After slowing down last year, venture capital deals for Australian startups look even scarcer in 2023. But not all sectors are equal, with some more favoured than others. Data journalist Juliette O’Brien takes the pulse of this country’s startup ecosystem and reveals where the money is flowing.

It’s been a sluggish start to 2023 for Australia’s venture capital scene.

Cut Through Venture, which gathers validated data via public and private sources, reports that Australian startups raised $661 million in the first quarter of the 2023 calendar year via 82 deals. This time last year, they’d raised double that. In 2021, it was five times that amount.

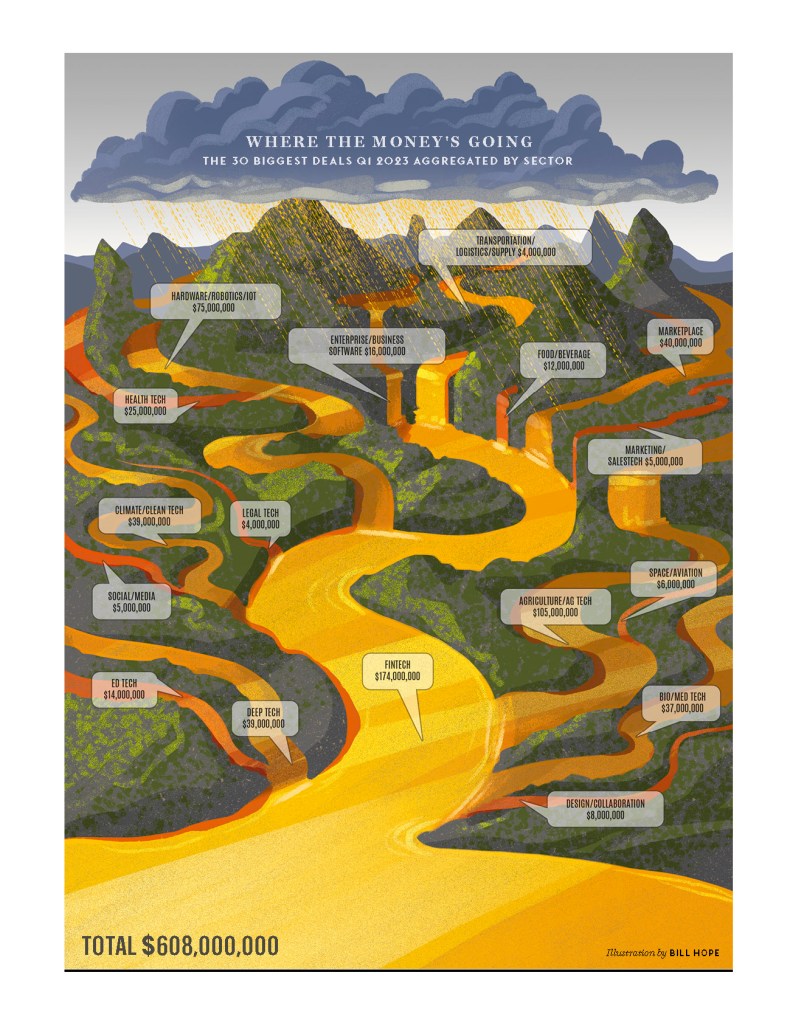

Where are the rivers of VC money flowing? And where are they dry?

AI is in. Crypto is out.

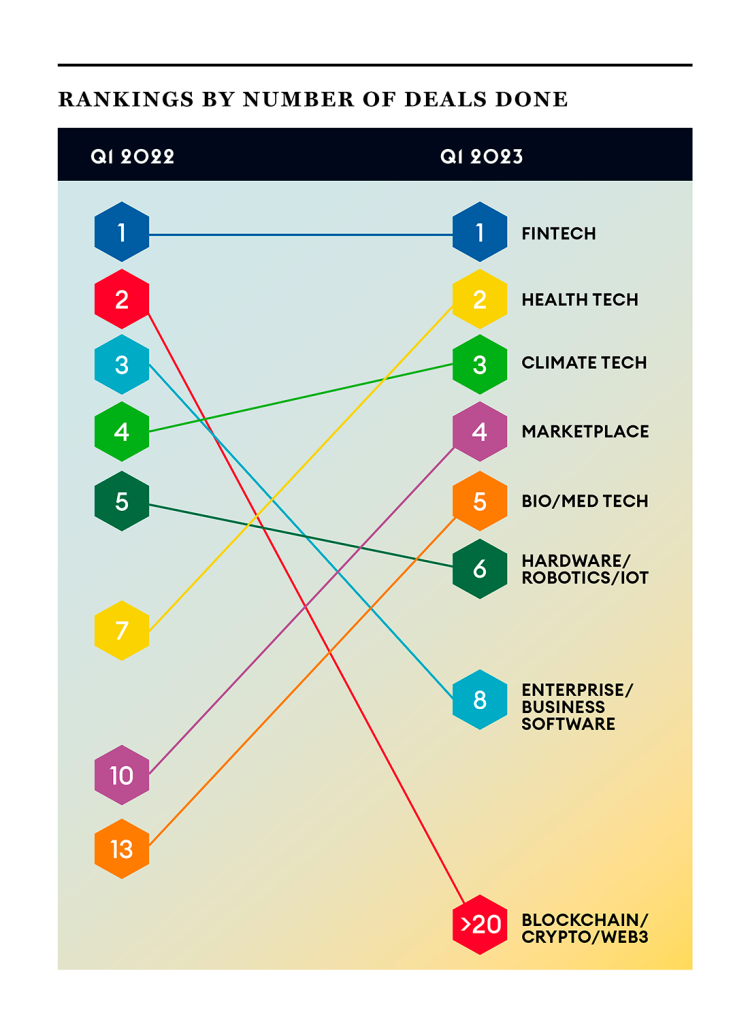

Blockchain, Crypto, and Web3 companies were among the most highly funded startups this time last year – both in real dollars and the number of deals. But the sector has fallen out of the top rankings (Chart 1).

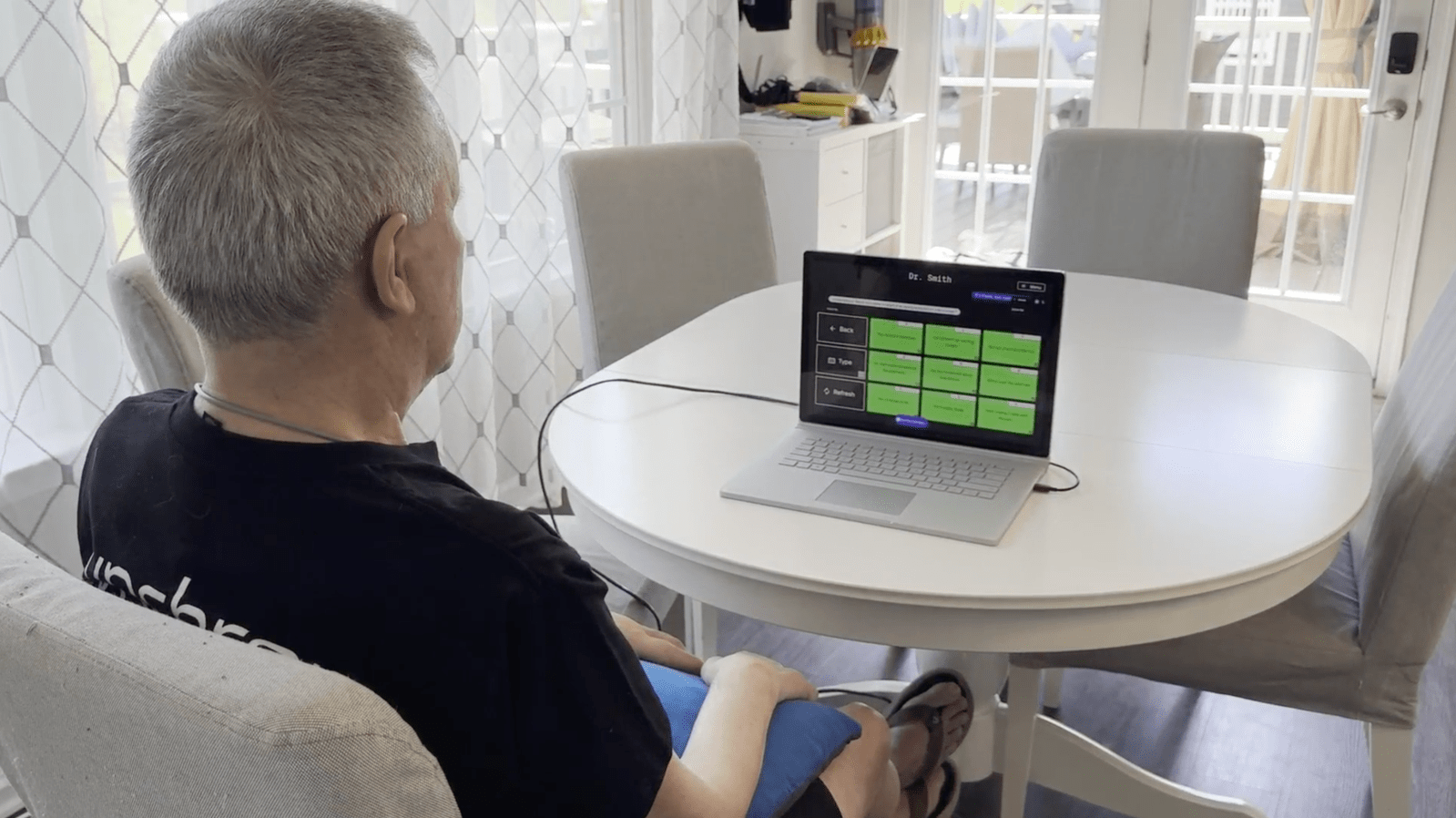

The rise of companies making Hardware, Robotics, and the Internet of Things (IoT) has coincided with OpenAI’s spectacular release of ChatGPT in late 2022. GigaComm, Lumiant, Milo, Quantum Brilliance and SwarmFarm Robotics collectively raised $75 million in the last quarter.

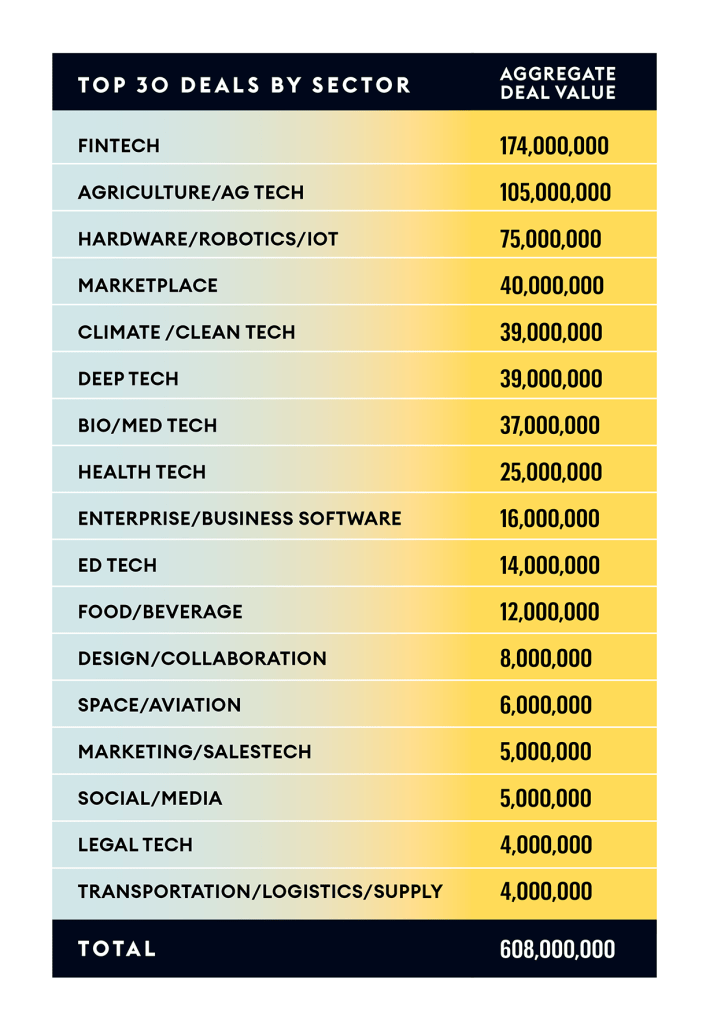

The Fintech sector has kept a firm grip on the top rankings – both in real dollars and the number of deals. Cut Through Venture says one in ten VC deals go to the Fintech sector. Looking at the biggest deals so far this year (which represent 92% of all funds raised), five leading FinTech startups raised $174 million (DataMesh, Hnry, SendFX, Shift and Till Payments).

The next biggest sector was Agriculture / Ag Tech, thanks to a mega funding round for one company – Loam Bio.

But when it comes to data, taxonomies are everything. Loam Bio is a carbon farming startup developing technology to improve CO2 storage in soil.

The remainder of Climate and Clean Tech deals may not have put the sector in the top five by funds raised, but it is the third biggest by deals done (Chart 2).

Despite mega deals slowing amidst global uncertainty, VCs insist Australia’s startup ecosystem is healthy. Eyes are on smaller deals in trending sectors for the rivers, or trickles, of gold.

Data source: The State of Australian Startup Funding and Cut Through Quarter, Cut Through Venture and Folklore Ventures.

Data notes: Data refers to deals in Q1 2023. Categories without number rankings have fallen out of the top 5 and have no clear ranking.