A $40,000 computer chip has become one of the hottest commodities in the tech industry. Startups are scrambling to buy up Nvidia’s H100, the graphics processing unit of choice among artificial intelligence companies looking to crunch huge amounts of data.

Now an unlikely new rival has joined the scrum: Tether Group, the crypto company behind the $86.5 billion stablecoin Tether, just spent some $420 million on 10,000 H100 GPUs in an unusual deal that will see it gain a 20% stake in a controversial German-listed bitcoin miner Northern Data who plans to rent the chips to AI startups.

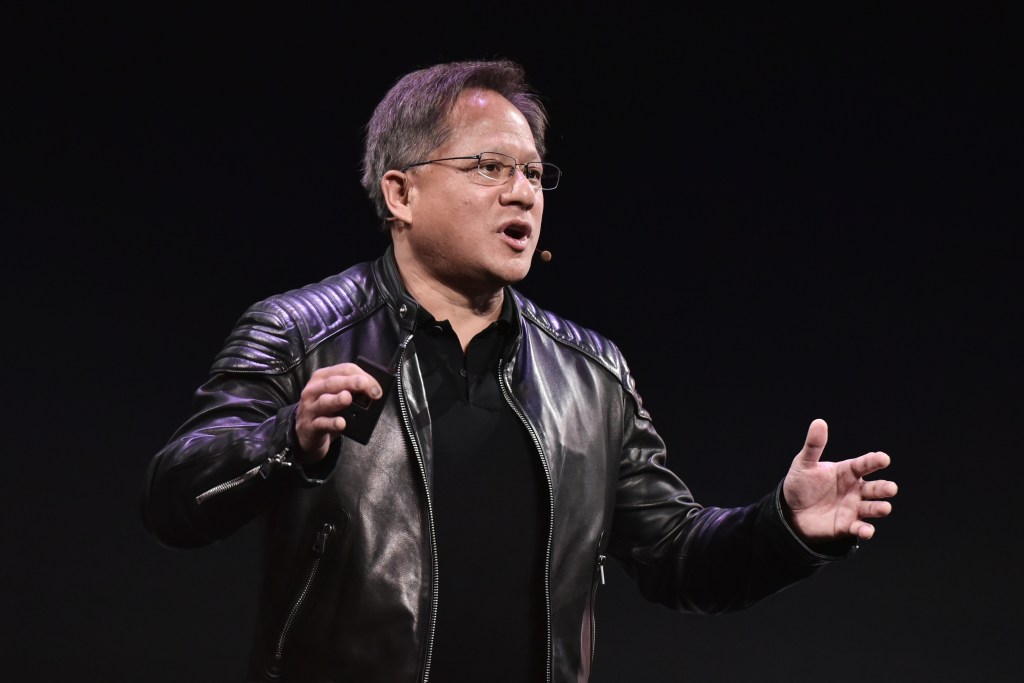

Northern Data isn’t the first bitcoin miner to look to the AI boom for new sources of revenue. “You are seeing a whole crop of new speciality GPU-specialized cloud service providers,” Nvidia CEO Jensen Huang said on an earnings call in August where he name-checked former crypto miner Coreweave. The New Jersey-based startup made the switch early from using the chips to run the calculations used in ethereum mining to powering InflectionAI and Microsoft’s AI projects and raised $2.3 billion in debt in August after sealing a $421 million Series B round earlier this year. Other miners like Hive, Crusoe, and Hut 8 have also converted GPUs now essentially useless for ethereum mining after the cryptocurrency’s September 2022 energy-saving overhaul to renting them by the hour to chip-hungry startups.

The deal could make the Frankfurt-based company the largest cloud GPU operator in Europe outside of cloud computing giants like Amazon, Microsoft Azure, and Oracle, claims Northern Data CEO Aroosh Thillainathan. “It was a great opportunity to have 2% of the hottest GPU allocation available as everyone is running short on GPUs,“ he told Forbes. The Financial Times reported in August that Nvidia was expected to ship a total of 550,000 of H100 chips this year.

Tether’s investment in GPUs, and cloud computing via Northern Data, outstrips even some nations. The Telegraph reported that the British government had set aside a $120 million (£100 million) budget for GPUs, while Saudi Arabia was reported to have bought around 3,000 of Nvidia’s H100.

Tether’s H100 deal is as messy as it is massive. The convoluted transaction will see the company buy the GPUs through Irish shell company Damoon (get it? “To damoon”) in which Northern Data will take a 70% stake in return for shares equivalent to 20% of its ownership. The German company, which has a stock market value of $570 million (€530 million), has an option to acquire the rest of the shell company, but the total cost remains unclear. The deal has not yet closed.

Related

Thillainathan struggled to explain why Tether had purchased the chips instead of Northern Data, the structure of the deal, or how much the stablecoin company would own of his business after the deal. “So we couldn’t go straight through to Nvidia…because everything is selling off really quickly so if you are not moving fast you are not getting the chips,” he said. “At the time everyone who had money could just take the allocations of these chips.”

Northern Data has a track record of using shell companies — often linked to its shareholders, to buy bitcoin mining gear and GPUs. In August 2021, it bought around 223,000 older generation AMD and Nvidia GPUs in a $430 million (€365 million) cash and shares deal from a company owned by controversial crypto fund block.one. A month later, it spent an additional $468 million (€400 million) on a bitcoin miner also owned by block.one, German billionaire Christian Angermeyer’s investment group, and Northern Data’s founder Marco Beckmann. Block.one, Angermeyer and Beckmann are all major shareholders in Northern Data.

Northern Data missed its EBITDA forecast for 2021 by 10.4% with $102 million (€89.6 million) reported in its 2021 annual report after also missing its 2020 financial guidance. Its 2022 accounts have not yet been published but in April it forecast revenues of $1 million a month from its new cloud division.

Germany’s security regulator filed a criminal complaint against executives at Northern Data over claims it had misstated revenues in October 2021, Bloomberg reported. The company said the case was now closed and no further action was taken.

Thillainathan became Northern Data’sCEO after the bitcoin miner he founded, Whinstone, merged with its German-listed rival in 2019. Northern Data’s U.S. operations were later sold to American blockchain miner Riot Blockchain for $651 million in April 2021. Riot sued Northern Data in September 2022 claiming it failed to disclose $84 million liabilities owed to a third party; Whinstone clients Japanese crypto miners GMO have also sued for breach of contract, and SBI for fraud over its operation of a Texas datacenter.

Northern Data’s deal with Tether Group is something of a departure for the crypto company. Its Tether stablecoin is meant to be backed 1:1 with U.S. dollars for the $86.4 billion currently invested. But the company was fined $21 million by the CFTC in 2021 for falsely claiming that it was professionally audited and fully-backed in fiat currency.

Tether publishes quarterly “attestations” via accounting firm BDO Italia that provide a loose breakdown of its assets. Its latest states that U.S. Treasury Bills now account for 64.5 % ($55.8 billion) of its assets after shrinking its holding of corporate bonds to just $115.4 million down from $8.4 billion in July 2022. The move followed the New York’s Attorney General allegation Tether was behind loans to highly indebted Chinese companies and failed crypto platform Celsius.

Tether Group, which is a sister company to crypto exchange Bitfinex, also holds over $2.3 billion in “other investments” that are listed with no other disclosure. In the last year, it made its first public investments in a volcano-powered bitcoin mining operation in El Salvador, and its own bitcoin mine in Uruguay, and a Georgian payments startup Citypay.io.

Tether’s cash holdings have plunged 98% to just $90.8 million since December despite the group claiming to have generated over $1 billion profit in the last quarter alone. The company announced a $115 million share buyback in July “to further strengthen the shareholder group”.

Tether Group has not yet responded to a request for comment.

This post originally appeared on Forbes.com