Going for gold: Why now might be the time to invest in precious metals

BRANDVOICE

Diversification in all investment portfolios is key, and precious metal assets like gold, silver and platinum can form part of that strategy. Like other assets, precious metals can fluctuate in value depending on market conditions, but Gold Bullion Australia Group director, Matt Colahan, says 2024 may be the perfect opportunity to invest.

Against a backdrop of geopolitical tension, global elections, and a high-interest rate environment, there’s a lot of uncertainty in equity markets this year. In times of uncertainty, investors often turn to safe-haven investments, like bonds and defensive stocks.

Precious metals may also prove a strategic asset to hold in times of increased volatility, according to Gold Bullion Australia (GBA) Group director, Matt Colahan.

“In every portfolio, there are right times and right weighting for everything. But, we believe there’s always a right time for some percentage of precious metals as a portfolio diversifier. Being a diversifier, it acts as an insurance policy for a portfolio, and can protect you against either economic or geopolitical shocks.”

Like inflation. The most recent consumer price index figures reveal inflation rose 3.4% in the 12 months to January 2024. While it’s the lowest annual inflation since November 2021, Colahan says precious metals can help protect against inflation with no counterparty risk.

“Despite inflation coming down a little bit at the moment, it’s sticky. And gold typically outperforms inflation, so it’s a great thing to have as part of your portfolio. You can think of it as an insurance policy that’s indexed above inflation. It’s just a great diversifier.”

GBA Group offers multiple ways to invest in precious metals.

The privately-owned business has more than 40 years of precious metals experience across gold, silver and platinum group metals market. Since its launch in 1980, its services have expanded throughout Sydney, Melbourne, Brisbane, Gold Coast, Sunshine Coast and internationally to Singapore.

The company provides an exclusive and discreet transaction service to all customers, regardless of the size of investment – whether it be as little as a single silver coin, or $25 million worth of gold bars. Both transactions of this kind have been facilitated at GBA.

Colahan is a big believer that GBA customers are long-term and providing investors with the best possible experience is key. “Rather than pressing them into an investment, we let them decide. And we typically have happy clients that come back.”

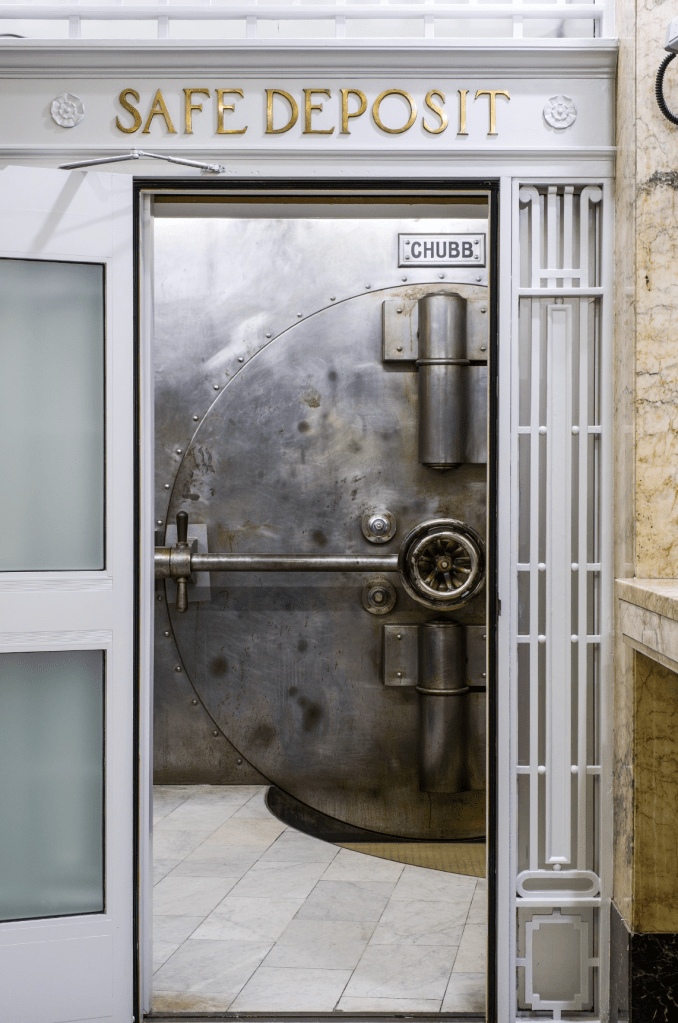

It also offers various vaulting solutions and safe deposit boxes services, where bars are numbered and stored, and investors can access their purchases at any time, for either withdrawal or inspection.

Its Singapore division also offers a portfolio management service, which uses an algorithm to invest in a group of different precious metals on behalf of customers. The weighting towards each metal will depend on the customer’s risk profile.

“All of it is backed by physical assets, and all of it is fully audited for the clients. So, we can go from one ounce of silver, which is about $30, all the way through to very sophisticated, portfolio-managed precious metal solutions.”

Trustees of self-managed super funds (SMSFs) may also opt to add precious metals as an asset to their investment portfolio, and GBA supports this.

Bullion bars, bullion coins and Pool Allocated products tend to be the most popular.

“There is a requirement for SMSFs that, if you keep precious metals in your own storage, they need to be independently audited. That’s quite onerous, so SMSF holders can acquire precious metals with us as part of their SMSF, store it in our vaults knowing that we’re insured, underwritten by Lloyds of London.”

This information is general only and not professional advice. Seek independent advice before making decisions. We are not liable for any loss resulting from reliance on this information.

This story featured in Issue 10 of Forbes Australia. Tap here to secure your copy.