The media giant’s hot drop into the realm of Fortnite could be a game-changer for the metaverse, movies and theme parks. It’s an IP world, after all.

After returning to his position as Disney CEO in late 2022, Bob Iger held a meeting with two top executives to talk about video games.

It’s a sector the company had mostly avoided since 2016, when it shut down the Disney Interactive Studios division that was, at one point, losing some $200 million per year.

But Iger’s aides came armed with demographics and other statistical trends showing that gaming had become too popular to ignore.

“When I saw Gen Z and Gen Alpha and even millennials, and I saw the amount of time they were spending in terms of their total media screen time on video games, it was stunning to me, equal to what they spend on TV and movies,” Iger said on Disney’s earnings call on February 7. “And the conclusion I reached was we have to be there, and we have to be there as soon as we possibly can, in a very compelling way.”

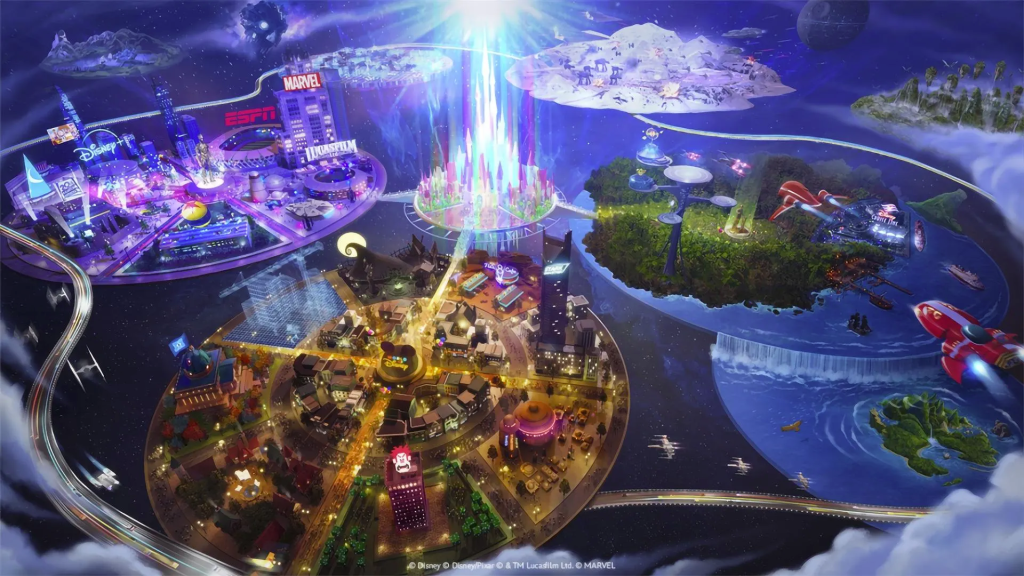

That same day, Disney announced its big move—the company would invest $1.5 billion into Fortnite developer Epic Games in exchange for a small equity stake in the company and the promise of building out digital worlds based on the company’s intellectual property.

The terms of the deal were not made public, but The Information reports the valuation of Epic dropped to $22.5 billion, down significantly from its peak of $31.5 billion in early 2022.

After the announcement, which was coupled with news of a new sports television venture involving ESPN, Fox and Warner Bros., Disney’s stock rose by 11%.

“They are the kings of passive entertainment, and they’re very good at parks, but they’ve been less successful with interactive,” says Jason Chapman, founder and managing partner of gaming investment firm Konvoy Ventures. “These worlds, if done successfully, could produce a heck of a lot more reusable entertainment and engagement and monetization mechanics than a movie. So I think it’s probably a really good investment for Disney, which desperately needs to figure this out because its audience is aging.”

The relevance of Fortnite—a battle royal-style game that has 70 million active monthly users—has been buffeted in recent years by collaborations with IP owners across pop culture.

Players can create in-game character “skins” out of sports stars, rappers, and fictional characters, including from Disney’s Marvel and Star Wars extended universes.

That licensing is likely to continue, and one could see how the IP could flow the other direction into a Fortnite cinematic universe or a TV series in the future.

The new partnership, however, suggests much more than an IP exchange. Epic Games CEO Tim Sweeney, estimated to be worth $4.1 billion, said in a statement the plan is to “build a persistent, open and interoperable ecosystem that will bring together the Disney and Fortnite communities.”

While Iger’s public comments strategically avoided the buzzword “metaverse,” his vision of a “new persistent universe,” in which people can “play, watch, shop and engage,” sounds familiar.

His goal to build a “gigantic Disney World a la Fortnite that could live next to Fortnite and be completely interconnected with it” is an enticing dream, but one that’s not yet technologically feasible.

A more tangible outcome in the short term is something similar to Lego Fortnite, a game experience that Epic published on the Fortnite Creative marketplace in collaboration with Lego Group, whose parent company Kirkbi invested $1 billion into Epic in April 2022.

The Lego “map”—as Epic calls new game builds—was a huge hit when it was released in December, peaking at more than 2.4 million concurrent players.

However, maintaining high player counts has proven far more difficult on the platform, where popularity changes as quickly as a viral trend on TikTok.. One month after release, Lego Fortnite was averaging around 100,000 players.

This week, some two months after launch, that average is closer to 40,000, still among the 10 most popular games on the service but a fraction of what Fortnite’s core Battle Royale modes achieve at any given time.

Rather than develop a digital Disney World, the two companies could collaborate on multiple game maps for some of Disney’s signature properties.

It could, for instance, make a Pirates of the Caribbean map, a Toy Story map and so on, interconnected only in the sense that each can be selected by players from a shared Fortnite menu.

But building each of these projects is labor intensive and would require additional investments from Disney to Epic and also, likely, other third-party developers. A single game, after all, can take many months to develop.

Lego Fortnite, for example, launched more than a year and a half after the announcement of Kirkbi’s investment.

Chapman says it’s unlikely that any Disney experiences on Fortnite could be released before the middle of 2025, and considering how nascent the in-game monetization tools still are, he predicts it will be years after that before the company sees any significant return on investment.

Meanwhile, the massive cash infusion allows Epic to continue to chase its metaverse dreams.

The company laid off more than 800 employees in September while transitioning Fortnite—which accounts for the vast majority of Epic’s estimated $6 billion in revenue—from a single video game into an all-encompassing ecosystem with thousands of games.

Epic currently offers its millions of users access to a simplified version of its professional game development software, Unreal Engine, and distributes a small portion of its revenue to those who create with it.

The goal is to ensure that the next Fortnite-sized hit happens on its platform, regardless of whether it’s designed by Epic, by everyday gamers, or now, by Disney.

“Our ultimate ambition remains the same, that it is to build a digital ecosystem that is metaverse scaled,” Sax Persson, Epic’s executive vice president of the Fortnite Ecosystem, told Forbes in November. “And Fortnite is the logical place for us to start, but it is to build to a billion people. It’s not to stay with a Fortnite size. It’s to get much, much bigger.”

The challenge Fortnite has not yet solved is how to shed its reputation as a shoot-em-up battle royale.

Maps like Lego Fortnite or Rocket Racing, another IP-based collaboration that debuted to big numbers in December only to settle below 20,000 players this month, prove the ongoing difficulty in sustaining different genres, especially those without guns.

Epic’s ultimate success in this metaverse arms race with other platforms such as Roblox and Minecraft may well depend on whether Disney’s lineup of beloved characters and millions of fans across the world can break the mold.

“Epic as a company today is way overexposed in risk to Fortnite,” Chapman says. “It’s just one game, and there’s so few games that last that long…I think they’re scared, they should be scared, because the 8-year olds of today aren’t going to find the Fortnite IP interesting in six years. This is the best bet Epic has at de-risking itself from its current offering, and it gets to do it with a group that has dominated IP content for the last century.”

This article was first published on forbes.com and all figures are in USD.