Data journalist Juliette O’Brien examines the numbers that show young Australians are rewriting the investment playbook, backing portfolios over property. Is this a structural shift in wealth building or a cycle driven by fashion and hype?

This story appears in Issue 20 of Forbes Australia, out now. Tap here to secure your copy.

With property prices soaring and wages stagnating, young Australians are taking control of their wealth creation. They are building their futures less through bricks and mortar, and more through markets.

The latest available Australian Bureau of Statistics (ABS) Survey of Income and Housing data (from 2020) showed the value of shares held by 25-35-year-olds jumping 118% in two years, while the overall change across all age groups fell 10%.

It’s partly explained by older investors selling down losses while younger investors bought the pandemic dip. But more recent data suggests this was not a one-off shock, but a shift that has gathered pace.

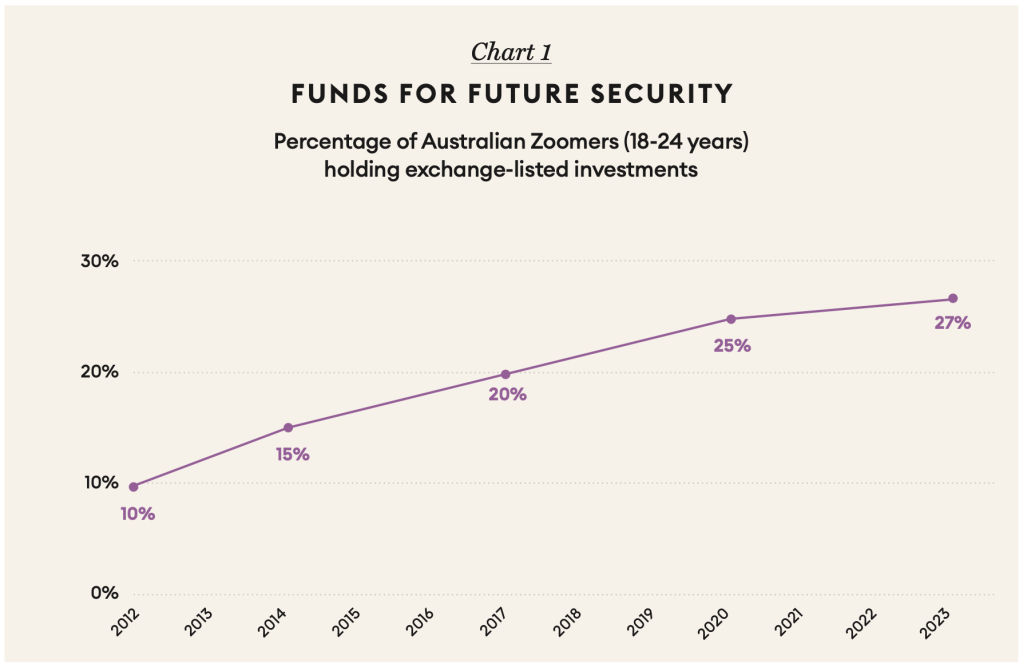

The ASX publishes an Australian Investor Study every three years, surveying roughly 5,500 adults – both investors and non-investors. A Forbes analysis of the survey data found that in 2023, ownership of exchange-listed investments among Zoomers (18- to 24-year-olds) reached 27%. (Chart 1).

The older demographic group, labelled ‘Wealth Accumulators’, are aged 25 to 49 in the 2023 report and 25 to 59 in the 2020 report. They also increased their exposure to market assets, but in different ways (Chart 2).

Between 2020 and 2023, both Zoomers and Accumulators embraced bonds and walked away from term deposits as returns dwindled. They also piled into exchange-traded funds (ETFs) and crypto assets, which appeared in the ASX Survey for the first time in 2023.

Property was the main difference. Older investors increased residential investment property holdings by 3.3 percentage points (20.1% to 23.4%), while Zoomers grew theirs by just one point (12% to 13%).

Zoomers instead turned to shares. Even though a larger proportion of Accumulators already own stocks, Zoomers expanded both domestic and international holdings at a faster pace.

Direct ownership of Australian shares rose among Zoomers by four percentage points (13.6% to 17.6%), compared with 2.6 points for Accumulators (26.5% to 29%). For international shares, Zoomer ownership grew by 4.6 points (5.7% to 10.3%) and 3.9 points among Accumulators (7.8% to 11.7%).

Share trading platform CMC Invest reports a similar pattern in sign-ups. This year, Zoomer users increased by 25%, compared with 13% among Millennials and 10% among Boomers.

However, month-to-month data shows Zoomers are far more volatile, with sign-ups jumping 67% in April before falling 52% in May. Older cohorts moved far more steadily.

This suggests trend-driven trading, as Zoomers react to market mood and social buzz. When you look at the stocks they buy, they do favour the zeitgeist.

While the ASX surveys show who is entering the market and how asset mixes change over time, survey data from trading platform eToro provides a window into what younger investors choose once they are inside the market.

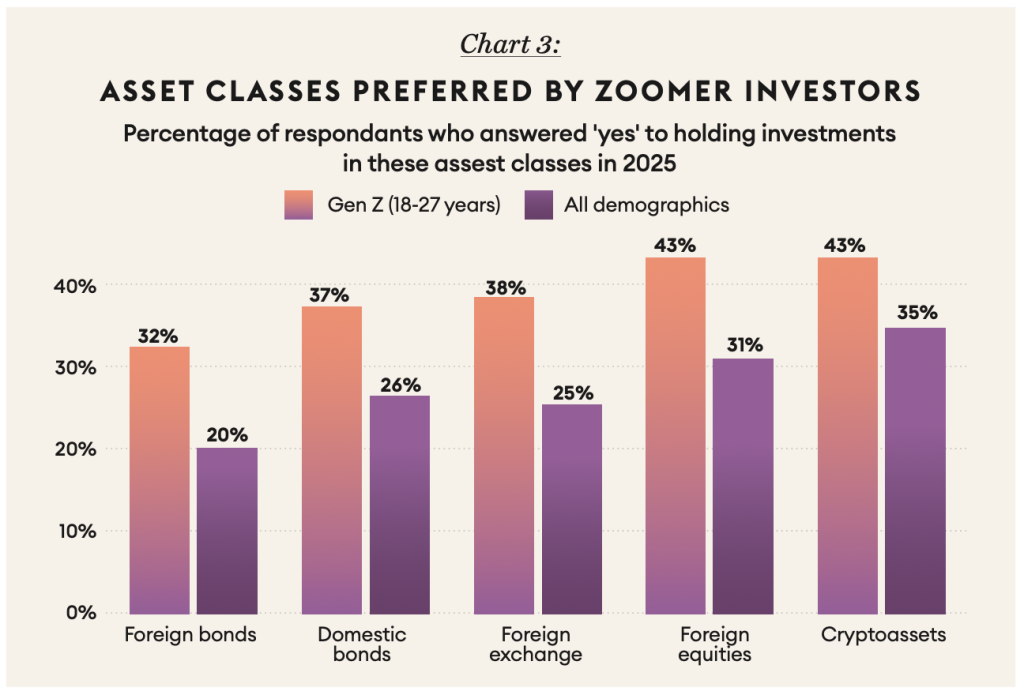

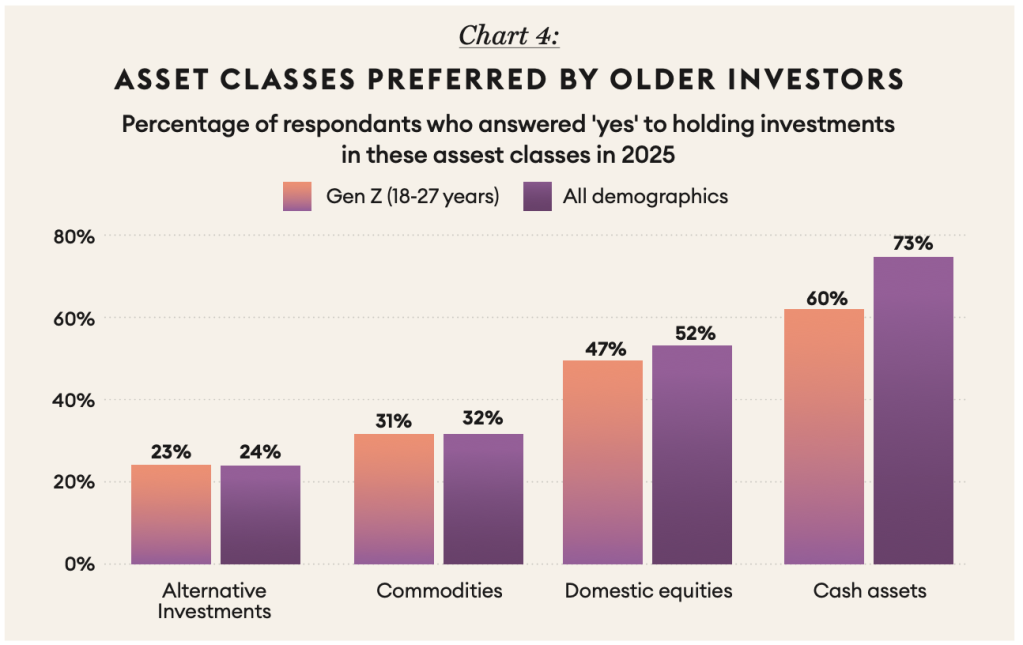

eToro’s Retail Investor Beat surveys 11,000 retail investors across 13 countries, including 1,000 Australians. Its report for the third quarter of 2025 showed that Gen Z investors (18- to 27-year-olds) were more likely than the broader group to trade cryptocurrencies, foreign stocks, foreign exchange, and bonds (Chart 3). They were less likely to hold cash, domestic stocks, commodities and alternative assets such as private equity (Chart 4).

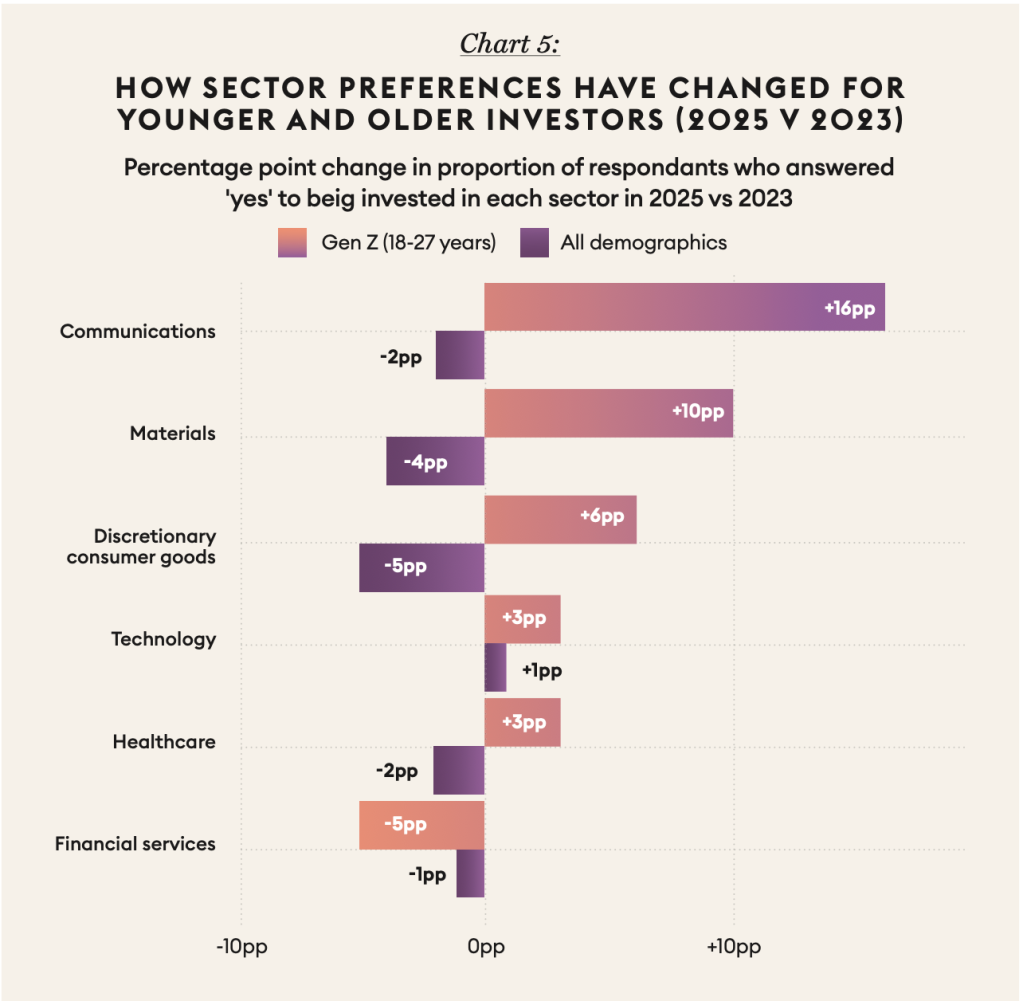

Between 2023 and 2025, the share of Gen Z investors holding communications sector stocks, including social media platforms, rose by 16 percentage points, while broader interest fell (Chart 5). Among E-Toro users, the top ten most-held assets among 18- to 24-year-old Australians were dominated by tech companies: NVIDIA, Tesla, Amazon, Apple, Microsoft, Meta, Alphabet, Advanced Micro Devices, Take-Two Interactive, and Palantir.

The question is whether this marks a structural change or a passing trend shaped by the attention economy and tech glamour. Young Australians have not yet lived through a serious correction as equity-first investors. The real test will come in a downturn.

Taken together, the data points to something more durable than a passing fashion, even if parts of it still look buzz-driven. If this generation holds its nerve when markets fall, it may look less like hype and more like a permanent rewrite of how wealth is built in Australia.

This article represents the views only of the subject and should not be regarded as the provision of advice of any nature from Forbes Australia.

The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance. You should seek independent financial and tax advice before making any decision based on this information, the views or information expressed in this article.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.