The accountants certified that Tingo Group had $462 million in the bank. The SEC says it was just $50. Short sellers are rejoicing.

Hindenburg Research, known for sniffing out corporate scams, took aim in June at an obscure Nigeria-based outfit named Tingo Group. Hindenburg rolled out a report with a title that left little to the imagination: “Fake Farmers, Phones, and Financials – The Nigerian Empire That Isn’t.” But Hindenburg didn’t just call Tingo a clear-cut scam. The short-seller also threw a spotlight on the auditor who green-lit Tingo’s financials, challenging its competence, and perhaps its willingness, to see the truth.

“The issues in Tingo’s financials are glaring enough that we’d expect they could have been spotted by any semi-conscious finance undergrad with severe vision loss,” Hindenburg wrote. “These issues were apparently not glaring enough for the company’s auditor, however.”

The auditor in question was Deloitte, the behemoth Big Four accounting firm with annual revenue of $65 billion through a global network that stretches from Amsterdam to Zhengzhou.

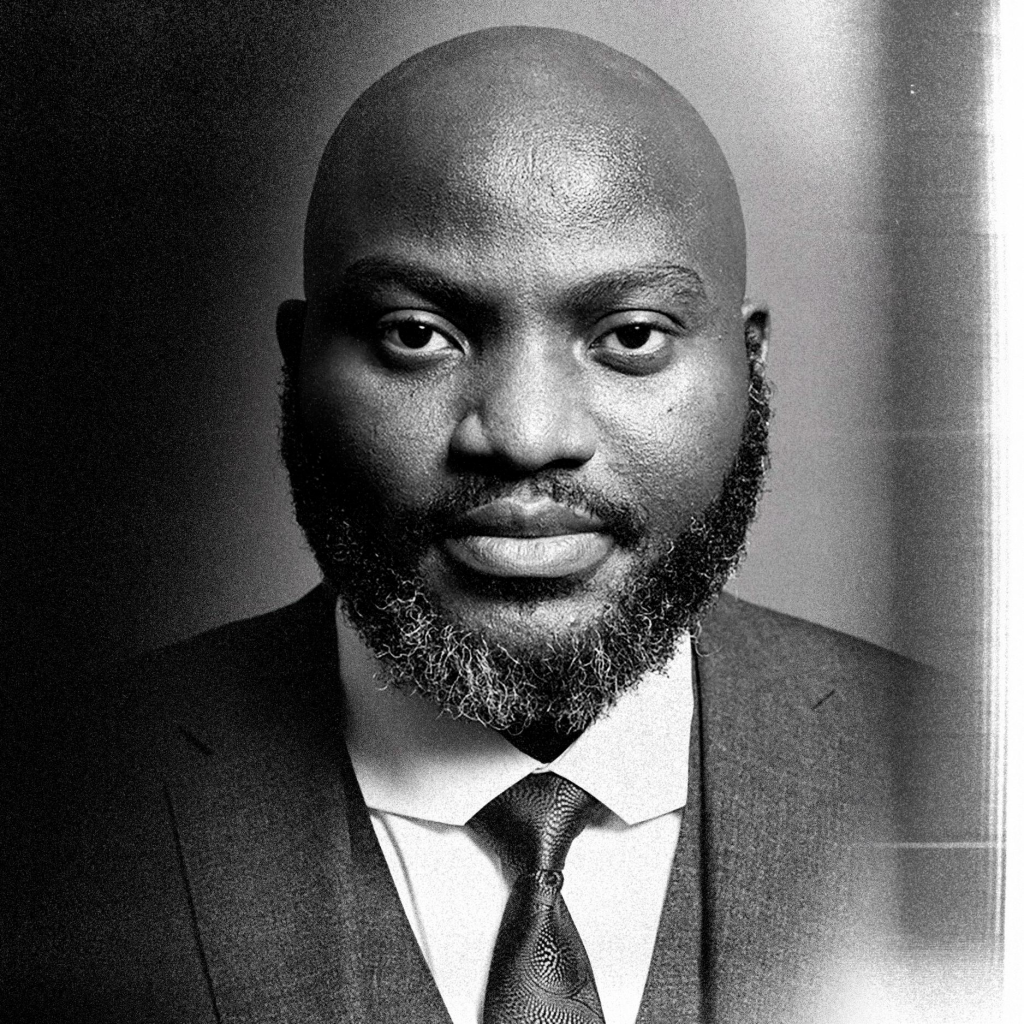

In November, after Tingo’s stock had already fallen about 80% wiping out more than $700 million in market value, the Tingo saga took a sharp turn. The Securities and Exchange Commission stepped into the fray, slamming the brakes on Tingo’s stock trading. In December, the SEC slapped Tingo CEO Dozy Mmobuosi with charges of “massive fraud.” Things only got worse this month, when the regulator tacked criminal securities fraud charges onto the bill of consequences. According to the SEC’s civil complaint, Tingo, whose audited books boasted a $462 million treasure chest socked away in Nigerian banks, actually had only $50.

“The issues in Tingo’s financials are glaring enough that we’d expect they could have been spotted by any semi-conscious finance undergrad with severe vision loss.”

Hindenburg Research

Auditors are supposed to be the financial world’s most trusted sources of information, armed with calculators and sworn to sniff out fiscal misconduct. A flip through history tells a different story: too often auditors, who are paid fees by the clients they are examining, fail to dig below the surface, and essentially rubber stamp seemingly obvious inconsistencies and problems in financial statements. Worse, some would even say they’re part of the problem, either by not being sharp enough or by looking the other way at the outrageous claims of their clients.

“As outsiders, we’d like to think that auditors are looking for fraud, but fraud detection isn’t one of their mandates,” Matthias Breuer, an accounting professor at Columbia University’s Graduate School of Business, told Forbes. “Auditors don’t go into their work with an adversarial mindset. Their mandate isn’t to be a whistleblower, and because of that it’s usually insiders and short-sellers that uncover these issues.”

Need a few examples? Ernst & Young, after nodding approval at Wirecard’s books, could only watch as the German firm imploded over a $2.08 billion vanishing act. Remember Arthur Andersen? Once an auditing giant, it crumbled under the weight of its involvement in Enron’s notorious collapse. And let’s not forget the infamous 1MDB saga, which roped in the trifecta of Ernst & Young, KPMG and Deloitte, as billions earmarked for development in Malaysia were splurged on lavish parties, opulent real estate and a cache of Monets and Van Goghs. That one cost Deloitte $80 million when it settled with the country in 2021, a hefty sum, but nothing compared to the $150 million it paid to the U.S. government in 2018 for its role in auditing failed mortgage lender Taylor, Bean & Whitaker.

Routine Failures

Auditing failures, despite the cost in money and reputation to the auditors, are practically routine. A 2020 study by the Association of Certified Fraud Examiners showed that auditors uncover less than 4% of frauds. That’s a dismal track record, for sure, but there are a couple of reasons why it actually makes a bit of sense.

First off, auditing is pretty much a by-the-book routine, says Columbia’s Breuer, which provides an opinion on whether companies’ financial statements are prepared in accordance with accounting standards, and whether companies maintain sound financial controls. It’s a straightforward, no-frills affair, and that’s just how the auditing world prefers it.

“What’s happened in the audit industry is that they’ve lobbied to do check-the-box exercises to limit their legal liability,” he told Forbes. “They’re just trying to satisfy the auditing standards, they’re not necessarily trying to attest to the real economic reality of the business.”

Secondly, despite their expertise, auditors are often outfoxed by companies willing to lie to them. Firms can concoct a tangle of fictitious documents, hide critical information, or devise schemes so elaborate they’re nearly impossible to decipher without a whistleblower’s help.

A 2020 study by the Association of Certified Fraud Examiners showed that auditors uncover less than 4% of frauds

But Deloitte’s Tingo case isn’t one you can just brush off with the usual excuses. It stands out because Hindenburg, along with a crew of independent internet detectives, managed to cut through the smoke and mirrors without any insider help.

Hindenburg’s exposé on Tingo, echoed by the SEC allegations, hints at a more unsettling issue. Auditors get their paychecks from the companies they’re supposed to keep honest. (Tingo paid $1.6 million in audit fees in 2022.) This setup can lead to auditors playing it safe, avoiding the hard-hitting questions that could upset a paying customer.

How did Deloitte, the auditing heavyweight watching over Tingo’s books, miss a scam that Hindenburg, an outsider, called out as painfully obvious?

Maybe the answer lies in who was holding Deloitte’s magnifying glass. Tingo, balancing its act between Nigeria and the Nasdaq in New York, wasn’t checked by Deloitte’s team in Nigeria. Instead, it was Deloitte’s Israeli branch, Brightman Almagor Zohar & Co., that certified the books. That’s a head-scratcher, especially since, as Hindenburg highlighted, Tingo didn’t really do much business in Israel. Why not use auditors who operate where the action is? It almost seems like a move to keep the auditors just far enough away so they wouldn’t stumble upon anything they shouldn’t.

In response to questions from Forbes, a spokesperson for Deloitte Israel declined to comment, saying “professional standards prohibit our commenting on client matters.” Tingo didn’t respond to a request for comment.

Astonishing Gap

The discrepancy between what Deloitte certified — $461.7 million — and Tingo’s actual cash balance of $50 was “astonishing,” Ed Ketz, an accounting professor at Penn State’s Smeal College of Business, told Forbes in an email. “The cash account is the most important balance sheet account and one of the easiest to audit,” he said. “One wonders how Deloitte Israel could have missed that.”

Verifying a company’s cash is a foundational part of the auditing process and one of the boxes auditors are supposed to check, said Stephani Mason, an accounting professor at the Driehaus College of Business at DePaul University.

“In the process of an audit there are some pretty basic things that should be done,” Mason told Forbes. “One of those is confirming cash balances by sending a form that goes directly to the client’s bank. The standard essentially says that the auditor has to verify the bank account independently.”

You’d think the obvious move would be to tighten standards on checking companies’ bank balance claims. But just cranking up the standards might not stop the deceit. In fact, academics argue that squeezing the fraud balloon doesn’t deflate it, it just pushes the hot air somewhere else.

A 2021 paper from folks at the University of Minnesota and Indiana University, titled “Everlasting Fraud,” lays it out. Fraud, they say, shifts shapes, constantly morphing as crafty companies stay one step ahead of regulators in a relentless game of cat and mouse. While regulators are busy learning from old scams like Enron’s off-the-books creativity, companies like Wirecard, and allegedly Tingo, are out there boldly cooking up fake bank balances. It’s a gutsy move, a bet that it’s so obvious that auditors might figure no company would even try it, and not even check.

Not Their Job

“If the auditors were really after fraud, I think they could find it,” Columbia’s Breuer told Forbes. “But that’s not the nature of their business. It’s not great for an auditor’s career to claim fraud with a client. They’re very cautious to not be too alarmist too often. That’s why they may look the other way or never get started on these things.”

An added impediment to accountability is the way auditing firms are set up, with offices in different countries acting more like independent franchises than branches of a central tree. That means Deloitte’s main office may never have to pay for this ridiculous oversight. Each office is its own island, so the fallout tends to stay local.

Where you might spot some consequences for auditors, however, is in the stock market. In the short term, Deloitte’s other client companies could feel a bit of a chill. There’s precedent for this. Consider what happened with PricewaterhouseCoopers’ clients after the “OscarGate” fiasco.

Rewind to 2017. PwC had the seemingly simple job of tallying votes for the Academy Awards. In the world of auditing tasks, this was so easy it was a bit dull, but with a hefty upside of a mountain of free publicity. Still, PwC screwed the pooch. Its accountants handed over the wrong envelope for the best picture award (La La Land instead of Moonlight) and what should have been a seamlessly glamorous affair turned into a comedy of errors, swapping the auditor’s PR triumph for a dose of public embarrassment.

Researchers Lawrence Abbott and William Buslepp decided to investigate how PwC’s blunder — witnessed by millions of TV viewers around the world — might ripple out to its clients. They dug into the data and, lo and behold, it was PwC’s roster of clients who ended up feeling the pinch.

“We find that abnormal returns in the days following the error are significantly lower for PwC clients,” the researchers wrote, “suggesting an impaired reputation for audit quality.”

Basically, for a brief spell — the study pegs it at a month — the market was giving PwC’s clients the side-eye. Investors discounted the companies’ financial statements, all because they started wondering if they could really trust what was in them.

“In my expectation, this isn’t likely to affect the Deloitte U.S. firm,” DePaul’s Mason told Forbes. “The SEC can fine Deloitte Israel, disgorge profits, or even give them the death knell, so to speak, by barring them from auditing companies in this jurisdiction. But what I’m interested in is what other companies have they done work for? If I was an investor long on a client Deloitte Israel audited, I’d be very concerned.”

This article was first published on forbes.com and all figures are in USD.