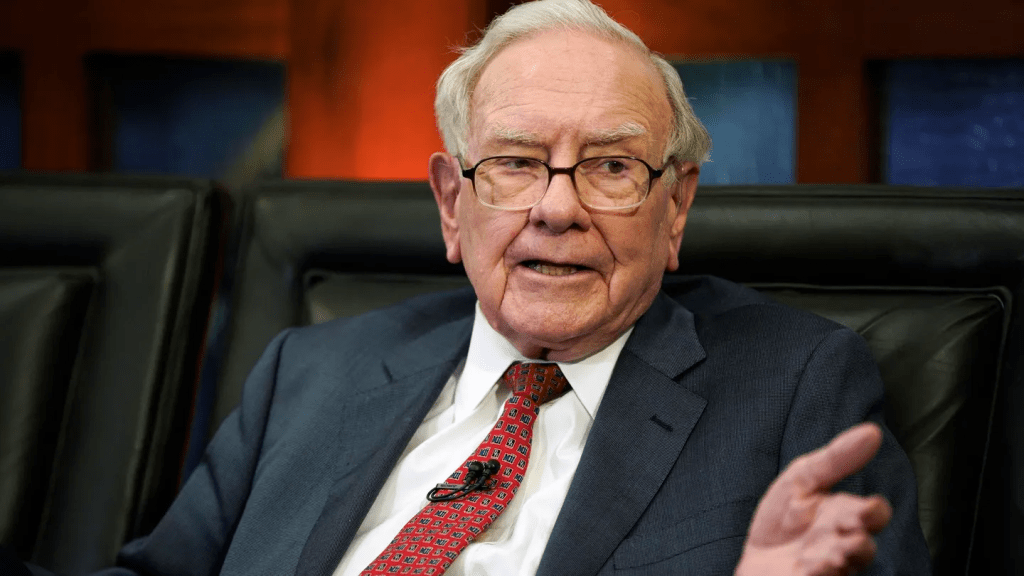

At Berkshire Hathaway’s first annual shareholders meeting since the death of former vice chairman Charlie Munger, CEO Warren Buffett projected the company’s record-setting cash pile would exceed $200 billion this year and spoke highly of Apple, despite the company’s Saturday earnings report showing it sold off a significant portion of its shares in the tech giant.

Key facts

- Berkshire’s cash pile: After Berkshire’s earning report showed the conglomerate’s cash pile had risen to a record $189 billion, Buffett said it’s a “fair assumption” that its cash and treasuries would exceed $200 billion at the end of this quarter, adding the company would “love to spend it” but wouldn’t unless it was on “something that has very little risk and could make us a lot of money.”

- Apple: Buffett said Berkshire’s opinion on the virtue of Apple stock had not changed despite Saturday’s news Berkshire sold a reported 13% of its stock in the tech giant this quarter, saying it was “extremely likely” Apple would remain Berkshire’s biggest investment by the end of the year “unless something really dramatic happens.”

- Taxes: He suggested selling Apple stock now could help Berkshire pay larger tax rates in the future, as he believes the federal government will soon increase corporate taxes, which he would not oppose, saying ”It doesn’t bother me in the least to write that check,” adding that “with all America has done for all of you, it shouldn’t bother you that we do it.”

- Artificial intelligence: Buffett sounded the alarm on advancements in artificial intelligence, recalling how he was startled by an AI-generated video of himself created by a scammer, saying artificial intelligence could make scamming the “growth industry of all time” and that while acknowledging it’s “enormously important,” he compared its potential to do harm to nuclear weapons, arguing: “we may wish we’d never seen that genie or it may do wonderful things.”

- Foreign investments: Buffett said that he doesn’t anticipate Berkshire making many significant investments outside the U.S., except the conglomerate was willing to invest in Canada, and was in the midst of “looking at one thing now.”

- Succession: Buffett, 93, teased his eventual succession, quipping that investors “don’t have too long to wait,” adding “I feel fine, but I know a little bit about actuarial tables” (he has already named Greg Abel, Berkshire’s vice chairman of non-insurance operations, as his eventual successor).

What did Berkshire’s earnings look like this quarter?

Berkshire on Saturday reported profits of $12.7 billion—a fraction of the $35.5 billion it reported in the first quarter of last year—but this drop was driven almost exclusively by a sharp drop in the value of Berkshire’s stock portfolio. The conglomerate’s operating earnings, or the profits generated directly by the businesses that it owns, rose 39%, from $8.065 billion in the first quarter of 2023 to $11.2 billion this year. Warren Buffett has long argued operating profits are a more valuable metric than net profits.

Berkshire benefited from a strong performance from its insurance businesses, which include Geico, and its operating earnings from insurance underwriting rose to $2.6 billion from $911 million last year.

Key background

Berkshire Hathaway’s annual shareholders meeting in Omaha is a hotly anticipated financial event each year, with investors eagerly awaiting to hear Buffett’s advice and predictions on finances and the economy. It’s often referred to as “Woodstock for capitalists.”

But this year’s event took on a different tenor, as it was the first time Buffett took the stage to speak with shareholders without Charlie Munger, his longtime friend and business partner who died last year.

Tangent

This year’s event was filled with tributes to Munger, including a video featuring Munger’s and Buffett’s many interviews and pop culture appearances—like on the sitcom “the Office.”

While answering questions from investors, Buffett turned to Abel and mistakenly called him “Charlie,” drawing laughter and cheer from the crowd.

“I’d actually checked myself a couple times already,” Buffett said. “I’ll slip again.”

This article was first published on forbes.com and all figures are in USD.