powerful combination, and companies that have growing dividends display exactly those characteristics.

As an investor, it is important to thoroughly assess a company’s free cash flow and understand the source, growth rate, volatility, and optimum applications given a company’s cost of capital.

Dividends and market uncertainty

In 2020 when the COVID-19 pandemic hit, there was (not surprisingly) a drop in the number of companies increasing their dividends. This raised a lot of concern at the time of whether companies could continue to pay dividends, and many companies in fact needed to adjust shareholder expectations. The key metric determining future growth was whether the company could continue to generate cash flow. Companies that continued to generate cash during this time were able to maintain their dividend policy.

Looking ahead, economic conditions remain challenging for stocks as slower growth and tighter monetary conditions pressure valuations. The winners in 2023 will be those companies that sell products and services into growing markets, that have good market share and position, that have some degree of pricing power, that have healthy balance sheets, and that follow sound capital allocation practices. These are the key characteristics to look for to identify resilient and growing companies.

No matter the economic situation, there are always investment opportunities, and it is the ability of a company to generate free cash flow that makes the business worth something. How management allocates a firm’s free cash flow determines whether the value of the business rises or falls.

By focusing analysis on a company’s ability to generate cash flow and assessing the skill with which management allocates that cash, investors can better determine which companies are worth investing in.

Kera Van Valen and John Tobin are portfolio managers at Epoch Investment Partners.