Once a Melbourne university spin-out, now a billion-dollar U.S. medtech, Synchron has secured $308 million to accelerate brain-computer interfaces — and Australia’s government is paying to bring it home.

Key Takeaways

- Australia’s government venture arm, the National Reconstruction Fund, chipped in $54 million for the now Brooklyn-headquartered company.

- The Series D round was led by Double Point Ventures, alongside existing investors ARCH Ventures, Khosla Ventures, Bezos Expedition, NTI and METIS.

- If it was still an Australian company, Synchron’s $308 million raise would be the largest bio-med capital raise in the country’s history.

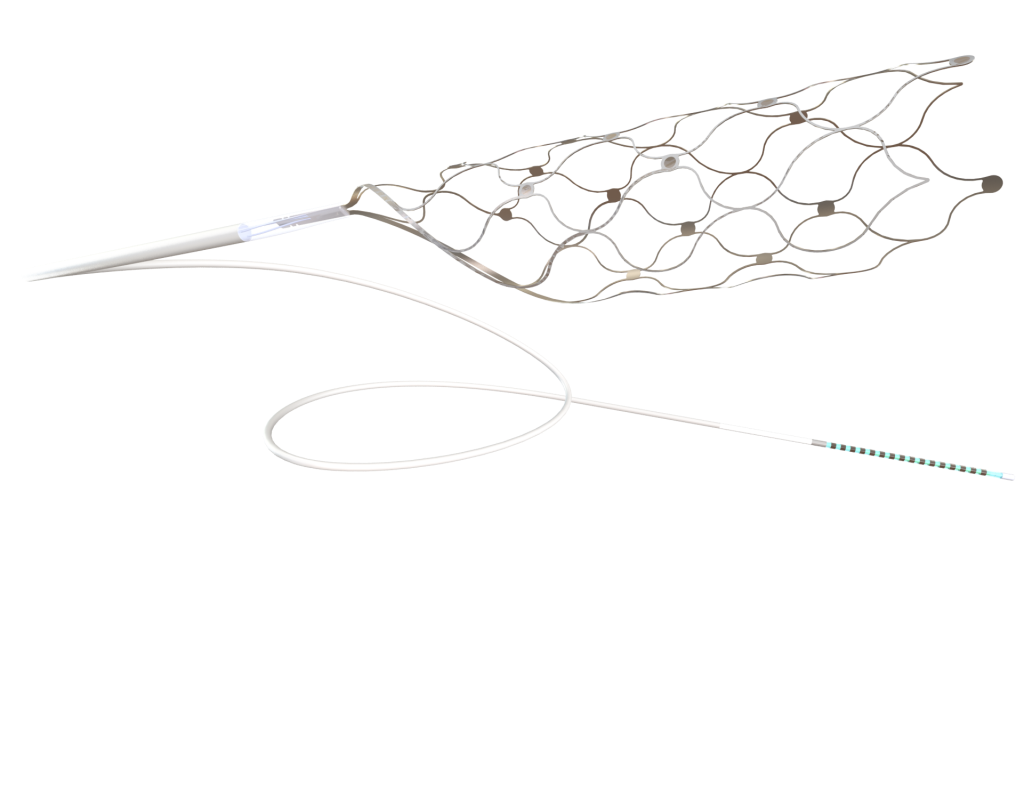

- The money is earmarked to finish clinical trials and accelerate commercialisation of the company’s first-generation Stentrode BCI platform.

- The money will also go towards developing in-brain hardware that will “leapfrog” Elon Musk’s Neuralink, Synchron co-founder Tom Oxley tells Forbes Australia.

- The financing brings Synchron’s total funding to $545 million [US$345 million, valuing the company at “about US$1 billion”], barely a quarter of the $2 billion [US$1.3 billion] raised by its competitor, Neuralink.

Key Background

Synchron’s brain computer interface was developed by founders Tom Oxley, a neurologist and brain surgeon, and Nick Opie, a professor of bio-medical engineering in 2011.

Synchron spun out of the University of Melbourne in 2012, but relocated its headquarters to Brooklyn in 2016.

It had its first devices in humans, operating their computers with only their thoughts, by 2019, five years ahead of Musk’s Neuralink.

Synchron’s Stentrode devices have been placed in 10 patients with paralysis across clinical trials in the U.S. and Australia, allowing them to use computers and devices with only the power of their thoughts.

Synchron was the first brain-computer-interface [BCI] company to integrate Apple’s BCI-human interface device (BCI-HID), having co-developing a Bluetooth-based iOS protocol that connects brain activity directly to Apple devices – no touch, voice, or eye-tracking required.

Tom Oxley moved to the US to raise money and complete his brain surgery qualifications while co-founder Nick Opie remained in Melbourne to run the R&D, but the Melbourne operation has been scaled back to almost nothing in recent years as Opie stepped back from the company [remaining on the board as a significant equity holder] and R&D moved to San Diego and Brooklyn. Key staff went to the US.

Why did you leave?

But that momentum began to shift when Oxley was contacted by the National Reconstruction Fund’s Rachel Levin earlier this year.

The National Reconstruction Fund Corporation was set up in 2023 by the Albanese government as a sovereign fund with $15 billion to invest in important industries.

“She reached out to me asking why Synchron had left Australia,” Oxley tells Forbes Australia. “I told her I couldn’t raise capital in Australia. I raised the money in the US. The investors wanted me to move to the US. So I did.”

They kept a research group going in Australia but timezones were challenging.

“Then I did the Series B in 2020. Again, no Australian investors joined, and the Series C in 22, no Australian investors. Where your investors are matters because they have a network, they want you to be successful, they open doors for you.

“So I just never had anything pulling me back to Australia. Eventually we shut down the clinical group there.”

Oxley told Levin – an American molecular biology PhD with a start-up background – that they were doing a Series D. She said she’d take a look.

Levin had $2 billion to work with that the NRF had allocated to bio-medical and healthcare investments. At this point it had put $150 million into biomed venture fund Brandon Capital and $32 million into medical unicorn Harrison AI.

To put the money in, the NRF needed to see Synchron coming back to Australia. It wanted Synchron to establish its Asia-Pacific commercial base in Melbourne, and it wanted to see Australians in the pivotal trial.

The NRF is mandated to aim for a five-year return of 2% to 3% above the government bond rate, NRF CEO David Gall tells Forbes Australia.

“I don’t think of it as picking winners,” Gall says. “But we do need to make sensible investments. We do a very thorough due diligence … There’ll be a lot of companies we choose not to invest in, but when you look at the companies we do invest in and what they do for the industries they’re in, what they do for the regions they’re in, what it means for jobs and how that impacts further opportunities, you’ll see we’re building on Australia’s comparative advantages.”

Help wanted

Asked if the NRF had imposed concrete requirements for what Synchron needed to do in Australia, he says: “We have an understanding where they are going to invest. The reality is, Synchron had options. They could have gone anywhere in the world and there were a lot of investors courting them.”

Oxley was happy with the deal. “It’s been great because there’s something pulling us back to Australia,” he says. Having taken key staff to the US in recent years, scaling down its Melbourne operation to just enough to look after existing patients, Synchron is now employing again. “We’re looking for local talent in Melbourne and Sydney in clinical and machine learning and in engineering,” says Oxley.

Hardware leapfrog

The next frontier is connectivity — and Synchron believes its less-invasive system can surpass Neuralink’s surgical approach.

Part of the newly raised money is will go to building better in-brain hardware, says Oxley. “We have a very exciting breakthrough which is going to be a next-generation system … I can’t talk too much about it, but it enables us to deliver lots and lots of sensors into multiple brain regions – still using catheters.”

While Synchron has been in front of Neuralink in hitting key milestones, one of the advantages that Neuralink has had over Synchron is the perception that its approach of inserting electrodes into the brain via surgery will give it greater connectivity to the neurons than Synchron’s less-invasive use of a catheter up through the jugular vein.

But Oxley predicts they will “leapfrog” Neuralink’s apparent advantage there. “It’s a different type of approach and it doesn’t go through the skull. It’s been a long time to figure out how to do this. We think we’ve got a big breakthrough that we’ll probably announce in the later half of 2026.”

Tangent

The NRF’s second largest bet, $150 million, was on med-tech venture fund Brandon Capital. Asked if Brandon had ever back Synchron, Oxley said, “Brandon didn’t think we were going to be successful.”

Big Number

US$9 billion. That’s how much competitor Neuralink is valued at, having raised $US1.3 billion in search of a brain computer interface.

Asked how Synchron got into humans four years before Neuralink with barely a quarter of the money, Oxley says, “I don’t know. Ferrari had 10 times as much as McLaren. And Bruce McLaren once said, if I had as much money as Ferrari, I wouldn’t know what to focus on.”

$680,000,000 down, $14,320,000,000 to go

Where the National Reconstruction Fund has spent its $15b budget to date.

Company / Fund | Investment | Description |

|---|---|---|

$200 million | Boosting supply chain resilience for critical minerals in the net-zero transition. | |

$150 million | Investment fund to help create and scale next-gen Australian medical breakthroughs. | |

Resource Capital Funds | $100 million | Emerging technologies driving safer, cleaner and more efficient mining. |

Liontown Resources | $50 million | Supporting lithium production and processing for batteries. |

Russell Mineral Equipment | $40 million* | Mine safety equipment made in regional Australia. |

$35 million | A new kind of Wi-Fi chip, Wi-Fi HaLow, letting devices connect over longer distances using less power. | |

$32 million | AI technology for diagnosing conditions like cancer. | |

PolyActiva | $27 million | Groundbreaking eye implant technology to treat glaucoma. |

Myriota | $25 million | World-leading satellite technology delivering real-time tracking for Australian businesses. |

Vault Cloud | $22.5 million | Storing defence and critical infrastructure information in Australia. |

$15 million | Cyber-security threat protection. | |

$13 million | A world-first diamond foundry for quantum computing. | |

Hypersonix Launch Systems | $10 million | Next-generation hypersonic aircraft that travel at Mach |

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.