The Federal Court has delivered its decision on Finder.com’s crypto subsidiary, after ASIC sued the consumer finance company back in 2022.

Key Takeaways

- The Federal Court has dismissed ASIC’s proceedings against Finder Wallet, in a judgment handed down on March 14.

- The case was the first to test the legal definition of debenture in an Australian court in relation to cryptocurrency.

- ASIC sued Finder in 2022 alleging that its Earn product provided unlicensed financial services.

- The finding comes amid a recent surge in cryptocurrency prices, with Bitcoin reaching an all-time high on Thursday at AUD$110, 231.

What happened?

The Federal Court has dismissed the Australian Securities and Investments Commission’s (ASIC) proceedings against Finder Wallet, in a landmark judgment handed down on March 14.

It found that Finder Earn was compliant with financial services law. It was the first time in Australia that the legal definition of debenture has been tested in relation to cryptocurrency.

“We are delighted with this outcome, which confirms that Finder was compliant with our regulatory obligations in offering Finder Earn to our customers,” Finder’s Global CEO and Co-Founder, Frank Restuccia says.

“We understand and respect the importance of good regulation to protect consumers and we engaged openly and proactively with ASIC from the outset.

“We are proud to have developed Finder Earn as a way for Australians to earn yield on their cryptocurrency investments in what was an ultra-low interest rate environment.”

What does this mean for Finder?

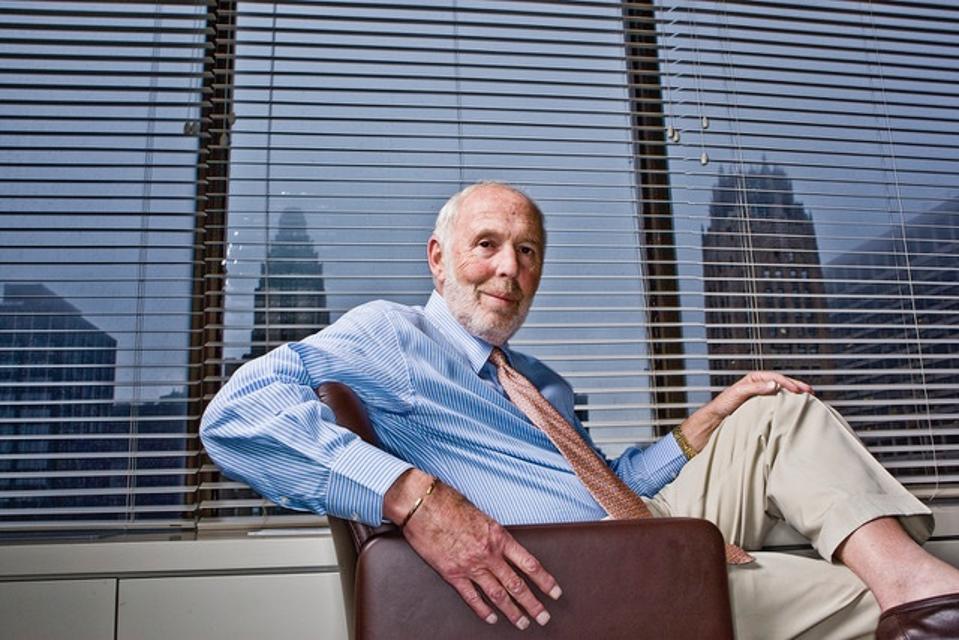

Finder had already chosen to sunset Finder Earn in 2022, so there are no changes to its product suite as a result. However, co-founder and executive chair, Fred Schebesta, says it has a more symbolic meaning for innovation in general.

“Innovation is core to our DNA at Finder and we’ll continue to innovate for the benefit of our customers,” Schebesta said.

“Innovation always moves faster than regulation, and this case is a great example.”

Fred Schebesta

“It highlights the need for more open communication between innovators and regulators, to navigate emerging sectors by ensuring a collaborative approach to both progress and compliance.”

What was Finder Earn?

Finder launched its Earn product in November 2021, with a view to help users earn interest on a crypto-based loan. The product, which operated under Finder’s Wallet subsidiary, functioned by allowing members to transfer funds into their Wallet, and then transfer and convert that into stablecoins to earn a return (4.01% per annum) on their capital. Interest was to be paid daily and investment through Finder Earn was capped at $10,000.

But a year later, the company sunset its product and returned all funds to members, citing interest rate rises.

“To put it simply, we have determined that Earn is no longer serving our members as it did in a low-rate environment,” Finder’s statement read at the time.

“Finder Earn was designed to give our members a competitive return on their cryptocurrency. As interest rates have increased and the macroeconomic environment has changed, it’s now possible to get a more attractive return elsewhere.”

All customer capital was returned, as well as over 500,000 in TAUD – valued at $500,000 in combined yield earned.

Why did ASIC sue Finder?

A month after Finder closed Earn, ASIC commenced civil proceedings in the Federal Court against Finder Wallet, for allegedly providing unlicensed financial services, breaching product disclosure requirements and failing to comply with design and distribution obligations (DDO) in relation to its crypto-asset related product Finder Earn.

“Our message to industry is clear – just because an offer involves a crypto-asset related product does not guarantee it will fall outside the current regulatory regime,” ASIC deputy chair, Sarah Court, said at the time.

ASIC argued that the product was essentially a debenture, or an unsecured loan, and therefore Finder Wallet required an Australian financial services license (AFSL) to offer the product.

Wider crackdown

It follows the corporate watchdog’s takedown of Block Earner earlier this year, when the Federal Court found the fintech engaged in unlicensed financial services conduct when offering its crypto-backed Earner product.

Similarly, Block Earner offered consumers a fixed yield return from different crypto assets. It was one of the first decisions on the application of the financial services law to crypto-backed products.

“This important decision provides some clarity as to when crypto-backed products should be considered financial products which require licencing under the law,” ASIC’s Court said.

“Crypto-assets are risky, inherently volatile and complex. ASIC remains concerned that consumers do not fully appreciate the risks associated with products involving crypto-assets and today’s decision is an important step forward to ensuring there are appropriate protections for consumers.

“Firms offering products with crypto-assets must carefully consider whether their offerings are financial products under the existing regime. And, if they are, ensure that they are appropriately licenced and authorised before distributing them.”

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.