Subway’s owners are about to chow down on a footlong fortune.

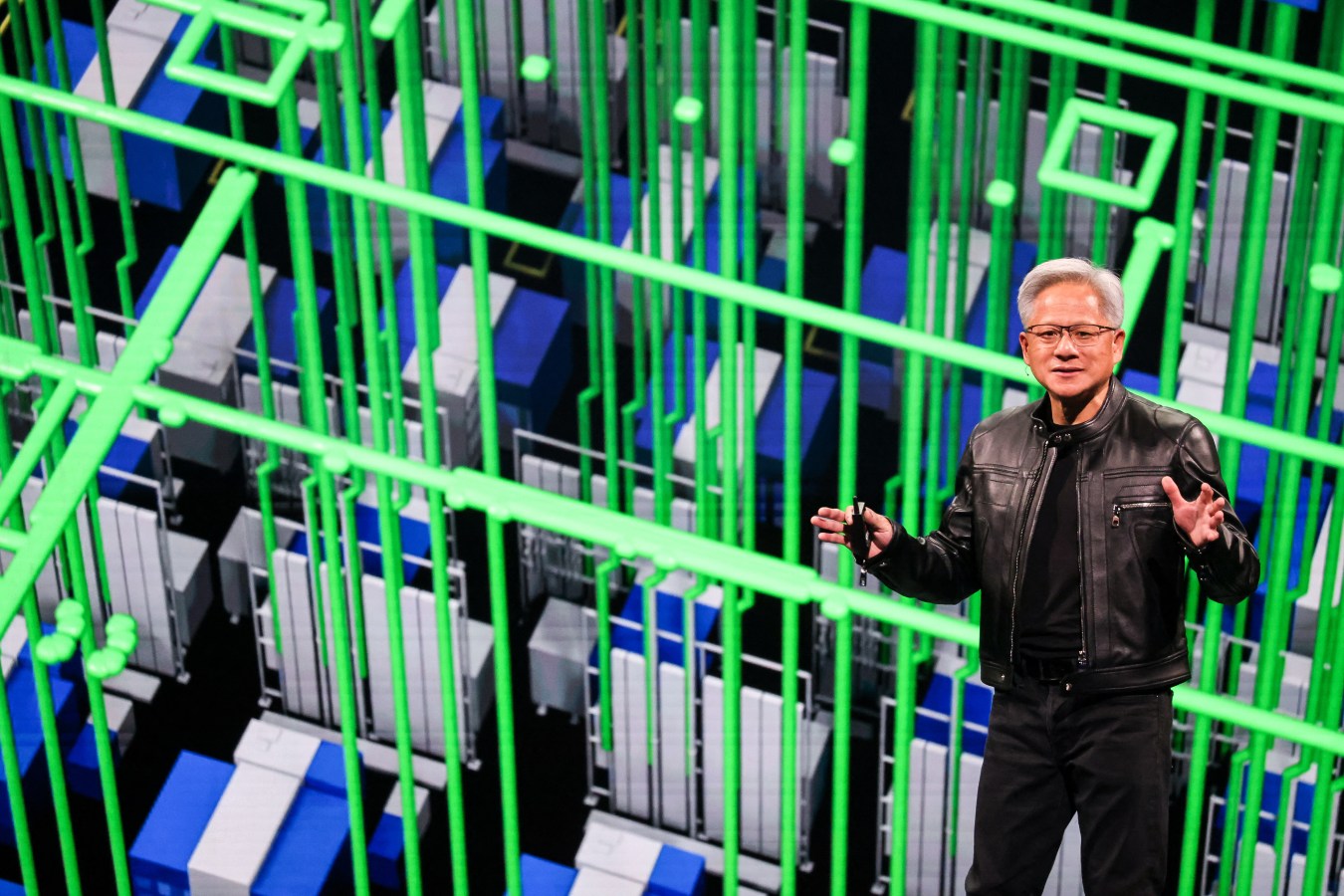

ILLUSTRATION BY YUNJIA YUAN FOR FORBES

The sandwich giant announced on Thursday that it has agreed to sell itself to Roark Capital, a private equity firm that owns U.S. restaurant brands including Dunkin’ Donuts, Arby’s and Buffalo Wild Wings.

The terms of the deal, which puts an end to a months-long battle over one of America’s largest fast food chains, have not been disclosed. But The Wall Street Journal and Reuters reported in the days preceding the sale that Roark was leading a field of 10 bidders at its peak with an offer to buy Subway for more than $9 billion.

The sale marks the first time in Subway’s nearly 60 year history that it will change hands from its two founding families. It also represents a big payday – at least for the one under-the-radar owner who’s held onto their half of the chain.

Neither of Subway’s original founders, Fred DeLuca and Peter Buck, are still alive. After his death in 2015, DeLuca left his 50% of the company to his wife, Elisabeth DeLuca, according to Forbes’ previous reporting. She has one son, Jonathan. The 76-year-old DeLuca would walk away from the sale with an estimated $3.4 billion (after tax) based on the reported $9 billion price tag. Her family’s estimated net worth would be about $8.2 billion after the sale.

Even before the deal, DeLuca had pocketed roughly $2.6 billion in cash from Subway royalties paid to her family over the years. She had ranked No. 699 on Forbes’ 2023 list of billionaires with an estimated net worth of $8 billion, which included an estimated value of her Subway stake. The main difference now is that most of her fortune will now be in cash.

Related

DeLuca’s proceeds from the sale do not take into account any future payments. Both The Wall Street Journal and Reuters reported that it would involve an “earnout” structure that made a portion of the sale price dependent on the chain meeting certain financial goals. The WSJ reported that Subway’s owners would receive $9 billion up front, with another $600 million available upon meeting the targets. According to Reuters, the arrangement was to help bridge a gap between what buyout firms were willing to pay for Subway and the $10 billion its owners were hoping to get. “We have not heard, no one has heard the exact number,” said franchise expert John Gordon of Pacific Management Consulting Group, who has been closely following the sale of Subway. He noted that his industry sources also indicated there is an earnout provision involved.

The estimated payout also does not take into account any tax minimizing maneuvers she may have privately done like setting up her Subway holding in a trust or making undisclosed philanthropic donations. Subway spokesperson declined to share further details about the deal due to “the wishes of the parties involved” while Roark did not respond to a request for comment. DeLuca has not responded to multiple outreach efforts by Forbes through her representatives. Subway’s other founder, Peter Buck, left instructions in his will, a partially redacted copy of which was obtained by Forbes, to leave his half of the company to his family foundation after his November 2021 death. This bequest could be worth at least $4.5 billion based on the minimum price tag reported by the WSJ and Reuters.

The gift, described as a way to bolster support of the foundation’s key causes like education and conservation, ranks as one of the biggest single charitable gifts to a foundation. It also saves Buck’s heirs, likely his two sons, Christopher and William, from a nearly $2 billion tax bill (calculated at the reported $9 billion sale price). If Buck had not given his Subway ownership to charity, his estate would have to pay a 40% estate tax on the “fair market value” of the asset. Elisabeth DeLuca would not have been subject to this estate tax because it does not apply to assets passed on to spouses. Buck’s wife, Carmen Lucia Passagem, died in 2003.

Related

Outside of his Subway ownership, Buck and his family spent millions – likely using his Subway royalties – buying up forestland in Maine that is now worth $1 billion. The Tall Timbers Trust, which still appears to be controlled by the Buck family, owns about 1.3 million acres of land in Maine, making them one of the largest landowners in the state. While the DeLuca family has not spelled out their gifts like the Bucks have, it seems possible that a significant portion of the windfall from the sale could go into the DeLuca family foundations, which support a range of organizations in Connecticut and Florida. Citing a Subway spokesperson, The Wall Street Journal reported that the majority of the proceeds from the deal are expected to go to foundations affiliated with the founders. Subway did not respond to follow-up questions from Forbes about whether this means DeLuca is pledging some of her sale proceeds too.

Though she keeps a very low profile, DeLuca has also been very charitable since taking over her late husband’s Subway ownership. Publicly available filings show the Subway founder’s widow gifted over $450 million to the Frederick A DeLuca Foundation between 2015 and 2020. In March 2022, she hired Kevin Byrne to be the foundation’s CEO: Byrne previously spent nearly two decades at the foundation started by the family of Dell Technologies CEO Michael Dell. DeLuca also set up her own foundation, the Elisabeth DeLuca Foundation, in December 2021. The same year she donated $253.7 million in stock including nearly $30 million worth of Airbnb and about $20 million of JPMorgan.

This article was first published on forbes.com and all figures are in USD.