Two of the four Big Four banks have adopted ConnectID, a new digital ID solution created by Australia Payments Plus (AP+), as Australia moves to prevent fraud and identity theft.

Commonwealth Bank and National Australia Bank customers will be among the first to use a new digital ID verification tech, created by AP+, an organisation representing Australia’s three major domestic payment providers (BPAY Group, eftpos and NPP Australia).

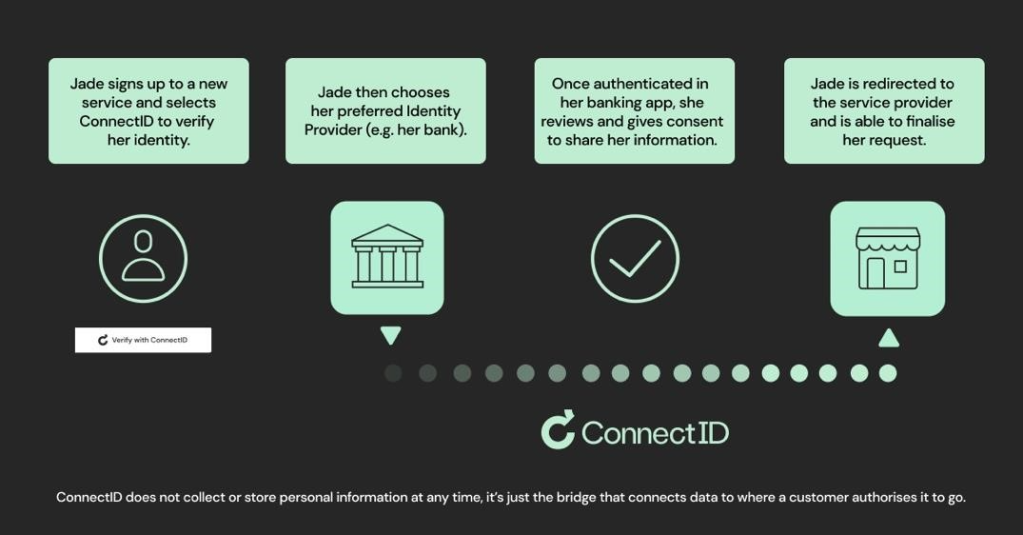

ConnectID acts as a bridge between an organisation that wants to verify someone’s identity and the organisation providing that verification. It only happens when the customer authorises it.

The idea is that, instead of customers having to continuously share their personal data to verify their identities, they can now ask a participating business to verify their information using organisations they already trust – like CBA or NAB.

“Traditionally, the volume of personal information businesses had to collect, validate, and store created a honeypot of data for criminals to target,” managing director of ConnectID, Andrew Black, tells Forbes Australia.

“A perfect example is having to verify your age or address. This could require sharing your birth certificate, driver’s licence or even passport. Once verified, though, there’s no need for these organisations to retain and store that kind of personal information alongside all the unnecessary additional data that comes along with it, such as a class of driving licence. It’s a risk, and this risk is compounded when you consider how many times you are asked to verify your age or address.”

But digital IDs can reduce the “oversharing” of personal data, removing the need to store more than what’s absolutely necessary, Black says. The customer is in control.

The announcement comes as the Australian government closes its consultation on the Digital Identity Bill. The bill will eventuate in legislation for an economy-wide Digital ID system, which involves: a voluntary accreditation scheme of Digital ID service providers operating across the digital economy; and an Australian Government Digital ID System that is currently based around government services and will be expanded over time to include private sector organisations that choose to participate.

Digital IDs are being proposed as Australians are increasingly transacting online, which is resulting in a high number of cyber incidents. In fact, according to Surfshark data, Australia had the fourth-highest cyber victim density (victims per 1 million internet users) in the world in 2022.

The cost of cybercrime has been estimated to hit $8 trillion in 2023, and this figure was predicted to increase to $10.5 trillion by 2025, according to Cybersecurity Ventures’ 2022 Official Cybercrime Report.

“This is important legislation that enhances the privacy and security of Australians’ personal information in the digital economy,” CEO of AP+, Lynn Kraus, told Forbes Australia.

“The future of identification in Australia is increasingly digital, but we will see more identity verification, through systems like ConnectID, and less identity sharing where people have to handover copies of their driver’s licence or passports. It’s a vital step in helping people reduce their exposure to scams and frauds.”

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.