Australia will soon produce its own mRNA vaccines, with Moderna’s Melbourne plant set to deliver doses by the end of 2025. The facility promises 100 million shots a year, $220 million in annual GDP, and $4.8 billion in avoided costs over three decades.

Key Takeaways

- Moderna has opened Australia’s first large-scale mRNA vaccine manufacturing facility in Melbourne which is expected to produce its first vaccines within months.

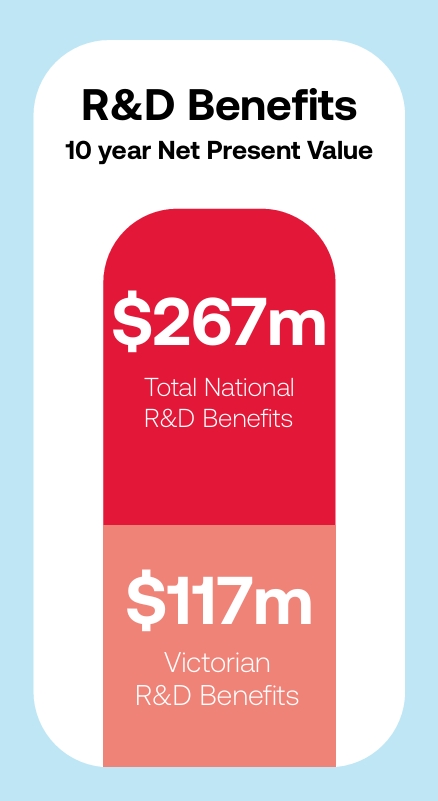

- A study by Oxford Economics found the facility would deliver $4.8 billion in benefits over 30 years, including $1.33 billion in avoided lockdown costs and $3.47 billion in health-related benefits.

- US Health secretary cancelled US$500 million in mRNA vaccine development funding last month, directly affecting Moderna.

- The Moderna Technololgy Centre – Melbourne, or MTC-M, is expected to produce up to 100 million vaccine doses annually.

- The facility is forecast to add $220 million to GDP each year, employing 140 people directly, and 850 indirectly.

- The move comes amid growing vaccine hesitancy and politicisation of health policy in the U.S.

Key Background

When COVID-19 struck, Australia was left at the back of the global vaccine queue, reliant on foreign governments and global supply chains. The scramble exposed a critical gap: the country lacked sovereign manufacturing capacity for cutting-edge vaccines.

Moderna’s new Melbourne Technology Centre (MTC-M) is intended to close that gap. The facility, located in the Monash Technology Precinct, is the first in the Southern Hemisphere capable of producing mRNA vaccines end-to-end. With the ability to scale up quickly in an emergency, the plant is expected to secure Australia’s vaccine supply and reduce reliance on overseas producers.

Nine newspapers reported in November that the Australia’s audit office would probe the Morrison government’s $2 billion deal with Moderna to set up the facility. Australian vaccine manufacturer CSL had reportedly offered to make inoculations here for less money.

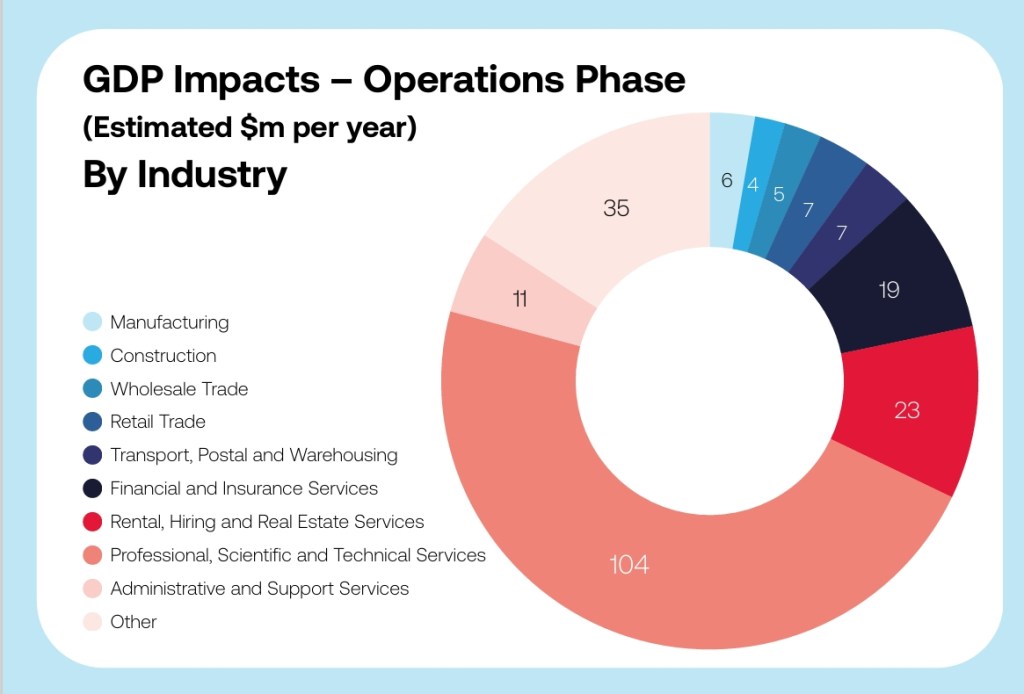

Oxford Economics estimates the centre will contribute $96 million in direct GDP annually, with a further $124 million from flow-on economic activity.

Oxford Economics Head of Economic Impact, Michael Brennan said the case for domestic

mRNA capability is compelling. “Pandemic preparedness is not just a health priority – it’s an

economic imperative. Our modelling shows that the Moderna mRNA facility in Melbourne

could save Australia billions in the event of a future health emergency by avoiding lockdowns,

reducing health impacts and improving wellbeing.”

Tangent

While Australia shores up its vaccine independence, political fault lines in the U.S. are widening. The so-called “MAHA” (Make America Healthy Again) movement has fuelled mistrust in vaccines and created uncertainty about long-term public health policy in the world’s largest pharmaceutical market.

In August, US Health Secretary Robert F Kennedy Jr announced he was withdrawing funding for development of mRNA vaccines aimed at flu and COVID-19, claiming “mRNA technology poses more risks than benefits for these respiratory viruses”. This claim is disputed by medical authorities.

For Moderna, investing in Australia not only diversifies its manufacturing base but also situates it in a jurisdiction where bipartisan consensus still exists on the value of vaccination and pandemic preparedness.

Big Number

US$204 billion. That was Moderna’s peak market capitalisation, in August 2021, the same month that Australia approved its COVID-19 vaccine. It has been steadily falling ever since, settling at at market cap of less than $10 billion today.