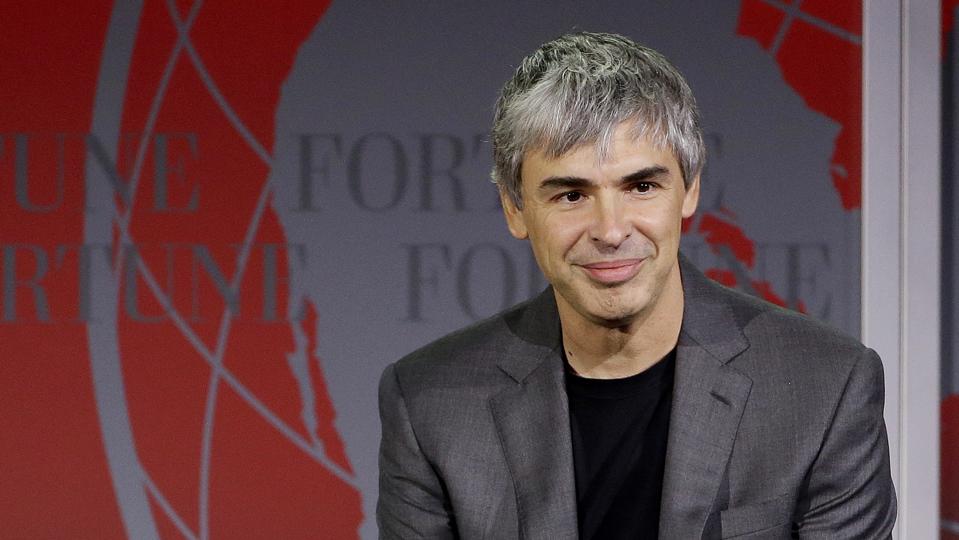

Google cofounder Larry Page passed Oracle’s Larry Ellison on Monday to become the world’s second-richest person, as parent firm Alphabet’s stock continued a weekslong rally fueled by AI momentum.

The Google parent’s stock has accelerated over the last week and is now valued more than Microsoft.

Copyright 2019 The Associated Press. All rights reserved.

Key Facts

Shares of Alphabet advanced 5.8% to around $317 as trading opened Monday, following an 8.4% rally for the stock last week that pushed its value from just over $276 to just below $300.

Oracle’s shares fell 1.5% to below $196 after the stock’s roughly 12% plunge over the previous two trading sessions.

Forbes Valuation

Page, who cofounded Google with Sergey Brin in 1998, has a net worth estimated at $255 billion after increasing by $8.7 billion on Monday. Page’s wealth has grown exponentially over the last five years, rising from $50.9 billion in 2020 to just over $144 billion to start 2025. Ellison’s net worth has similarly accelerated this year alone after becoming the second person to be worth $400 billion, though his fortune has dropped in value as Oracle shares have declined in recent weeks, bringing Ellison’s net worth to an estimated $248.8 billion. Brin passed Amazon’s Jeff Bezos ($235.1 billion) to become the world’s fourth-richest with a net worth estimated at $236.4 billion.

Big Number

67%. That’s how much Alphabet’s shares have rallied since hitting a low of $187.82 on Aug. 1. Oracle’s shares have plummeted by 43% since a nearly 36% surge on Sept. 10, which marked the largest intraday gain for the stock since 1992.

Why Does Larry Page Hold More Alphabet Stock On Than Sergey Brin?

It mostly seems to come down to Brin’s charitable giving. Page and Brin hold a combined 87.9% of Alphabet’s Class B shares, though Page has accumulated 389 million shares compared to Brin’s 362.7 million. Alphabet has three classes of stock: Class A, Class B and Class C, which award one vote per share, 10 votes per share and no votes, respectively. The difference in equity between Google’s cofounders is largely attributed to stock trades, according to Securities and Exchange Commission filings: Brin has been more active in selling his stake than Page, who last disclosed selling shares in 2022. Brin has also donated his Alphabet and Tesla stock multiple times to nonprofit groups and to research on Parkinson’s disease in recent years, including a $700 million donation earlier this year, as well as donations of $615 million and $600 million in 2023, and a $450 million donation in 2021.

Why Is Google’s Stock On The Rise—and Oracle On The Decline?

Alphabet’s stock appears to have benefited from recent optimism for the company’s AI business in recent weeks. Warren Buffett’s Berkshire Hathaway disclosed a nearly $5 billion stake in Alphabet earlier this month, marking one of the firm’s rare bets into tech behind a larger Apple stake. Alphabet also released its latest AI model, Gemini 3, last week in an announcement that fueled a 6% rally for the stock. The company disclosed a 34% boost in cloud revenue through its third quarter last month, as Alphabet topped $100 billion in quarterly revenue for the first time. Oracle, however, has declined alongside Nvidia, Broadcom and other megacap firms in recent weeks as fears of an AI bubble have risen. Bank of America, in a survey of global fund managers released last week, reported that 45% of investors viewed an AI bubble as a top risk. More investors have started trading against Oracle’s stock as part of a broader bet against the AI trade, according to Bloomberg.