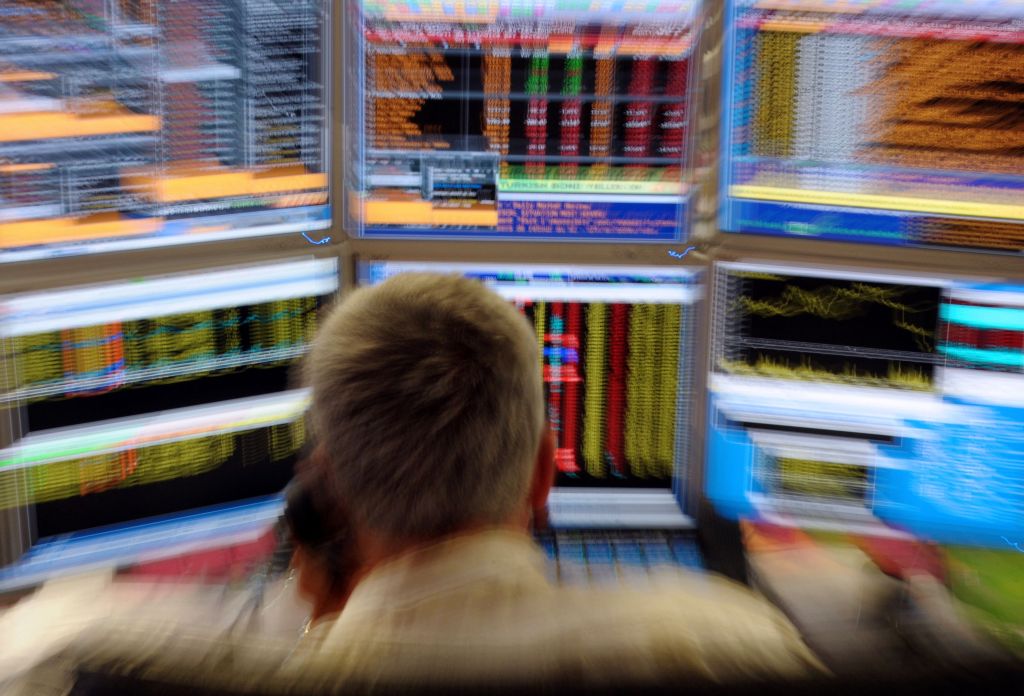

Find out what the experts think are the potential investing trends for the next 12 months.

Inflation, interest rates, recession, supply chain disruption and geo-political upheaval were the biggest impacts on markets, the economy and investment throughout 2022. So what might 2023 bring?

Bill Evans, Chief Economist at Westpac says: “We see 2023 as a year when inflation falls; economies stall; central banks continue to tighten decisively in the first half; are on hold by mid-year; and remain resolute through the remainder of the year.

“That will lay the platform for an extension of the falling inflation in 2024 and the conditions for sustained policy easing. Compared to our central scenario, markets are too dovish on the RBA [Reserve Bank of Australia] in the first half of 2023; too ambitious around the timing of rate cuts both by the RBA and FOMC later in 2023; and too cautious around the extent of rate cuts in 2024.”

That said, 2022 was tough in so many aspects, and Matt Reynolds, Investment Director at Capital Group (Australia) says 2022 was arguably, “one of the more extraordinary investment periods of recent times and in 2023 and beyond, we believe there is a new reality taking shape for global markets”.

“While digital-first companies are not going away, it’s likely that investors will start to place greater emphasis on producers of physical assets.”

– Matt Reynolds, Investment Director at Capital Group (Australia)

He cautions investors to be wary of highly leveraged companies with interest going higher. “Money isn’t free anymore, so a larger slice of earnings will go towards servicing debt. And companies able to fund their own growth will remain particularly attractive.

“While digital-first companies are not going away, it’s likely that investors will start to place greater emphasis on producers of physical assets. Moreover, broader market leadership may emerge among a variety of companies, which should provide a positive backdrop for stock pickers over indexers.”

The globalisation of supply chains is another multi-decade trend that is adjusting course. For a generation, companies moved manufacturing overseas to cut costs, but the limitations of placing efficiency over resilience are now clear, says Reynolds.

“Growing geopolitical tensions and pandemic-induced disruptions have prompted companies to create supply chain redundancies so that a single breakdown won’t derail an entire operation. Such capital investments may help inspire a renaissance among smartly managed industrial companies.”

Reasons for optimism

Paul Taylor, Head of Investments Australia at Fidelity International thinks that despite the challenging environment, there are reasons for some optimism.

“China may start to open and official interest rates may not reach predicted levels (even if they do, they are still low by historical standards). However, we are learning to live with Covid. Although inflation is higher than usual, that can work in favour of equity markets if it remains reasonable.

“The businesses that tend to do well during inflationary periods are those linked to commodities (both soft and hard), as well as essential businesses that have pricing power.”

Taylor says the opposite is true for companies with no pricing power or offering fixed-price contracts.

“Businesses such as contractors and building companies with fixed-price contracts and rising input costs see their margins significantly squeezed through inflationary periods.”

While sectors such as essentials (supermarkets, healthcare), materials, insurance and financials are likely to perform well in 2023, a more challenging environment should provide investors with an opportunity to invest in inexpensive, high-quality businesses with long-term structural growth, Taylor says.

Will recession hit?

Jonathan Webster, director & co-founder of funds manager Jameson TTB predicts that Australia will avoid a recession.

“Rapidly rising inflation and international turmoil means the outlook is murky but with the RBA cash rate (3.1%) now above the upper inflation band target (3.0%) we should start to see contraction.”

He notes that Australia has avoided several global recessions before, giving the examples of the Asian financial crisis in 1997, the “tech-wreck” in 2001, and the Global Financial Crisis in 2008, and he believes the nation can do it again “with good judgement from our RBA regulators about when to follow the US on rates, and when not to”.

Fixed income

Global investment manager Invesco says in its 2023 investment outlook, “we remain underweight equity due to the possibility of further weakness in growth in favour of fixed income, which now offers attractive 5-6% yields in investment grade or 8-9% yields in risky credits.

“Within fixed income, we are underweight risky credit as a contractionary regime has historically led to underperformance in high yield relative to higher-quality debt with similar duration. While high yield spreads have widened again to about 5.5%, average recessionary regimes have seen spreads widen to 7-8% (except for the Global Financial Crisis, when spreads rose to 20%); hence we remain underweight and wait for further widening before increasing exposure.”

Emerging markets

Individual emerging market countries and sectors are expected to display divergent paths in 2023, as has proven to be the case in 2022, says Martin Currie Portfolio Manager Alastair Reynolds.

“This will be most obvious in terms of monetary policy with Brazil, for example, being about 12 months ahead of developed countries in its interest rate cycle. Brazil should soon be exiting from peak interest rates while other countries may see continued rate rises into 2023.

“India looks set to deliver the strongest growth amongst the large economies, fuelled by strong domestic demand. Technology-focused economies such as Korea and Taiwan are expected to see earnings declines as technology supply chains are entering a period of de-stocking.”

Reynolds says that despite a wide variance in individual performance, share prices have responded rationally to what have been significant changes in investment conditions at both country and sector levels.

“We will enter 2023 with emerging market stocks trading on close to 10x their price-earnings (P/E) ratios – well below the average of the past decade. This reflects expectations of slowing global growth as the effects of higher interest rates start to weigh on consumption. Corporate earnings growth is likely to be lower overall in 2023, following a strong recovery from the Covid pandemic in 2021 and 2022, as the commodity boom seen this year is unlikely to be repeated.”

Daniel Graña, Portfolio Manager, Emerging Market Equity at Janus Henderson Investors says there needs to be resolution on the trajectory of Federal Reserve interest rates and the resulting impact of the dollar.

“We have seen some tentative signs that US inflation perhaps is peaking, but until the market gets a good sense on the grasp on where interest rates are going to top, it’s going to be hard for the riskiest of asset classes to get comfortable that it’s time to rally.”

– Daniel Graña, Portfolio Manager, Emerging Market Equity at Janus Henderson Investors

He says another consideration will be China policy pivots with its zero-Covid policy and the property market constraining China growth and the China equity markets throughout 2022. Given that China is roughly a third of the EM benchmark, this has consequently been a constraint on the emerging market equity index.

Leading European asset manager Amundi says in its 2023 Outlook that China’s economy could unveil positive surprises in 2023, depending on the outcome of the two main challenges: housing market and Covid-19 policy.

“On the former, we see stabilisation thanks to looser policy, on the latter a gradual relaxation of restrictions. Geopolitical pressure and an intensifying US-China confrontation are key risks.”

Impact investing

Martin Currie’s Head of Stewardship, Sustainability and Impact David Sheasby says impact investing has become significantly more prominent as investors focus on the intentionality of their investments and seek to generate positive impact alongside financial returns. “We expect that investors will look at the role of public equites in generating impact as a key focus for 2023,” he says.

Climate will remain a key issue next year with an increased sense of urgency for action as the window for limiting climate change rapidly closes. Human rights, social issues and inequality will have increased prominence as stewardship topics, with the emergence of regulation in this space, he says.

Group chief investment officer at Amundi Vincent Mortier says long-term ESG themes have been reinforced by the Covid-19 crisis and the Russia-Ukraine war. Amundi’s 2023 Investment Outlook says investors should play the energy transition and food security themes, accelerate the net-zero path, and look for companies that can improve their ESG profile through active engagement.

Female traders look to CFDs

Over the past three years in Australia, CMC Markets has seen a 13% increase in female ALPHA Contracts – For-Difference (CFD) traders. In the same time period, total male ALPHA traders decreased 7% suggesting the rise of the female investor is significant in the once typically male-dominated sector.

Female ALPHA traders (high-volume CFD traders), are identifying opportunities and trading short-term price movements across markets like the ASX 200 index, foreign exchange pairs including AUD/USD, and commodities such as silver, CMC data shows.

“These assets tend to be a popular starting point for traders because they’re familiar. Information and commentary are readily available across not just the media but also our CMC Markets Analysts,” says CMC Markets Senior Sales Trader, Kurt Mayell.

CFDs trade on the price movement of underlying financial assets (such as forex and commodities), and fluctuations in price can be significant, so it pays to stay across market movements, Mayell says.

Cryptocurrencies

Australians remain confused about cryptocurrencies and whether to invest of not. High profile company fails have shaken the market, which traded as high as US$64,000 in November 2021, but is currently sitting around US$21,000 a Bitcoin.

While a survey by global cryptocurrency app Luno found 71% of respondents still don’t understand the market or how to invest in it, almost half the number of people surveyed said they were considering adding it to their portfolio.

“One of the benefits of cryptocurrency is that anyone can invest. It was designed to be decentralised, meaning everyone has the power to access, trade and invest in coins. However, like any financial system, it’s imperative that potential investors do their research before entering the market,” said James Logan, Country Manager, Australia, Luno.

This article represents the views only of the interviewees and should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance. You should seek independent financial and tax advice before making any decision based on this information, the views or information expressed in this article.