These 20 franchises combined for $4.5 billion in operating income, but one team remains in a league of its own—more than $200 million beyond any other.

For the 30th straight year, the Dallas Cowboys will be stuck at home on Super Bowl Sunday. But even when victories are hard to come by on the field, owner Jerry Jones keeps piling up financial wins.

The Cowboys, the world’s most valuable sports team, worth $13 billion, are also the most profitable franchise, racking up an estimated $629 million last season in operating income (earnings before interest, taxes, depreciation and amortization). That total put America’s Team more than $200 million ahead of the NBA’s Golden State Warriors—No. 2 among the most profitable franchises with an estimated $409 million in EBITDA last season—and nearly $400 million ahead of any other team.

In fact, among the 211 franchises that Forbes valued in 2025 across 13 leagues, only 28 generated more in revenue than the Cowboys made in operating income during the most recent season with available data.

Together, the world’s 20 most profitable teams hauled in $4.5 billion in EBITDA, or an average of $226 million, up 16% from the previous year’s $3.9 billion and $195 million. Once again, the NFL leads the way with seven franchises ranked, followed by the NBA with six, but it is a closer split than last year, when the list of 20 teams featured nine from the NFL and five from the NBA. The NHL and the Premier League each have three clubs represented this year while one Formula 1 team makes the cut.

A generation ago, sports franchises were not necessarily expected to stay in the black, and team owners typically made their money whenever they eventually decided to sell their stakes. Even today, profitability is not a given: Among the 185 men’s sports teams valued by Forbes in 2025, an estimated 37 failed to reach break-even, including 16 clubs from MLS and 11 from MLB. The New York Mets, for example, lost an astonishing $268 million in 2024, according to Forbes estimates, in large part because of massive luxury-tax penalties imposed by the league.

Investor expectations are shifting, however. Teams are wringing considerably more money out of their sponsorships and premium seating, and with a surge in national media rights fees, they can count on much more lucrative distributions from their leagues. For instance, in the NFL—where team revenue averaged $662 million, up 91% over the past decade, according to Forbes estimates—each franchise received an estimated $443 million from the league last season.

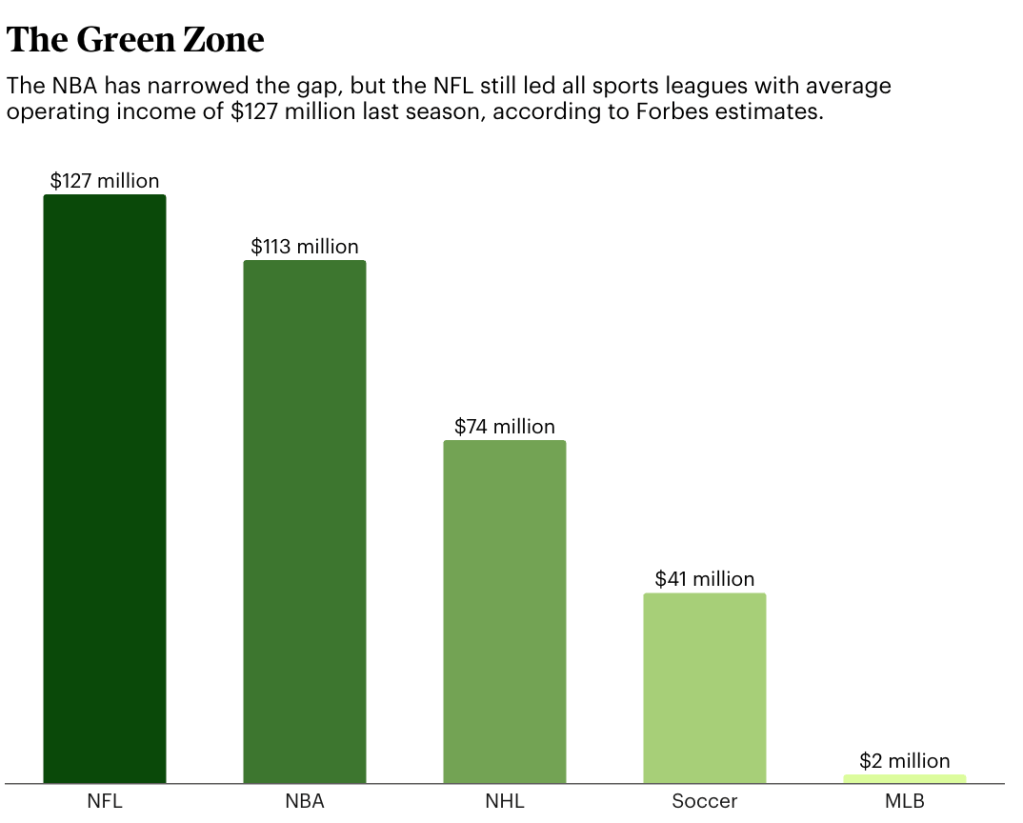

With that kind of cushion, NFL teams are almost guaranteed profitability, and no franchise posted operating income worse than $21 million in 2024, with an average of $127 million, according to Forbes estimates. In the NBA, where revenue topped $416 million per club last season and just two teams were in the red, average operating income was a similarly robust $113 million, and that number should climb this season in the first year of the league’s 11-year, $76 billion media package with ESPN, NBC and Amazon.

Even the NHL—whose 32 franchises averaged a modest $248 million in revenue last season—had an impressive $74 million in EBITDA per club, according to Forbes estimates, and no team operated at a loss, thanks in part to a strict salary-cap system that keeps player payrolls in check.

Formula 1 is undergoing a similar transformation under a cost cap that was implemented in 2021 to level the playing field by restricting teams’ spending in many areas related to car design and construction. With that league-imposed financial discipline, Mercedes collected $227 million in EBITDA in 2024, ranking fifth among all sports teams. By contrast, the lack of cost controls in European soccer means that even top clubs can suffer significant losses, such as Paris Saint-Germain’s estimated $111 million in 2023-24.

Only one team owner controls two franchises among the 20 most profitable: Stan Kroenke, who owns both the NFL’s Los Angeles Rams (tied for third with estimated EBITDA of $244 million) and the Premier League’s Arsenal (No. 17, $173 million).

Still, at $417 million, those two teams’ combined operating income is more than $200 million shy of the Cowboys’.

Here are the world’s 20 most profitable sports teams, ranked by estimated operating income (earnings before interest, taxes, depreciation and amortization) during the most recent season with available data.

#1. Dallas Cowboys

Operating Income: $629 million

League: NFL

Value: $13 billion

Owner: Jerry Jones

#2. Golden State Warriors

Operating Income: $409 million

League: NBA

Value: $11 billion

Owners: Joe Lacob, Peter Guber

#3 (tie). Edmonton Oilers

Operating Income: $244 million

League: NHL

Value: $3.2 billion

Owner: Daryl Katz

#3 (tie). Los Angeles Rams

Operating Income: $244 million

League: NFL

Value: $10.5 billion

Owner: E. Stanley Kroenke

#5. Mercedes

Operating Income: $227 million

League: Formula 1

Value: $6 billion

Owners: INEOS, Mercedes-Benz, Toto Wolff

#6. New England Patriots

Operating Income: $222 million

League: NFL

Value: $9 billion

Owner: Robert Kraft

#7 (tie). Atlanta Hawks

Operating Income: $203 million

League: NBA

Value: $5 billion

Owner: Tony Ressler

#7 (tie). Philadelphia 76ers

Operating Income: $203 million

League: NBA

Value: $5.45 billion

Owners: Josh Harris, David Blitzer

#9 (tie). Houston Rockets

Operating Income: $191 million

League: NBA

Value: $5.9 billion

Owner: Tilman Fertitta

#9 (tie). Toronto Maple Leafs

Operating Income: $191 million

League: NHL

Value: $4.4 billion

Owners: Rogers Communications, Larry Tanenbaum

#11. Manchester United

Operating Income: $185 million

League: Premier League

Value: $6.6 billion

Owners: Glazer family, Jim Ratcliffe

#12. Tottenham Hotspur

Operating Income: $184 million

League: Premier League

Value: $3.3 billion

Owners: Joseph Lewis Family Trust, Daniel Levy

#13. New York Rangers

Operating Income: $182 million

League: NHL

Value: $4 billion

Owner: Madison Square Garden Sports

#14. New York Giants

Operating Income: $181 million

League: NFL

Value: $10.1 billion

Owners: John Mara, Steven Tisch

#15. New York Jets

Operating Income: $180 million

League: NFL

Value: $8.1 billion

Owner: Johnson family

#16. Las Vegas Raiders

Operating Income: $179 million

League: NFL

Value: $7.7 billion

Owner: Mark Davis

#17. Arsenal

Operating Income: $173 million

League: Premier League

Value: $3.4 billion

Owner: E. Stanley Kroenke

#18. Los Angeles Lakers

Operating Income: $170 million

League: NBA

Value: $10 billion

Owners: Mark Walter, Todd Boehly, Jerry Buss Family Trusts

#19. Chicago Bulls

Operating Income: $160 million

League: NBA

Value: $6 billion

Owner: Jerry Reinsdorf

#20. Houston Texans

Operating Income: $156 million

League: NFL

Value: $7.4 billion

Owner: Cal McNair

METHODOLOGY

The 20 most profitable sports teams are culled from Forbes’ 2025 Formula 1, MLB, MLS, NBA, NFL, NHL, NWSL, global soccer and WNBA team valuations. (The global soccer list included 30 men’s teams across six leagues: 12 clubs from England’s Premier League, eight teams from the United States’ MLS, four from Italy’s Serie A, three from Spain’s La Liga, two from Germany’s Bundesliga and one from France’s Ligue 1.)

The most profitable ranking reflects Forbes’ estimates of operating income (earnings before interest, taxes, depreciation and amortization) for the most recent season with available data (2024 for MLB, MLS, the NFL, the NWSL and the WNBA; 2024-25 for the NBA and the NHL; and 2023-24 for European soccer). The profit figures are in U.S. dollars and are rounded to the nearest $1 million.

The listed team values are enterprise values (equity plus net debt) and reflect the economics of each team’s stadium (including revenue from concerts and other non-sports events that accrues to the team’s owner), but they do not incorporate the value of the stadium real estate. Similarly, the values reflect rights fees from regional sports networks owned by the team but do not include the value of the RSNs themselves. Equity stakes in other sports-related assets and mixed-use real estate projects are also excluded.

Sources for Forbes’ estimates included team executives, sports bankers and league consultants; public documents such as stadium lease agreements and credit rating reports; and sponsorship and broadcasting industry executives

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.