Leo Koguan, a Singapore-based billionaire who claims to be Tesla’s biggest retail investor and has previously called himself an Elon Musk “fanboy,” voted against restoring Musk’s $50 billion compensation package ahead of the company’s annual meeting after it was eliminated by a Delaware judge early this year.

Leo Koguan, left, and Tesla CEO Elon Musk.

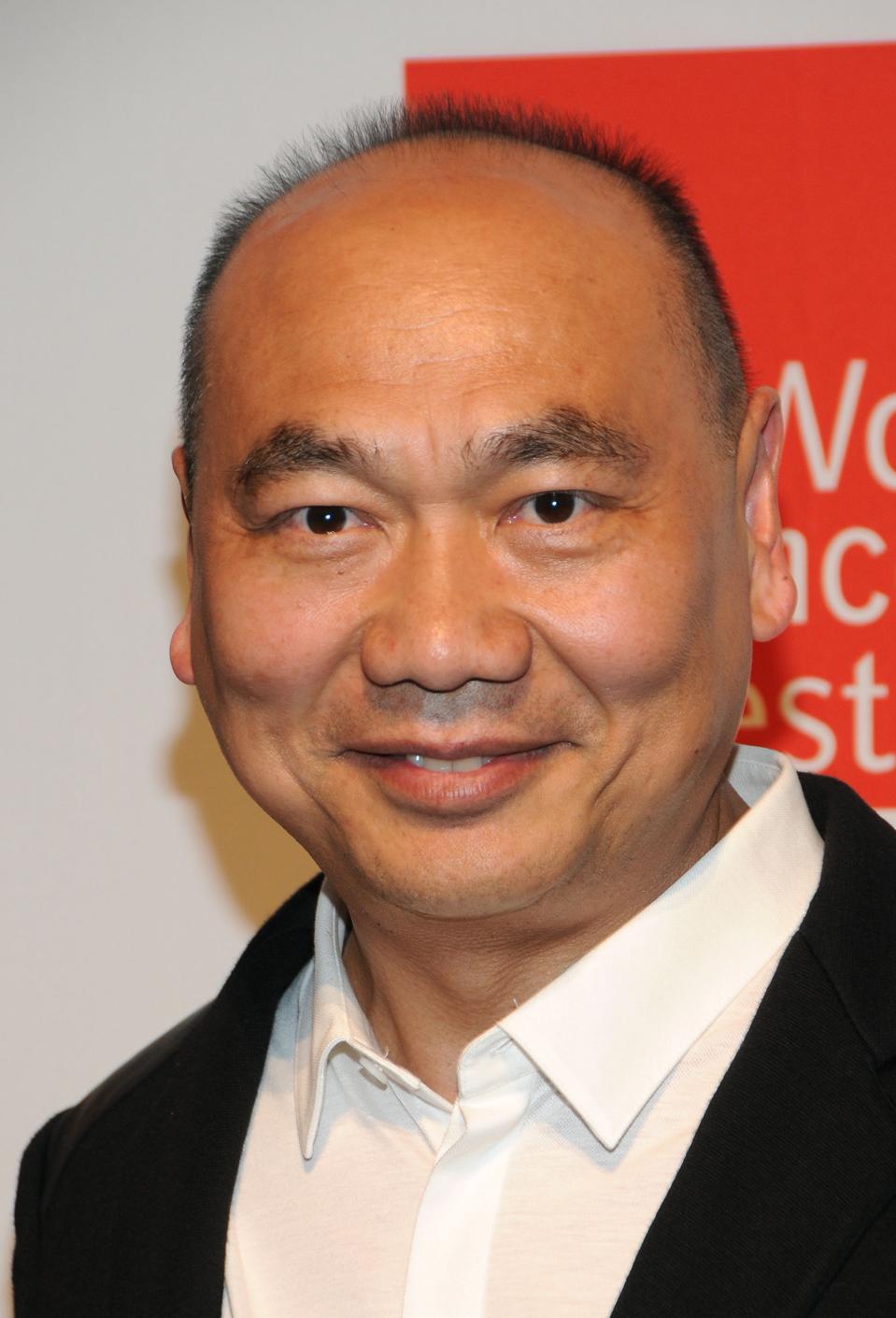

Leo Koguan

Koguan, with a net worth Forbes estimates to be $5.9 billion and founder of IT provider SHI International, told Forbes he also voted all his 27.7 million shares of Tesla against incorporating the company in Texas, new board terms for Musk, his brother Kimbal and James Murdoch and retaining PricewaterhouseCoopers as the company’s accounting firm. Shareholders are voting ahead of Tesla’s annual meeting on June 13.

Koguan said votes are based on the belief that Musk has “abandoned Tesla for his other companies,” he told Forbes in an email. “He is temporarily back to claim his $55 billion ransom money. I am broken-hearted.”

It’s a dramatic about-face for Koguan, who told Forbes in 2021 he was “Elon’s fanboy,” and said, “I would say he is the only person I really respect on Earth.”

Tesla’s shares are down about 30% this year as its EV sales slow and Musk pushes through the biggest job cuts in the Austin-based company’s history, affecting more than 14,000 employees worldwide. At the same time, he’s also prioritized focusing Tesla’s business on selling robotaxi rides despite the fact that it appears to be far behind companies such as Alphabet’s Waymo in autonomous driving technology.

Leo KoGuan

WireImage

“Lately, I’ve discovered Tesla has one shareholder, a one-person (board of directors) and one tyrant CEO. I tried to reach out, but he doesn’t listen to anyone. Only to his own loud voices in his head,” Koguan said. “The priority is he should work and do his job as CEO of Tesla. He already received 13% of Tesla. More than enough. He’s funded all his ventures from the Tesla ATM machine.”

The carmaker didn’t respond to a request for comment.

Tesla Chair Robyn Denholm has been trying to rally shareholders to support restoring Musk’s 2018 compensation package and moving its incorporation from Delaware to Texas. Restoring Musk’s stock-based package “means he will continue to be driven to innovate and drive growth at Tesla because the value of his shares will depend on it!” she said in its recent proxy filing with the SEC.

“He already received 13% of Tesla. More than enough. He’s funded all his ventures from the Tesla ATM machine.”

Musk’s pay package was originally greenlit in 2018 when Tesla’s market capitalization stood below $60 billion and included financial and market cap targets. It fully vested in late 2022 after Tesla hit key performance milestones that included boosting market cap to $100 billion and reaching annual revenue of more than $20 billion, which were attained rapidly. Theoretically, that allowed Musk to boost his stake from 13% to 22%.

Tesla’s market value is $555 billion as of Wednesday’s close, implying the value of the pay package is about $50 billion after accounting for the cost of exercising the options.

A Tesla Cybertruck electric vehicle sits parked next to a garbage truck in Los Angeles, California, on May 15, 2024.

PATRICK T. FALLON/AFP via Getty Images

In her January ruling, Delaware judge Kathaleen McCormick determined that Musk and his co-defendants, Tesla and some of its board members, failed to prove the process underlying the award of “the largest potential compensation opportunity ever observed in public markets” was fair because of conflicts of interest and Musk’s “control” over the board.

Her decision resulted in Musk losing his title as the world’s wealthiest person. Forbes currently ranks him second, with a net worth of $195 billion.

Born in Indonesia, Koguan received a Master’s from Columbia and law degree from New York Law School. In 1989 he married Harvard MBA Thai Lee; later that year, the couple paid less than $1 million for a software reseller that became SHI International, a global IT provider. Lee is its president and CEO while Koguan, a U.S. citizen who moved back to Asia years ago, serves as board chair.

Tesla’s shares fell 2% to $173.99 in Nasdaq trading on Wednesday.