Can Samantha Johnson help reshape a sustainable Australian automotive landscape in a land obsessed with fuel-guzzling SUVs and light trucks?

At face value, Samantha Johnson might not appear to be a natural choice as one of the most influential leaders in Australia’s burgeoning electric vehicle (EV) market. But her extensive career in the international multi-billion-dollar motoring industry, combined with an insatiable passion for the environment, makes her an obvious choice as a leader in the much-needed restructure of Australia’s automotive landscape.

As managing director of the Australian arm of Scandinavian automotive company Volvo’s EV business, Polestar, Johnson is tasked with growing the prestige brand in a largely male-dominated, petrol-invested Australian automotive industry.

Johnson understands business transformation. She knows the blood, sweat and tears needed to drive meaningful change in this country. In addition to her role leading Polestar, Johnson spends much of her time working with industry boards and governments helping to educate and dispel myths around EV adaption.

Throughout her career in traditional “boys club” industries, Johnson worked as Director – Business Control, Financial Services & Digital Transformation at Volvo Car Australia. Before that, she was a director at arguably one of the most masculine companies in the world, Harley Davidson.

Johnson’s love of breaking down barriers extends from her work into her private life. An avid sportswoman, Johnson regularly participates in yacht racing, kiteboarding and snowboarding. She longs for the day that she can run or ride her bike through her beloved Northern Beaches streets without car exhaust fumes in her face.

“I worked overseas in Hong Kong and Japan for a few years, which really helped me grow as a leader. I sailed a yacht back to Australia from Hong Kong with my husband – which was exciting. We sailed through the Philippines, Papua New Guinea and into Australia. It was a great adventure, and even in doing that, there’s a lot of planning, safety, and leadership – so there were a lot of learnings there.”

Despite her thoughtful, sometimes quiet demeanour, Johnson has never been one to be put off by a challenge, no matter how dangerous the odds. After returning from Australia from Asia in 2005, Johnson had the arduous task of leading the motorcycle company Harley Davidson through a period of change and transformation. One of her early tasks involved taking back distributorship rights from independent dealerships.

During that time, Johnson was responsible for building the Harley Davidson business across all divisions – from human resources to logistics and information technology – increasing employee numbers by around 10-fold. Over a decade with the international motorcycle brand, Johnson worked with everyone from dealers to large corporate clients, to bikies and “Mum and Dad” customers.

“I really had an interest in all areas of the business. That’s where I learned a lot of my retail, customer experience skills and leadership as well,” she says. “I was working in an environment with a very flat organisational structure, so you had to earn your respect to grow in the organisation.”

Before joining Polestar, Johnson worked in a business controller role at Volvo Car Australia –essentially the equivalent

of Chief Financial Officer – for five years. Behind the scenes, she quietly worked on the set-up of Volvo’s new EV arm, Polestar, and in February 2021, the company asked her to head its Australian operations.

Johnson’s love of nature, particularly the ocean, made Polestar a natural career and life choice for Johnson.

“Sustainability was a huge part of my interest in Polestar because the company is doing positive things to create that carbon-neutral vehicle by 2030 – Project Zero,” she says. “This is very difficult to do a short time frame, but we are going to do it.”

At the end of 2022, Polestar distributed around 1,000 of its Polestar 2 vehicles in Australia after 10 months in the market. Selling the cars in this market has not been difficult, Johnson says; however, sourcing them has been a problem. There are “literally thousands” of orders in the pipeline for Polestar 2s. However, customers must wait for the vehicles to be shipped to Australia. There’s been a lot of interest in its new Polestar 3 model, but she says Australians will need to wait until the first quarter of 2024 to purchase one.

“Our CEO, Thomas Ingenlath, is the ex-head of design for Volvo, so the design of the vehicle and how it looks is critical. It’s also very innovative; it has the Google Entertainment system and the innovation in safety – the sustainability is excellent from the exterior to the interior.”

Flying the EV flag

As one of only a few “EV-only” players in the Australian automotive industry, Johnson believes Polestar needs to play an important role in educating consumers and governments about EV technology and its benefits.

“We’re part of climate groups, where we are spreading the word and making sure we’re influencing others.

“We are on the board of the Electric Vehicle Council, which is very forward-thinking in moving away from traditional working methods and we need to do to accelerate electric mobility here.”

Johnson says that the key to the change will be introducing a fuel efficiency standard, so Australian EVs are on a “level playing field with the rest of the world in supply for EVs”.

That, along with continued government commitments to fund charging infrastructure, will be crucial to encourage growth in the EV market.

“The Government has to drive demand a lot stronger with tax incentives and other benefits really to help promote EVs,” she says.

What will it take?

2023 has been described as “the year of now or never” for the roll-out of a national EV strategy. Whether Australia will succeed in having a sustainable vehicle future, catching up with global technological advancements and reducing greenhouse gas emissions, or continuing to remain a petrol-dominated market, remains to be seen.

Last year the Federal Government called for industry submissions on Australia’s National Electric Vehicle Strategy and is expected to release a series of recommendations based on the consultation period this year. Industry bodies and players predict that a fuel emissions standard will be announced in the first half of this year. But the effectiveness of any new legislation will determine the success of a compelling EV future in Australia.

To say that Australia is lagging vastly behind almost every developed country in the world in its EV sales and adaptation is an understatement. Data from the industry body, the Federal Chamber of Automotive Industries (FCAI), show that. In January, EVs made up 5.7 % of all vehicles sold in Australia. Almost 90% of all vehicle sales in Norway are electric.

Toyota is the leading car manufacturer in Australia by far, selling more than 13,000 vehicles in January 2023. Its Hi-Lux utility vehicle was the second most popular car, with more than 4,131 sales in January, with the first prize going to the Ford Ranger with 4749 sales.

Hybrids are increasingly popular – accounting for 12.28% of vehicles sold during January. However, EV purists argue that technology represents “the worst of both worlds” – with internal combustion engines and electric components requiring double the servicing and maintenance costs.

Hybrids are seen as a softer entry into the EV market, particularly those with “charging anxiety” or fear their vehicle will run out of battery in the middle of a journey. The self-charging technology of hybrid cars – or regenerative braking – means that kinetic energy is stored in the electric battery, ready to be used without recharging. Hybrids have some benefits – although they still produce emissions, they are less powerful and expensive.

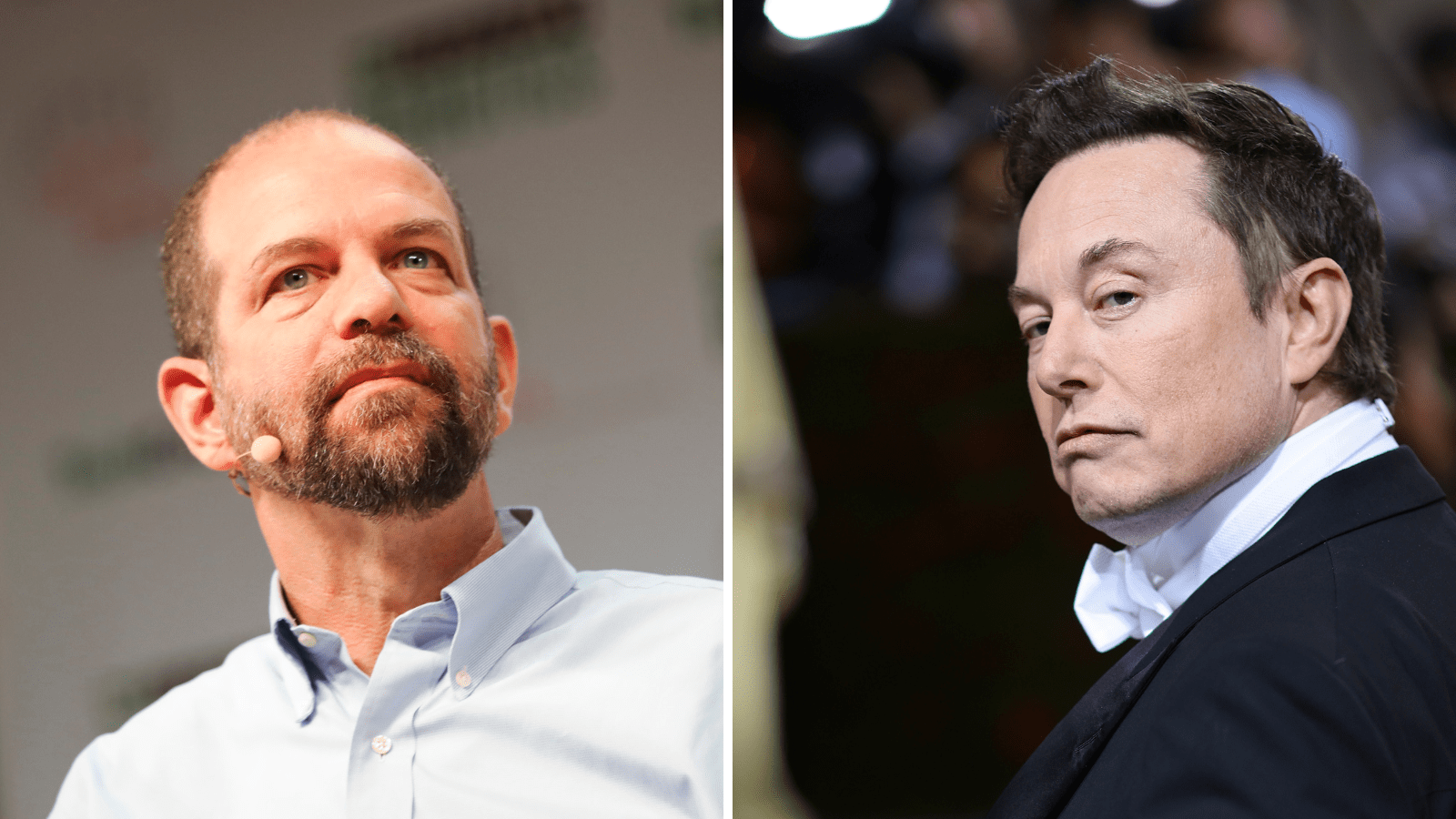

Electric Vehicle Council CEO Behyad Jafari believes this year is a “now or never” scenario for EVs in Australia. Most developed nations are significantly ahead of Australia in their electrification strategies, so technology is changing, and time is running out. In Norway, nine out of 10 new cars sold are EVs, almost half of the vehicles sold in Sweden are electric, and countries such as Germany, the United Kingdom and the US are quickly catching up.

One of the most significant hurdles is Australia’s lack of fuel emission standards, Jafari says. He says time is running out to establish Australia as a serious market player in vehicle electrification. But when it comes to consumers, no convincing is required, Jafari says. Many car manufacturers that offer plug-in EV vehicles cannot keep up with the customer demand and have long waiting lists. Now the industry and governments must play catch up, he says.

“We could easily see a short-term future where electric vehicles make up most new vehicle sales in Australia. That would mean more than half of new vehicles being electric,” he says. “But we have one chance to get it right. We must convince the world that we are a market worth investing in.”

In Europe and other developed countries, the incentive for car manufacturers to invest in EVs is simple: fuel efficiency standards dictate that specific rules must be adhered to, and electric engines meet the brief. The direct impact of fuel emission standards on EV sales was seen last year when New Zealand introduced a fuel emission standard. Within 12 months, EV sales in the country increased from around 4% of total vehicle sales to 15%.

“EVs also use lithium… It’s potentially another mining boom. There’s opportunity to grow that doesn’t exist with petrol”

Behyad Jafari CEO, EVC

In 2022, the Federal Government passed the Treasury Laws Amendment (Electric Car Discount) Bill through Federal Parliament. The bill removes import tariffs for zero and low-emissions vehicles that sit beneath the luxury car tax threshold ($84, 916) and makes them exempt from Fringe Benefits Tax. Industry players hope other tax incentives and environmental legislation will encourage people to invest in EVs.

Jafari believes that industry bodies such as the Federal Chamber of Automotive Industries (FCAI) have a conflict regarding the support of EV technology. Most of the organisation’s board members come from influential, global car manufacturing companies, such as Toyota, Honda, Nissan and Volvo, and it is their mandate to support the interests of those members. While these large companies produce EVs and Hybrids, the bulk of sales

is still single-combustion engine fuel cars.

Jafari argues that while the industry body acknowledges the need to support new forms of car technology and “claims to be neutral”, he says there is an “undercurrent of negativity” about EVs and the challenges they present rather than the positives. Jafari believes car manufacturers have “stopped investing in internal combustion engines”, and innovation globally is focused on EVs and other fuel alternatives. Australia needs to be a part of the change.

“Part of our challenge is that the customers are there and waiting. We just need to allow them to buy the cars they want and give them a choice.”

Behyad Jafari, Electric Vehicle Council CEO

Carefully considered change

Tony Weber, chief executive officer of peak automotive industry body the FCAI, says the industry embraces alternatives to petrol and diesel cars. However, the changes need to be practical and meet the needs of consumers. Part of that will be working with the Federal Government to develop a fuel standard while ensuring there is a charging infrastructure to support the change.

“EVs or low and zero emissions vehicles are just the future; there’s no question about that.

“People talk about EVs… but I think they’re really talking about low-emission vehicles. Regardless of the technology, it doesn’t matter, but that’s where the future is. Whether it’s a battery EV, a hydrogen fuel cell, another type of fuel or another technology, that’s the direction we’re going – zero tailpipe emissions. That must be the future,” Weber says.

Weber believes one of the challenges of a widespread EV roll-out is the vastness of Australia. Australia is larger than the continental US, and while the US has a population of around 331 million people to support its EV infrastructure, Australia only has roughly 26 million.

“The key areas [of challenge] in my mind are apartment living, regional and rural Australia and highways,” he says. “People who buy electric vehicles have the confidence that that vehicle will meet their needs.”

He argues that Australians need to be able to use their vehicles for the purpose they drive them for. Weber says cost is a prohibitive factor with EVs, although more companies are continuing to introduce lower-cost, smaller electric vehicles.

“When they move to electric vehicles, they want to have that same level of comfort and utility from that vehicle as what they can currently from an internal combustion engine,” he says. “I think we need to develop a target that is ambitious but achievable.”

Related

Weber argues that there are limitations in larger cars and utility vehicles because batteries are “inherently heavy”. He says that requiring more batteries in larger vehicles creates engineering issues and needs more space. “There’s a real engineering concern around Utes and large SUVs”.

But in other countries with a love of big cars and motorways, such as America, larger electric vehicles and trucks and buses are already becoming popular as the technology is refined more and more.

“We can draw lines on graphs about the rate of improvement. However, if consumers don’t purchase these products, we won’t get the improvement in terms of the vehicles on our roads. And that’s the important issue.”

Weber says EVs are not unique in terms of difficulty in sourcing vehicles. He says supply chain issues due to several factors – including the war in Ukraine, an inability to source neon (a semiconductor that is critical in the production of chips) and international shipping delays – have contributed to the inability to source many vehicles.

Demand is not the problem

Sourcing the vehicles from Europe has been the most challenging part. For companies such as Polestar Australia – the Australian EV subsidiary of the Scandinavian vehicle manufacturer Volvo – it is not convincing customers to buy their product that has been the challenge. Polestar – a Scandinavian design-led, EV-only brand – had around 1,000 of its Polestar 2 model vehicles on Australian roads in late 2022 – but customers had “thousands” on backorder, waiting for them to be shipped out.

Part of that challenge, along with global supply chain restraints, has been convincing European parent companies to send more vehicles to Australia, a far less sophisticated market in terms of both charging infrastructure and government policies than other markets in Europe, the United Kingdom and the United States.

Luxury European carmakers, such as Audi, tend to lead innovation in the EV space. Audi, for example, first introduced its all-electric vehicle – the Audi e-tron – to the market five years ago and has solidly expanded its offering in the years since. For environmentally conscious drivers, Audi EV vehicles are built at its carbon-neutral Brussels manufacturing plant.

Audi currently has six plug-in vehicles on offer in the Australian market, including one in the increasingly popular SUV category. Polestar Australia Managing Director, Samantha Johnson, says part of her role is to give her bosses at the EV manufacturer’s Gothenburg-based headquarters confidence that Australia is a

serious electronic vehicle market.

In late 2022 she travelled to Polestar’s headquarters to discuss the work Polestar Australia has done with the Electronic Vehicle Council and the government.

“There’s a lot of challenges with supply, which is across the industry. So, for us, it’s giving our headquarters confidence that we have the right government policies in place to support EVs and for them to have the confidence to supply us in Australia with EVs.

“We’re here in Gothenburg this week [late 2022], at the headquarters, talking to them about what we are doing. That provides confidence… that ‘alright, we can send more EVs to Australia

because it has the right policies’, and so that those cars aren’t going to sit on the docks – that the demand is going to be there.”

Luxury EVs are leading the way

Like Polestar, Mercedes-Benz Cars Australia spokesperson Jerry Stamoulis says demand for its range of seven EVs in Australia – ranging from $81,000 to $328,000 – has been at an “all-time high”. As a result of increased demand and industry supply chain issues, it hasn’t been able to keep up with customer demand.

Stamoulis says the luxury consumer for EVs differs in several ways from the average electric vehicle driver who uses one car as their primary mode of transport. Not only are luxury EV owners charging their vehicles at home, but they are further reducing the cost of running their cars by charging them at work.

“We find most of our customers charge their vehicles at home or work rather than via the publicly available services.

“Range is a factor for some customers at first, but once they live with an EV, they build a new routine that fits into their lives, and the benefits outweigh any of the typical myths,” Stamoulis says.

Stamoulis believes it will not be long before Australia follows Europe and Scandinavia’s lead, with new EV-supporting technology – such as solar and battery solutions in new homes and offices – built into design briefs.

Electrified: new industry opportunities

Introducing a new innovation, such as EVs, presents opportunities for growth in manufacturing, supply chain and mining.

Lithium, one of the key metals used to make EV batteries, is abundant in Australia. Research by Fitch Solutions shows that Australia overtook Chile as the top supplier five years ago.

While car manufacturing is dead in Australia, there are many opportunities for industry growth arising from EVs, according to the Electric Vehicle Council’s Jafari.

“There are opportunities for economic growth in EVs beyond the sale of the vehicles themselves. For example, we import all our petrol and diesel from offshore – however, we make our own electricity. It’s keeping our money onshore. EVs also use lithium – it’s potentially another mining boom. There’s opportunity to grow that doesn’t exist with petrol.”

One criticism of EVs is their cost. While there are cost savings associated with owning an EV – from fuel (it costs around $20 to charge an EV versus upwards of $100 to fill a tank with petrol) and to servicing (only once every two years) – the cost of new EVs can range from around $47,000 for an MG ZS EV to more than $350,000 for a Porsche Taycan.

Tasmanian company, The Good Car Company, buys used EVs from other countries and reconfigures them for the Australian market. A $10 million investment from tech entrepreneur Mike Cannon-Brookes and a $1 million investment from Canva co-founder Cameron Adams and his wife Lisa Miller will help the business put around 2,000 low-cost EVs on the market.

The Good Car Company founder Anthony Brose van Groenou says the mission of his business is to “make EVs affordable for everyone”. With most EVs starting at around $80,000, his vehicle’s $20,000 price tag will be palatable for many consumers.

“Our mission is quite simple: it is to enable everyone to access cleaner, more affordable transport and energy. By doing that, carbon emissions are reduced by thousands of tonnes – it’s a win-win,” van Groenou says.

Log book

- EV sales accounted for just 5.71% of all vehicles sold in January 2023.

- 90% of all vehicle sales in Norway are electric.

- Toyota is the leading car manufacturer in Australia, with 13,363 vehicles sold in January 2023.

- The Ford Ranger was the most popular, with more than 4,749 sales (in January). Followed by Toyota’s Hi-Lux with 5,073 sales.

- Hybrids are increasingly popular – accounting for 12.28% of vehicles sold during January.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up for the Forbes Australia newsletter here.