As loyalty programs surge in popularity across Australia, one fintech start-up is helping businesses tap into the benefits. Pay.com.au is turning everyday expenses into airline points and premium perks – and has just banked $18 million to prepare for its expansion into the US.

‘Fresh Faces’ was featured in Issue 17 of Forbes Australia. Tap here to secure your copy.

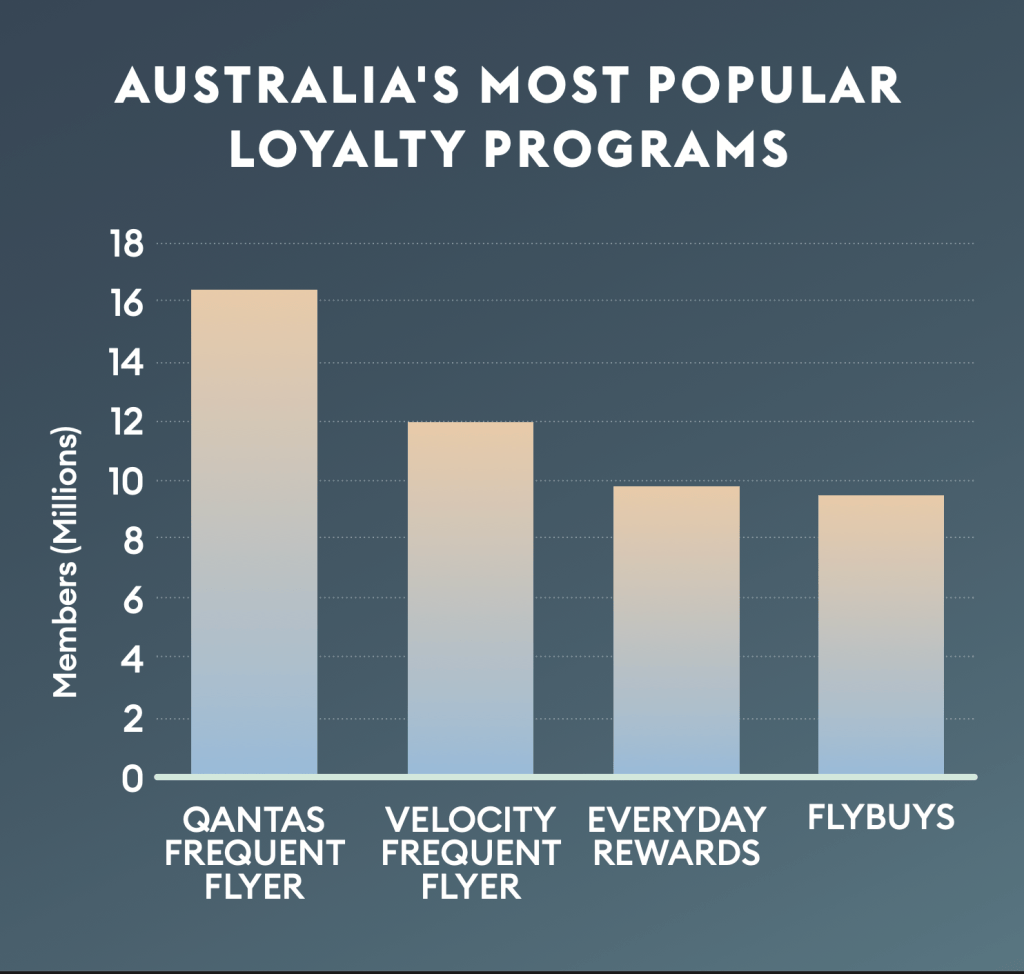

Few countries embrace loyalty programs quite like Australia. With 79% of Australians participating in a retail loyalty program, according to Mastercard, the country is considered one of the most mature markets in the loyalty space, sitting well above the Asia-Pacific average of 61%.

This widespread appetite has turned loyalty into a highly profitable industry. For instance, Qantas’ Frequent Flyer program generated over $500 million in the 2024 financial year, while Virgin Australia’s Velocity program earned $115 million.

Yet despite the widespread success of consumer loyalty programs, small and medium-sized enterprises, which comprise 98% of all Australian businesses, have been mainly left out of the equation. Business owners have long relied on simple bank transfer payments, missing out on the perks available to everyday consumers.

Ed Alder and his co-founders, Damien Waller and Grant Austin, saw an opportunity to change that. In 2020, the trio launched pay.com.au, a business-to-business platform designed to help businesses earn rewards on payments that traditionally went unrewarded.

“There really wasn’t a platform out there that has enabled business owners in that SME space, you know, the large rump of the Australian economy, to make payments on their credit card and earn any rewards in return,” Alder says. “So we built one that did.”

Pay.com.au lets businesses earn points on a wide range of expenses, from ATO bills and rent to supplier invoices and payroll. By bridging the gap between bank transfers and reward-earning payments, the platform helps unlock loyalty-style benefits from everyday spending.

“We’ve always said that businesses should be putting 100% of their expenses through us, because the value they get back in rewards far outweighs our fees”, Alder says.

At the heart of it all is PayRewards, pay.com.au’s proprietary currency that can be transferred to an extensive roster of partners, including Qantas, Virgin Australia, Marriott, and IHG.

“It’s become much more than just a payment platform for earning reward points; it’s evolved into a full ecosystem for SME payments,” Alder says. “We call ourselves the Switzerland of points because anyone can connect with us, whether it’s BPAY, credit card, bank transfer, or multiple airline and hotel partners”.

“We’re creating a new, incremental market that builds on top of existing systems to deliver value to everyone across the board”.

Built for Growth

Since its inception in 2020, pay.com.au has become one of Australia’s fastest-growing start-ups. Over the past three years, it recorded a compound annual growth rate of 385%, scaled annualised gross revenue to $164 million, and recently concluded an $18 million capital raise.

When asked about the secret behind the company’s rapid growth, Alder puts it down to one thing: “a well-thought-out, planned and executed strategy.”

“We spent a lot of time planning it out,” he explains. “I remember sitting for hours into the night in our boardroom, just trying to unpick every aspect of the problem we were solving, turning every pebble, every bit of risk, every opportunity.”

Early on, the team deliberately chose to start small, launching the product in a closed environment. They worked closely with a trusted group of users, using their feedback to fine-tune the platform and build credibility among SMEs.

“People don’t like change,” Alder explains. “We had to make sure that the bookkeepers, financial controllers and CFOs we were working with felt comfortable and confident making that shift, especially in those early stages when trust was everything.”

The groundwork paid off. By launch, pay.com.au had already been vetted by real businesses and their trusted advisers, giving the platform credibility and helping it reach cash flow positivity early on.

That same methodical, feedback-driven approach would later prove crucial in securing deals with major airline and hotel partners.

“They’re not easy contracts to initiate and execute. The airlines guard their frequent flyer programs like the golden child of their business,” he explains. “So we had to be crystal clear on our value proposition – we weren’t there to cannibalise their existing channels, we were there to build something entirely incremental.”

Much of that persuasion came down to data.

“Our team is heavily numeric, most of us are chartered accountants, so we’re very data-driven. That helped us demonstrate the benefits of partnering with us”.

Qantas was the first to sign on in 2021, setting a powerful precedent that paved the way for future deals. Since then, pay.com.au has partnered with over ten airline programs and three major hotel groups, cementing its position as a key player in the loyalty space.

Polishing the Spanner

While a well-executed strategy set the foundation for pay.com.au’s rise, Alder highlights culture’s role in sustaining it.

“We’ve got a fantastic team going, but more than that, we’ve built a culture of ownership,” he says. “Nearly all of our staff are shareholders, and many have put their own money in, creating a collegiate culture. There’s nothing better than when everyone owns a part of the spanner – if you drop it, pick it up, polish it – you take care of it. You don’t just toss it aside.”

It’s a mindset that shapes how the team approaches their work.

“We say to the staff, ‘You’re all shareholders. You probably only get one or two chances in your life to build something like this, so let’s make it count. Let’s extract as much value as we can from the business and grow it together.’”

Today, the company employs around 70 people in its Melbourne office. While Alder acknowledges they’ll need more staff as the business grows, he’s cautious about expanding too fast. “I still go to every mid-year and Christmas function and know 99% of the team – not just by name, but well,” he says. “Once you grow beyond a certain size, it starts to feel corporate, and we want to hold onto that close-knit, family-style culture.”

Preparing for Takeoff

As pay.com.au strengthens its foothold in Australia, Alder sees major local and international opportunities.

Domestically, the potential is clear. With 2.6 million SMEs operating across the country, the company has only just started to scratch the surface. “The runway is enormous,” Alder says. “You look at Qantas Business Rewards – they’ve got over 600,000 SMEs on there. We’re not even at 5% of that yet, so there’s still a massive market to go after.”

Still, the team has its sights set on a much bigger stage. With its recent acquisition of a global domain name and plans to establish an office in Dallas, pay.com.au is preparing to expand into what Alder calls “the biggest and toughest market in the world”: America.

“Over there, 99% of companies are SMEs,” he says. “So, it’s nerve-wracking, but at the same time, we’re excited about what can happen in that space. A huge number of Australian companies have gone there and failed, but then you’ve got examples like Afterpay, and it shows there’s a real path to scale if you get it right”.

‘Fresh Faces’ was featured in Issue 17 of Forbes Australia. Tap here to secure your copy.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.