Randal Jenneke, Head of Australian Equities and Portfolio Manager at T. Rowe Price, outlines some of the things to watch in the markets and global economies heading into 2023.

The main concern for the world’s major central banks currently is that inflation has become ingrained or ‘sticky,’ proving difficult to eradicate without triggering an economic recession. This is of particular concern in the US where the Federal Reserve has fallen behind most central banks in meeting its inflation target, committing to raising interest rates until it feels that US inflation is back under control.

Spillovers from higher US interest rates to global rates, liquidity, currencies, and markets are simply collateral damage for other countries, including Australia.

Sticky inflation the biggest risk

‘Sticky inflation’, which plots the Atlanta Fed’s measure of more enduring components of inflation against wages growth, is a major problem for markets given the extent to which the post-pandemic surge in sticky consumer prices has been accompanied by a commensurate surge in wages, (see Figure 1).

That’s the real concern here, because when we started to talk about inflation over twelve months ago, supply chain issues and how they had impacted the goods market were in focus. The situation is now well beyond component shortages affecting goods prices, inflation is now firmly embedded in the services sector and in wages.

So the challenge for central banks around the world, including the Reserve Bank of Australia (RBA) is how do you get inflation back to your target, when wages growth is running as strongly as it is?

In the US the problem is the most acute, with wages growth north of 6%. In Australia, where macro imbalances created by stimulus have been less pronounced, annual wages growth has remained a little over 3%. We are however seeing signs that Australia may follow the global trend, with enterprise bargaining agreements striking higher rates and the recent decision to increase the minimum wage by 5.2%. So, pressure on wages is rising, which is why we think it is so important that central banks continue on this path to bring wages down. Unfortunately, this means rising unemployment and a challenging business environment in the short term.

We expect an earnings recession in 2023

Our base case for 2023, is that Australia is likely to experience an earnings recession. Earnings are at historically high levels, and have held up reasonably well until now, largely because the impact of domestic rate hikes is only just starting to bite.

The August reporting season saw earnings downgrades in the order of 3% to 4%, mostly from the mining sector under pressure from rising mining costs and higher capex spending. Yet the average decline in ASX earnings during an earnings recession has been close to 30%.

The real pain will be felt next year when fixed rate mortgages that originated during the covid period roll off to considerably higher variable rates. Ironically, the more resilient the consumer might be in the short term, the more the RBA will need to act in order to curb demand.

Cyclical sectors of the economy face the greatest risk going forward due to slowing demand, rising unemployment and pressured earnings. Further, we’re probably only about halfway through the house price downturn, so our expectation is that household wealth will continue to fall, financial conditions will soften, and earnings will fall, as we’ve seen in past cycles, (see Figure 2).

Sectors likely to suffer most are energy, materials, mining, and financials, notably banks.

The more defensive part of the economy, which tends to be more stable during softer underlying business conditions, is likely to hold up best. This includes areas like healthcare, consumer staples, retail, communication services and utilities. The latter are supported by the underlying demand for power for homes and businesses.

Stay cautious on energy and mining

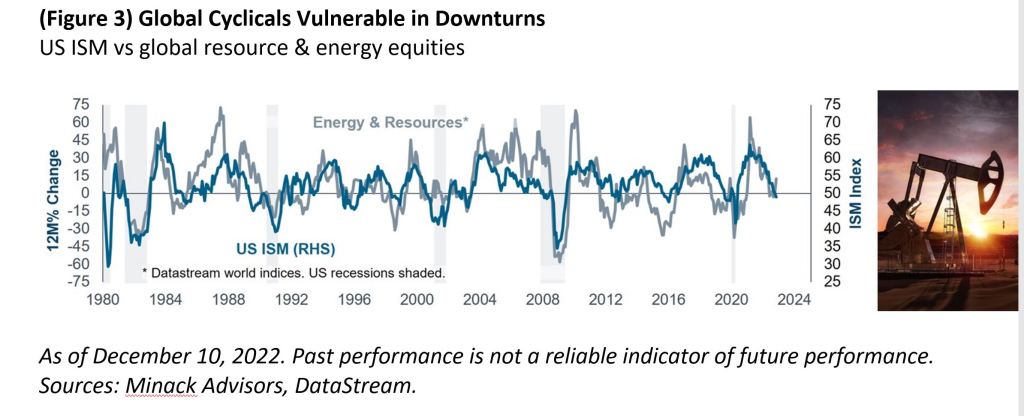

At the global level, when overall activity is strong, so too is the demand for energy and mining commodities. But when activity weakens, the demand for energy and commodities also declines, and this is the global environment which we are now in, (see Figure 3).

As the global economy slows in 2023, we expect energy and mining stocks to underperform. When the price of their underlying commodities rolls over, as we have already witnessed recently, there will be eventual declines in earnings and cash flows.

From a longer-term perspective, we still see select opportunities in the resources sector related to the green energy transition and EV manufacturing. However, in the short term we expect further earnings downgrades for the mining sector.

Bottom line

Labour markets are too tight and not consistent with central banks meeting inflation targets. The collateral damage from rising rates and unemployment will be corporate earnings, which are expected to be downgraded going forward. Any policy error will be one of overtightening causing a recession, but with or without an economic recession, we will have an earnings recession as economies slow.

While the market has been pre-occupied by valuation risks in 2022, we expect the risk focus will shift as earnings downgrades gather pace. We maintain a defensive posture in the face of rising earnings risks and continue to selectively look for opportunities in oversold growth names. As more cyclical parts of the market come under earnings pressure, we believe companies with more quality and defensive attributes should outperform in 2023 as their earnings prove more resilient.

Randal Jenneke is Head of Australian Equities and Portfolio Manager at T. Rowe Price.

Important Information

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. Investment involves risks. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of September 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

Australia – Issued by T. Rowe Price Australia Limited (ABN: 13 620 668 895 and AFSL: 503741), Level 28, Governor Phillip Tower, 1 Farrer Place, Suite 50B, Sydney, NSW 2000, Australia.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/ or apart, trademarks of T. Rowe Price Group, Inc.

202212-2639094

This article represents the views only of the author and should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance. You should seek independent financial and tax advice before making any decision based on this information, the views or information expressed in this article.