Formula 1’s most valuable teams 2023

Since the series tapped the brakes on constructors’ spending in 2021, valuations have been revving up, with Ferrari now worth $3.9 billion and Mercedes hot on its tail.

By Mike Ozanian and Brett Knight

In 2021, Swiss motorsports company Sauber was ready to sell a majority stake in its Formula 1 team, Alfa Romeo Racing, to Andretti Autosport at a valuation of about $350 million, two people with knowledge of the negotiations tell Forbes. When the deal fell through, Sauber turned to Audi and ended up parting with a minority stake in January at a valuation of roughly $650 million—nearly doubling the price in just 15 months, with an earnout that could push that number even higher.

Today, even that souped-up sale price looks like a bargain. Forbes now values Alfa Romeo Racing at $900 million, based on estimated revenue of $210 million for 2023.

It’s a similar story with Alpine, whose owner, Renault, revealed last month that it had sold a 24% stake to a group led by RedBird Capital Partners and Otro Capital in a deal that valued the team at just over $900 million. The terms of the agreement were locked in eight months ago, according to people familiar with the negotiations, and Forbes believes the team could now fetch $1.4 billion.

On average, Formula 1’s ten teams are worth $1.88 billion, according to Forbes estimates, an incredible 276% increase from the $500 million average when Forbes last valued the series’ teams in 2019 (using 2018 revenue figures). Ferrari leads the way once again at $3.9 billion—a 189% jump from 2019—with Mercedes close behind at $3.8 billion after a 274% rise.

The gain is largely the result of F1’s 2021 move to implement a cost cap that limits how much teams can spend, with the bar set at a base of $135 million for 2023 (excluding certain expenses such as engines and driver salaries, as well as inflation adjustments). The rule changes, along with the popularity of the Netflix series Drive to Survive and a new race schedule (with a Grand Prix added to Miami and one coming to Las Vegas this November), have helped stir new interest in a sport whose television audience had been in decline, pushing up team revenue from an average of $220 million in 2018 to $380 million this year, according to Forbes estimates.

Finding a new gear

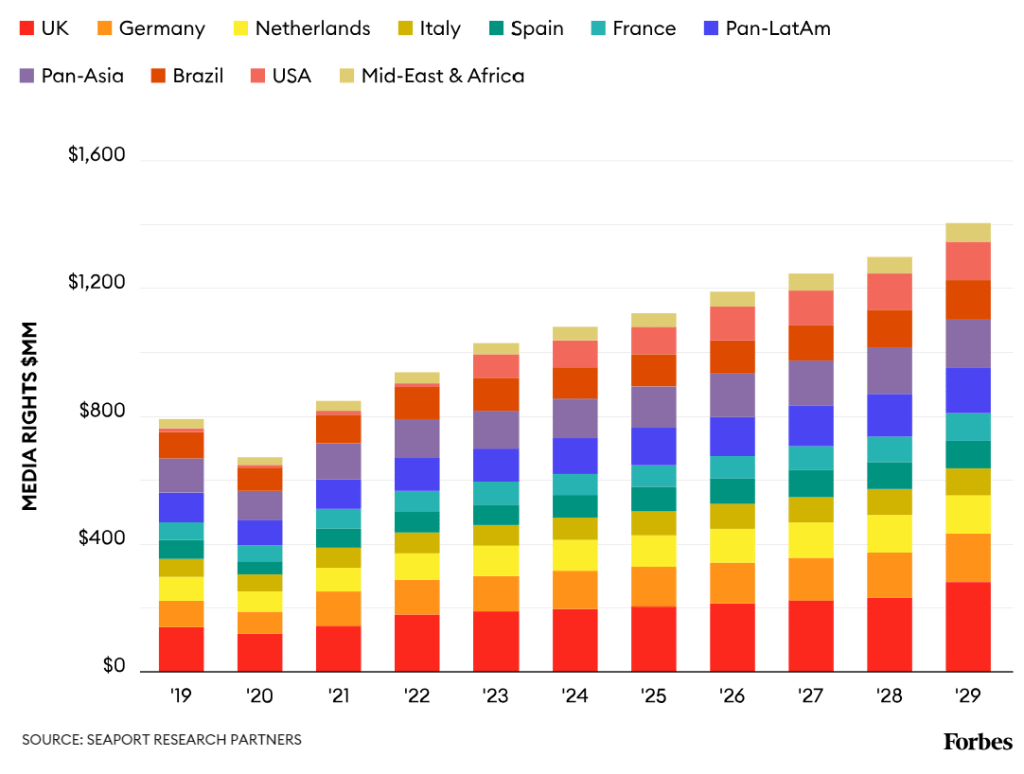

Seaport Research Partners estimated the growth in Formula 1 media rights in the coming years, noting, “F1 Media Rights include 4% escalators and varying step-ups upon renewals, but we assume normal-course market catch-up step-ups could start moderating from here, unless F1 demonstrates the ability to negotiate some catch-ups relative to other leagues.

”

In addition, revenue should benefit from greater promotion from Live Nation Entertainment, which is 31% owned by Liberty Media and has helped F1 organize several-day-long, Super Bowl-like experiences for many of its race weekends. This year, the company will be even more directly involved in helping Formula 1 self-promote its inaugural Las Vegas Grand Prix, which is expected to generate about $500 million in ticketing and hospitality-related revenues for F1, according to Seaport, while at the same time generating tens of millions of dollars of Ticketmaster fees for Live Nation.

The future looks bright at the constructor level, too. Most sponsorship agreements are locked in for years at a time, so in many cases, teams have not yet been able to raise their rates to capitalize on the increased interest.

Across the grid, Formula 1 is ready to hit the gas.

All figures are in USD.

#1 • $3.9 billion | Ferrari

Est. 2023 Revenue: $680 million | Est. 2023 EBITDA: $115 million

Team Principal: Frédéric Vasseur

Horse Play: Ferrari driver Charles Leclerc celebrates qualifying ahead of the Azerbaijan Grand Prix at Baku City Circuit.

Dan Mullan/Getty Images

Ferrari is synonymous with Formula 1, having competed in the series since its inaugural season in 1950. While the team is currently fourth in the standings, the Prancing Horse has won 16 constructors’ championships—seven more than any other.

#2 • $3.8 billion | Mercedes

Est. 2023 Revenue: $700 million | Est. 2023 EBITDA: $192 million

Team Principal: Toto Wolff

Silver Bullet: Mercedes’ Lewis Hamilton is tied (with Michael Schumacher) for the most F1 driver championships, with seven.

Mario Renzi/Getty Images

After taking on the Mercedes branding for the 2010 season, the team went on one of the most dominant runs in sports history, winning eight straight constructors’ championships from 2014 to 2021. Behind star driver Lewis Hamilton and the up-and-coming George Russell, the Silver Arrows are back up to second in the 2023 standings after a disappointing third-place finish last year.

#3 • $2.6 billion | Red Bull Racing

Est. 2023 Revenue: $510 million | Est. 2023 EBITDA: $85 million

Team Principal: Christian Horner

He’s No. 1: Red Bull’s Max Verstappen is a two-time F1 champion and leads the driver standings in 2023.

Mark Thompson/Getty Images

Red Bull broke Mercedes’ winning streak by capturing the constructors’ championship last year and is all but assured a repeat title, with Max Verstappen having won eight of ten races in 2023—and his teammate Sergio Pérez having claimed the other two.

#4 • $2.2 billion | McLaren

Est. 2023 Revenue: $490 million | Est. 2023 EBITDA: $58 million

Team Principal: Andrea Stella

Wunderkind: McLaren’s Lando Norris reached his first podium in 2020 at the Austrian Grand Prix.

Mark Thompson/Getty Images

McLaren rebounded from a tough start to the season with a promising showing at the British Grand Prix this month as Lando Norris raced to a second-place finish. Among current teams, only Ferrari has been in the series longer than McLaren, which made its debut in 1966.

#5 • $1.4 billion | Alpine

Est. 2023 Revenue: $325 million | Est. 2023 EBITDA: $50 million

Team Principal: Otmar Szafnauer

Drive to Thrive: The Alpine team added three celebrity owners this year.

Peter Fox-Getty Images

Owned by and formerly known as Renault, Alpine made news recently with the sale of a significant minority stake to RedBird Capital Partners and Otro Capital. The investors also included three Hollywood actors: Wrexham A.F.C. owners Ryan Reynolds and Rob McElhenny and Creed star Michael B. Jordan.

#6 • $1.375 billion | Aston Martin

Est. 2023 Revenue: $290 million | Est. 2023 EBITDA: $32 million

Team Principal: Mike Krack

Top of the Pop: Aston Martin’s Fernando Alonso celebrates after the Miami Grand Prix.

Dan Istitene/Getty Images

Aston Martin signed popular driver Fernando Alonso ahead of this season and is widely viewed as being on the upswing, running in third in the constructor standings in 2023 with a slate of valuable sponsorships.

#7 • $1.125 billion | AlphaTauri

Est. 2023 Revenue: $260 million | Est. 2023 EBITDA: $20 million

Team Principal: Franz Tost

No Bull: The Red Bull-owned AlphaTauri team is expected to rebrand itself in 2024.

Peter Fox/Getty Images

One of two F1 teams owned by Red Bull, AlphaTauri is headed for a shakeup, with a rebrand expected for 2024 and team principal Franz Tost set to be replaced by Ferrari racing director Laurent Mekies. In a surprise move this month, the team brought in Daniel Ricciardo to replace driver Nyck de Vries for the rest of the season.

#8 • $900 million | Alfa Romeo

Est. 2023 Revenue: $210 million | Est. 2023 EBITDA: $25 million

Team Principal: Alessandro Alunni Bravi

Ciao for Now: The Alfa Romeo team will be rebranded under the Audi name in 2026.

Paul Crock/Getty Images

The team is set to drop the Alfa Romeo name next year before eventually rebranding as Audi in 2026. The German automaker purchased a minority stake in the team in January and will also enter the series as an engine manufacturer in 2026, when new rules will require cars to run on sustainable fuels with increased electric power.

#9 • $780 million | Haas

Est. 2023 Revenue: $180 million | Est. 2023 EBITDA: $2 million

Team Principal: Guenther Steiner

Team America: Haas is the only F1 constructor based in the United States.

Jon Hobley/Getty Images

Haas is F1’s youngest team, having entered the series in 2016, and the only one based in the United States, with a headquarters on the same site as founder Gene Haas’ Nascar team in Kannapolis, North Carolina. (It also has facilities in England and Italy.) Haas has a new title sponsorship deal in 2023 with MoneyGram after dropping Russia’s Uralkali in March 2022 in the wake of the invasion of Ukraine.

#10 • $725 million | Williams

Est. 2023 Revenue: $160 million | Est. 2023 EBITDA: – $5 million

Team Principal: James Vowles

Stalled: The venerable Williams team has the second-most F1 championships but hasn’t won a title in more than 25 years.

Dan Istitene/Getty Images

Williams is among F1’s most storied teams, having joined the series in 1977 and won nine constructors’ championships, second-most after Ferrari. The last of those titles came in 1997, however, and the team has endured some lean years since. Still, impressive infrastructure and the scarcity of Formula 1 teams—with series CEO Stefano Domenicali saying recently that “ten teams are more than enough to create the show, or the business, and the attention that we want to see on the track”—prop up Williams’ valuation.

This article was first published on forbes.com and all figures are in USD.

More from Forbes Australia

METHODOLOGY

Forbes’ valuations were compiled from information obtained from public filings and private documents—such as valuations done on teams by banks—and from interviews with industry executives, analysts, bankers and investors. Forbes calculated its valuations based on 2023 revenue estimates because, with the series’ explosive growth and the season now half over, the available 2022 revenue figures would have produced team values that did not reflect current expectations in the market. Revenues are from F1 operations and exclude ancillary businesses, such as selling engines. Team values are enterprise values (equity plus net debt), and EBITDA figures are earnings from continuing operations before interest, taxes, depreciation and amortization. All figures were converted to U.S. dollars based on exchange rates as of July 7, 2023 (£1 = $1.28; €1 = $1.09).