The effects of emerging technology will continue to be widely felt by authorities in 2023 and beyond.

In December 2022, the Federal Reserve hosted senior representatives from the European Central Bank (ECB) and the Bank of England (BoE) in Washington D.C. The purpose of this interagency engagement is to enhance collaboration in Supervisory Technology (SupTech).

Global engagement is a vital pillar for authorities exploring new and emerging technologies. Looking at the year 2023 and beyond, these are some of the technology related trends we can expect to continue:

SupTech and RegTech

Supervisory Technology (SupTech) solutions have the potential to enable central banks and regulatory institutions, with the ability to automate and streamline complex processes, as well as

improving data, analytical and enforcement capabilities. Subsequently, Regulatory Technology

(RegTech) has the potential to help organisations reduce compliance costs, automate their

reporting, highlight organisational risks and reduce human error.

It is no surprise that these technologies are seeing continued investment at a global level. Statistics from Fintech Global show the resilience of the industry, for instance following a short COVID-19 driven pause in the first three quarters of 2020, RegTech investments bounced back strongly in Q4 2020 almost tripling from Q3 2020 ($1.2bn) to Q4 2020 ($3.1bn).

Investment in RegTech has continued to generate billions of dollars in investment at an international level, year by year. In 2023 it is expected the industry will continue to experience steady growth, which can have a positive impact in Australia as the world’s third largest RegTech hub, behind the US and the UK. The Reserve Bank of Australia have already initiated greater dialog with fellow central banks and regulatory bodies surrounding digital innovation, which will lead to greater global collaboration.

Artificial Intelligence (AI)

The exploration and implementation of Artificial Intelligence (AI) continues to be adopted across

many industries including Financial services, Healthcare, Education and Construction. Within

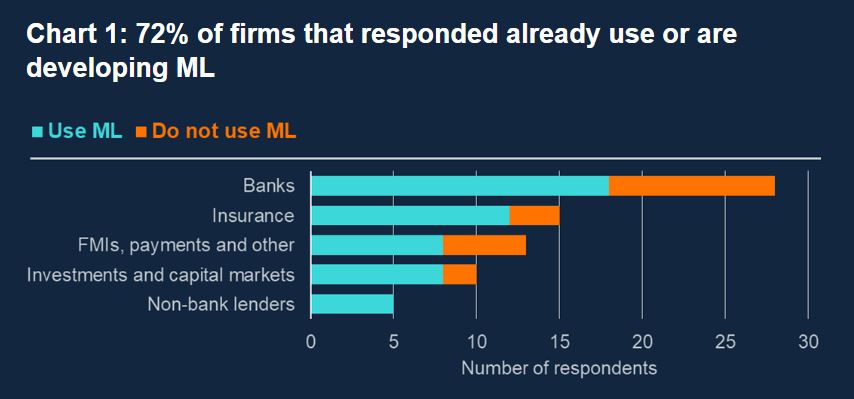

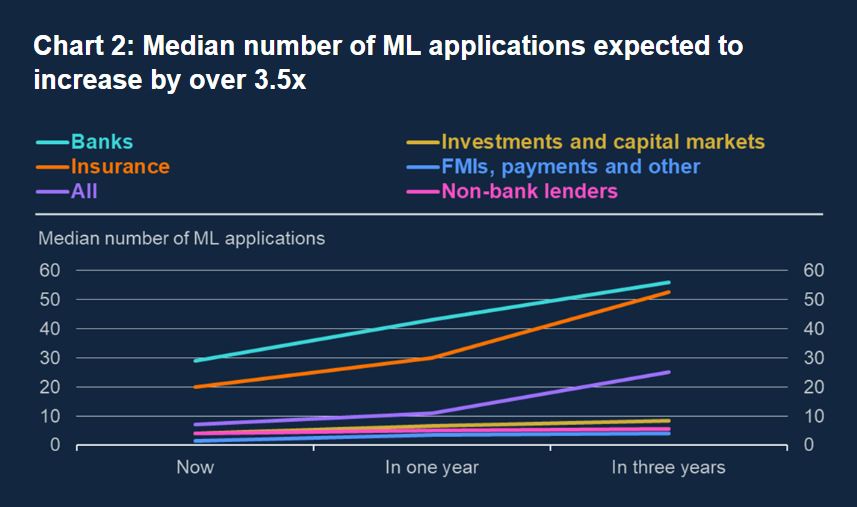

Financial services, the Bank of England (BoE) found that the number of Machine Learning (ML)

applications used in UK financial services continues to increase. Respondents expected this trend to continue, with the median number of ML applications expected to increase more than 3.5 times by 2025.

Machine learning in UK financial services | Bank of England

This trend is not exclusive to financial services in the United Kingdom (UK). Given the growing prominence of AI solutions, the Australian Government made a public strategic vision to establish Australia as a global leader in developing and adopting trusted, secure and responsible AI. Research by AlphaBeta shows Innovations driven by digital technologies, including AI, could add up to $315 billion to the Australian economy by 2028.

In the years ahead, we can expect both public and private sector organisations to continue their

investments in AI; resulting in a steady move from exploration/production to deployment stage as

the value of AI continues to be realised.

Central Bank Digital Currency (CBDC)

A CBDC is issued and regulated by a nation’s monetary authority or central bank such as the Reserve Bank of Australia. CBDC’s are called digital (or electronic) currency as it is not physical money like notes and coins, it is the digital form of a country’s fiat currency.

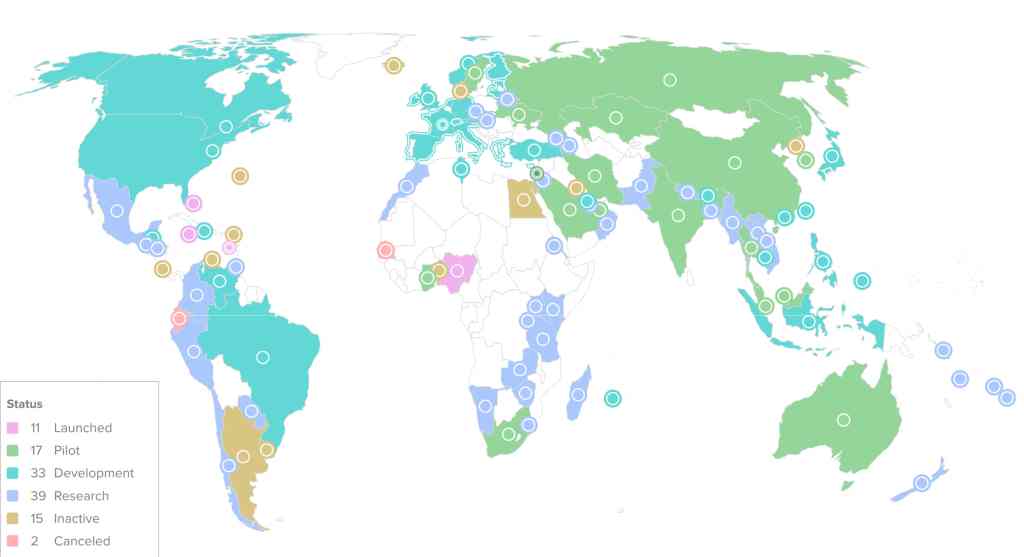

Research from the Atlantic council found that 114 countries, representing over 95 percent of global GDP, are exploring a CBDC. 11 countries have fully launched a digital currency, with Jamaica being the latest nation to launch its CBDC, the JAM-DEX. In 2023, Australia is expected to join over 20 countries in taking significant steps towards piloting a CBDC.

As technology continues to impact the world of payments, coupled with the popularity of

cryptocurrencies and stablecoins, the year 2023 will likely be a year that will provide greater insights into how CBDC’s could potentially support the policy objective of central bank, including safeguarding public trust in money and promoting efficiency, safety, resilience and innovation in

payment systems and financial market infrastructures.

Global status of Central Bank Digital Currencies (CBDC’s)

January 2023

Metaverse

Imagine a virtual world where billions of people work, shop, learn and interact with each other. This idea can seem futuristic, however just as the internet has allowed billions of people to have access to information, knowledge and entertainment on demand, the metaverse has the potential to enrich the lives of many people. For instance, the metaverse has the potential to vastly increase the affordability of a wide range of products, deliver substantial reductions in carbon emissions and provide enhanced virtual employment opportunities.

Governments are already acknowledging the potential benefits of the metaverse, for instance in

October 2022, the Australian Communications and Media Authority (ACMA), which regulates

communications and media, confirmed the metaverse is included in its 2022-23 research program.

Furthermore, the Australian Trade and Investment Commission (Austrade) announced that Australia will host US$100m Metaverse R&D Center, which will be located in Melbourne, Victoria. Once operational this is expected to the one of the largest in the world. For 2023, we can expect this trend in understanding and learning about the metaverse to continue at an international level.

STEM skills for the future

Diversity | Equity | Inclusion

Australians who have studied science, technology, engineering and mathematics (STEM) are driving forward positive change in an ever-growing digital world, which some experts have coined as the Fourth industrial revolution. Access to medical services, education, training and employment increasingly depend on technology, which require investment in digital skills surrounding emerging technologies such as artificial intelligence, machine learning and data science.

The Australian Government projects that by the year 2026, STEM occupations will grow by 12.9%, well above the average of all occupations (7.8%) and more than twice as fast as non-STEM occupations (6.2%). So, what can the Australian authorities learn from other government agencies on promoting STEM careers?

In summer 2022, the Bank of England’s hosted the winners of the Innovation Campaign, who were personally welcomed by Governor Andrew Bailey. The Bank of England launched the initiative to give students across the United Kingdom the opportunity to secure paid jobs within STEM at the British central bank.

The innovation campaign had the following objectives:

▪ Increase female representation in STEM positions as women are underrepresented across

the STEM sector. This was in line with the Centrals Banks public commitment to diversity and

inclusion.

▪ Promote careers in STEM to students across the entire United Kingdom, which include the

countries of England, Scotland, Wales and Northern Ireland.

▪ Encourage unrepresented groups to pursue or consider a career in central banking.

Applications were accepted via popular media platforms such as TikTok, YouTube and Vimeo.

The Bank of England took a digital led approach in working towards the set objectives. The Bank

promoted its campaign via social media channels and followed on to have senior leaders from the organisation engage directly with students across academic institutions.

The Bank removed work experience requirements to the campaign as built-in networks bequeathed by wealthy parents can disadvantage students that did not have facilitated access to work experience at a young age. Applicants had to simply answer one open question related to the Banks mission that required independent research. Applicants could opt to submit their answers via video or a standard presentation.

The achievements of the campaign were astounding as 70%+ of the competition winners were

female, and the Bank received applications across the United Kingdom which supported the

organisations public commitment surrounding gender inclusion.

The achievements of the campaign were highly commended in the Financial Times (FT) Diversity in Finance Awards 2022. Similar campaigns have been launched by various organisations such as the Summer Diversity Intelligence Internship within the intelligence agency MI5.

In summary, the effects of emerging technology will continue to be widely felt by authorities in 2023 and beyond. Innovation requires new ideas and different ways of thinking, which can only be achieved by ensuring diversity and inclusion are at the centre of decision making. From Perth to the Gold Coast, from Darwin to Tasmania, Australians across the country need the opportunities to secure valuable jobs to solve the problems of the future.