JSHealth co-founders Jessica Sepel and Dean Steingold are eyeing international expansion amidst an explosion in the global vitamins market. But as Sepel explains, the bigger you get, the more challenges you face.

This article was featured in Issue 10 of Forbes Australia. Tap here to secure your copy.

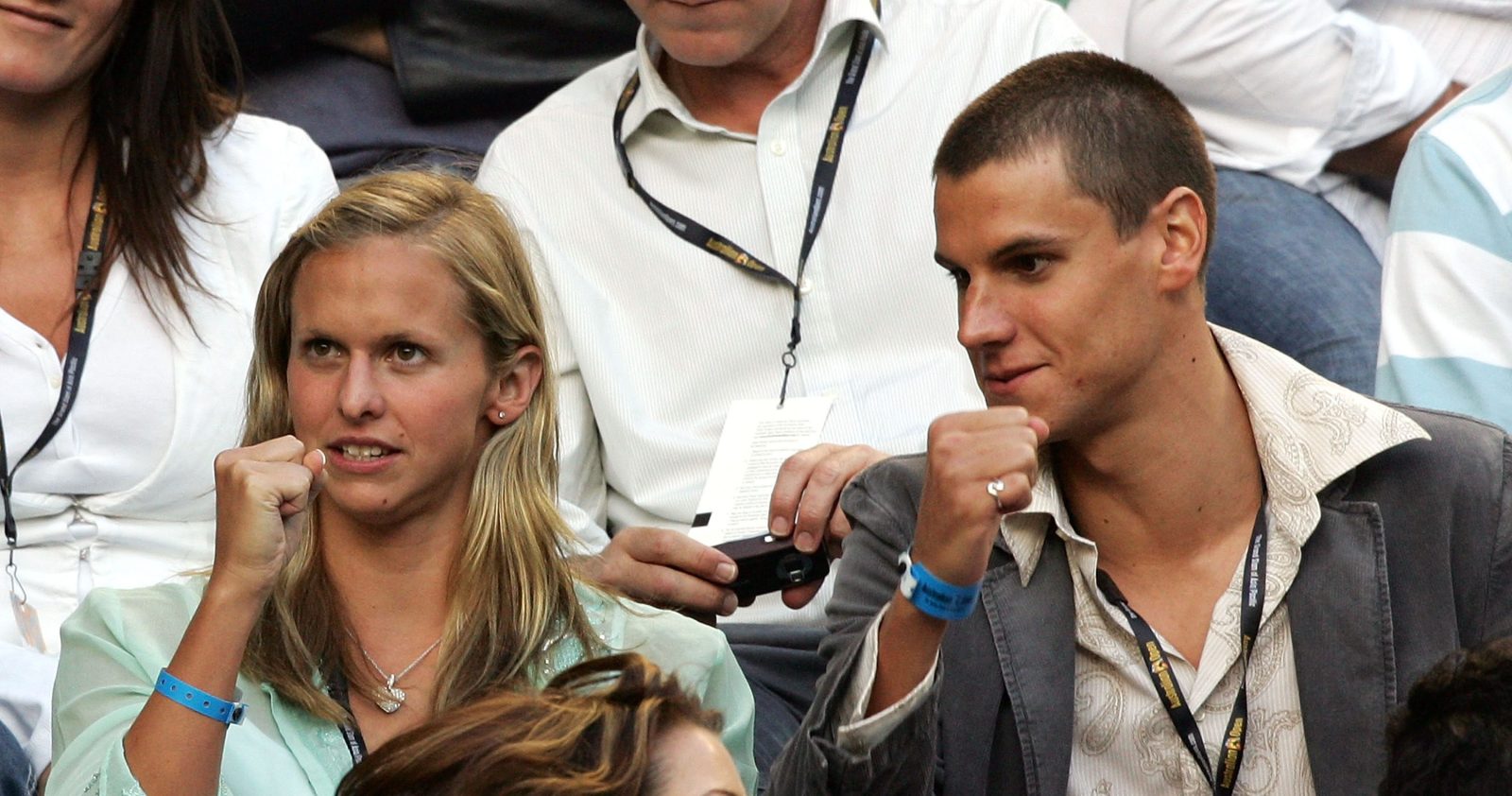

What would motivate someone to move from a $15-million-dollar Sydney mansion? For JSHealth Vitamins co-founders Jessica Sepel and Dean Steingold, it was dreams of global expansion.

The couple are in Los Angeles, where they’ve been living for the past eight months, intending to grow their vitamin empire.

The company, officially launched in 2018 out of Sepel’s then-much-smaller home in Vaucluse, now sees its products stocked in more than 1,800 retail stores in Australia, including Priceline and Chemist Warehouse, and more than 1,000 in the United Kingdom.

But, after experiencing exponential growth in the US (300% year-on-year, according to 2023 company figures), Sepel and Steingold say they made the call to move to California to build the team on the ground.

“We’re back into the building phase,” Sepel says. “We’re typical entrepreneurs in that sense – in how we function and roll with it. We’ll jump anywhere we need to for the business, and it’s growing quite fast here [in the US], so we’re here to see that through.”

But it all comes with a cost. “The bigger you get, the hotter it gets,” Sepel says. “I will always say being a small business is preferable in terms of everything but financial gain. The stakes get so high.”

Their plans are fuelled by the boom in the wider global dietary supplements market, which was valued at US$177.5 billion in 2023 and is projected to grow at a CAGR of 9.1% between 2024 and 2030, according to Grandview Research. The buzz around preventative healthcare is driving that growth, and so is the ageing population. Vitamin supplements comprise the bulk of this market at 30%, followed by botanicals, proteins and amino acids, and minerals.

“There is a major focus in the market and shift towards ingestible beauty,” a spokesperson for Chemist Warehouse says.

“The introduction of the JSHealth brand in our stores around the country enables us to meet this demand and provide our valued customers with a direct in-store line to the brand’s popular products.”

The pair, both South African-born, were reportedly valued at a combined $454 million in 2023, hile the company, according to other media reports, was valued at close to $600 million in 2021. But their success has been more than a decade in the making.

It feels like a spiritual calling – I’m not even joking,” Sepel says. “I’m not actually a woo-woo person, believe it or not, but it does feel like a gravitational pull.

Jessica Sepel, founder, JSHealth Vitamins

Sepel’s namesake vitamin brand evolved from her health blog, which she launched in 2012 after a decade-long battle with dieting and disordered eating. Days after switching her Blogspot site from private to public, Sepel amassed 20,000 visits. That same year, she published an e-book, which sold about 10,000 copies. By 2014, the book deals rolled in for The Healthy Life, Living the Healthy Life and The 12-Step Mind Body Food Reset.

While Sepel says she was earning a solid income from her book sales and endorsement deals, it wasn’t until February 2017 when the business went into overdrive with her JSHealth 8-week Program.

“The 8-week program was when JSHealth really began,” Sepel says. It was a meal plan developed by Sepel that promised to help users live a “happy, healthy and balanced life”. For $149, or $18.63 a week, the book was a hit. The business grew from about $400,000 to $7 million in 12 months.

Sepel struck while the iron was hot, launching her JSHealth Nutrition app in 2018, and a year later, had amassed more than 50,000 downloads. In the meantime, Steingold, who was

working to build his own business, IT consulting firm, Mall Ops, had joined Sepel’s growing empire.

“It was a big risk,” he says. “I mean, we were putting our eggs into one basket. And it’s a start-up. You have no idea how these things are going to go. But, we thought giving her community amazing products and letting her do what she loved to do outweighed the risk we were taking on our personal lives to hopefully financially sustain us.”

And together, the pair had begun toying with a product. They attempted to launch a cereal, estimating they lost about $30,000 in the process, but Sepel, who studied health, says her passion was always vitamins.

“It feels like a spiritual calling – I’m not even joking,” Sepel says. “I’m not actually a woo-woo person, believe it or not, but it does feel like a gravitational pull.”

There’s a lot at play in Sepel’s early life that she attributes to this pull: her grandmothers – on both sides – would start their days with trays of vitamins and were both early-day biohackers, eating probiotic-rich foods and taking cold showers. The co-founder also worked at Priceline as a teenager, and in a full-circle moment, her brand is now stocked there.

“I remember just hanging out in the vitamin aisles and I used to drive the pharmacists crazy, just asking them, ‘What does this do? What does that do?’”

And so, as Sepel built her health brand, she was plotting how to create her own vitamin company – despite warnings from industry peers. “I was always told, ‘It’s a dangerous world. Don’t get into it, you’ll lose all your money.’”

Well, maybe not all. But thousands. To cut a long story short, the pair tried and failed to engage several manufacturers, were scammed out of $10,000 somewhere along the way, and found themselves with only $40,000 left to spend.

Then, fortuitously, Sepel was introduced to a manufacturer in Sydney’s Northern Beaches, whose father worked with Marcus Blackmore’s father and who Sepel claims pioneered the vitamin industry in Australia. The pair convinced this manufacturer to create a small run of 2000 units of Sepel’s first major creation, the Hair + Energy formula. It sold out in four weeks. JSHealth uses the same manufacturer to this day.

Five months post-launch, revenue from JSHealth’s Vitamins range had jumped 326%, which the pair credit to Sepel’s loyal community (Sepel boasts nearly 1 million followers between personal and business accounts) and innovative marketing (labels convey the problem the user wants to solve, like Anxiety + Stress).

“No one had ever put the pain point on the label. People don’t realise that, and I never understood why that hadn’t been done,” Sepel says.

Six years on, 34-year-old Sepel and 38-year-old Steingold employ more than 60 staff members globally, and the company has grown its workforce by more than 40% in Australia to invest in strategic support functions and scale revenue-driving roles.

There have been some teething issues: in 2022, the Therapeutic Goods Administration (TGA) fined JSHealth Vitamins $26,640 for unlawful advertising after claiming its Turmeric+ supplement could prevent “serious health conditions”. That same year, certain Detox + Debloat supplement batches were recalled for failing to contain the appropriate warning labels. And again, in March 2023, the business copped another fine, this time $13,320, for alleged unlawful supply of a complementary medicine.

“The way we do vitamins, and the incorporation of social media, it’s all so new to the FDA and the TGA, whom I have a strong relationship with now,” Sepel says. “Regulatory bodies are also learning, and the more they learn, the more they can help us learn. So, you need to be in good standing,” Steingold adds.

However, the last reported growth figures (2022) show that business was up 57% year-on-year overall. It claims its Hair + Energy formula has been the number-one hair supplement product in Australian pharmacies for two years in a row*. Sepel counts Marcus Blackmore as a mentor after she invited him to lunch back in 2017.

“That day, I met an outstanding young woman who I’ve come to admire for her unbelievable passion and energy in our industry,” Blackmore says.

“My first exposure to JSHealth Vitamins was when my stepdaughter came home with a JSHealth product, to which I said, ‘Why are you paying for that when I can get you vitamins for free?’ I then started to understand better what makes JSHealth Vitamins a success in a fairly crowded space.

It sounds so cliché, but I know my formulations are the best in the world. And my goal is just to be the most trusted vitamin brand in the world.

Jessica Sepel, founder, JSHealth Vitamins

“Her product range, her podcasts, her attention to millennials and excellent use of social media were all a relatively new combination to this industry. Her business success is testimony to her marketing approach and desire to learn more. I enjoy our discussions.” But that’s not the experience Sepel has had with all industry members.

In 2022, vitamin manufacturer Life Botanics, owned by Jimmy Seervai, began employing comparative advertising techniques, claiming its products contained the same ingredients as JSHealth’s but at a fraction of the cost. Sepel and Steingold sued Life Botanics and Seervai in the Federal Court for misleading or deceptive conduct and copyright infringement, and the matter settled in December. Life Botanics and Seervai gave undertakings to the court not to disparage JSHealth or reproduce JSHealth’s content.

“It was very tough on me,” Sepel says. “I don’t have children, JSHealth is like my baby, and I don’t know what it’s like to have children, but I can only imagine that feeling of, ‘I need to protect you’.” But there’s a lesson in it for Sepel: “In business, being emotional is probably not a good idea.”

Steingold’s a little less bothered. “At the end of the day, [imitation is] the biggest form of flattery. It’s a compliment beyond a compliment. And we could not be happier with the result.”

The pair are eyeing growth and taking a slice of the vitamins market, which has historically been occupied by global giants, like Blackmores, which was bought out by Kirin Holdings in 2023 in a $1.9 billion deal, and Swisse, which is owned by the $1.5 billion Hong Kong-based vitamin company Health & Happiness. Nature’s Way, owned by PharmaCare Laboratories, is also up there. In a 2023 interview, PharmaCare’s CEO, Glenn Cochran, estimated it held 15% of Australia’s supplement market, while Blackmores and Swisse each held about 14%.

JSHealth is set to expand throughout the US, and in July this year, the pair are launching into Watson’s Pharmacy, a top health and beauty retailer in Singapore.

“I want to be in as many people’s hands as possible,” Sepel says. It is easier said than done – each country has regulations and logistical problems.

“As a tech company, before you expand, it’s just, ‘How do you get market share?’ But with vitamins, there’s a new environment and regulations to contend with. If we want to enter a new country, we can’t have an Australian team looking at the regulations in that country. We have to start from scratch. It’s very strategic, and it’s bit-by-bit. You can’t rush it,” Steingold says.

While Blackmores was formerly an ASX-listed business, it’s not in Sepel’s vision to be there. So far, the business has taken on only two external investors, holding a 23% stake between them.

“Those investors, they’re more like mentors to us,” Steingold says. “We didn’t want to bring them on because we needed extra money for marketing. I’ve worked with these people for over 15 years – they’re like father figures to us.”

While they admit they look at buy-out or investment opportunities as they are presented there are no immediate plans to accept further investment or list publicly, the pair say.

“It sounds so cliché, but I know my formulations are the best in the world. And my goal is just to be the most trusted vitamin brand in the world,” Sepel says.

*In terms of retail value sales, IQVIATM, Pharmacy Sell Out Service, Hair, Skin and Nails Supplements and Hair Growth Supplements Vitamins category, Value Sales, 52 weeks until W/E 31-10-2023.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.