Paytime CEO Steven Furman is providing solutions for a growing movement in Australia that is wanting earned wage access. But don’t confuse it with pay in advance apps.

Key Takeaways

- Popular in the UK and US, earned wage access is offered by companies to their employees as a staff benefit – and allows their workers to choose when they’re paid

- The technology plugs into the company’s payroll and time and attendance software to access real-time information on the hours and days worked

- No effect on a company’s cash flow when staff access their pay, as Paytime funds these withdrawals on behalf of the company

Already popular in the UK and US, earned wage access is offered by companies to their employees as a staff benefit – and allows their workers to choose when they’re paid.

It is not a loan, but enables users to pay a small ATM-style fee to access a portion of the wages they’ve already earned.

Here, in a question and answer session, Furman explains the details.

Can you explain what earned wage access is and how it works.

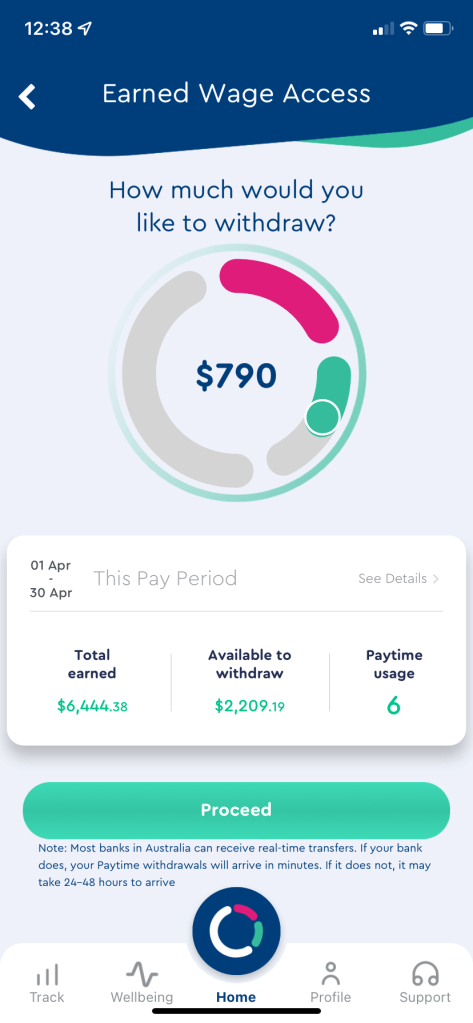

Earned wage access (EWA) is a B2B2C technology solution offered by companies to their staff which provides workers with the ability to access their earned wages on an on-demand basis, at any time during the month, as opposed to having to wait weekly/fortnightly or monthly for their payday.

The technology plugs into the company’s payroll and time and attendance software to access real-time information on the hours and days worked.

How is this better than what is already available with pay in advance?

“Pay in advance” products are essentially a tech-enabled payday loans, who disguise themselves as a healthier, On-demand pay alternative. However under the hood, they are all just consumer loans packaged differently. The amount users can withdraw is not directly linked to a user’s earned pay, but rather their historical pay. They charge 5% on the amount requested and the provider direct debits the user for the money back, on payday – it’s a pure unsecured, B2C consumer payday loan. In the event that their direct debit is rejected due to insufficient funds in the user’s account, the lender would then typically commence collection action which risks putting them into a deeper state of debt and having a poor credit history against their name.

EWA provided by Paytime is not an advance, loan or any other form of credit made or given by us or the employer, it is simply a payment of one’s already earned/accrued wages in advance of the normal payday. There is also nothing to repay back, the employee user will simply get their remaining pay on payday. EWA does not charge 5% (or any other percentage) of the advance amount, there is a flat fee charged (think small ATM fee) regardless of the amount accessed with no ongoing fees and charges. EWA is not putting a user in debt, whatsoever.

How does this help employees manage their finances better?

- Break the debt cycle: Earned wage access can help break the debt cycle by providing an employee with immediate access to funds that they have earned. It allows them to better manage their finances, save money, plan ahead, and be prepared for unexpected bills and emergencies.

- Be in control of how/when to pay bills, and avoid late fees: Whether it’s a school/uni payment, a medical emergency or employees simply want to pay down credit card bills to avoid late fees and interest charges, there are and will be times when bills cannot wait until payday.

- Nurture a savings habit: Paytime has a feature that can help employees pay themselves first, directly to their savings account, before their salary goes to their checking/spending account on payday. This way, savings is automated and guaranteed, every pay period on a ‘set and forget’ approach.

What interest have you had from companies to use this technology?

With the tight labour market and acute issue around attracting and retaining staff, companies are embracing the offering. EWA is already quite a common employee benefit offered in Europe and the US, with millions already having access to EWA in their workplace – Australia is still behind the eight ball, but no doubt will catch-up in the short to medium term.

Not only are there clear employee benefits by offering EWA, but from an employer’s perspective EWA has shown to improve staff attraction and retention rates by over 20% and improve shift filling by 15%+, according to an internal report by Paytime.

What are the benefits of the technology for employers? and for employees?

For employers:

- Ease of recruitment: There is a window of opportunity for Australian companies to take up Earned Wage Access (EWA) and differentiate themselves from their competitors, as EWA is still relatively new in Australia. A recent whitepaper by ADP, a global payroll company, shows that 80% of workers stated that it is important for their employers to offer EWA, and 75% of those stated that the availability of EWA will influence and prioritise their acceptance of a job offer. This is also reflected from their survey on the companies – of which 96% stated that it helped with attracting talent.

- Increase in Employee Retention: Once employees realise how much easier managing finances is since EWA is made available by their employers, they tend to become more loyal and stay longer in their employment. 93% of companies surveyed stated that Earned Wage Access helped them retain talent.

- Improve shift filling: When each new or additional shift is seen as an opportunity and not an obligation, it’s proven to make you fill shifts much quicker and easier, without having to call and convince your staff every time. This benefit is enhanced when the company advertises the new shift with automatic earned wage access attached to it (e.g. “You will be paid your wages from this shift immediately after you finish / the next day”).

For employees:

- Prevents / break the cycle of debt

- Reduces Financial Stress

- Ability to deal with emergency/unexpected expenses (Financial Safety Net)

What else can you say about the technology and how it operates.

Employees can typically access 50-70% of their earned pay and it is received within minutes into their bank account. Unlike payroll; HRIS; CRM’s or ERP solutions, Paytime does all the heavy lifting when it comes to implementation so that there is very little required from the company’s side, it can be up and running in a few weeks and it runs seamlessly in the background with no need to change their payroll process. There is also no effect on a company’s cash flow when staff access their pay, as Paytime funds these withdrawals on behalf of the company.