Prices are reaching record levels across a group collectively worth $353 billion, but a familiar franchise lassos the top spot in the ranking once again, at $13 billion.

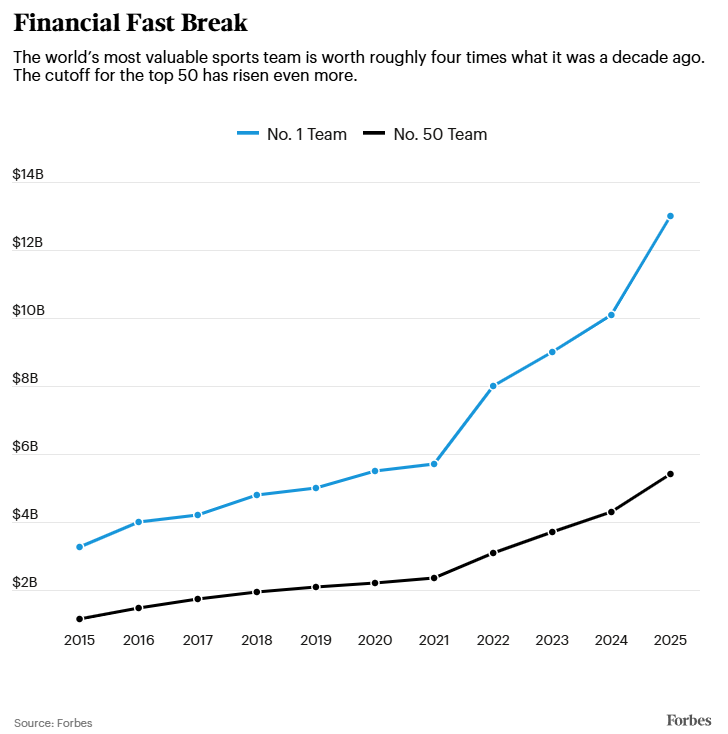

Six years ago, the world’s most valuable sports team was worth $5 billion. Now, that figure wouldn’t even crack the top 50.

The Dallas Cowboys remain No. 1—as they have every year since 2016—but these days, America’s Team is valued at a stratospheric $13 billion. And there is no shortage of data points to chart the spectacular growth in sports franchise valuations in recent years.

Together, the 50 top teams are worth more than $353 billion, or an average of $7.1 billion each—up 22% from 2024 and more than double the mark from just four years ago. Eight franchises in the top 50 posted year-over-year increases of at least 30%, and that number doesn’t include Formula 1’s Ferrari and Mercedes, which are both up 58% since 2023 but were not valued by Forbes last year.

At the top of the ranking, a year after the Cowboys established the $10 billion club, it has four new members: the Golden State Warriors, estimated at $11 billion, followed by the Los Angeles Rams ($10.5 billion), the New York Giants ($10.1 billion) and the Los Angeles Lakers ($10 billion). And the New York Knicks are already knocking on the door, as the world’s sixth-most-valuable team at $9.75 billion.

Broadly speaking, the soaring sports valuations of the past two decades are the result of a surge in media rights fees. Last year, for instance, the NBA struck 11-year broadcast deals with ABC/ESPN, NBC/Peacock and Amazon Prime Video for a reported $76 billion, or an average of $6.9 billion per year, a roughly $4 billion annual raise over the old agreements. The year prior, the NFL agreed to a package guaranteeing at least $125.5 billion through 2033.

With larger distributions from the leagues—and with teams making big financial gains in areas including sponsorship and premium seating—NBA and NFL franchises have seen their average revenue climb 141% and 91% over the past decade, respectively, to an estimated $417 million and $662 million. And because sports teams are generally valued on multiples of revenue, the extra money is directly pushing up sales prices.

At the same time, sports valuations aren’t always grounded purely in economics—and each subsequent sale of a team ends up being used as a measuring stick around its league, potentially resetting the market. In perhaps the most obvious example, billionaire Steve Ballmer bought the Los Angeles Clippers for $2 billion in 2014 after a scandal involving owner Donald Sterling. The previous year, Forbes had valued the Clippers at $575 million, and the NBA average was $634 million, around 4.2 times the previous season’s revenue. The year after the transaction, Forbes’ average was up to $1.2 billion, with a revenue multiple of 7.2. (Today, those figures stand at $5.4 billion and 12.9x.)

It’s hard to imagine another team purchase having that level of impact, but majority stake sales this year for the Lakers and the Boston Celtics, plus minority deals involving the Giants and the Mercedes Formula 1 team, are already driving up valuations.

Still, even with values increasing steadily across the sports world, some leagues and teams are benefiting more than others. While the NFL’s 32 franchises spiked 25% this year, the 20 most valuable European soccer clubs inched up 5% amid issues including stagnating media rights fees, rising costs and significant debt. Over the last three years—since fans started to return to stadiums and arenas during the Covid-19 pandemic—the NBA leads the way with its average team value jumping 87% while MLB and European soccer are neck and neck at 25% and 24%.

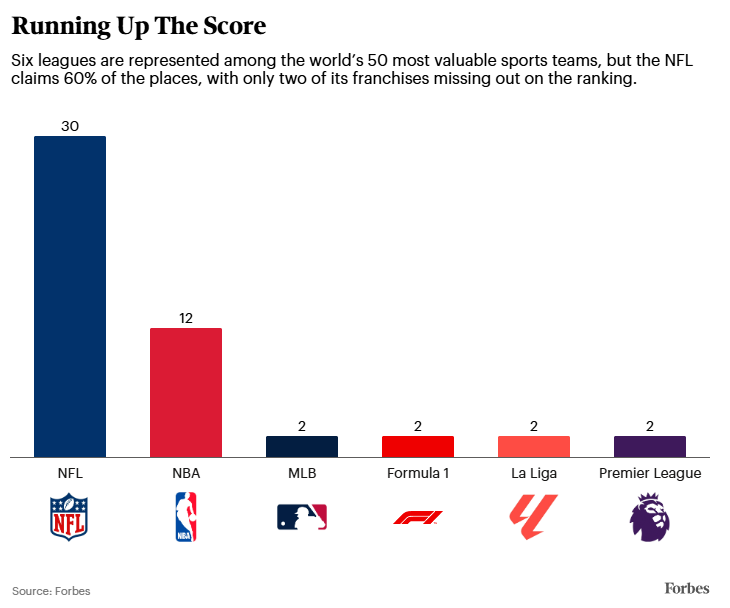

With that disparity, soccer now accounts for only four of the world’s 50 most valuable teams—two clubs from Spain’s La Liga and two from England’s Premier League—down from seven in each of the past two years, with England’s Manchester City, Germany’s Bayern Munich and France’s Paris Saint-Germain dropping off the list.

MLB is also down to two representatives, after the Boston Red Sox fell out of the top 50, and the NHL, where the Toronto Maple Leafs reign at $4.4 billion, and MLS, where LAFC was No. 1 at $1.25 billion, are among the men’s professional leagues that could not break into this year’s ranking. Nor were there any qualifying franchises from women’s sports, where the most valuable club this year was the WNBA’s New York Liberty at $400 million.

Meanwhile, Formula 1 makes its return after a year off—with Ferrari and Mercedes each now worth at least $6 billion—and the NBA has a robust 12 teams included for the second straight year, with the Miami Heat making the cut in place of the Dallas Mavericks.

No league, however, compares to the NFL, which has 30 of its 32 teams among the top 50—everyone except the $5.3 billion New Orleans Saints and the $5.25 billion Cincinnati Bengals.

And if pro football is a financial freight train, then the Cowboys are the locomotive. Last season, their revenue surpassed $1.2 billion. Only one team from any sport was within $350 million of that figure, trailing by $105 million, according to Forbes estimates.

The closest rival is La Liga’s Real Madrid—incidentally, the last club to have topped the Cowboys in the valuation ranking, a decade ago, when Los Blancos came in at $3.26 billion and Dallas was at $3.2 billion. Now, of course, Real Madrid is barely worth half of the Cowboys, at $6.75 billion.

The way that team prices are trending, 2015 feels like the leather helmet era.

THE WORLD’S 50 MOST VALUABLE SPORTS TEAMS 2025

#1. $13 billion

Dallas Cowboys

League: NFL | Owner: Jerry Jones | One-Year Change: 29% | 2024 Rank: 1

#2. $11 billion

Golden State Warriors

League: NBA | Owners: Joe Lacob, Peter Guber | One-Year Change: 25% | 2024 Rank: 2

#3. $10.5 billion

Los Angeles Rams

#4. $10.1 billion

New York Giants

#5. $10 billion

Los Angeles Lakers

#6. $9.75 billion

New York Knicks

#7. $9 billion

New England Patriots

#8. $8.6 billion

San Francisco 49ers

#9. $8.3 billion

Philadelphia Eagles

#10 (tie). $8.2 billion

Chicago Bears

#10 (tie). $8.2 billion

New York Yankees

#12. $8.1 billion

New York Jets

#13. $7.7 billion

Las Vegas Raiders

#14. $7.6 billion

Washington Commanders

#15 (tie). $7.5 billion

Los Angeles Clippers

#15 (tie). $7.5 billion

Miami Dolphins

#17. $7.4 billion

Houston Texans

#18 (tie). $6.8 billion

Denver Broncos

#18 (tie). $6.8 billion

Los Angeles Dodgers

#20. $6.75 billion

Real Madrid

#21 (tie). $6.7 billion

Boston Celtics

#21 (tie). $6.7 billion

Seattle Seahawks

#23. $6.65 billion

Green Bay Packers

#24 (tie). $6.6 billion

Manchester United

#24 (tie). $6.6 billion

Tampa Bay Buccaneers

#26 (tie). $6.5 billion

Ferrari

#26 (tie). $6.5 billion

Pittsburgh Steelers

#28. $6.4 billion

Cleveland Browns

#29. $6.35 billion

Atlanta Falcons

#30. $6.3 billion

Tennessee Titans

#31. $6.25 billion

Minnesota Vikings

#32. $6.2 billion

Kansas City Chiefs

#33. $6.1 billion

Baltimore Ravens

#34 (tie). $6 billion

Chicago Bulls

#34 (tie). $6 billion

Los Angeles Chargers

#34 (tie). $6 billion

Mercedes

#37. $5.95 billion

Buffalo Bills

#38 (tie). $5.9 billion

Houston Rockets

#38 (tie). $5.9 billion

Indianapolis Colts

#40 (tie). $5.7 billion

Carolina Panthers

#40 (tie). $5.7 billion

Miami Heat

#42. $5.65 billion

Barcelona

#43 (tie). $5.6 billion

Jacksonville Jaguars

#43 (tie). $5.6 billion

Brooklyn Nets

#45. $5.5 billion

Arizona Cardinals

#46. $5.45 billion

Philadelphia 76ers

#47. $5.425 billion

Phoenix Suns

#48 (tie). $5.4 billion

Detroit Lions

#48 (tie). $5.4 billion

Liverpool

#48 (tie). $5.4 billion

Toronto Raptors

METHODOLOGY

The 50 Most Valuable Teams are culled from Forbes’ most recent Formula 1, MLB, NBA, NFL and soccer franchise valuations. (No teams qualified from Forbes’ 2025 NHL, NWSL or WNBA valuations.) No one-year change figure is listed for Ferrari or Mercedes because Forbes did not value Formula 1 teams in 2024.

The team values are enterprise values (equity plus net debt) and include the economics of each team’s stadium but not the value of the stadium real estate itself. Similarly, the values include rights fees from regional sports networks owned by the team but not the value of the RSNs themselves; equity stakes in other sports-related assets and mixed-use real estate projects are also excluded. All figures are in U.S. dollars.

To compile the valuations, Forbes examined recent transaction data and spoke with industry insiders including team and league executives, team owners, institutional investors, investment bankers, advisors and consultants. Forbes also reviewed public documents, such as arena lease agreements and bond documents, and consulted industry studies, such as Deloitte’s Football Money League report.

With reporting by Justin Birnbaum.

This story was originally published on forbes.com and all figures are in USD.