Finding out who owns Australia’s biggest companies isn’t easy. Data journalist Juliette O’Brien sleuthed dozens of sources to find the answer.

This article was featured in Issue 8 of Forbes Australia. Tap here to secure your copy.

Sometimes, the simplest questions are the hardest to answer. Who owns it? That’s what we asked about the biggest companies in Australia.

Beneficial ownership is often obscured behind institutional and boutique investment funds, nominees, trusts and private companies.

But Australia’s Corporations Act and ASX listing rules require some disclosures.

These include the 20 biggest shareholders (which accounted for an average of 76% of total stock among the companies analysed) and notification if a beneficiary controls more than five per cent of voting stock.

We started by compiling the biggest public companies in Australia by market cap in each sector.

Then, we combed through more than 80 annual reports, ASIC searches, ASX announcements, proxy statements to the US Securities and Exchange Commission (SEC) (in cases where the company had dual listing), as well as news archives.

Institutional investors, such as HSBC, J.P. Morgan and Blackrock, were ubiquitous.

In several cases, especially among banks and resources, it was impossible to find out who any of the beneficial owners were.

But the real beneficial holders we did find delivered fascinating insights into the rich and powerful people behind corporate Australia.

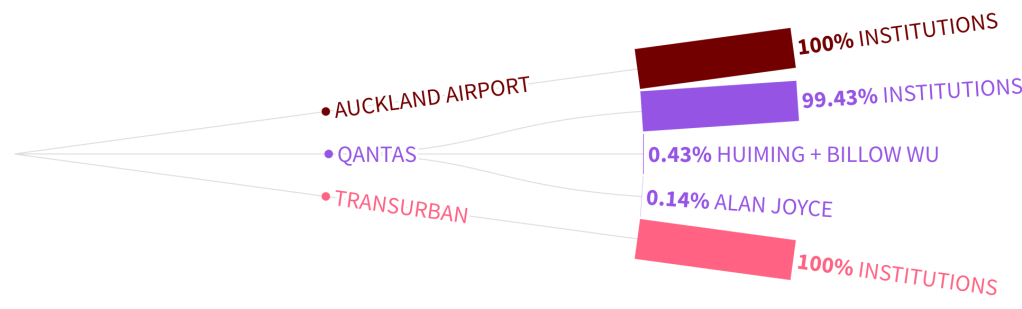

Over 15 years as CEO of Qantas, Alan Joyce AC became one of the largest individual shareholders of the $8.93 billion company. He currently owns 0.14%.

Westfield Corporation, founded in 1959 by Sir Frank Lowy AC and John Saunders AO and acquired by European multinational Unibail-Rodamco-Westfield in 2017, is owned today by French billionaire Xavier Niel as its largest shareholder.

He has 16.2% of the $11.62 billion company.

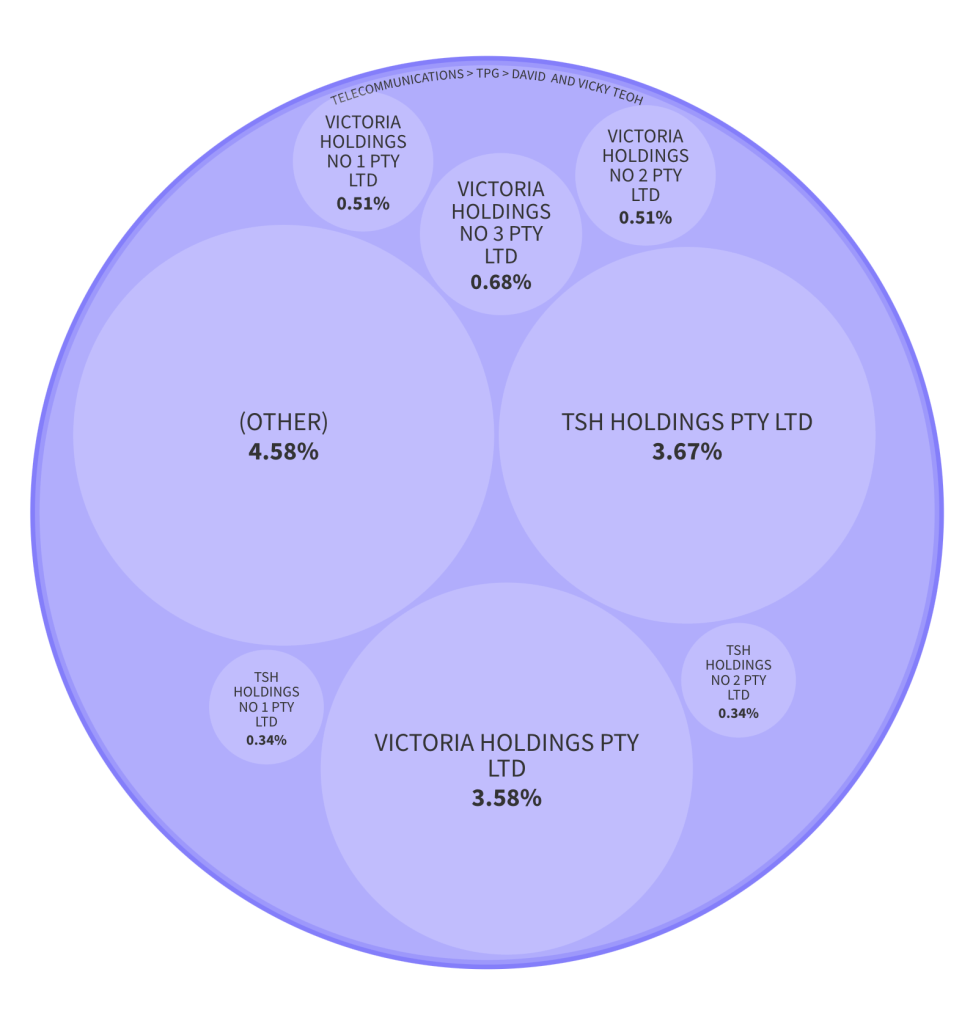

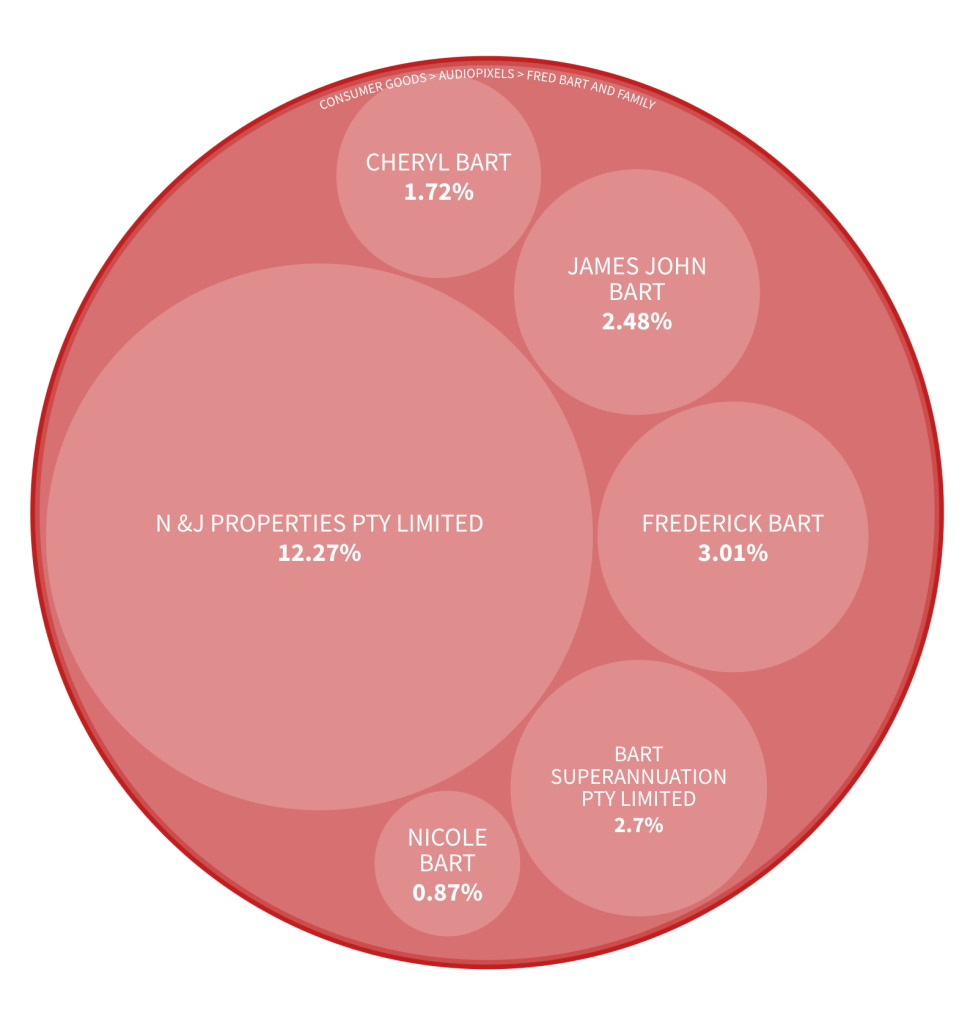

Often, the full extent of an individual’s or family’s control over a company is masked by a web of private companies and disparate shareholders (see bubble charts at the bottom of article).

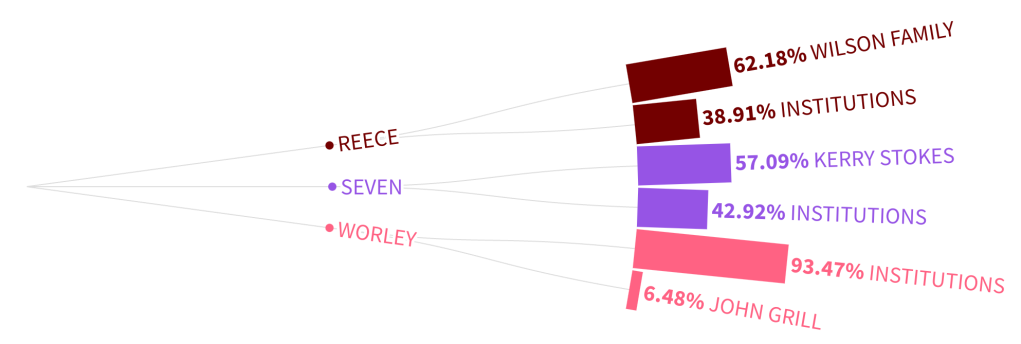

The majority of Reece, a bathroom and plumbing products supplier with a market cap of $11.87 billion, is owned by John, Leslie and Bruce Wilson. We identified 12 different registered shareholders where the Wilson family are beneficial owners.

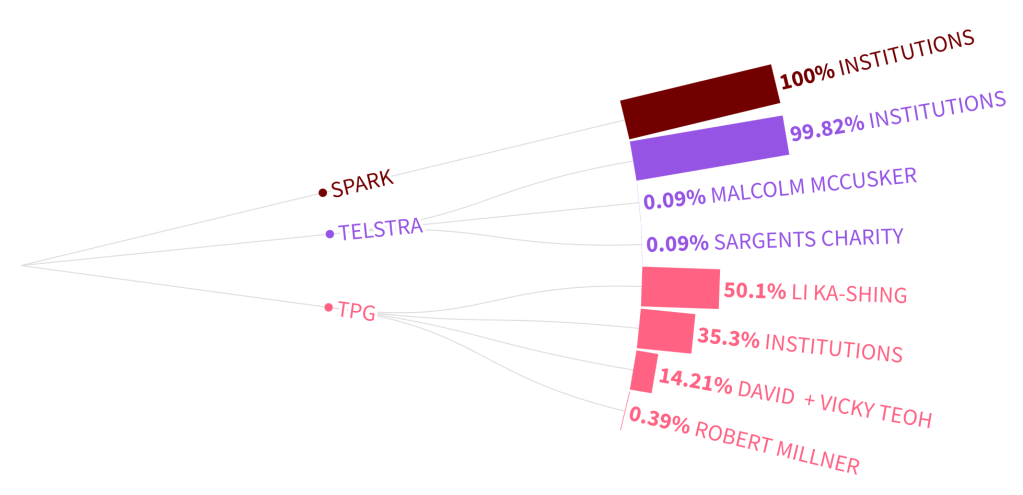

David and Vicky Teoh own 14.21% of telecommunications giant TPG through at least seven different companies.

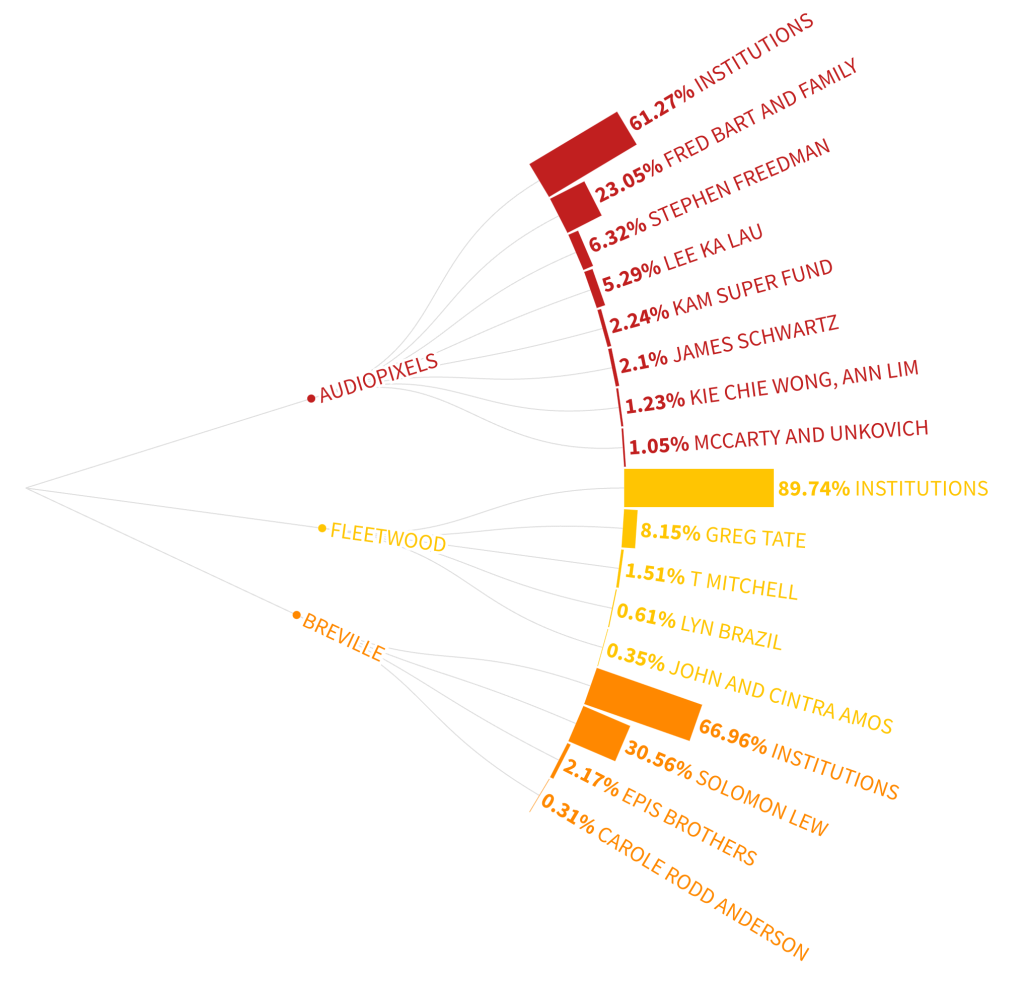

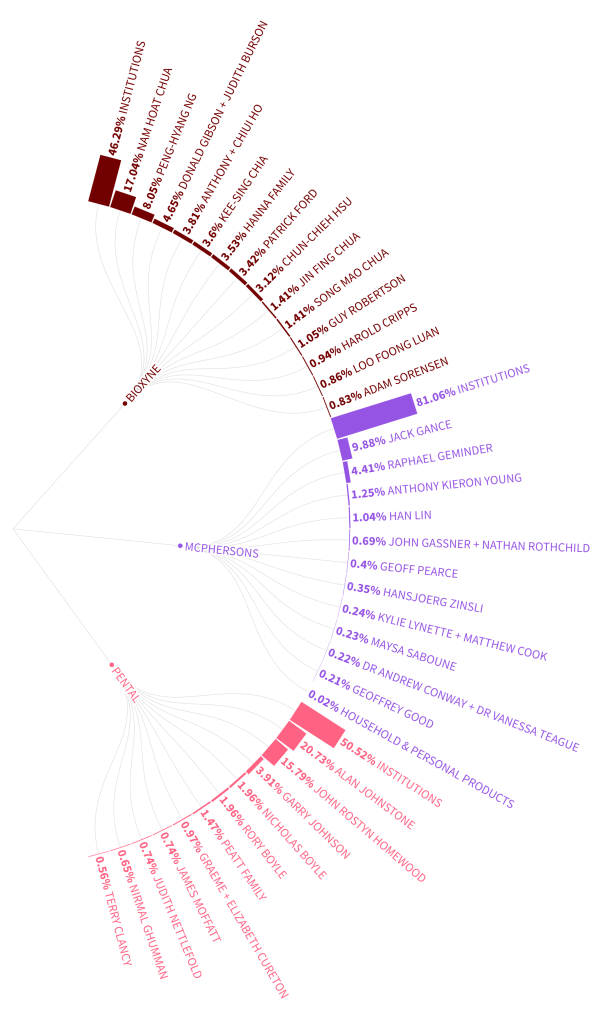

The sectors where institutional investors play a smaller role in Australia are Tech Hardware and Personal Products. The largest companies in these sectors have smaller market caps and are more likely to be owned and controlled by insiders.

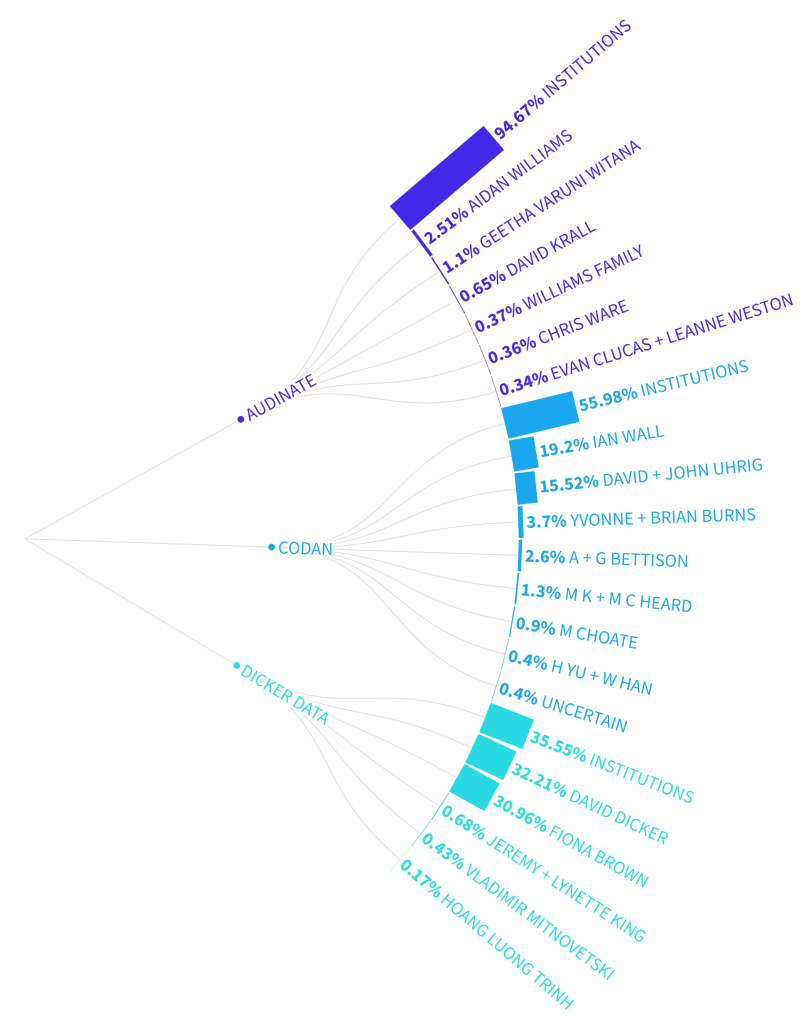

More than 60 per cent of Dicker Data, a wholesale distributor of computer hardware, software and cloud products worth $1.99 billion, is owned by its namesake, David Dicker, and his ex-wife, Fiona Brown.

It’s worth noting that things can move quickly when it comes to buying and selling stocks. The data here is primarily based on the most recent published annual reports.

In the case of Bioxyne, a consumer health products company worth $25 million, the 21/22 annual report said CEO Nam Hoat Chua held 17.04% of the stock; however, in June this year, it was reported that Chua was diluted to 6.13%.

Who owns Australia? Any answer is a snapshot in time.

But while much of the picture is murky, the most powerful beneficial owners are clear.

Companies analysed

| Sector | Company | Market Cap (billions) | % of total owned by top 20 shareholders |

| Banks | ANZ | $76.94 | 58.84% |

| Banks | CBA | $167.44 | 50.37% |

| Banks | NAB | $90.93 | 59.28% |

| Capital Goods | Reece | $11.87 | 89.79% |

| Capital Goods | Seven | $10.63 | 91.33% |

| Capital Goods | Worley | $8.83 | 88.88% |

| Consumer Durables | Audiopixels | $3.22 | 62.52% |

| Consumer Durables | Breville | $0.25 | 88.61% |

| Consumer Durables | Fleetwood | $0.16 | 76.58% |

| Consumer Staples | Coles | $20.68 | 63.91% |

| Consumer Staples | Endeavour | $8.97 | 61.70% |

| Consumer Staples | Woolworths | $43.37 | 70.01% |

| Equity Real Estate | Goodman | $41.86 | 89.99% |

| Equity Real Estate | Scentre | $13.39 | 90.78% |

| Equity Real Estate | Unibail-Rodamco-Westfield | $11.62 | * |

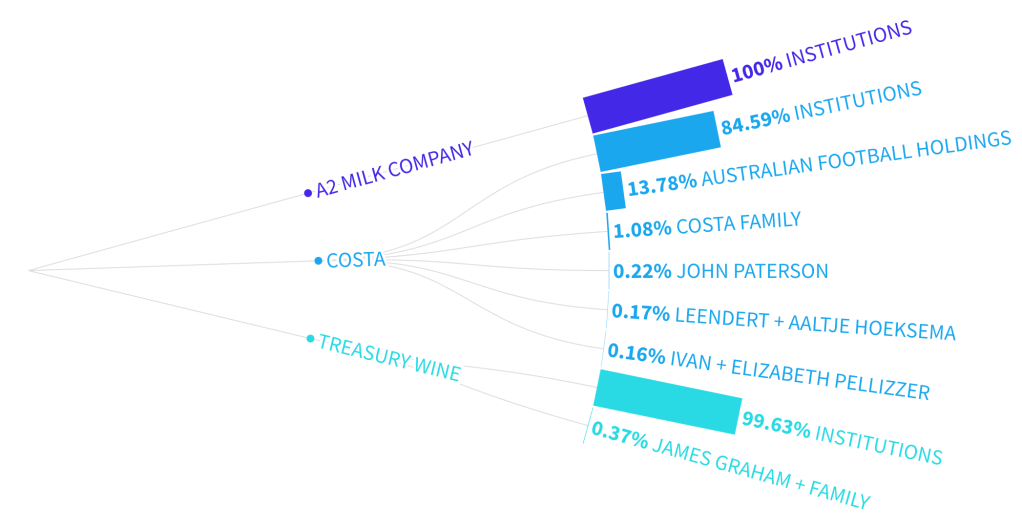

| Food + Bev | A2 Milk Company | $2.89 | 61.69% |

| Food + Bev | Costa | $1.46 | 72.34% |

| Food + Bev | Treasury Wine | $7.97 | 83.61% |

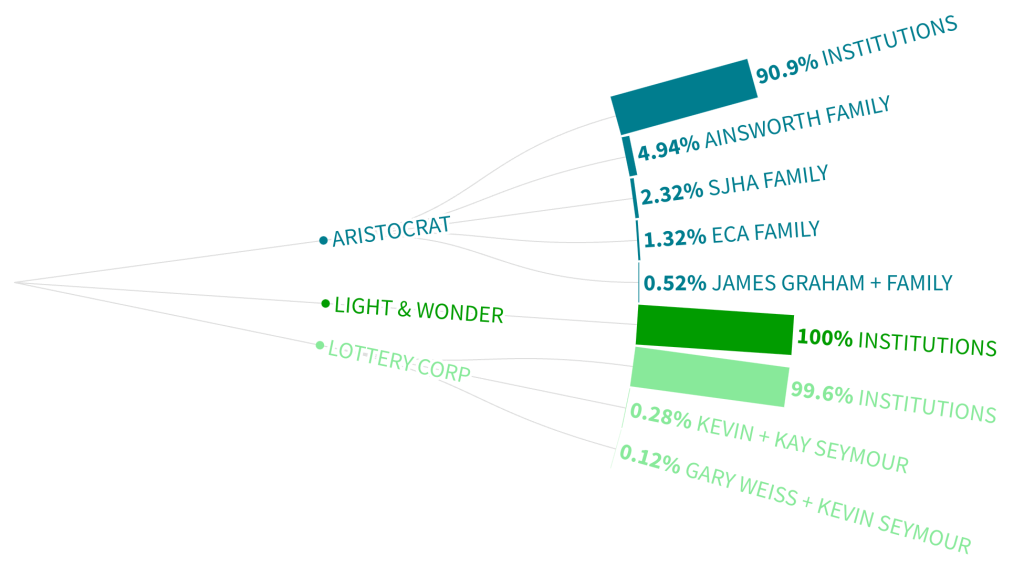

| Gambling | Aristocrat | $25.50 | 91.97% |

| Gambling | Light & Wonder | $10.62 | * |

| Gambling | Lottery Corp | $10.24 | 75.66% |

| Hardware | Audinate | $1.10 | 65.34% |

| Hardware | Codan | $1.99 | 70.60% |

| Hardware | Dicker Data | $1.99 | 77.42% |

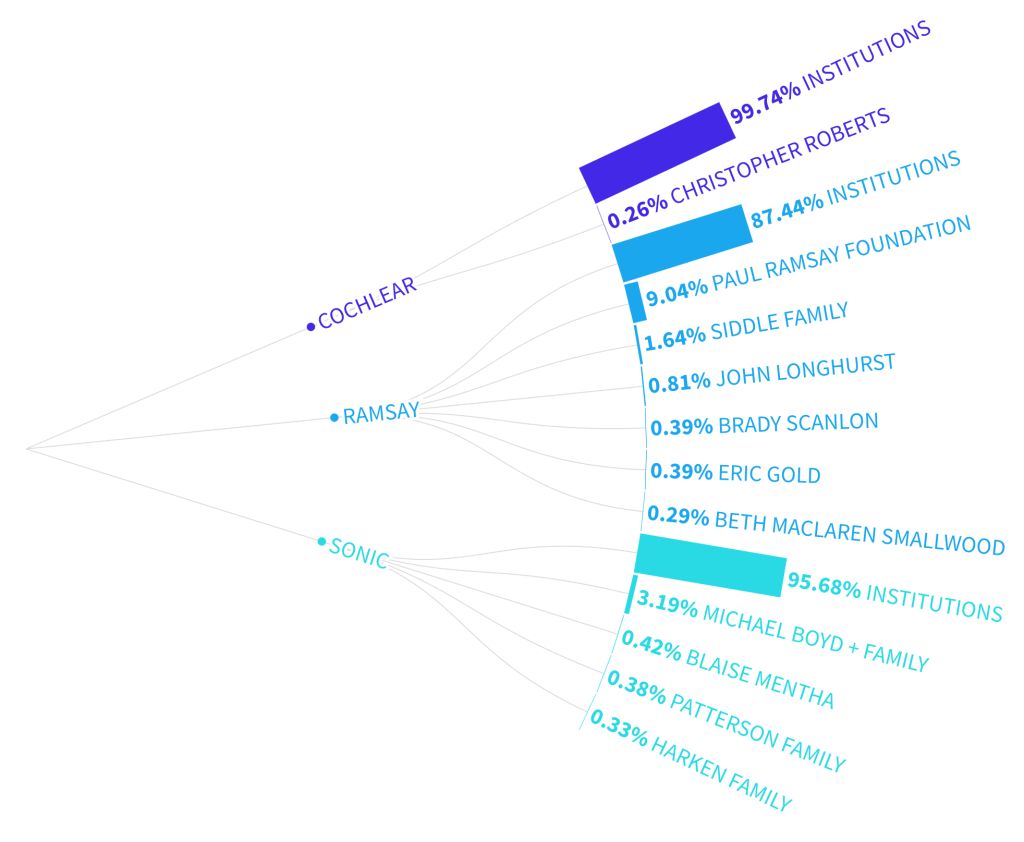

| Healthcare* | Cochlear | $16.22 | 79.71% |

| Healthcare* | Ramsay | $11.63 | 75.59% |

| Healthcare* | Sonic | $14.01 | 71.61% |

| Personal Products | Bioxyne | $0.02 | 73.48% |

| Personal Products | McPhersons | $0.06 | 57.59% |

| Personal Products | Pental | $0.07 | 62.21% |

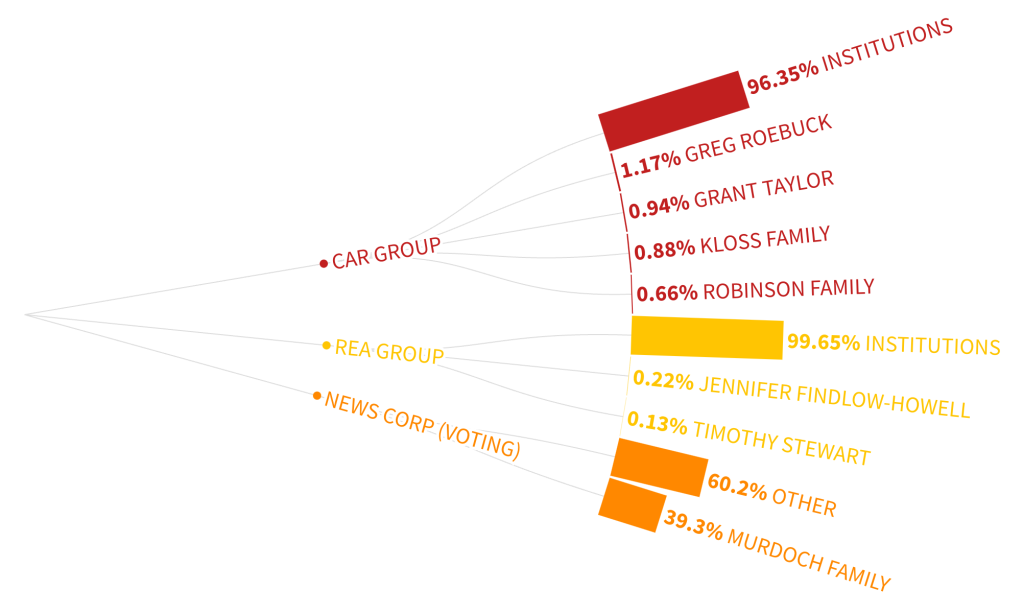

| Media | Car Group | $10.80 | 80.21% |

| Media | News Corp | $19.67 | * |

| Media | REA Group | $20.53 | 93.71% |

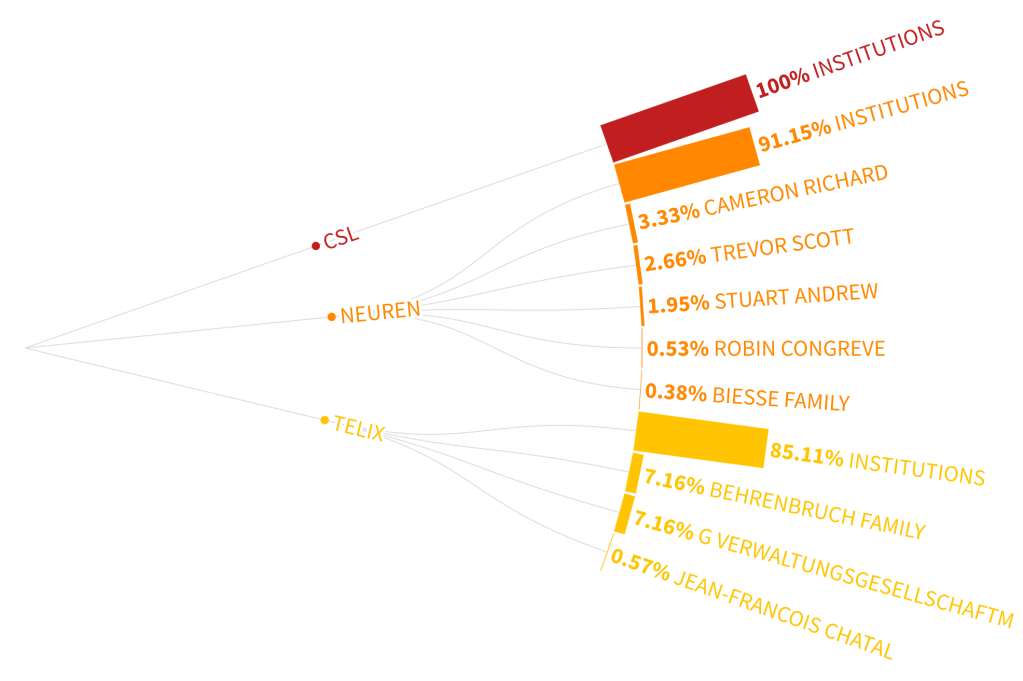

| Pharmaceuticals | CSL | $117.87 | 70.83% |

| Pharmaceuticals | Neuren | $1.58 | 55.72% |

| Pharmaceuticals | Telix | $2.99 | 69.63% |

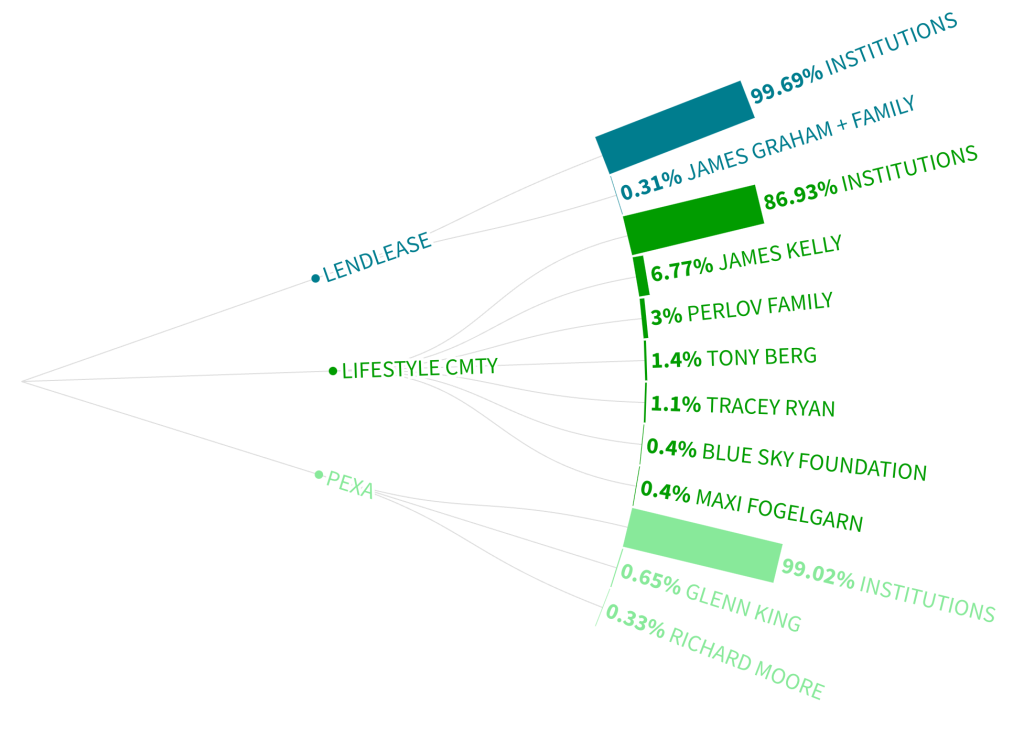

| Real Estate | Lendlease | $4.40 | 77.39% |

| Real Estate | Lifestyle Communities | $1.76 | 86.30% |

| Real Estate | Pexa | $2.05 | 81.16% |

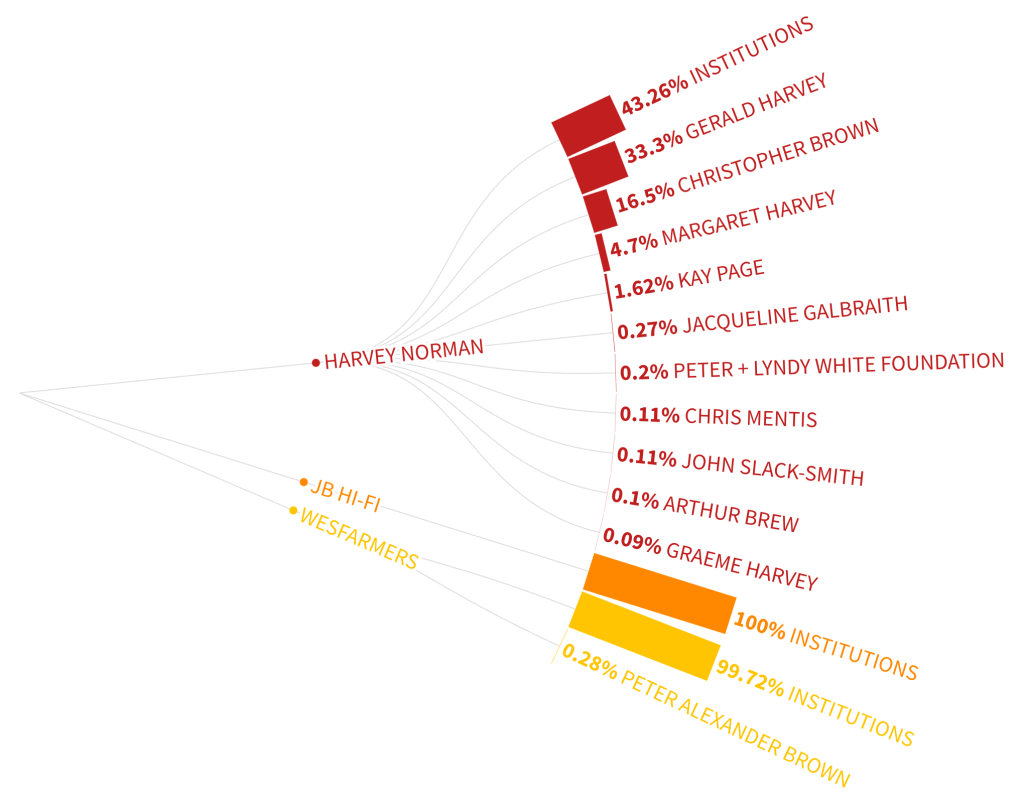

| Retail | Harvey Norman | $4.60 | 53.55% |

| Retail | JB HI-FI | $5.09 | 82.83% |

| Retail | Wesfarmers | $59.36 | 75.10% |

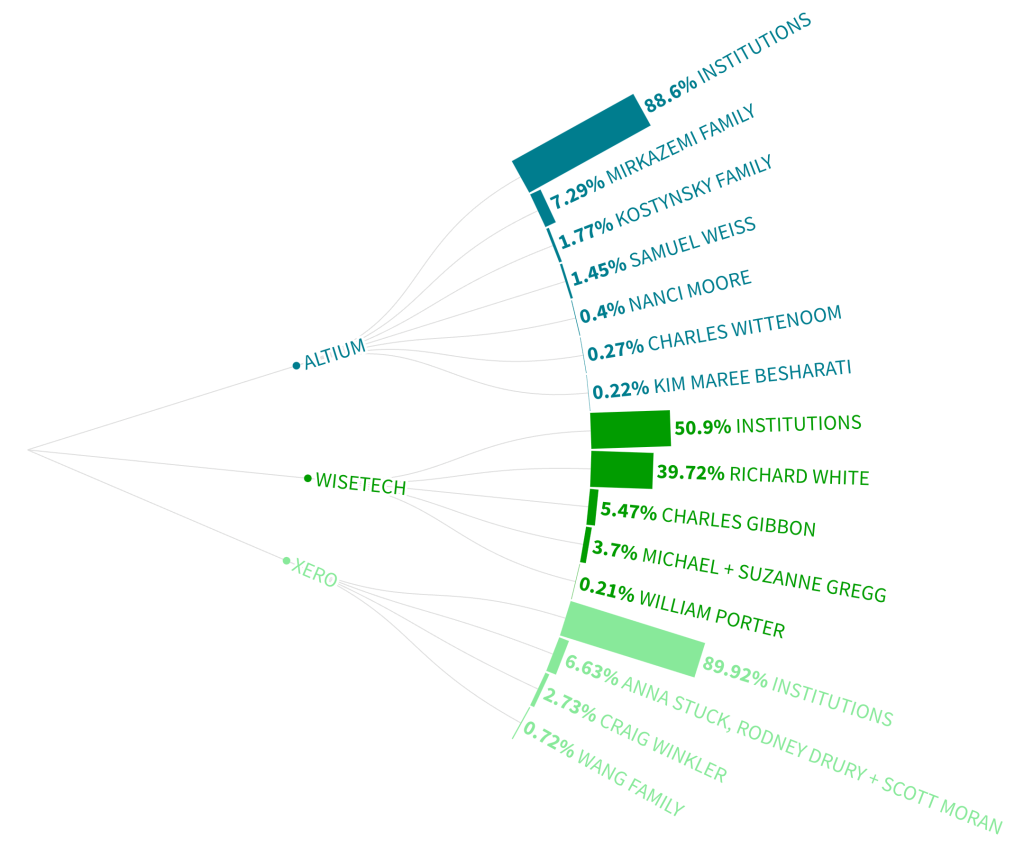

| Software* | Altium | $5.38 | 81.06% |

| Software* | Wisetech | $20.02 | 84.67% |

| Software* | Xero | $17.01 | 87.67% |

| Telecommunications | Spark | $8.46 | 76.25% |

| Telecommunications | Telstra | $44.72 | 57.28% |

| Telecommunications | TPG | $9.84 | 93.26% |

| Transport | Auckland Airport | $10.47 | 79.23% |

| Transport | Qantas | $8.93 | 74.36% |

| Transport | Transurban | $38.17 | 82.86% |

Who owns the biggest companies on the ASX by sector?

(Largest 20 shareholders analysed)

Pharmaceuticals

Transport

Banks

Telecommunications

Capital Goods

Media

Food + Bev

Gambling

Real estate

Equity Real Estate

Healthcare

Tech Hardware

Retail

Consumer staples

Tech Software

Consumer Goods

Personal Products

Three examples of the many companies behind family owners

Telecommunications > TPG > David and Vicky Teoh

Consumer Goods > Audiopixels > Fred Bart & Family

Capital Goods > Reece > John, Leslie & Bruce Wilson

Data sources:

Source for market capitalisation: ASX

Sources for company shareholders: Most recent annual report for each company; ASIC filings; ASX announcements regarding changes in directors’ duties or notices of substantial holders; proxy statements to the US Securities and Exchange Commission (SEC).

Data notes:

Categories adopted from ASX, except gambling, which has been separated from Consumer Services.

Some companies’ annual reports did not include the top 20 shareholders as they complied with a different jurisdiction. They did disclose substantial holdings.

These were Unibail-Rodamco-Westfield, News Corp and Light & Wonder.

Some companies in Australia among the top three by market cap were excluded from the analysis.

- Resmed was excluded from the healthcare sector because SEC filings did not include necessary information.

- Fisher and Paykel Healthcare was also excluded from healthcare because the top 20 shareholders were all institutional. The next biggest, Ramsay, was analysed instead.

- NextDC was excluded from Software because the top 20 shareholders were all institutional. The next biggest, Altium, was analysed instead.

Forbes Australia Issue 8 is out now. Tap here to secure your copy.